gesrey

For investors interested in getting exposure to “value” stocks, the Pacer US Cash Cows 100 ETF (BATS:COWZ) may be a good choice, as its focus on high free cash flow companies has historically outperformed the simple value factor, as represented by the iShares Russell 1000 Value ETF (IWD) fund. However, investors should keep in mind that “growth” and “value” investing ebbs and flows, and when value investing is out of favor, the COWZ ETF may underperform the market (COWZ underperformed the Russell 1000 index from 2017 to 2020).

Fund Overview

The Pacer US Cash Cows 100 ETF aims to provide exposure to U.S. companies with the highest free cash flow yields. The fund has $7.3 billion in assets.

Strategy

The Pacer US Cash Cows ETF strategy is to screen the Russell 1000 Index for the top 100 companies based on free cash flow yield. The companies are then ranked by their trailing 12-month free cash flow yield, with individual weights capped at 2%. The index is reconstituted and rebalanced quarterly.

The key ideas behind the fund strategy are that high-quality companies tend to have strong free cash flows, and high free cash flow yields signal the companies are trading at a discount.

Portfolio Holdings

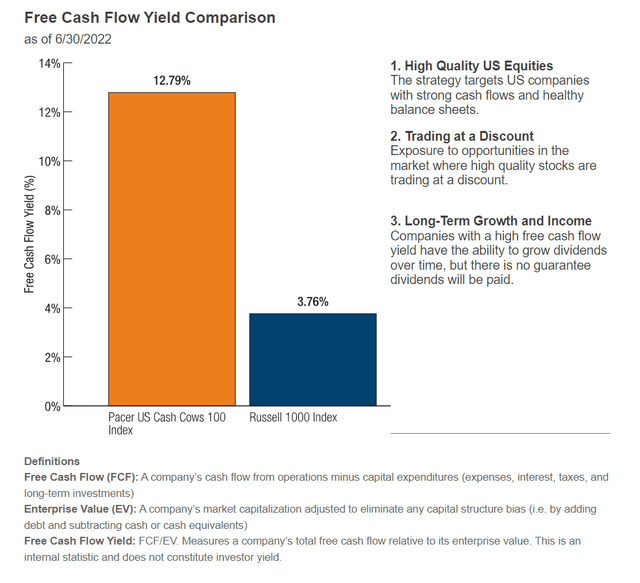

True to the fund’s strategy, the COWZ ETF portfolio has a 12.8% free cash flow yield as of the June rebalance, vs 3.8% for the Russell 1000 Index (Figure 1).

Figure 1 – COWZ Free Cash Flow Yield (paceretfs.com)

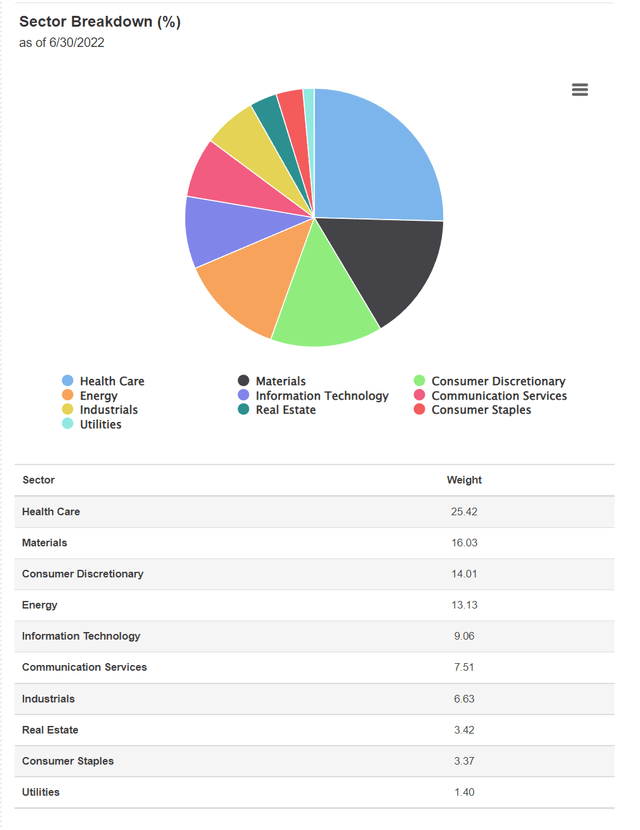

Figure 2 shows the COWZ ETF sector breakdown as of June 30. The Fund’s focus on high free cash flow yields skews the portfolio allocation towards value/defensive sectors such as Healthcare (25% vs. 14% in the S&P 500) Energy (13% vs. 4%) and Materials (16% vs. 3%). COWZ is underweight growth sectors like Information Technology (9% vs. 28%).

