Michael Vi

Coupang, Inc. (NYSE:CPNG) – the Amazon of South Korea – has seen increasing buy-ins by a number of hedge funds and investment managers deepening their exposure in the Asia ex-China/Emerging Markets themes. In terms of revenues, the company has indeed gone from strength to strength but the overall picture for the company’s future prospects is rather complicated.

Coupang Financials: Segments and Trends

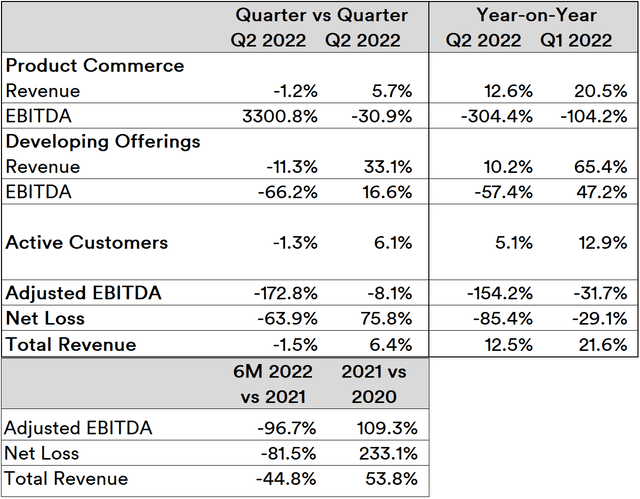

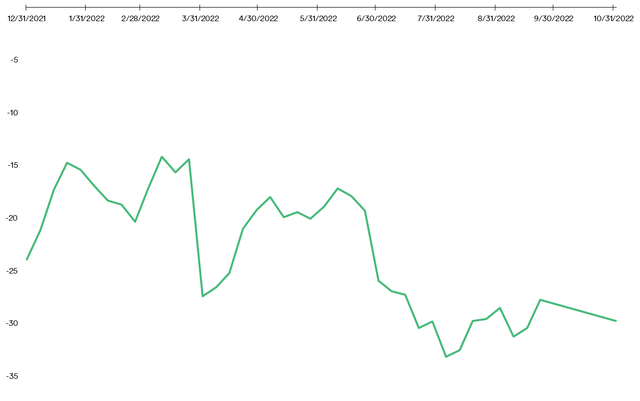

An examination of the company’s financials shows ample reasoning why so many institutional investors have been showing interest in a year of market lows and investor exits (as covered in an earlier article). The “delta” analysis done on a quarter-on-quarter basis for this year as well as a year-on-year basis relative to the past year reveals some excellent trends:

Source: Created by Sandeep G. Rao using data from Coupang’s Quarterly Statements

On the face of it, the negatives might look discouraging. But this echoes the problem with estimating metrics for Amazon (which was also covered recently).

First, the company started reporting financials as per two segments from this calendar year onwards. The reason for this becomes immediately apparent: the company’s mainstay – “Product Commerce” (or e-commerce) – went from negative EBITDA to an increasingly higher levels across both Q1 and Q2 of this year. In fact, it went up 3,300% in the second quarter.

Second, after a massive jump in net losses in 2021, net losses in the 6 months of 2022 is only a little over 18% of the entirety of the previous year. In the same period, it has already accrued well over half of the revenue accrued in the previous year. EBITDA losses are only 3% of what was in the previous year.

Third, the drag is primarily led by its evolving “Developing Offerings” segment which includes the likes of Coupang Eats (restaurant ordering and delivery), Coupang Play (video streaming), fintech services, and advertisements related to these categories. In other words, a now-steadily improving mainstay segment is subsidizing the company’s forays in diversification. Even in this segment, EBITDA losses relative to revenues earned have been falling (while still being a net loss).

The “Active Customer” metric shows a little attrition but this has not been a significant detriment. This doesn’t necessarily mean “customer loyalty” (there is no logical reason why any customer would stridently stay loyal to an e-commerce platform) but it does show that effective engagement strategies have been effective in retaining customers’ attention to a large extent.

