Inside Creative House/iStock via Getty Images

Summary

CPI Card Group Inc. (NASDAQ:PMTS) is the third largest credit and debit card manufacturer in the U.S. The company’s financial performance has improved primarily due to market share gains, as well as ASP expansion and industry growth. The company’s fundamentals are stable with 90% of its revenue recurring due to lost, stolen, damaged, or renewal card demand. The credit card industry is a growth industry, in which PMTS is taking significant share. PMTS is trading with a low P/E and EV/EBITDA due to its low share float, which should resolve as the stock price increases and catalysts unfold. (S&P 500’s 19x P/E)

Catalysts

Low Share Volume – we have discussed PMTS with many institutional investors, and their biggest push back to acquiring shares is the low share volume. The primary reason for the low volume is one large shareholder. The company disclosed that their largest shareholder (58% owner) registered its shares for sale last year. As we discussed in our first report, Tricor has made a lot of money in PMTS over its nearly 15 year holding period. We believe it inevitable that Tricor would begin selling its shares, enticing sell-side coverage as Tricor would sell through a secondary offering, which is very lucrative for investment banks, and it would remove the share overhang. A greater float would bring in new institutional investors that would increase volume in shares traded, which should improve the company’s multiple.

Strategic M&A – the company has disclosed it could pursue strategic acquisitions. We believe a deal that could consolidate the industry could have significant synergies, creating a larger company, strengthening the industry with greater pricing stability, and increasing share liquidity with increased shares outstanding. A well-structured deal could send the stock significantly higher than our $75 price target.

Additional Market Share Gains – the company disclosed it increased capital investments that expanded capacity by 50%, sending a strong signal to its customers and competitors for their intent to take additional market share.

Returning Capital – the company should generate $4 of cash earnings in 2023. The reduction of the company’s buffer inventory accumulated because of capacity concerns and reduction in capex could allow the company to generate $5 per share of free cash flow in 2023, allowing for a dividend or share buybacks.