Figure 2 – COWZ Allocation breakdown (paceretfs.com)

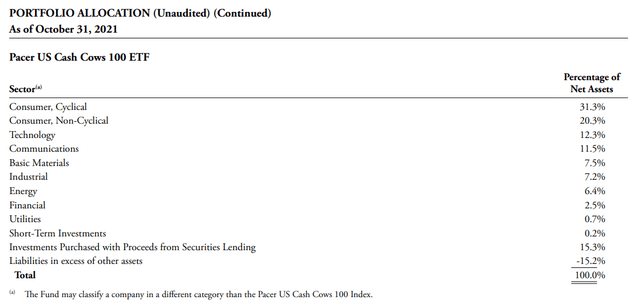

However, investors should note the fund’s sector allocation is not constant, as the tracking index is reconstituted and rebalanced every quarter. For example, if we look at the fund’s allocation from October 2021, we can see that Materials (7.5% vs. 16.0% currently) and Energy (6.4% vs. 13.1% currently) portfolio weights were much lower in October versus now (Figure 3).

Figure 3 – COWZ October 31, 2021 Portfolio Allocation (paceretfs.com)

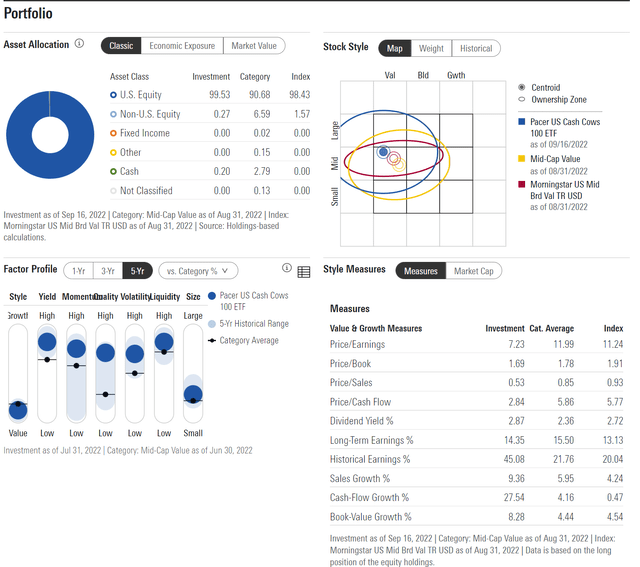

Overall, the fund is considered a Mid/Large Cap Value Fund, using Morningstar’s criteria (Figure 4).

Figure 4 – COWZ portfolio tilt (morningstar.com)

Returns

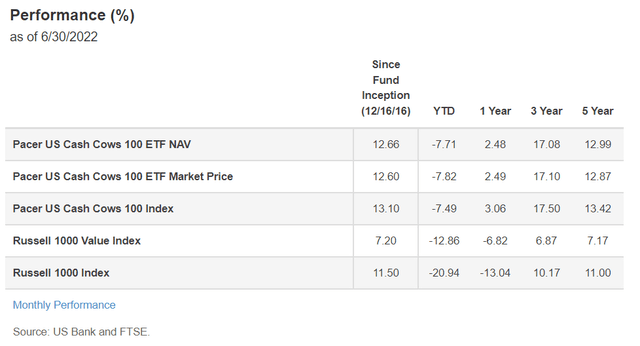

Returns for the fund have been robust, particularly since the COVID lows in early 2020. COWZ has 3 and 5-year returns of 17.1% and 13.0%, respectively, to June 30, 2022 (Figure 5). This compares well with the Russell 1000 Index, which delivered 10.2% and 11.0% performance over the same timeframe. YTD, the COWZ ETF is only down 3.3% to August 31, compared to the Russell 1000 Index, which is down 17.0%.

Figure 5 – COWZ returns (paceretfs.com)

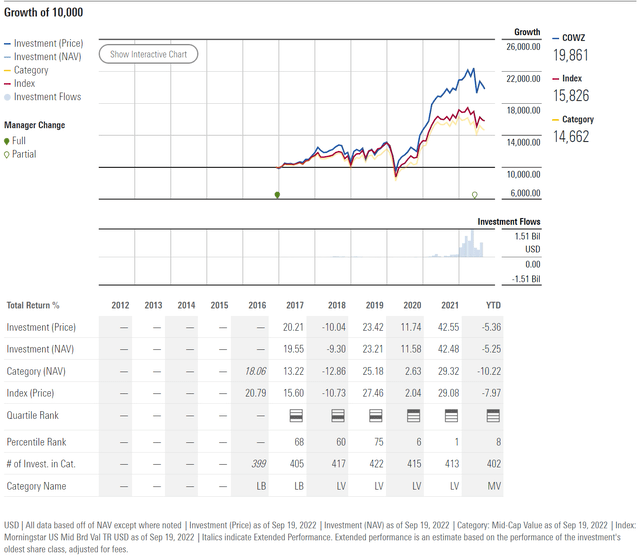

Comparing COWZ to its peer group, we see that the fund has been a top quartile fund since 2020. Prior to 2020, COWZ was a third quartile fund (Figure 6).

