putilich

Introduction

Properties and REITS are known to be good inflation hedges. Corporate Office Properties Trust (NYSE:OFC) is a specialized office REIT catering to the US Defense sector. Over the years, the business has sold non-core assets to reorient its portfolio more toward the US defense sector. Now, as it is expanding its portfolio within its niche, it is poised to reap the benefits from a higher defense spending environment. Management has prudently locked in fixed low-rate interest for at least 4 more years resulting in a balance sheet largely immune from continued interest rate hikes. Despite this positioning, the stock trades at decades-low valuations. I expect an imminent re-rating of the stock along with outperformance over the S&P 500.

Business Overview

OFC is an office REIT specializing in catering to the facility needs of the US Defense Technology industry. It is the main player in this niche, albeit fragmented segment. The barriers to entry are much higher than it is for other REITs since the properties have to meet certain standards such as meeting requirements of the Anti-Terrorism Force Protection (ATFP) and having Sensitive Compartmented Information Facilities (SCIF). It is not easy to meet these standards from a business decision perspective as it commits to a certain office layout that may not suit other uses, increasing concentration and asset under-utilization risk.

90% of the company’s rental revenues come from Defense and IT Technology customers, with the Fort Meade location along the Baltimore – Washington corridor making up 48% of overall rent revenues and 39% of overall square feet. In the picture below, Fort Meade is highlighted in green, defense locations marked in red and the Baltimore – Washington corridor is outlined in black:

Fort Meade Location (Google Maps)

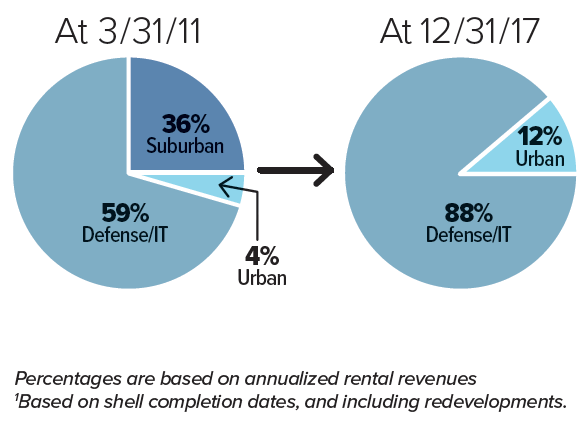

OFC used to have a real estate portfolio that had a higher non-defense assets mix in 2012. However, since then, the company has undergone an asset recycling plan wherein it sold legacy non-defense assets to create new defense related developments:

Revenue Mix Shift (Company Overview Tearsheet)

This strategy continues today; the company sold one of its data centers early this year to improve its balance sheet and double down on development projects catering to its niche. According to a September 2022 company conference, management intends to exit its remaining 3 data center assets that are currently in a joint venture by 2024. The strategic plan going forward is to expand their portfolio by focusing on defense, capitalizing on the bright outlook in this end-use industry.

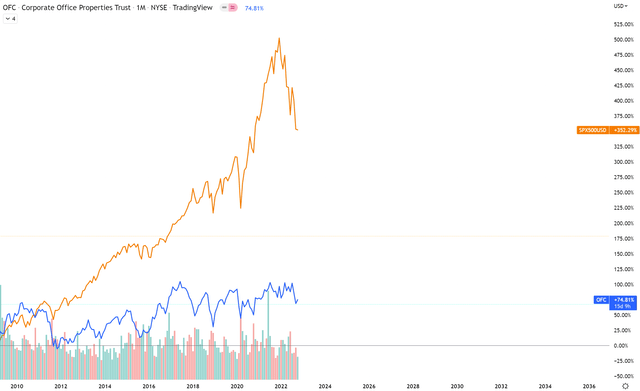

Note that OFC has underperformed the S&P500 (SPY) massively since the recovery of the 2009 recession in March 2009:

Performance of OFC vs S&P 500 (TradingView)

The S&P500 has returned about 352% since March 2009 till October 2022. OFC has returned a measly 75% over the same period. Naturally, it begs the question:

Why Is OFC A Buy Now?