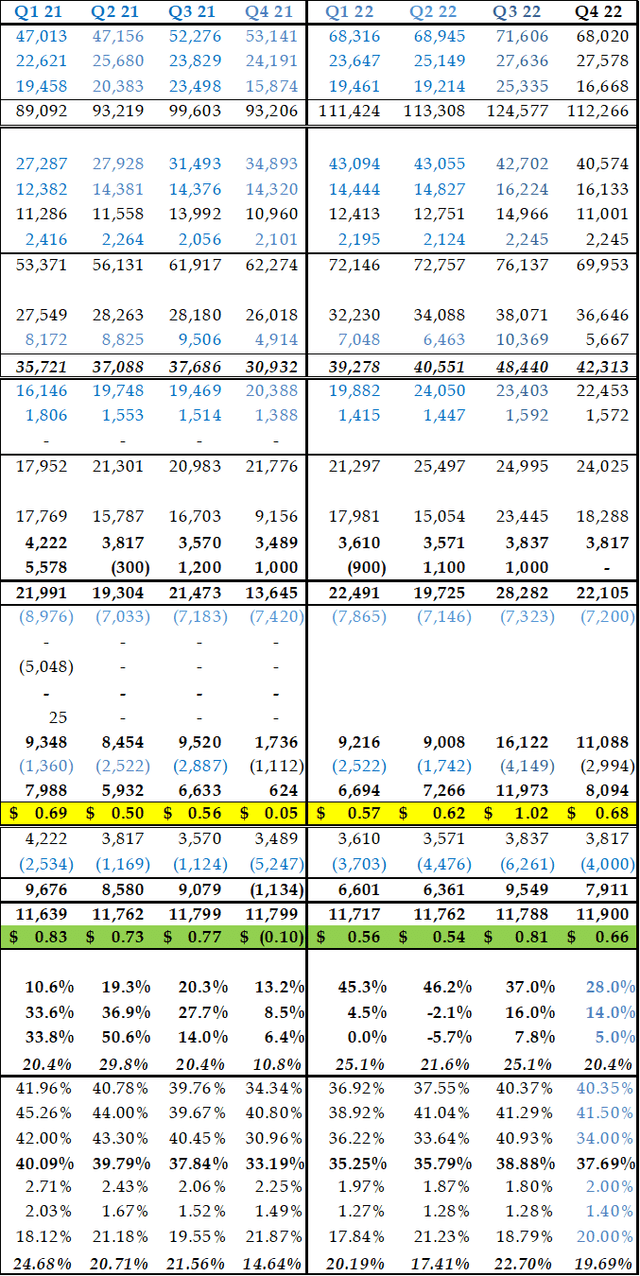

Q3 2022 Quarterly Financial Update

The single sell-side analyst covering PMTS expected $.52 earnings per share for the third quarter, while the company generated over $1 EPS driven by greater than expected market share gains. We are confident the company will generate about $90MM EBITDA or close to $3 EPS for 2022, which is almost exactly what we estimated one year ago.

We believe the company should continue to grow revenue in the high single digits in 2023 driven by market share growth and contactless and eco-card adoption that carry higher (ASPs). Due to the company’s fixed cost structure, cash earnings should be approximately $4 in 2023 and $5 per share in 2024.

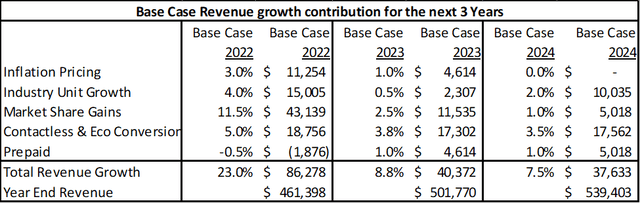

Company Revenue Drivers

Source: Created by the author based on company’s filings

Inflation Pricing – we expected the company to use its pricing power to maintain margins in 2022, but the company instead grew units to maintain margins through revenue scale benefits. The company disclosed 85% of growth this year was driven by units, and pricing contributed only low single digits to the growth rate.

Industry Unit Growth – The company stated in its year-end 2020 investor letter that credit and debit card units usually grow by approximately 3% per year. We assume 4% industry growth in 2022 and .5% in 2023 due to a slowing economy.

FinTech’s spending is increasing industry units as targeted marketing campaigns increase financial inclusion to the underbanked. FinTech’s believe their superior algorithms can better assess borrowers’ ability to repay loans. FinTech’s asset light business models use credit and debit cards to allow them to access traditional financial service infrastructure much in the same way Netflix uses cable company infrastructure to deliver movies. FinTech’s need debit and credit cards to enable their customers to transact at all possible payment points in the physical world.

Market Share Gains – the company has gained market share every year since 2018. Growing units vs raising price is advantageous, as greater unit scale allows for increased profitability while enhancing the company’s competitive position. We believe the company’s competitors have taken greater inflation pricing to grow revenue, which puts the company in a better competitive position to either raise price or continue to gain share in the future.

Contactless Conversion – as of 9/30/22, the company believes the industry will convert to 80% contactless by the year 2025. Since the company has 66% of its revenue tied to small issuers, we believe their conversion rate is lower than the market and has considerably more room to expand through 2025. We believe conversion to contactless drives about $20MM of revenue growth per year through 2025.