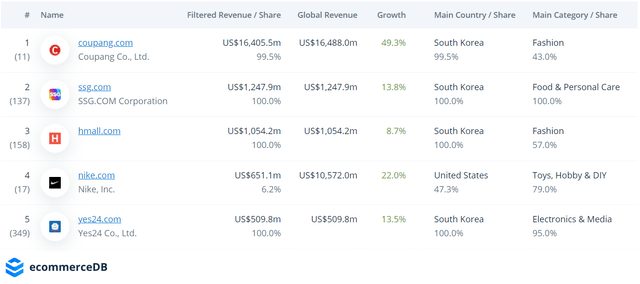

In hindsight, the high losses in 2021 looks to have been a highly calculated move. As per one source (ecommerceDB), the company jumped ten places to the No. 1 position in South Korea by the end of 2021.

However, as the stats indicate, Coupang is by no means the only successful “native” e-commerce company: competition is tight and highly variegated. For instance, hmall, which has the same primary segment as the company, is far behind in net revenues (at least currently) but has witnessed a very impressive leap in ranking as well. South Korea has many fast-rising e-commerce champions and has well and truly become a paradise chockful of choices for specialist investors who play in this particular niche.

This heightened competitive space also underlines why the company will have to continue engage in a costly battle to maintain its place. As per the U.S. International Trade Administration, 99.7% of all households (as of 2020) have internet access and extremely high smartphone penetration has been a driving factor for the explosive growth in e-commerce.

Market Trends and Macroeconomics

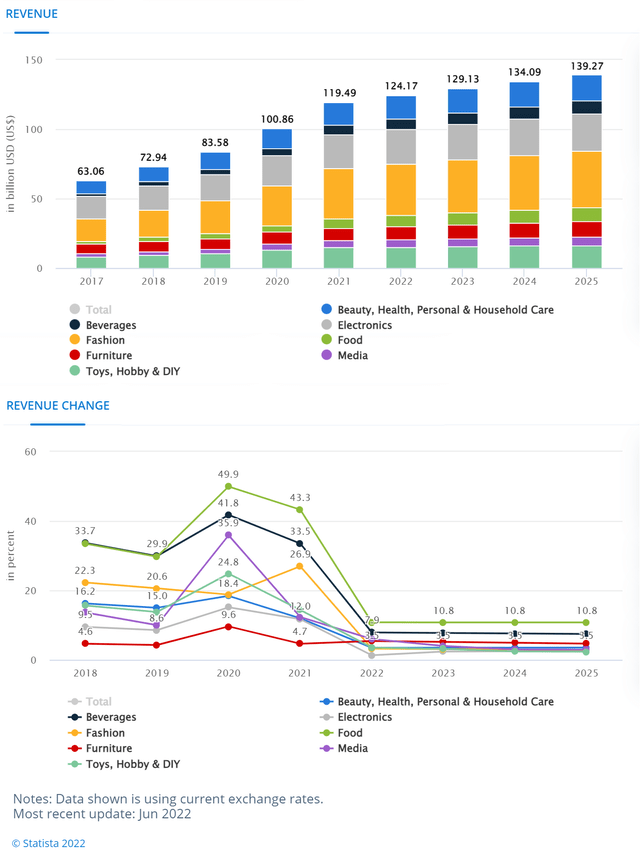

When it comes to South Korea, trends in e-commerce revenues are quite fascinating. For one, it seems that the market has essentially peaked.

Going forward, even change in revenue is essentially flat and estimated to be stable. Across categories, even broad Average Revenue Per User (ARPU) is largely estimated to be stabilizing and the net market for “native” e-commerce platforms is overwhelmingly domestic with no effective change foreseen in the near future.

The high penetration of internet services in the country coupled with these trends strongly suggest that e-commerce as a whole is not only an attractive means of commerce but a nearly de facto one. Virtually every “brick and mortar” big-box store in the country already operates in “hybrid” mode.