Figure 6 – COWZ vs. Peers (morningstar.com)

COWZ Outperforms When Value Is In Vogue

I believe the key deciding factor on the COWZ ETF’s relative performance is whether “growth” or “value” investing is in vogue. Looking at the ratio between the iShares Russell 1000 Value ETF and the iShares Russell 1000 Growth ETF (IWF), we can see that when the value factor underperforms growth, COWZ also underperforms its peers (years 2017 to 2019). Since the COVID pandemic lows, value has outperformed growth, hence COWZ has been a top quartile fund.

Figure 7 – IWD vs. IWF ratio (Author created with price chart from stockcharts.com)

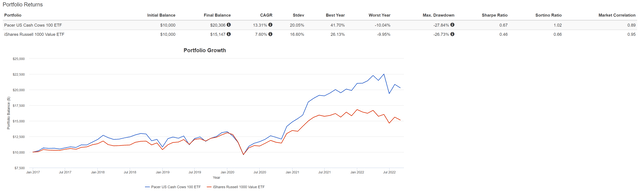

However, when we compare COWZ to the IWD ETF using Portfolio Visualizer (isolating the value factor), we find that COWZ does outperform IWD in the time period analyzed (January 2017 to August 2022), with 13.3% CAGR returns vs. 7.6% CAGR returns for IWD. Max drawdowns are roughly similar at 27.8% vs. 26.7%, while COWZ has a better Sharpe ratio of 0.67 vs. 0.46. So although COWZ is highly correlated to the “value” factor, its focus on free cash flow yield appears to outperform the pure value factor, as represented by the IWD ETF.

Figure 8 – COWZ vs. IWD (Author created using Portfolio Visualizer)

Distribution & Yield

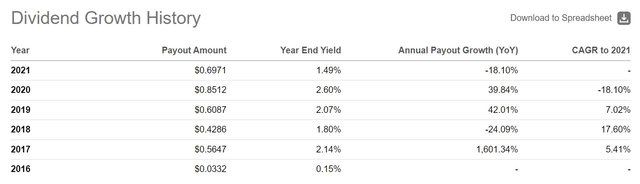

Although the COWZ ETF focuses on high free cash flow companies, the fund itself does not pay a high distribution yield. It has a 30D SEC yield of 1.9% and the distribution growth is irregular, with 2 annual declines of 24% and 18% in its 5-year history (Figure 9). The distribution is paid quarterly and the most recent distribution amount of $0.2125 was paid on June 29, 2022.

Figure 9 – COWZ distribution history (Seeking Alpha)

Fees

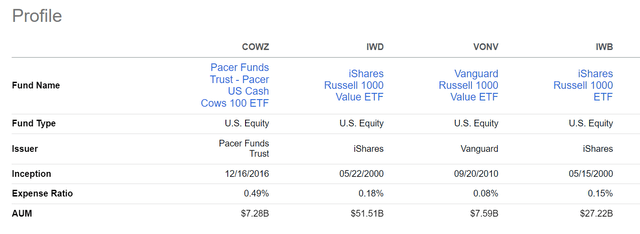

The COWZ ETF charges a relatively high expense ratio of 0.49%. For reference, the IWD ETF charges a 0.18% expense ratio and the Vanguard Russell 1000 Value ETF (VONV) charges a 0.08% expense ratio (Figure 10).

Figure 10 – COWZ vs. peer ETFs (Seeking Alpha)

Risk

There are a couple of risks I see with the COWZ strategy. First, as the trailing 12-month free cash flow yield calculation is backward looking, it may not react quickly to changing market conditions. For example, Moderna (MRNA) has a relatively large weight in the fund, at 1.9%. This is because the company has benefited greatly from the recent sales of its COVID vaccine and has been generating lots of free cash flow. However, the strategy does not assess whether this free cash flow will persist into the future.

If COVID vaccines are no longer needed (or not needed for the general population, as President Biden has recently declared the COVID pandemic to be over), shares of Moderna may discount the future loss of sales and sell-off while the index ranking methodology may still consider the stock to have high free cash flow yields based on trailing financials. Perversely, it may even rank the company higher, since the stock price has fallen, and its ‘free cash flow yield’ has increased.

Another risk is that the Fund reconstitutes and rebalances the index every quarter, creating a large turnover. For the fiscal year ended April 30, 2022, the COWZ ETF had a portfolio turnover rate of 114%. Over the past 5 years, the portfolio turnover rate has varied between 85% to 122%. High turnover rates increase trading expenses, and can also lead to capital gains being distributed to investors.

Finally, as free cash flow yield is a “value” factor, the fund may underperform during periods when the market prefers “growth” investments, like the years leading up to 2020.

Conclusion

I personally believe “value” investing should be done on an individual company basis, as there are many nuances to “value” beyond simple financial ratios. However, for investors interested in getting broad exposure to “value” stocks, the Pacer US Cash Cows 100 ETF may be a good choice, as its focus on high free cash flow yielding companies have historically outperformed the simple value factor, as represented by the IWD ETF.

Investors should also keep in mind that “growth” and “value” investing ebbs and flows, and when value investing is out of favor, the COWZ ETF may underperform the market (COWZ underperformed the Russell 1000 index from 2017 to 2020).

Be the first to comment