jetcityimage

Here at the Lab tower, in our initiation of coverage, we highlighted how Corteva (NYSE:NYSE:CTVA) was a long-term winner thanks to population growth expectations and higher productivity in the cultivated areas with better crop protection products. After the Q2 results and also in the CMD comment, we were positively impressed by the company’s long-term view. As a reminder, looking at our buy case, our conclusion was: “more R&D, better and new product offering versus competitors, an increase in product mix developments and in price, resulting in higher operating leverage that equal more profits in a continuous positive circle”. Aside from the core business operation, what positively surprised our view was: Corteva’s strong balance sheet (with cash in hand), a new additional buyback plan, advantages in rising interest rate to lower the company’s pension liability (valued at $4 per share), and a strong emphasis on simplifying its internal organization to lower costs and royalty fees. You can have a look at our publications at the links below:

- Corteva: Additional Upside

- Corteva: Comment On The Investor Day

Q3 results

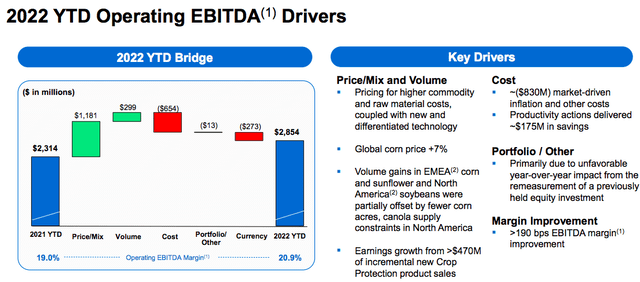

Q3 performances were exceptional. Last time, we were cautious about the EU energy crisis and the strong US currency development (not supportive for an export-oriented company such as Corteva). However, they managed to outperform these challenges with positive price/mix development. Despite the negative FX contribution, the core EBITDA increased by $96 million compared to the minus $51 million achieved in the same quarter last year, with price up by more than 13% and also a volume increase of 9% (accelerating from the half-year performances). The company’s ability to pass through cost increases with higher prices is ongoing and we expect additional positive pricing delta for the future.

Corteva EBITDA evolution

Source: Corteva Q3 results presentation

Looking at the divisional highlights, here are our key takeaways:

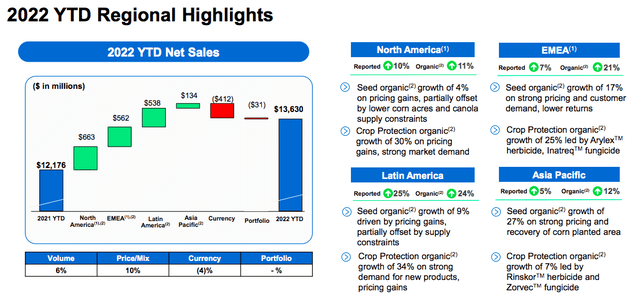

- Seed EBITDA reached $224 million versus Wall Street consensus expectation that was forecasting $169 million. Despite the summer period being a lower season, the company achieved outstanding results. Indeed, the price mix is less seasonal and Corteva was able to increase top-line sales in all the geographic areas (Fig below), confirming our 2023 numbers in the segment;

- Crop Protection EBITDA stood at $352 million and beat once again the company collected consensus estimated at $198 million. Compared to the seed division, the crop protection segment is less seasonal. This is due to the fact that crop protection is usually applied pre and post-cultivation. It is also more balanced in the geographic area. EBITDA was up by more than 500 basis points compared to last year’s number with positive evolution in all the regions, with a particular focus on North America.

Corteva GEO sales

Source: Corteva Q3 results presentation

Conclusion and Valuation

After these results, despite our cautious approach, we can no longer provide a neutral rating to Corteva. It is not easy to forecast an EBITDA line given all the current challenges in this market environment. However, it is clear that the company is able to totally offset raw material inflationary pressure with a strong track record of price increases. Rolling forward our EBITDA, we forecast a $3.45 billion number in the 2024 account, and applying a multiple of 13x (in line with its historical average), we derive a target price of $73 per share. Important to note are: interest income totally offsets interest expenses (with a positive delta of $25 million per year), the lower contribution for Corteva’s pension liabilities, the latest share repurchase program, and the higher guidance provided in the Q3 results both in top-line sales and EBITDA evolution. The key risk to our target price includes product recall and failure, the decline in interest rate, and negative FX development. Others risks are included in our initiation of coverage.

Be the first to comment