Anton Petrus/Moment via Getty Images

The VanEck Vectors Oil Refiners ETF (NYSEARCA:CRAK) provides exposure to a portfolio of global refiners. Crack spreads, a measure of refiner profitability, has been rising rapidly in recent weeks in anticipation of an EU embargo on Russian refined oil products. Elevated crack spreads could drive refiner stocks higher in 2023.

Fund Overview

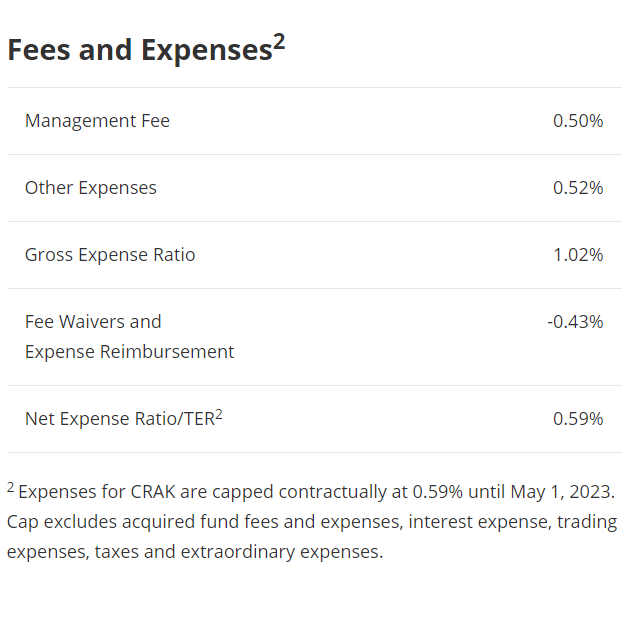

The VanEck Vectors Oil Refiners ETF provides exposure to global refiners. It seeks to tack the MVIS Global Oil Refiners Index (“Index”), a rules based index of companies involved in crude oil refining. The CRAK ETF charges a 0.59% net expense ratio after waivers. Although, the lower fee is only until May 1, 2023 (Figure 1).

Figure 1 – CRAK fees and expenses (vaneck.com)

Portfolio Holdings

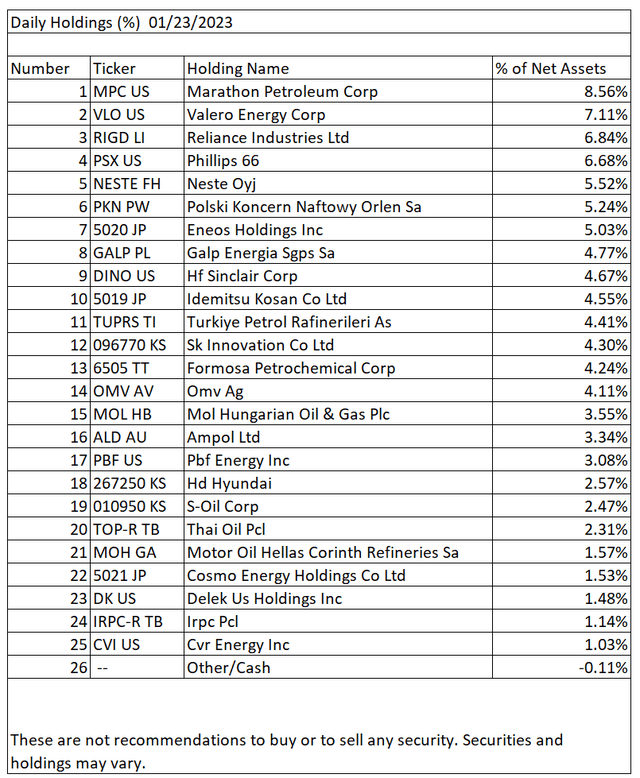

The CRAK ETF has 25 positions in refiners across the world. The top 10 holdings account for 59% of the fund’s assets. Figure 2 has a full listing of the fund’s assets.

Figure 2 – CRAK ETF holdings (vaneck.com)

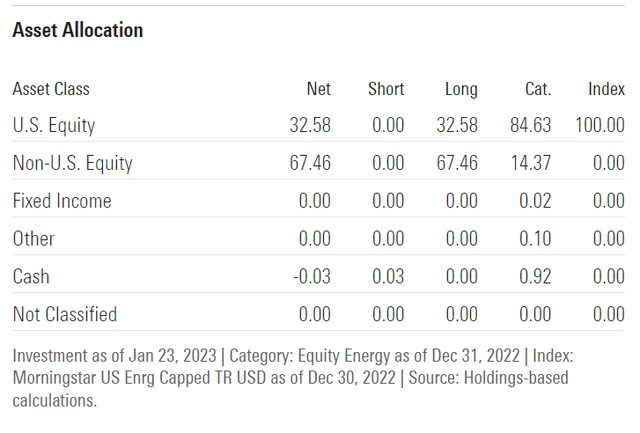

Investors should note that the CRAK ETF has a high international stock component, with global equities accounting for 2/3 of the fund’s assets (Figure 3).