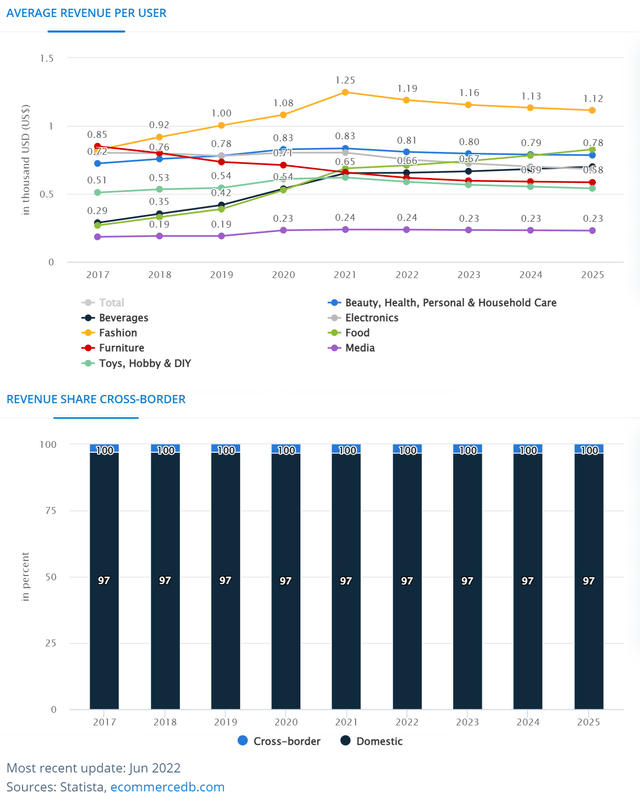

In contrast, the U.S. is still expected to exhibit higher relative upward potential in market penetration for e-commerce in the years to come.

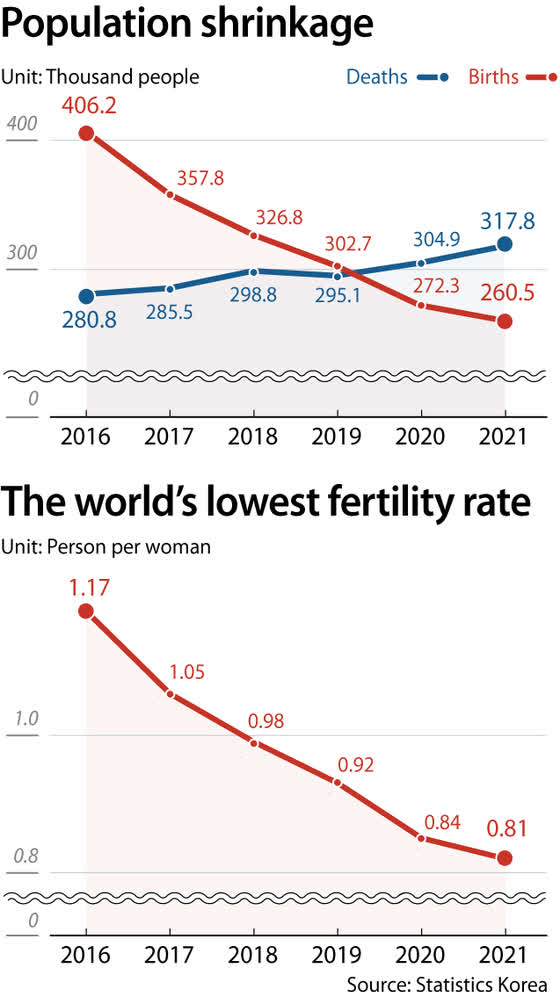

Now, a significant portion of spending in general can be linked to average disposable income. Like the U.S., South Korea has also had a significant period of wage stagnation coupled with inflation for a number of years now. This has been considered to be contributory factors for the ongoing population shrinkage in the country. 2021 marked the country has having the world’s lowest fertility rate.

Visualization by Korea JoongAng Daily

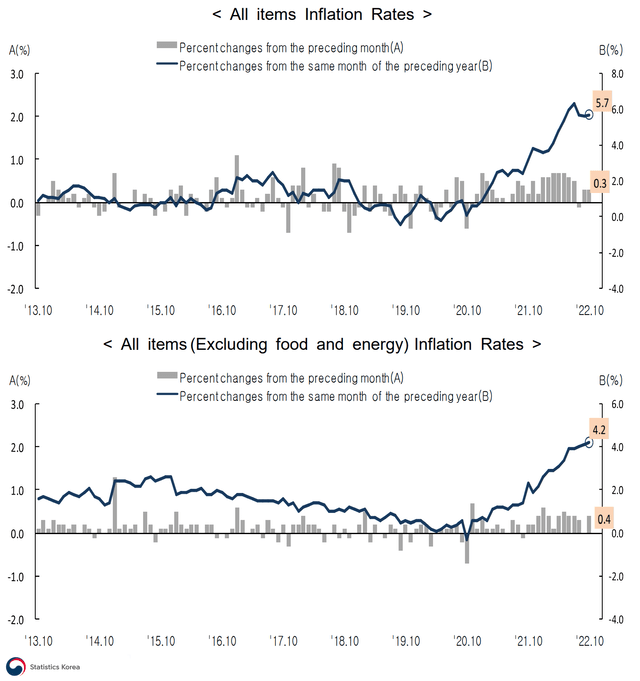

In the year so far, while overall inflation rate has been estimated to be showing some signs of a downtrend or flattening, in items excluding food and energy, the uptrend is still prevalent.

