Dan Kitwood

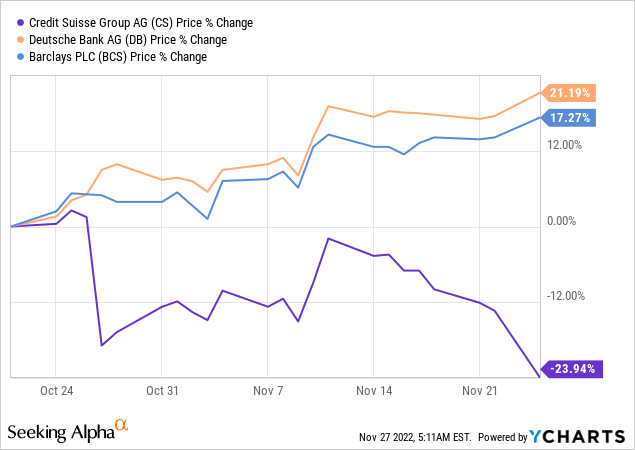

In my latest article on Credit Suisse (NYSE:CS), I compared it to its European peers Deutsche Bank (DB) and Barclays (BCS). My conclusion was stark, I had DB and BCS as a strong buy (with a preference for DB) and a Sell rating for CS.

In a little over a month, my call played out even much better than expected with a relative outperformance of ~45%.

The key reason for the Sell rating attached to CS was to do with its Investment Bank (“IB”) massive restructuring. I have seen a number of these play out in the past and all, without exception, have turned out to be prolonged and costly exercises. Unwinding the excesses of an IB is never orderly and usually results in massive destruction of capital and shareholders’ value.

However, I also postulated that there will be a time to buy CS. After all, the core CS division of Wealth Management (“WM”) is an exceptionally attractive asset and traditionally has comprised ~2/3 of the bank. This is CS’s crown jewel.

The recent news flow suggests that the WM division is also impaired. It appears that in the first 6 weeks of Q4, CS has experienced client outflows of ~$89 billion comprising predominantly WM assets (~10% of its AUM in its WM division) as well as a smaller amount of deposits.

There are now fears of contagion from the IB, if CS is unable to stem the outflows, the WM division may be permanently impaired. It appears that UBS (UBS) and Morgan Stanley (MS) are major beneficiaries of clients’ exodus. This certainly has the look and feel of a potential tailspin. It appears that the social media frenzy regarding CS’s financial stability in recent weeks has also caused some wealthy clients to leave the bank.

The important point to note is a WM business is to a large extent a fixed-cost business. Such significant outflows suggest that efficiency ratios and profitability will likely point deep south in the short to medium term. The second-order impact will likely continue as key WM executives desert the ship and take additional AUMs along with them.

Hence, it is not surprising that CS has forecasted a pre-tax loss of up to SFr1.5bn ($1.6bn) in the fourth quarter and that the WM division will also experience a loss during the quarter.

A most concerning aspect for CS is the massive reduction in its liquidity buffers which fell from 192% in the 3rd quarter to 140% currently. This liquidity capital ratio measures the ability of the bank to withstand a bank run. Regulators require banks to maintain a ratio above 100% at all times. If the outflows continue for the rest of this quarter and beyond, CS would be at risk of a liquidity crunch.

Catching A Falling Knife

CS is certainly cheap at a small fraction of tangible book value (further diluted now due to capital issuance) but buying it now may still be the proverbial “catching a falling knife”. The tangible book of a large systemic book is only valid as long as the firm’s business model is a going concern and not a former restructured shadow of itself. I foresee, still, significant destruction of capital in the upcoming months and years.

I also expect a significant exodus of private bankers to other firms in the next few months, negotiations for these are probably underplaying as we speak and many others will depart subsequent to bonus payments.

When May I Consider Buying?

The first condition is clear evidence that the outflows from the WM division are stopping or even better are reversing. To date, the outflows seemed to have slowed but nothing further. Furthermore, the liquidity and capital position will also need to show signs of stabilization.

Importantly, the WM needs to prove that it can stabilize and survive. The macro-environment at the moment is not conducive either to the IB or the WM, so it is very unlikely to provide tailwinds in the short term either.

The only light at the end of the tunnel now is the seemingly successful capital raise of SFr 4 billion albeit at a heavily discounted share price of 2.52 francs per share. Still, this was supported by more than 90% of shareholders – I suppose there are no other viable options available given the circumstances.

Final Thoughts

I am struggling to find a light at the end of the tunnel or any other form of good news currently. The unfortunate part is that it was mostly self-inflicted. It all started with colossal risk management lapses (Archegos Capital debacle) leading to losses in the IB, higher cost of funds, a spike in CDS premium, and (somewhat unjustified) social-media frenzy around financial stability.

Now it is culminating in wealthy clients deserting the bank en masse.

This bank desperately needs some stability and it is increasingly hard to find.

There is a distinct possibility that this is the end of CS as we know it and could well be a case of death by a thousand cuts.

Buying here is too brave for me. I still say avoid and look for signs of stability in the WM platform. There may be a time for me to buy this stock, but not just as yet. I suspect this will be a monumental multi-year story if it survives in its current state.

Be the first to comment