Luis Alvarez

Initiating Coverage

We are initiating coverage on Cowen (NASDAQ:COWN). Though Cowen’s current stock price is near The Toronto-Dominion Bank’s (TD)(TD:CA) acquisition price, we believe that given the company’s strong fundamentals and undervaluation relative to peers, Cowen could be of interest to investors in the event that TD acquisition is called off or the price were to fall well below the current acquisition price of $39. We also remain skeptical on the acquisition by TD, and we will continue to monitor this stock to see if there are any meaningful updates regarding the acquisition that can determine our view on the stock.

Company Overview

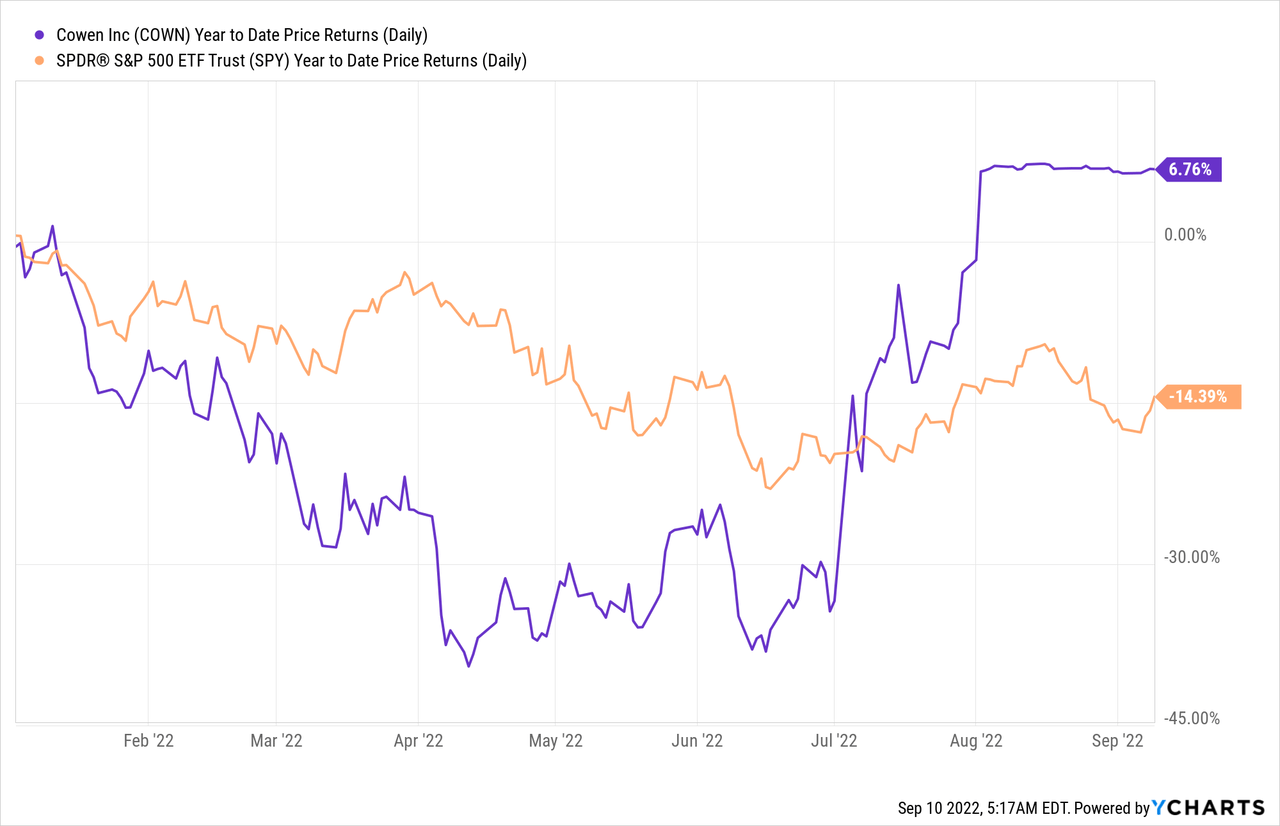

Cowen Inc. is an American multinational independent investment bank and financial services company that was founded in 1918. This company has two business sections: a broker-dealer and an investment management division. Year-to-date, the stock price has seen an increase of 6.76%, outperforming the S&P 500 index which has fallen -14.39% in the same period of time. Currently, Cowen’s market capitalization is $1.07 billion and dividend yield is 1.25%.

TD Acquisition

TD in early August announced a $1.3 billion acquisition of Cowen (~$39 per share) that is expected to close in the first quarter of 2023. Though the acquisition is part of a string of acquisitions by TD to bolster its franchise especially in the United States, we have mixed views about the move. First and foremost, TD’s $1.3 billion acquisition is seen as a credit negative decision by credit agencies, with Moody declaring the acquisition a “negative for its credit quality”. Furthermore, it remains to be seen how easy the integration of the acquisition will be, and TD estimates that integration costs will amount to $450 million over three years. Given the economic slowdown and high inflation, though Cowen is a solid business with strong financial performance, we feel uneasy about TD’s overall execution and success of the acquisition. The current market price of Cowen is near the acquisition price, so we do not believe that there are more to be gained by Cowen shareholders at the current price point. Until the deal fully closes, we will remain vigilant on Cowen as if the company were to be assessed as a standalone business, there remains some value proposition at current levels.