Visualization by Statistics Korea

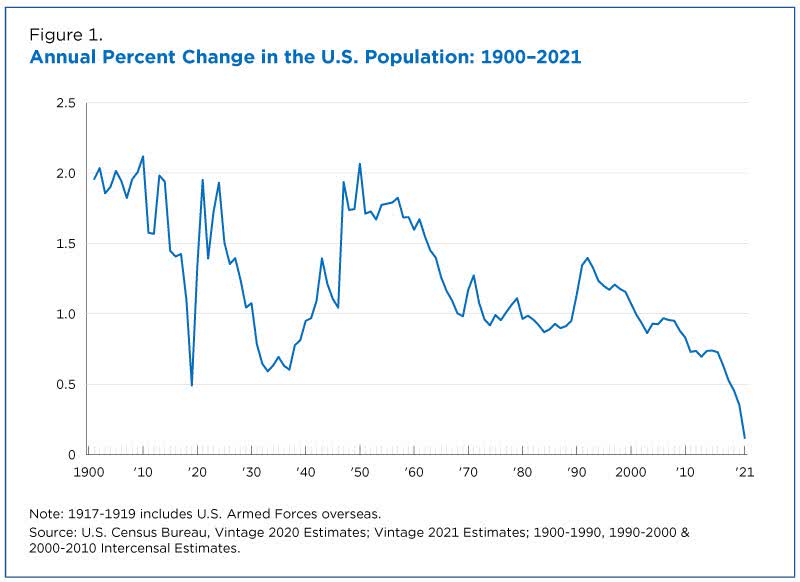

When it comes to demographics, the U.S. also shows similar trends, as highlighted in an article written in December last year. Shortly after the article’s publication on this platform, the U.S. Census Bureau confirmed that the U.S. population grew at a slower rate in 2021 than in any other year since the founding of the nation. This has been a persistent trend since the mid-nineties.

Source: U.S. Census Bureau

The relevance of the flattening population growth to consumption is intuitive: while the value of e-commerce revenues might be higher, it could be argued that the volumes transacted will likely be stabilizing for some time to come (at least), be it in the U.S. or in South Korea.

In light of this, the estimated uptrend in e-commerce revenues is rather interesting. It’s highly suggestive that e-commerce penetration isn’t as extensive in the U.S. as it is in South Korea. Thus, at least when it comes to the company’s prospects, it’s a battle to retain share in an essentially static market that doesn’t have any near-term expectation of growth either in existing or future customers. This will become more and more apparent in the U.S. as well.