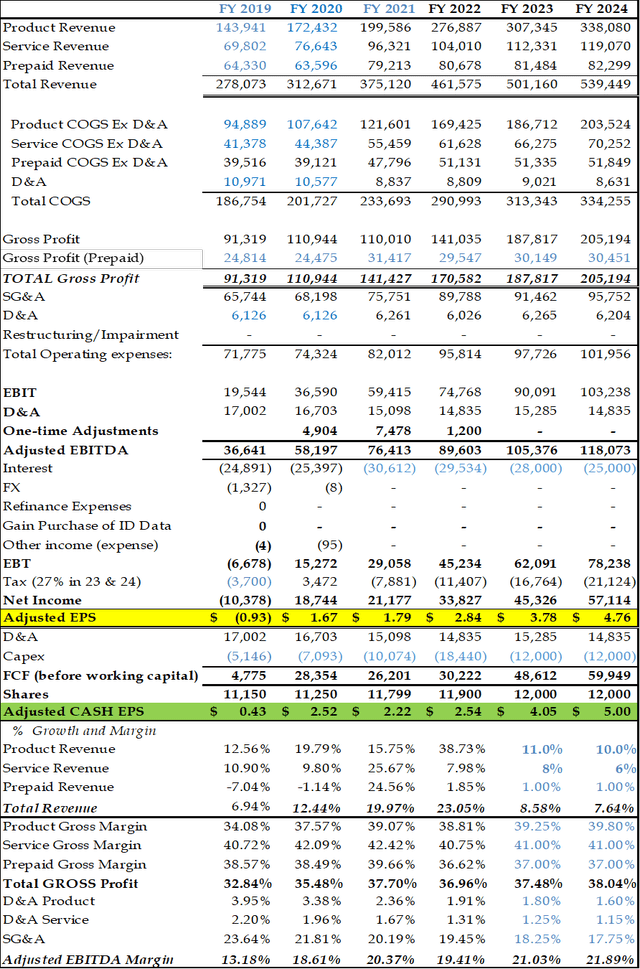

Source: Created by the author based on company’s filings

Prepaid Revenue – the company enjoys a 50% market share in this segment, so we assume modest growth going forward of 1%.

Margins – we expect near term pressure due to higher material and labor costs as price increases are implemented.

Capex – the company greatly expanded capacity in 2022 and we expect those expenditures to decline going forward.

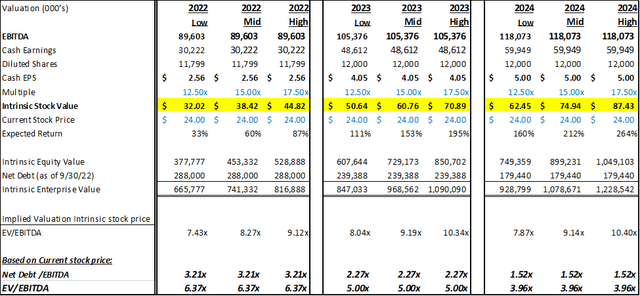

Valuation

Source: Created by the author based on company’s filings

Risks

Margin Compression – inflation is causing companies all over the world including credit card producers to raise prices. However, we do not know how much of the cost increases will be passed along, nor do we know how much of this inflation is transitory or permanent, so we have been conservative and factored in margin pressure despite scale benefits associated with organic growth from contactless conversion and new units.

FinTech Funding – Fintechs are a growth driver for the company and as the Fed raises interest rates, investments into VC firms could slow, thereby slowing their investments into FinTech companies. However, FinTech companies already have significant war chests to spend on customer acquisition.

Recession Risk – According to the company, the last significant recession of 2007-2009 saw cards in circulation fall by about 10%. We believe the Great Recession was especially difficult on the industry because it was a credit and liquidity fueled recession with several banks collapsing. Even if we assume a similar recession, it should reduce the company’s cards produced by approximately 15MM or approximately $25MM in revenue per year for two years. Just the ASP expansion of contactless cards could almost offset the revenue headwinds from a severe recession. If the company continues to take market share, that could further offset the recessionary headwinds and allow the company to grow its revenue during a large recession.

Stock Illiquidity – at higher stock prices, the company’s largest shareholder will sell shares providing more liquidity. With one investment bank taking coverage, others should probably join in as the fees associated with the secondaries will be considerable.

Conclusion

PMTS is a mispriced stock given historical and anticipated results with a below market multiple. Investors who purchase stock now are getting a significant value discount to hold an illiquid stock. The company has many drivers including pricing, market share increases, and contactless conversion that should drive revenue growth for years to come. If the company can execute its business plan, we could see a stock worth $75 once the market realizes earnings will be greater than $5 per share.

Lastly, the company has been discussing potential acquisitions. One potentially interesting situation has emerged with Idemia’s private equity owner rumored to be considering selling or breaking the company up. According to Reuters, Idemia has hired Goldman Sachs and Rothschild as bankers to run a sales process. If a deal whereby PMTS buys part of Idemia could be structured, it could increase operational scale and efficiency for the company, promote greater industry pricing stability, and increase share float allowing for our target price of $75 to be exceeded.

Source: Created by the author based on company’s filings

Source: Created by the author based on company’s filings

Be the first to comment