Alistair Berg

Corsair (NASDAQ:CRSR) had a terrible Q2, but Q3 looked a lot better. The main reason is the evolving glut in components taking the choke off the supply chain. There is pressure on this non-discretionary consumption, but Q2 was so bad that Q3 is seeing meaningful sequential improvements. While conditions are definitely improving, we don’t love CRSR’s long term prospects, and think that the commodification of the industry is demonstrated in margin comments on some of the new products. There’s little value add here yet CRSR is being valued like a marvel on forward estimates. We think it’s best avoided, there’s cheaper quality elsewhere.

Key Q3 Notes

Because of all the moving parts, it’s really the sequential information that’s most informative.

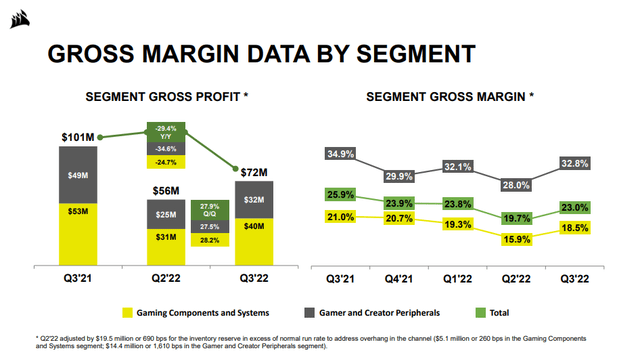

The two segments are both seeing improvements primarily on volume but also on cost. Freight and material costs are coming down and improving marginally, but it’s the working through excessive inventories built up in the earlier half of 2022 that is mostly repairing margins. Thankfully, no inventory write-offs had to occur, but CRSR built up way too much inventory thinking the gaming craze would hold. A combination of pressured consumers as well as pressured supply chains, particularly in semiconductors, became a bit of a problem – Europe remains a soft market even now.

While consumers are still under pressure in their non-discretionary spending, the incremental benefits are coming from the fact that there is a growing glut of components. GPUs are the easiest to track and closely linked to the collapse of crypto. As crypto prices come down, people try to resell GPUs that were being used for mining. All of this makes it more affordable and feasible to get together all the parts that make a self-build PC. Some of these components like cooling systems are sold by Corsair. Moreover, as new builds happen, gamers buy new sets of peripherals. This dynamic has been favoring results, and there is the expectation of 20% sequential growth into an usually strong Q4 thanks to the holiday season.

Bottom Line

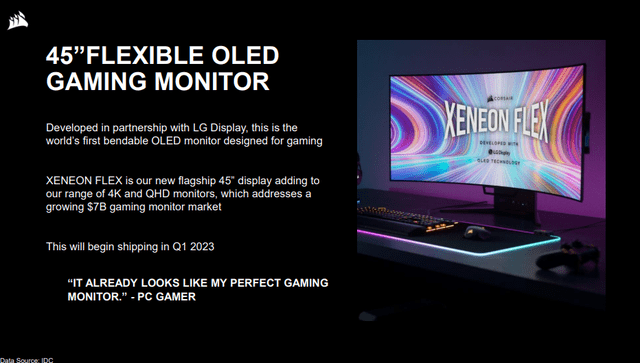

The company noted that there were some new product releases. The first is a gaming laptop which seems to sell at around the $2k price level. While this is higher end, all the margin ends up going to component manufacturers like AMD (AMD). While CRSR will capture something in memory products, the margins are likely to be weak, certainly below current operating profit margins. Same goes for the new bendable OLED screen. It looks amazing, but the technology is coming from LG not from CRSR who they’re manufacturing it with. Margins will probably be lower than the current margin and be a negative mix effect if it’s a successful product in volumes.

CRSR is not that cheap either. Once EBITDA normalizes from a really poor 2022, multiples are in the 10x EV/EBITDA range. Peripherals are a really competitive market, and the new initiatives are giving away margin to others and are not very margin accretive. CRSR is considered very cool today, but it could follow the path of Razer (RAZR) which was all the rage till it started falling off in popularity some years ago. The industry structure is tough, and we think the critical element is needing a lot of conviction in the brand to go forward with the investment at this price.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment