Torsten Asmus

Investment Thesis

Coterra Energy Inc. (NYSE:CTRA) reported a sizzling hot Q3 result. But Coterra’s results were overshadowed by two minor considerations.

Firstly, an update on its proven reserves. Secondly, the idea now surfaces that inflationary pressure will persist into 2023.

Together, these two impacts add uncertainty around this investment. While I don’t believe them to be material, the market did sell off on the back of these announcements.

That being said, I don’t believe this changes the investment case.

U.S. Natural Gas Will Move Higher, Nearly Certain

There’s bound to be some quarterly variation and instances when Coterra’s investors’ expectations get slightly ahead of what Coterra can deliver.

There’s a mismatch between near-term hopes and medium-term potential. Investors wanted more. There’s a lot of focus on the near term, particularly for investors that don’t quite buy into the ”whole natural gas” story.

For anyone that wants a recall, the story is incredibly straightforward. I believe that we are going to continue to see an arbitrage between low natural gas prices in the U.S. and Europe and China.

There’s no reason for the price in the U.S. to remain about 5x to 7x cheaper than in other parts of the world.

Meanwhile, for now, we have two factors that are weighing down U.S. Henry Hub prices:

- Unseasonal warm weather.

- The Freeport LNG facility remaining out of use for a lot longer than expected.

These two are leading the U.S. to have above-normal natural gas inventory at this time of year. So that’s the backdrop. Now, let’s jump into the quarter.

Free Cash Flow Jumps, As Expected

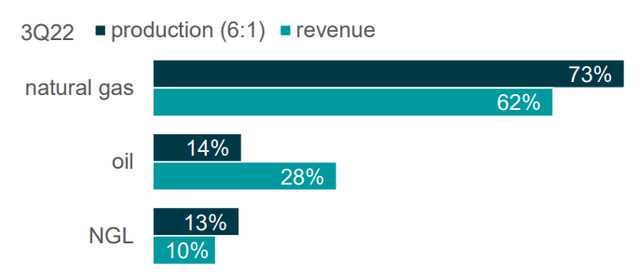

As a reminder, Coterra is predominantly a natural gas producer.

Coterra has other revenue streams, but for all intents and purposes, this is a pure-play natural gas producer.

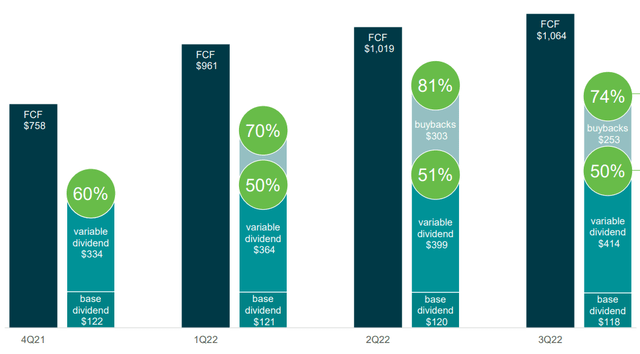

Consequently, anyone following Coterra would have expected to see a very strong performance in Q3. Hence, for Coterra to report an increase of 744% y/y in free cash flow would not have shocked anyone.

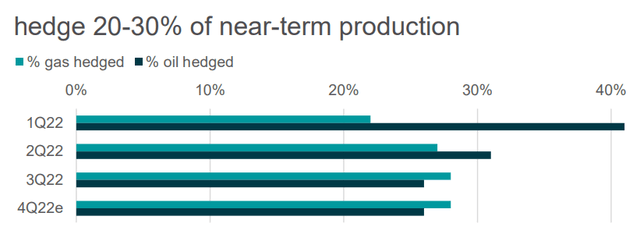

Anyone that has followed my commentary on Coterra will have read my argument that Coterra will more likely than not continue to hedge out its production by approximately 25% in 2023.

And that’s really why what you see here is very much consistent with my prior analysis.

Next, we’ll discuss a couple of blemishes in this quarter’s earnings.

Bearish Overhangs In Q3

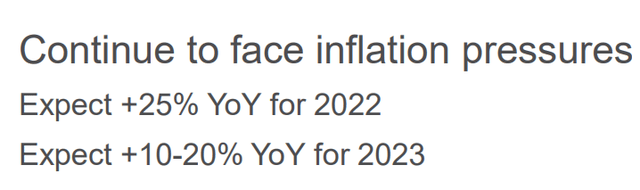

In the first instance, inflationary pressures continue to persist.

What you see above is that in 2023, the projected total well costs are going to increase by 15% y/y due to inflation. That’s going to eat away at Coterra’s free cash flow next year.

The other impact was the update on Coterra’s proven reserves. Coterra noted on the earnings call that proven reserves will decrease by approximately 15-20 percent year over year by year-end.

That being said, during the earnings call, Coterra went to great lengths to explain that it did not see a material change in its cash flow forecast over the next 3 to 5 years.

This is an estimate that will bore itself out very slowly over a multi-decade period, and that revision spans the 50-year life of its wells.

Capital Allocation Policy Discussed

Coterra aims to return 50% of its free cash flow via dividends, plus 24% of its cash flows returning via buybacks.

As an energy investor myself, I’ve now heard every argument and contra argument from shareholders advocating for more dividends while others prefer more buybacks. It appears that to satisfy both groups, Coterra continues to deliver some proportion of the two.

One way or another, the capital is coming back to shareholders. It’s a good problem to have!

CTRA Stock Valuation – 7x This Year’s Free Cash Flow

At the start of the year, Coterra was guiding for $4.5 billion of free cash flow. At the time, there was low inflation and high strip prices.

Today, as both of those inputs reverse slightly, Coterra now guides for approximately $3.9 billion of free cash flow.

Given that Coterra is still priced at 7x this year’s free cash flow, together with a 9.4% annualized total dividend, I believe that this is seriously cheap and that this downward revision isn’t a huge deal.

The Bottom Line

Coterra Energy is very well positioned for the secular growth opportunity that’s underway, the demand for U.S. natural gas.

Admittedly, Coterra’s Q3 quarterly results were not without blemishes. But altogether, at 7x this year’s free cash flow, I believe that the risk-reward remains attractive for Coterra Energy Inc.

Be the first to comment