Ratio Trends and The Onset of Conviction

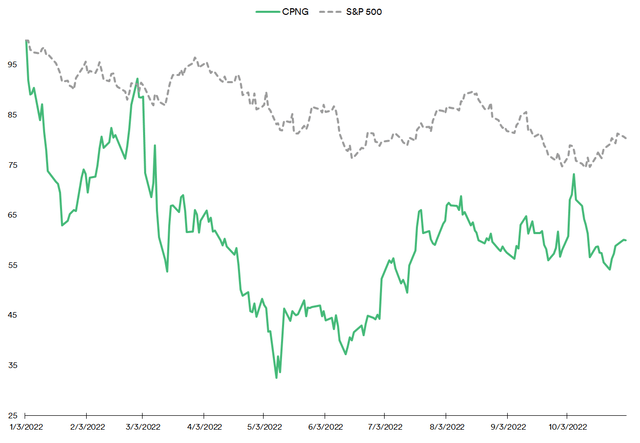

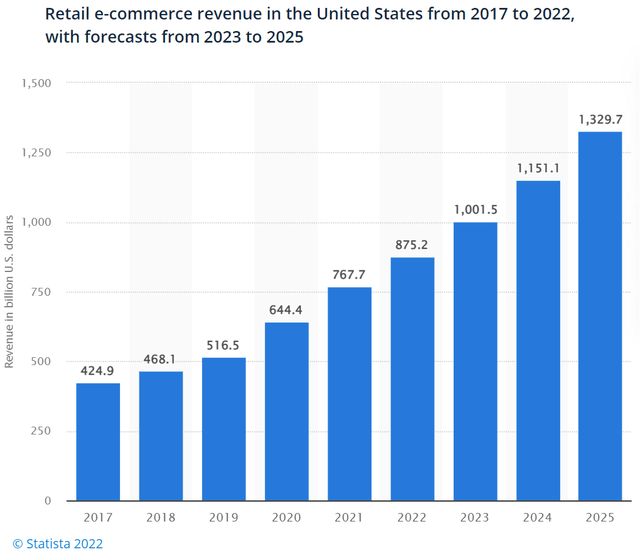

Comparing the Price to Earnings (PE) Ratio of the company’s stock versus that of the broad market S&P 500 (SPX) is largely unnecessary: in the year till date (YTD), the company’s PE Ratio has grown increasingly negative.

Source: Created by Sandeep G. Rao using data from Zacks’

The reason for this has been the company’s ability to beat earnings estimates in the YTD. Consensus estimates indicate that earnings per share for Q3 (due to be released on the 9th of this month) will be less negative than in Q2 and the overall EPS for the year is expected to improve 81% from -$1.08 in 2021 to -$0.2.

While the company – in terms of price performance – has certainly underperformed relative to the S&P 500 in the YTD, swings in both the upside and the downside in the latter occur concurrently with a massive swing in the same direction in the former.

Source: Created by Sandeep G. Rao using data from Yahoo! Finance

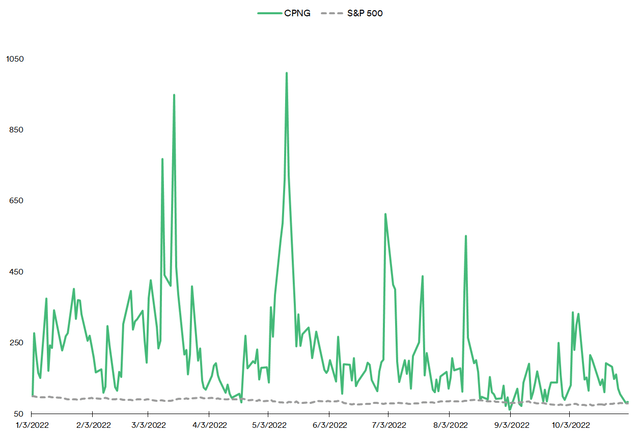

Now, in the most recent Amazon article, it was indicated that the year has seen steady exits by individual investors from U.S. equity markets coupled by flows into broad-market ETFs. Relative to daily change in volumes traded for the broad-market S&P 500 ETF, Coupang’s volumes have been several orders of magnitude higher until recently.

Source: Created by Sandeep G. Rao using data from Yahoo! Finance

Going by the year’s trends, a massive upswing in volumes can be expected, depending on the magnitude of surprise in actual earnings which, in turn, is likely to happen and be positive. Large-scale buy-ins – particularly by global institutional players – can be expected if they turn out to be less negative than expected – which is well within the realms of possibility – as it will imply even stronger earnings per share for the current financial year. A breakout into a net positive can also be expected.

In Conclusion

The company has an extremely interesting profile: trends in traded volumes mark it as a “high-conviction” stock while trends in its earnings see it showing vast improvements leading it to the cusp of a breakout into profitability. On the other hand, the company’s battling for dominance in a mature market against several high-quality competitors. It can be expected that some element of consolidation via acquisitions will be initiated in the Korean e-commerce space once the company’s earnings for the year trends positive.

The price ratio performance marks it as a “growth stock” while its trends in earnings and its current position in the largely-static addressable market mark it as being on the cusp of maturing into a “value stock” with diversification benefits since it gives international investors exposure to the South Korean economy.

Over the long run, the company can be expected to become a mainstay for investors unless it goes on to have a number of disastrous earnings or makes a couple of adverse business decisions over the next few quarters. In the current absence of evidence of the latter, there are plenty of arguments to buy in at the moment.

Thus, the current recommendation is to “Buy”.

Be the first to comment