Two key reasons:

- OFC is relatively immune from macro headwinds

- Strong defense spend tailwinds, and a healthy development pipeline will boost growth

Here’s my story for each:

OFC is relatively immune from macro headwinds

Inflation

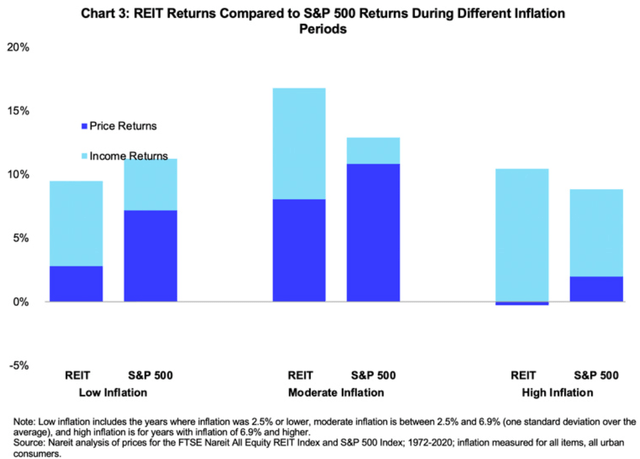

Rent prices are generally less sticky with rent revisions keeping in track with inflation. This is mainly why property asset classes such as REITs are a great play, particularly during times of more prolonged inflation. In more prolonged inflation periods lasting multiple years, there is ample opportunity for multiple rent revisions. Empirical evidence from a study done by the National Association of Real Estate Trusts (Nareit) spanning 1972 to 2021 confirms this hypothesis:

REIT Returns During Different Inflation Periods (Nareit)

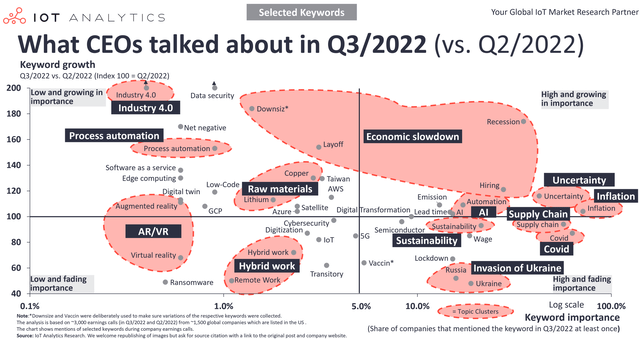

Protection against high inflation is particularly important in this environment because rising inflation is a very topical concern today:

Key Issues for CEOs (IoT Analytics)

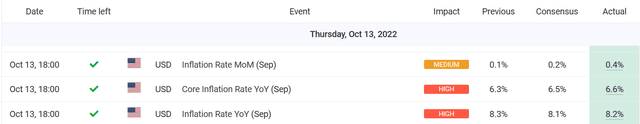

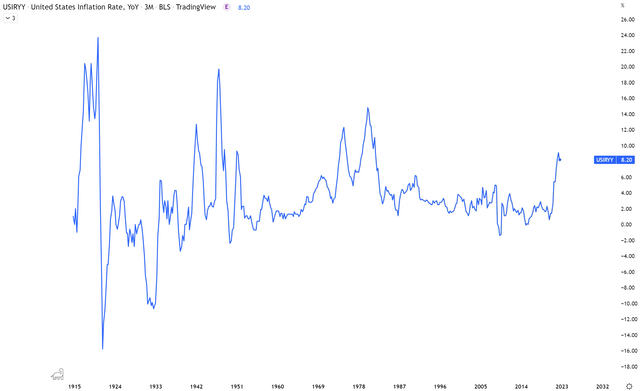

After decades of sub-4% inflation, the US printed 8.2% increase on Thursday 13th October:

The fact that this was more than 0.2% more than month-on-month ((MoM)) consensus estimates, suggests that people are still underestimating the rise in inflation:

September 2022 Inflation – Consensus vs Actual (Myfxbook Economic Calendar)

From a bottom-up perspective, OFC has 25% of the total current square feet of leases renewing over the next 2.5 years. Management has strong renewal visibility for about 49% of this lease area. This provides the company with many opportunities to secure higher base year rental rates in this inflation heavy environment in the years ahead. Considering that the weighted average lease term is 13.4 years and the fact that rent revisions are sensitive to base-year rents, OFC stands to lock in long-term benefits from upcoming lease renewals.

Interest Rates

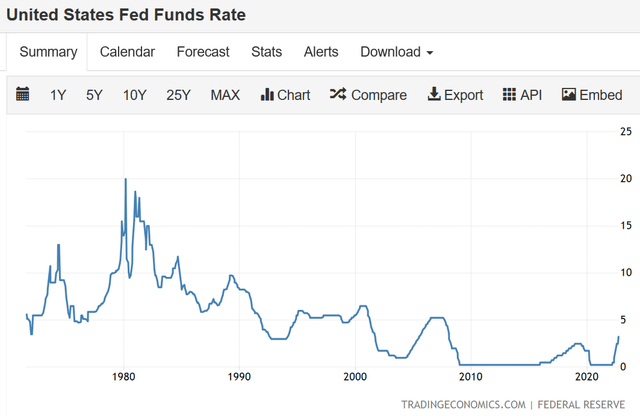

To counter inflation, the central bank is hiking interest rates. Currently, the Federal Funds rate stands at 3.25%:

United States Federal Funds Rate (Trading Economics)

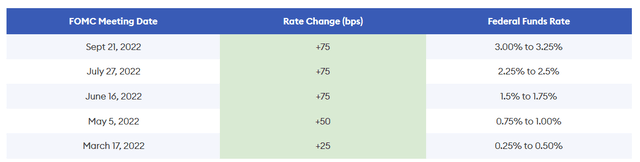

This is after 5 consecutive rate hikes this year:

2022 Federal Rate Hikes (Forbes)

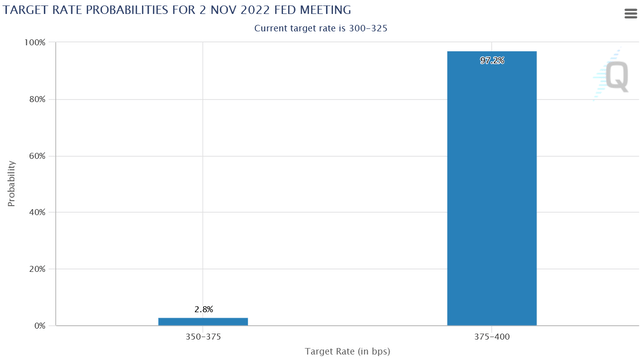

The momentum in rate hikes is expected to continue. The market is expecting a 97.2% chance of another 25bps rate hike in the November 2 2022, meeting:

November 2022 Rate Decision Probabilities (Countdown to FOMC – CME Group)

Interest rate hikes matter because they impact the cost of debt. Debt makes up the majority (52%) of the company’s overall financing mix, as determined by the debt/total assets ratio.

The management of OFC has very prudently refinanced the company’s debt, exploiting the low-interest rate environment in 2020. Now, the business enjoys a weighted average interest rate of 2.5% for an average term of 9 years. More than 96% of their consolidated debt is based on a fixed rate till at least 2026. This gives the company another 4 years of insulation against a very precariously rising interest rate environment.