Figure 3 – CRAK geographical allocation (morningstar.com)

Returns

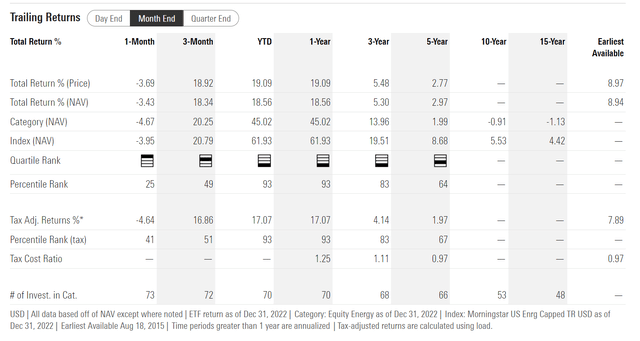

The CRAK ETF had a strong 2022, returning 18.6%. However, longer-term returns have been modest, with 3 and 5Yr average annual total returns of 5.3% and 3.0% respectively to December 31, 2022 (Figure 4).

Figure 4 – CRAK historical returns (morningstar.com)

Distribution & Yield

The CRAK ETF pays an annual distribution that amounted to $0.96 in 2022. This equates to a 3.1% trailing 12-month yield.

High Refining Margins Led To Superior 2022 Performance

As noted above, the CRAK ETF had a strong 2022 driven by elevated refining margins. Refining margins are cyclical and depend on a variety of factors such as crude oil supplies, demand for refined products, and capacity utilization of refineries.

