Darren415

While the focus remains on its pending acquisition of Columbia Care (OTCQX:CCHWF), Cresco Labs (OTCQX:CRLBF) issued a solid earnings report which showed some margin expansion amidst an environment in which peers are seeing the negative effects of price compression. Like MSO peers, leverage has been moving up higher but with the bulk of planned capital expenditures completed in the near term, free cash flow may increase moving forward as the company begins to reap the benefits of improving scale.

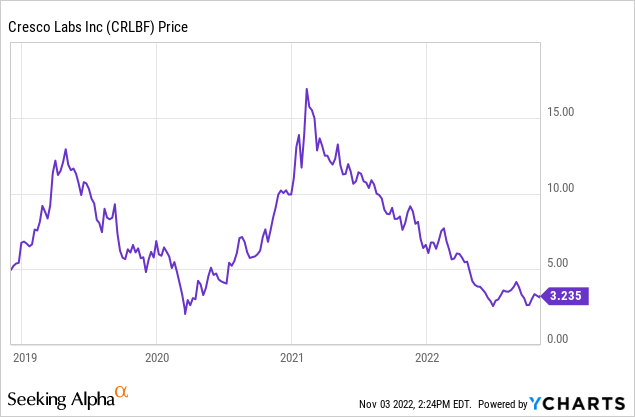

CRLBF Stock Price

After peaking in early 2021, CRLBF has crashed alongside the rest of the cannabis sector.

At the beginning of the crash, the plunging stock prices were hard to understand on account of the still-strong fundamentals. Recent price compression and deceleration in growth now appear to validate the steep declines, though the stock remains too cheap here.

CRLBF Stock Key Metrics

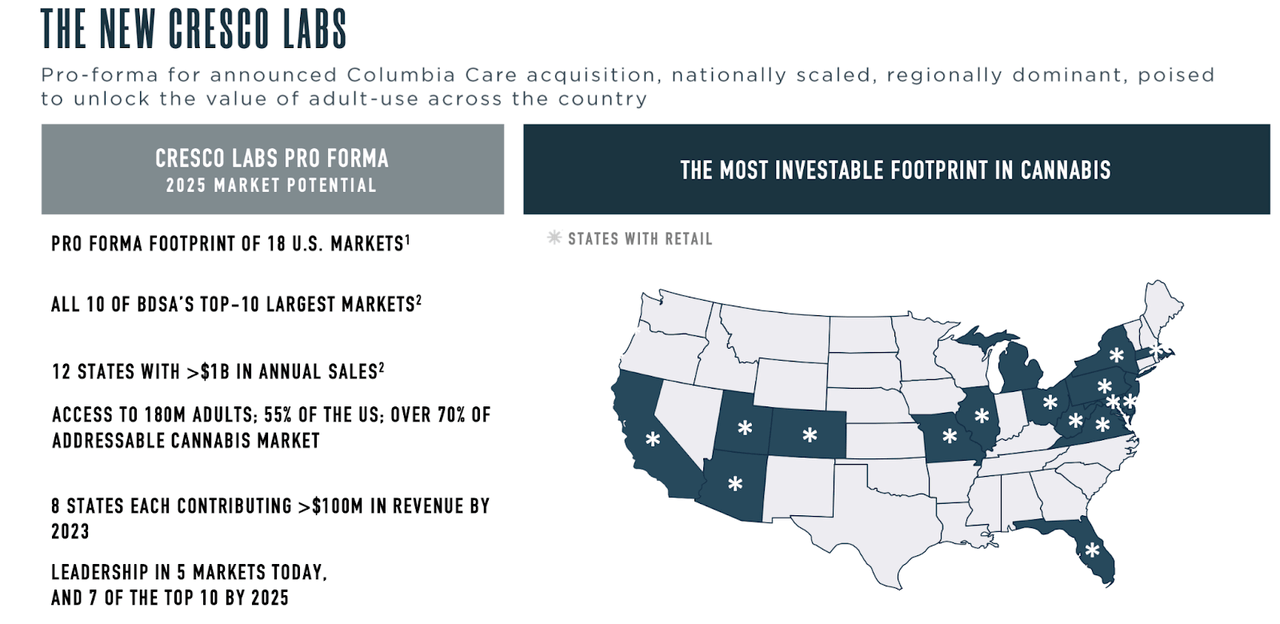

CRLBF, pro-forma of its acquisition of CCHWF, would have a footprint across 18 U.S. markets, giving it one of the widest footprints in the sector.

