Mario Tama/Getty Images News

Introduction

Costco (NASDAQ:COST) should be on any long-term investor’s radar. To begin with, their impeccable value proposition which is built upon being a consumer-oriented retailer, which trades off higher margins for consumer loyalty, has provided them with long-term per share expansion beating competitors such as Target (NYSE:TGT) and Walmart (NYSE:WMT). Secondly, Costco is showcasing its resilience during a period of higher inflation and supply chain issues. Thirdly, Investors vigilant about future economic activity have nothing to worry about as Costco’s success is primarily independent of the global economy. Lastly, the company’s EV/EBITDA ratio has fallen to 20 meeting my valuation criterion for a mature company.

Analyzing Costco’s Resilience

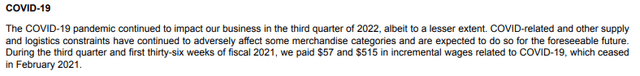

To start off my bullish thesis for Costco I’d like to highlight how well the company has been operating through the global supply chain disruptions and rising inflation relative to peers such as Walmart and Target. Costco was the only one out of the three to post positive operating income growth in their most recent quarter whereas Target and Walmart saw 43% and 23% declines in their operating income respectively. Costco even acknowledged in its most recent earnings report that supply chain constraints did not have a significant impact on the company’s current operations.

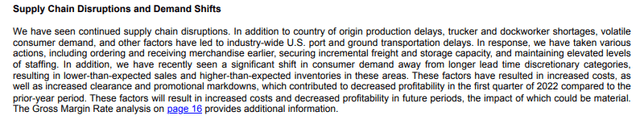

Source: 10-Q

The same cannot be said for Target, which is currently facing challenges regarding delays, volatile consumer demand, and is reluctantly offering markdowns on its products.

Source: 10-Q

Target’s management disclosed in the MD&A portion of their most recent 10-Q that if these supply chain disruptions pertain that future profitability will be in jeopardy. Fortunately, supply chains have only had a marginal effect on Costco’s operations. Additionally, in some cases, higher inflation has probably benefited the company as higher gasoline prices contributed to the company’s sales growth in the most recent quarter. Moreover, Costco being able to offer cheaper gasoline to its members could enhance customer loyalty as consumers look to save on their gasoline expenditure. Overall, I suspect Costco will continue to hold up better than its peers during these times of supply chain constraints and higher inflation levels.

Comparable and Common-Size Analysis: Superior Mid/Long-Term Financial Performance

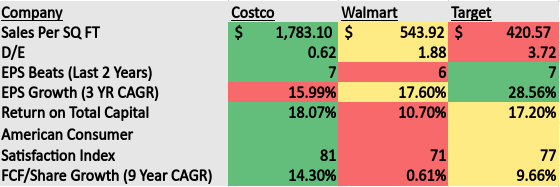

In addition to Costco performing better than its two close rivals in the most recent months, my comp analysis shows that Costco has superior management execution when compared to Walmart and Target in the mid/long term. The following is my comp analysis consisting of key financial ratios that I believe best measure management effectiveness over time and display these companies’ current financial positions accurately.

Excel

Source: Excel

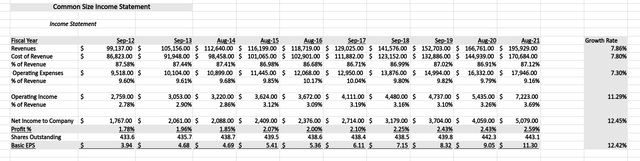

As you can see, Costco beats its two closest peers on almost every important metric whether it’s long-term FCF per share growth or customer satisfaction. This indicates that Costco’s value proposition is superior to that of Walmart and Target, providing the firm with a long-term competitive advantage. The second analysis I did was a common-size analysis of the company’s income statement. The objective of this analysis was to assess the main drivers of Costco’s EPS expansion.

Source: Excel

Here, we see that weighted shares outstanding since 2012 have remained stagnant and that the company’s EPS growth is primarily driven by net income growth. Indicating that the company has used retained earnings to expand operations as opposed to increasing EPS through repurchases. Additionally, the company has shown impressive long-term EPS growth for a consumer staple at a CAGR greater than 12%. Once again I attribute the company’s success to its customer-oriented business model which has led to adequate consumer loyalty and impeccable brand recognition.

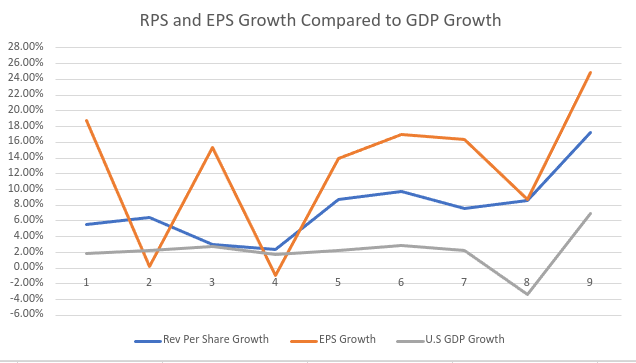

Economic Slowdown Will Not Equate To A Costco Slowdown

For long-term investors or investors looking for a defensive holding over fears of a potential recession, Costco may be the play you were looking for. The company has not only demonstrated significant results despite supply chain constraints, but its long-term performance has been relatively independent of the overall economy. For example, in the year 2020 when U.S GDP contracted 3.5%, Costco’s revenue per share rose 8.58% while EPS rose 8.77%. The following excerpt is a chart comparing U.S GDP growth to Costco’s revenue per share and EPS growth since 2012.