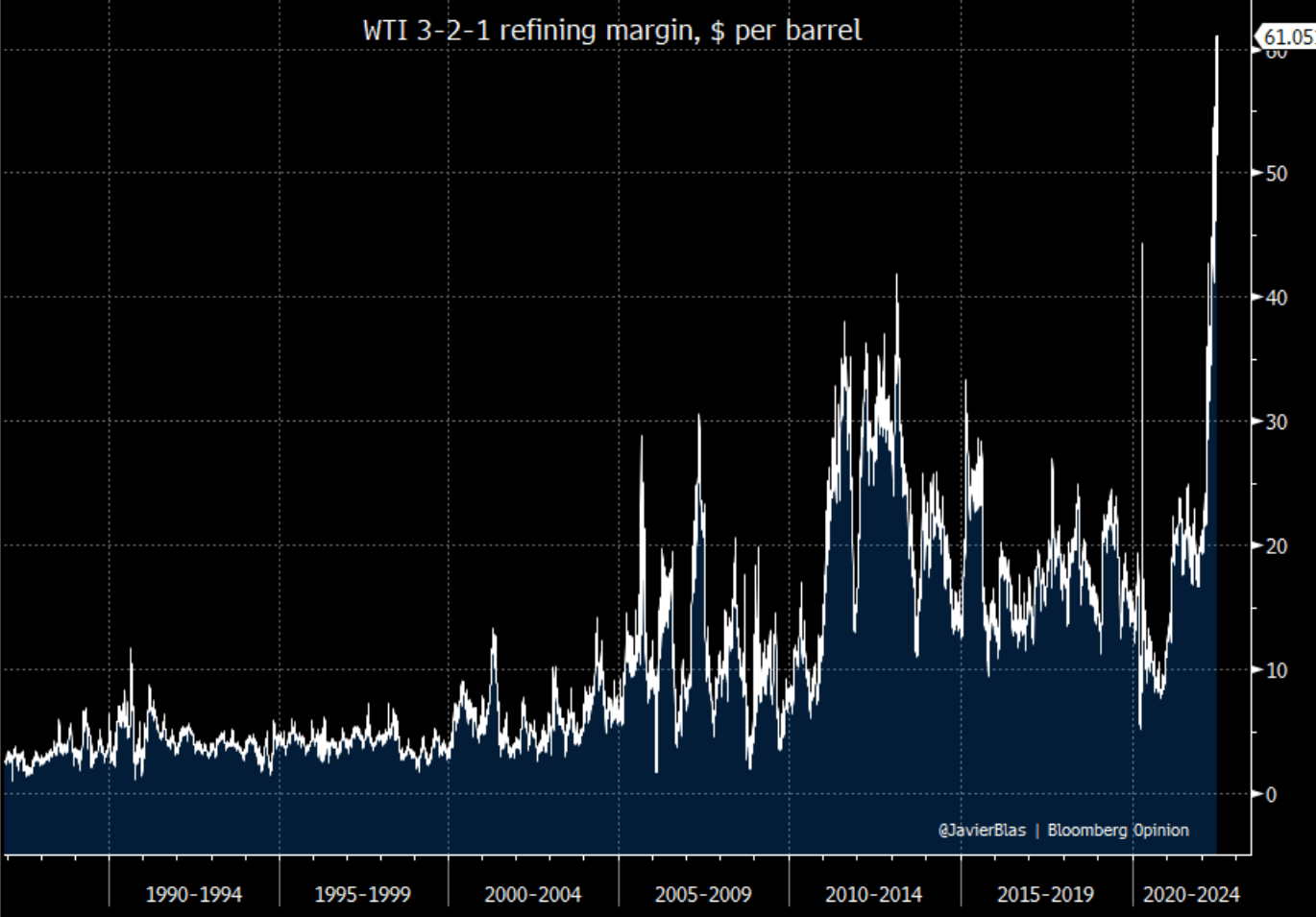

A measure of refiner profitability is the 321-Crack Spread, which measures the theoretical spread that can be derived from ‘cracking’ 3 barrels of crude oil into 2 barrels of gasoline and 1 barrel of distillate like diesel. Historically, the 321-Crack Spread averaged between $10 to $20 since the early 2000s, with periodic spikes and troughs (Figure 5). However, in 2022, crack spreads went on an epic surge, as Russian refined products were briefly taken off the market due to Russia’s invasion of Ukraine. This coincided with a surge in fuel demand as consumers returned to the roads with a vengeance after two years of COVID lockdowns.

Figure 5 – Crack spreads surged in 2022 (Bloomberg)

Although the crack spread did calm down in the summer months, they surged again into September/October, as Europe ran into an energy crisis with natural gas prices, represented as Dutch TTF Natural Gas, reaching 330 EUR/MWh or an equivalent of $100/mmbtu (Figure 6).

Figure 6 – European gas prices surged in 2022 (tradingeconomics.com)

Many European countries turned to diesel generators to power factories and homes, causing a surge in demand for diesel and a rebound in the crack spread to $55 (Figure 7).

Figure 7 – Crack spreads surged in Sep/Oct and have been rallying in recent weeks (tickertech.com)

As European natural gas prices calmed down, so did crack spreads, with the 321-crack spreads falling to a low of ~$25 in early December. However, in recent weeks, the 321-crack spread has been racing higher once again. What is going on and is this sustainable?

Refiners Could Benefit From Coming Russian Oil Embargoes

I believe crack spreads have been surging in recent weeks because of the EU’s embargo on Russian crude oil and refined products. The EU’s embargo on Russian oil went into effect in December, meaning European countries can no longer import Russian crude oil. While the oil embargo made all the headlines, an important follow-on embargo on Russian refined products has attracted little attention until now.

Beginning in February, European countries will no longer be allowed to import Russian refined oil products like diesel. Currently, the EU imports ~450k bpd of diesel from Russia. Once the products embargo goes into effect, European countries will have to source diesel from other countries like the U.S. and Saudi Arabia.

Furthermore, unlike Russian crude oil that can be diverted to friendly countries like India and China, the displaced Russian diesel will struggle to find a home as countries that are not part of the EU’s embargo will prefer to import heavily discounted Russian crude oil and capture the enormous crack spreads themselves. If Russia cannot find a home for this diesel, then the most likely outcome is this diesel production gets taken offline.

Tighter diesel markets will keep product prices high and crack spreads elevated. Moreover, refiners who have access to cheap feedstocks can benefit even more from the elevated crack spreads. Within CRAK’s holdings, I suspect Reliance Industries may benefit the most, as it is an Indian company and may be able to circumvent the EU embargo on cheap Russian crude oil as feedstock.

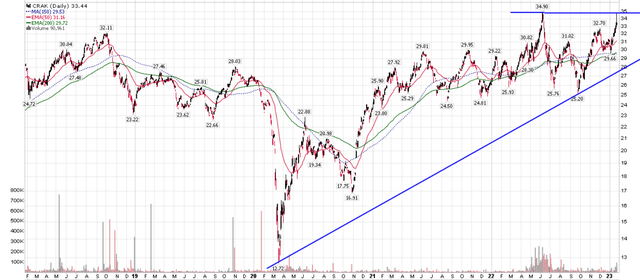

CRAK Technicals Breaking Out

Technically, the CRAK ETF is challenging its 2022 highs and may be shaping an ascending breakout pattern (Figure 8). Taking out the 2022 highs will lead to new all-time highs for the ETF.

Figure 8 – CRAK about to break to new all-time highs (Author created with price chart from StockCharts.com)

Risk To CRAK

The biggest risk to the CRAK ETF is a slowing global economy. Many economists like the IMF and the World Bank are forecasting a global recession in 2023 partly because of restrictive monetary policies enacted in the prior year. A slowing global economy could reduce demand for refined oil products, which could dampen refiner profitability.

On the flip side, a re-opening of China could create a surge in demand for fuel products like diesel and jet fuel, which could boost refiner profitability even further.

Conclusion

The CRAK ETF provides exposure to a portfolio of global refiners. Crack spreads, a measure of refiner profitability, is rapidly increasing in recent weeks in anticipation of an EU embargo on Russian refined oil products. Following on 2022’s strong performance, the CRAK ETF could be looking at a rosy 2023.

Be the first to comment