2022 Q2 Presentation

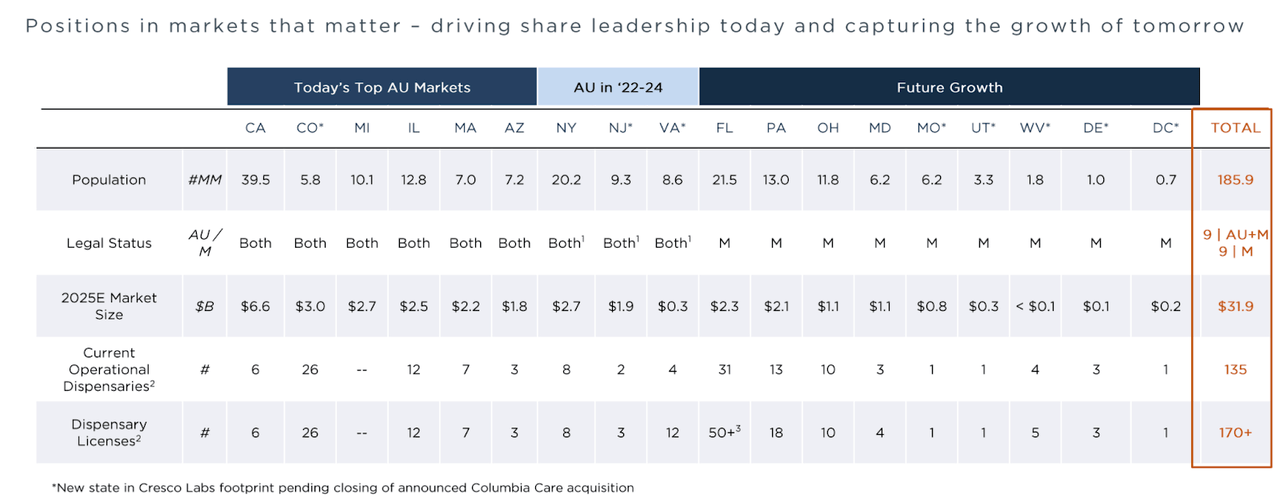

Below is a snapshot of the mature adult use markets, rapidly growing adult use markets, as well as medical markets still-yet-to-turn adult use.

2022 Q2 Presentation

The fact that more than half of its footprint is still only in medical markets may add optimism that the decelerating growth seen in recent quarters should eventually pick up in the future as more states come online for adult use.

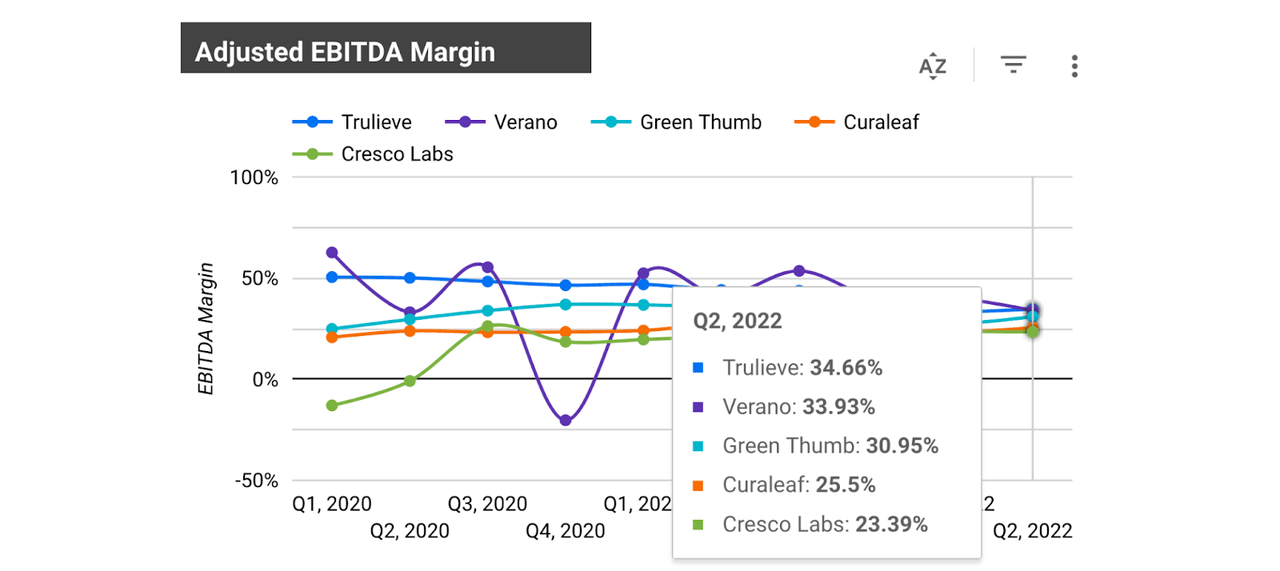

In the latest quarter, CRLBF reported 4% year over year revenue growth to $218 million. Gross margin stood at 53%, reflecting some margin expansion as the company benefited from improved efficiencies. Adjusted EBITDA stood at $51 million or 23% of revenue, reflecting some margin expansion.