Review of Financials and Shareholder Policies

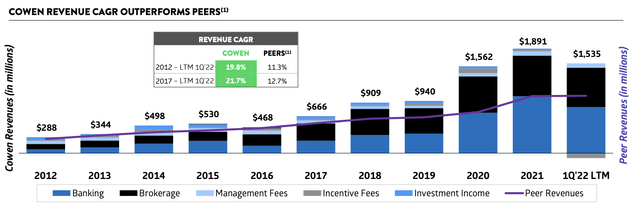

In the past quarter, Cowen reported $302.4 million of Q2 2022 Revenue, and also reported a $12.4 million of net income which translates to $0.41 per share. Cowen’s recent financial performance has been impressive, as Cowen has had a 21.7% of revenue CAGR since 2017 which is far more than the similar competitors’ revenue CAGR of 12.7% when using the 1Q22 LTM numbers (2Q22 LTM is unavailable). Furthermore, this company has a strong balance sheet, reporting $8.8 billion in assets and $926.8 million in cash as of June 30, 2022. The strong balance sheet is another reason why we think the company is financially strong. Cowen also has decent shareholder friendly policies. The company has a quarterly dividend of $0.95 per share which translates to 1.25% current dividend yield. In addition, Cowen has conducted roughly $159.8 million in share buyback in 2021, and has authorized $50 million so far this year. These indicate management’s confidence in the business prospects and such policies should provide support to shareholder value.

Cowen Earnings Presentation

Acquisition Valuation

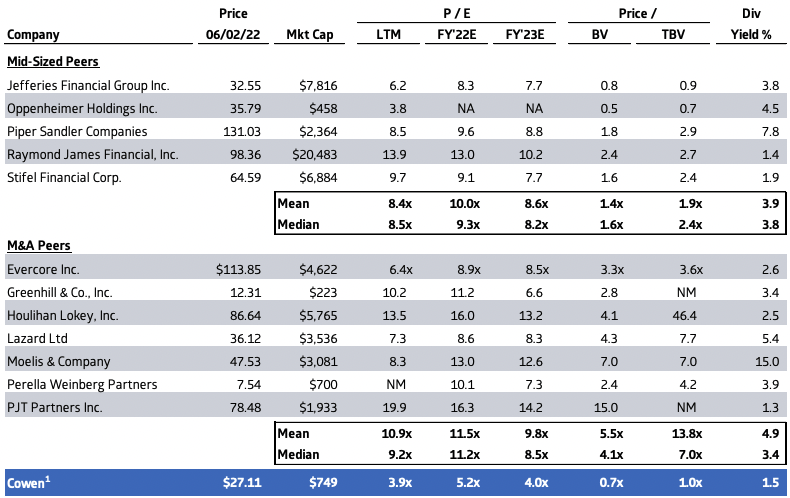

We believe that Cowen even at the current market price after the acquisition announcement is undervalued compared to peer valuation. Cowen is a financially strong company that should be trading comparable to its peers. However, the current market multiples for Cowen are quite low and we believe that the company is fundamentally undervalued even after acquisition. Based on the strong financial performance and robust fundamentals, the company should at the very least be trading in the same P/E multiple range as its self-identified M&A peer group. Based on Q2 2022 earnings presentation, the median FY’22E P/E multiple of its M&A peer group is 11.2x. Given that the current FY’22E P/E ratio of Cowen is 7.3x based on the current market capitalization of $1.06 billion, there is at least a ~53% undervaluation even after the acquisition. Assuming all else equal, even in the event of the successful completion of the acquisition, we view this deal to be highly accretive for TD Bank.

Earnings Presentation

Risk

For Cowen investors, we believe the main risk for shareholders is if the acquisition were to not go through. Cowen traded at around ~$35 per share prior to the TD acquisition news. Given that Cowen trades at ~$39 per share currently, we could reasonably expect to see Cowen trade at 10% less than its current market value if TD were to back out of this deal. Given the limited upside based on the ceiling set by TD’s acquisition price of ~$39 per share, we believe that there’s too much downside risk for investors in the current environment. As a result, we believe that Cowen is not worth adding to at current levels, but should be an attractive stock if the TD acquisition were not to go through and the stock price drops based on its intrinsic valuation.

Conclusion

We believe Cowen is an undervalued company that could be of interest to investors. Cowen is an investment bank that is undervalued relative to peers, and the company is financially strong with a history of outsized financial performance compared to competitors. However, the current price is capped by TD’s acquisition price, and so we are recommending a “HOLD” at the moment. We will continue to evaluate the company carefully over the next few months to see how the acquisition unfolds.

Be the first to comment