Baris-Ozer

Thesis

Reflecting on a continuing bear market, paired with elevated levels of volatility, markets, JPMorgan Equity Premium Income ETF (NYSEARCA:JEPI) might very well be one of the smartest investment opportunities available. The fund pursues a defensive portfolio allocation (low Beta), while writing call options on the asset base – collecting an attractive premium given the market’s rich volatility levels (reference, VIX above 30). Accordingly, investors benefit not only from relatively muted downside risk, but also from a high income yield – which is especially valuable in a risk-off environment where growth/long duration assets get punished the most (ARKK is down more than 63% YTD).

Although JEPI is down about 16.6% YTD, the ETF has clearly outperformed the S&P 500 and U.S. treasuries – with the SPY and TLT being down 21.7% and 33.4% respectively.

Seeking Alpha

Defensive Portfolio Allocation

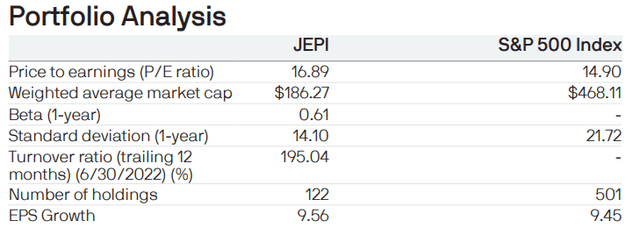

The 2022 bear market, which might very well continue for (a little) longer, has been especially hard on high beta and long duration assets. Accordingly, investors might want to appreciate the JEPI for a low beta and low duration asset allocation. As of October 24th, the fund claims a beta as low as 0.61 and a P/E of less than x17. Moreover, JP Morgan’s Equity Premium Income ETF reports that the fund’s 1-year standard deviation is 14.1%, versus 21.7% for the S&P 500 benchmark.

JPMorgan Equity Premium Income ETF – Portfolio Analysis

The ETF prospectus says that investment allocations are made using a ‘time-tested, bottom-up fundamental research process with stock selection based on our proprietary risk-adjusted stock rankings’.

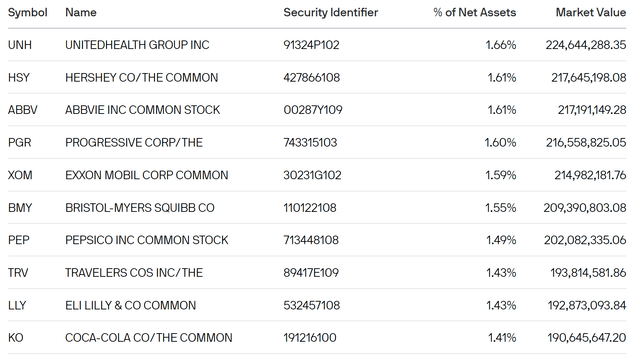

The defensive portfolio strategy is evident when looking at the ETF’s top 10 largest holdings, which tilt towards health care, pharma, energy and consumer staples. The list highlights names such as UnitedHealth (UNH), Exxon Mobil (XOM), Coca-Cola (KO). See here for the ETF’s full portfolio.

JPMorgan Equity Premium Income ETF – Holdings

JEPI’s YTD performance has benefitted from underweighting high-tech / high-growth firms such as NVIDIA (NVDA), Tesla (TSLA), and Microsoft (MSFT).

Looking ahead, JEPI’s portfolio manager shows little intention to be more aggressive. The following commentary is taken from the ETF’s prospectus: (emphasis added)

While the economy has steadily recovered, we remain balanced and continue to monitor incremental risks that could represent headwinds for U.S. stocks. Through the volatility, we maintain exposure to quality, focus on high-conviction stocks and take advantage of market dislocations for compelling stock-selection opportunities.

Call Overwrite Makes Perfect Sense

One of the most attractive propositions that an investor can enjoy from investing in JEPI is a high yield (short-duration). The ETF not only invests in high-dividend names with stable pay-out history, but also selectively sells out-of-the-money call options on the S&P 500 Index to generate additional distributable monthly income. While selling call options may sound risky, investors should consider that the opinions are more/less directly and indirectly covered through the ETF’s holdings.

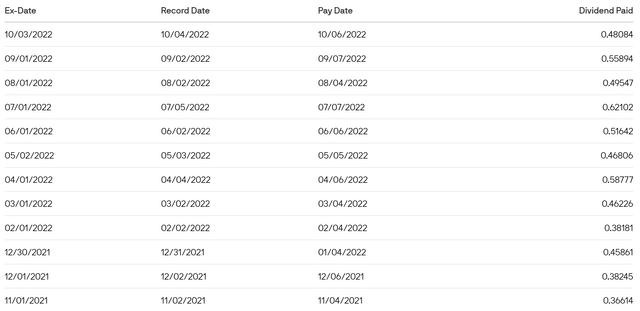

Writing options is especially attractive in a high-volatility market environment, where the VIX is constantly trading at levels greater than 30. This strategy enabled the fund to offer an attractive income yield, with monthly payouts in 2022 consistently close to 1% of asset value.

- a 12-month rolling dividend yield of 8.26% and 30-day SEC yield of 13.79%

- a yield in the top 10% of all U.S.-registered open-end funds and ETFs.

JPMorgan Equity Premium Income ETF – Dividends/Payout

Risks

There are two major risks that I would like to highlight for JEPI investors.

First, investors should consider that the JPMorgan Equity Premium Income ETF remains an equity portfolio. Accordingly, even though the asset allocation is defensive, the fund’s performance might not be immune to a sharp repricing for equities.

Second, the JEPI ETF is not ideal for investors who are looking for capital appreciation opportunities. There are two major considerations: A) selling call options limits the upside potential that might be realized in a bull market; B) JEPI allocates capital to low beta stocks with anti-cyclical characteristics. If bullish sentiment would return, such a capital allocation strategy generally underperforms the S&P 500 (as the JEPI ETF has underperformed in late 2020 and throughout 2021).

Strong Buy

JPMorgan Equity Premium Income ETF is a ‘Strong Buy’, in my opinion. Reflecting on the current macro-environment, I argue that a low-beta and low-duration investment in equities is poised to outperform alternatives – including cash which is expected to lose 6 – 8% of value due to inflation

Moreover, given that the volatility premium is rich and upside limited (my opinion), the additional income from writing call opinions on JEPI’s asset base is highly attractive. Finally, investors might also appreciate that the ETF is relatively low cost, with net expenses as low as 0.35% per year.

Be the first to comment