Excel

Source: Excel

Despite there being some correlation between per share expansion and the yearly U.S GDP growth rate, Costco has been able to provide per share expansion despite the state of the economy, including when the economy went into recession in 2020. This should provide confidence to investors that Costco will provide adequate results even if the economy goes into recession in the near future.

Valuation

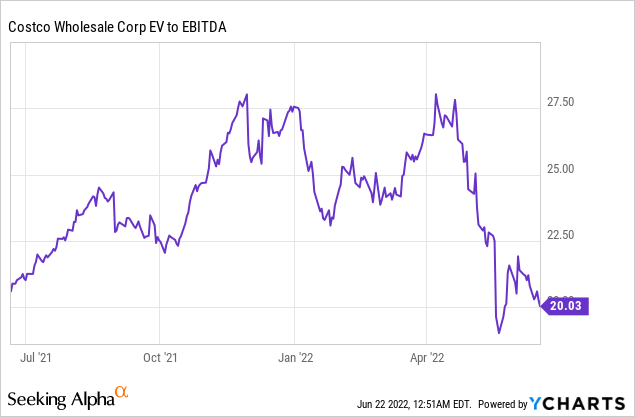

Most Costco bears notably point at the company’s high P/E multiple as to why the company is not an attractive investment. However, Costco’s recent drawback makes the company’s stock compellingly priced when looking at its EV/EBITDA.

Costco’s current EV/EBITDA ratio just makes my threshold for my valuation criteria for a mature company, which is that the stock’s EV/EBITDA multiple has to be 20 or below. Furthermore, the company’s Price-to-earnings-to-growth ratio of 1.82 is below the company’s 5-year mean of 2.96.

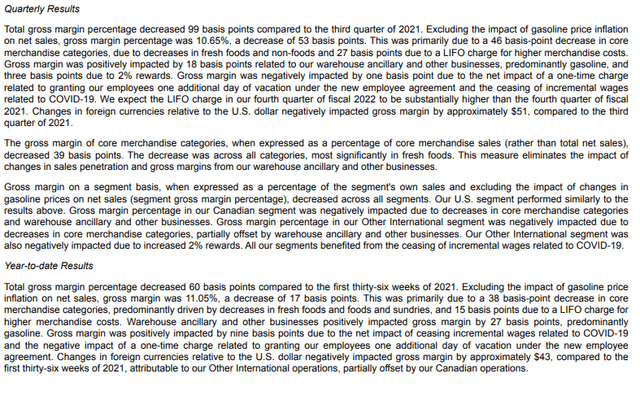

Risks: Short-term Gross Margin and Operating Cashflow Decline

Although I stated earlier that the company has been relatively unscathed by higher inflation and the supply chain issues that have eventuated, the company will not completely avoid these global dilemmas either. The company’s gross margin in its most recent quarter declined by 99 basis points and management is already expecting a greater decline in quarters to come as higher merchandise inventory is expected to create a substantial LIFO charge in Q4 and higher oil prices continue to squeeze gasoline margins.

Source: 10-Q

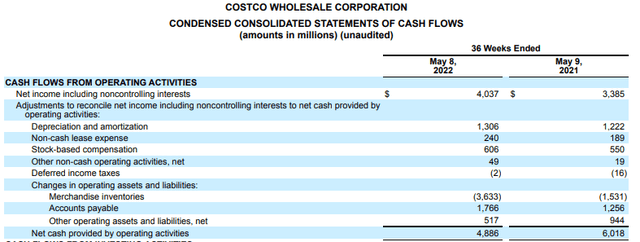

Additionally, in order for Costco to reduce the impact of rising prices from squeezing its margins, the company has been needing to purchase inventory earlier than usual which has caused rising inventory levels. This has impacted the company’s operating cash flow quite a bit as seen in its most recent earnings report.

Source: 10-Q

Due to these rising price levels forcing the company to buy and hold onto more inventory to control costs, I do expect Costco’s operating cash flow to either stagnate or decline over the next year or so.

Conclusion: A Great Business

To conclude my bullish thesis, Costco has a great value proposition which has allowed the company to retain 90% of its American members yearly, and expand its per-share metrics greatly over the last decade. Overall, there is no reason to believe that the company will not deliver better than expected results despite a slowing economy and supply chain disruptions. I see Costco providing solid returns to investors over the next several years as well as adequate protection of principle when tumult reaches the markets.

Be the first to comment