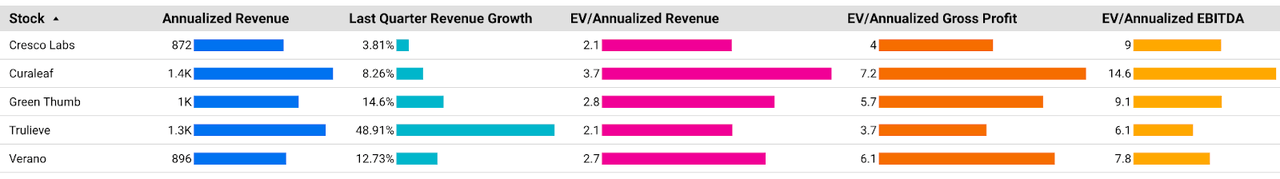

CRLBF has traditionally underperformed Tier 1 peers – those being Trulieve (OTCQX:TCNNF), Green Thumb (OTCQX:GTBIF), Verano (OTCQX:VRNOF), and Curaleaf (OTCPK:CURLF) – in terms of profitability but it continues to move closer to the pack while many of those peers are seeing margin compression.

Cannabis Growth Portfolio

On the conference call, management noted that they gained or held branded market share in every state except California, which they had reduced exposure in last year.

CRLBF has traditionally prided itself in its wholesale strength, but after announcing the CCHWF acquisition, it appears to be distancing itself from that identity. The company noted that net wholesale revenue fell 12% year over year but excluding the California impact was flat year over year. The company may benefit in the near future from increased wholesale revenues in Illinois, where the state has finally issued the vast majority of the 185 social equity licenses slated to be issued. There are still some hurdles before those social equity licenses eventually turn into operating stores, but additional stores should help increase the overall legal market size in the state, leading to strong wholesale revenues.

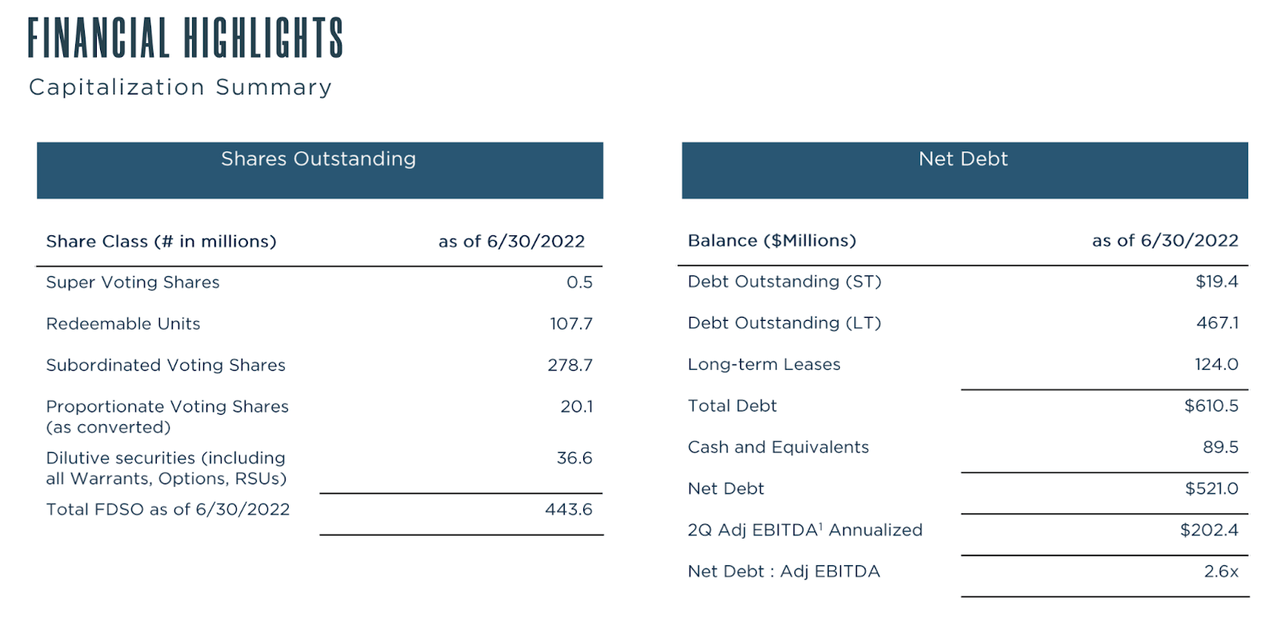

CRLBF ended the quarter with $89.5 million of cash versus $610.5 million of debt for a 2.6x net debt to EBITDA ratio.

2022 Q2 Presentation

That ratio is reasonable for companies in the consumer goods sector, but the ratio in itself is not representative of the true effect of leverage. 2.6x debt to EBITDA from a soda maker is not equivalent to 2.6x debt to EBITDA from a cannabis company due to high “I’s” and “T’s.” US cannabis companies have high costs of capital and pay high tax rates due to inability to deduct operating expenses from taxable income (known as ‘280e taxes’). CRLBF recorded $23.6 million in income taxes versus $15.3 million in taxable income in the latest quarter. The interest rate it pays on its debt is in the double-digits. While 2.6x debt to EBITDA may be an appropriate leverage ratio in a world where cannabis is federally decriminalized, it is arguably much too high today. Many MSOs have increased leverage in order to accelerate capital expenditure plans – they will need to execute on expected margin expansion in order to support the high debt loads.

I now have the view that legislative reform is years if not more than a decade away. This means that 280e taxes and high debt interest rates may not be going away anytime soon. Given that backdrop, I have focused my attention on cannabis operators which can generate positive cash flow even inclusive of 280e taxes and high interest expenses. I have defined operating free cash flow as being adjusted EBITDA minus interest and tax expenses.

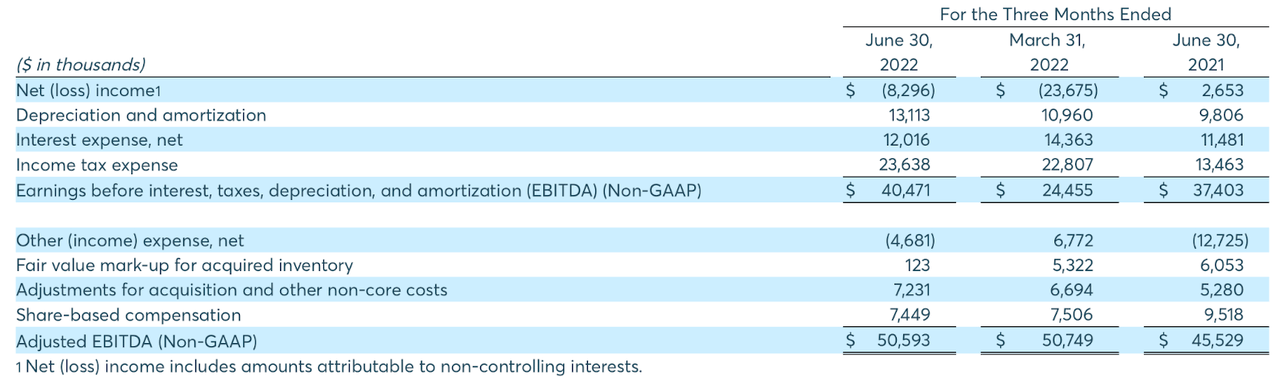

2022 Q2 Press Release

CRLBF generated $15 million in positive operational free cash flow after deducting interest and income taxes, though I note that is excluding $7.4 million of share-based compensation and $7.2 million of additional acquisition costs. This is a solid cash flow profile but I note that CCHWF burned $18.2 million in its latest quarter (using the same metric), meaning that the combined company is likely to have negative operational free cash flow.

The company spent $14 million on CapEx in the quarter and has projected $35 million of CapEx for the rest of the year. Management continues to expect somewhere between $300 million and $400 million of proceeds from selling assets related to its CCHWF acquisition. It expects those proceeds plus underlying growth to bring leverage down to around 1.5x debt to EBITDA exiting 2023. That may prove to be an overly ambitious timeline as it is unclear if expectations from those dispositions are too high given the valuations at which cannabis stocks trade at today.

Is CRLBF Stock A Buy, Sell, or Hold?

CRLBF has historically traded at a discount to Tier 1 peers and continues to do so today.

Cannabis Growth Portfolio

Yet that discount is arguably warranted due to its pending acquisition of CCHWF. While that acquisition may be accretive on a price to sales basis, as discussed earlier is likely to put a strain on cash flows. Moreover, these two companies may be stuck in a sort of “limbo” between now and the closing of the merger, as they may not want to waste capital expenditure spend on properties that end up being disposed of in the future.

Given the high leverage, there is the risk that projected margin expansion does not occur and this company is left with an unsustainable debt load. That may force the company to dilute shareholders at poor prices – the risk has become much more elevated now as compared to 1 year ago. Institutional capital remains more or less excluded from investing in the US cannabis sector, which means that multiple expansion is highly dependent on the prospects for legalization. Prospective investors should be prepared to hold through the long term with significant volatility to be expected.

CRLBF remains buyable in its own right, but it is hard to recommend buying the stock relative to Tier 1 peers considering the weaker cash flow profile amidst a tightening environment.

Be the first to comment