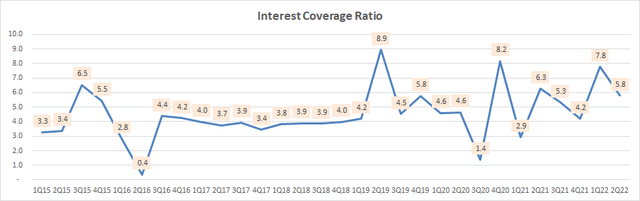

The company’s interest coverage ratio is above historical levels at a healthy 5.8x:

Interest Coverage Ratio (Company Filings, Own Analysis)

Thus, I believe OFC is very well positioned amid the macro backdrop, with good immunity from the major headwinds.

Strong defense spend tailwinds, and healthy development pipeline will boost growth

Defense Tailwinds

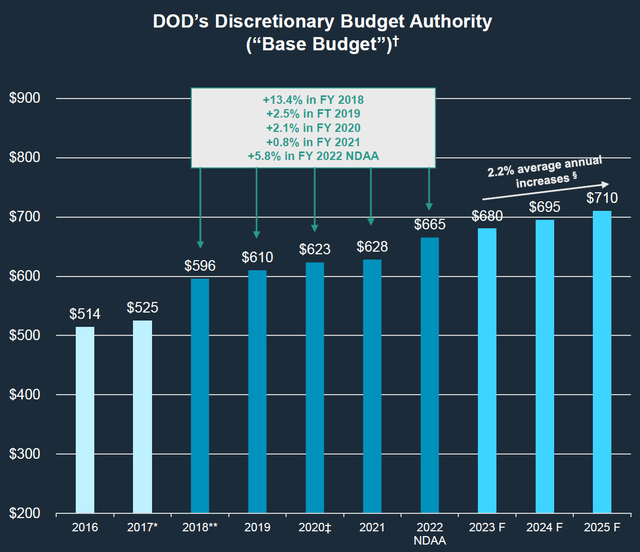

Defense spending is increasing in the United States. In March this year, the National Defense Authorization Act (NDAA) increased budgets by 5.8%. This is how the Department of Defense’s Discretionary Budget Spend is expected to pan out over the next 3 years:

Department of Defense Budget (Department of Defense, Company Presentation)

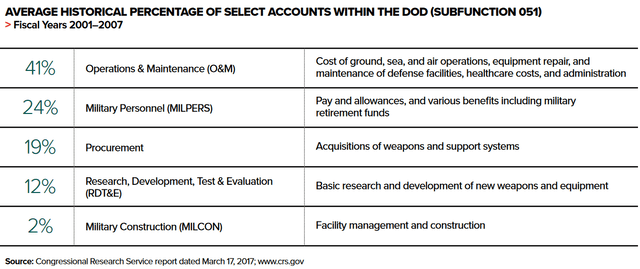

Historically, about 2% of the overall defense budget corresponds to facility management and construction, which is where OFC stands to benefit. This corresponds to about $13.3 billion of opportunity in 2022. Using the same 2% proportion to estimate the addressable market and OFC’s 2021 revenues of $736 million, the company’s market share is estimated to be 5.9%.

Department of Defense Spend Mix (US Congressional Research Service)

Noteworthily, CEO Stephen E. Budorick noted in a September 2022 Company Conference Presentation that the US has been seeing strong bipartisan support for increased defense spending since 2017. The trend is only gaining in strength as geopolitical risks escalate, particularly with Russia. Furthermore, Budorick noted that:

And currently, both the House and the Senate and the Services Committee are recommending defense spending in excess of the presidential request, between 6% and 10%.

This is expected to be constructive to OFC as the increased defense budget spend trickles down to increased headcount hiring and facilities expansion needs.

Development Pipeline

OFC’s portfolio spans 21.93 million square feet currently. The company has active developments of 1.9 million square feet, expected to be completed between 2022 and 2024. This corresponds to an 8.7% increase in overall area coverage in the portfolio. Noteworthily, this is a low-risk expansion since 91% of the additional area is already pre-leased.

Management expects the expansion to result in $47 million in incremental annualized net operating income (NOI), which corresponds to a 13.2% increase in the LTM NOI of $354 million.

The entirety of the 1.9 million expansion is for Defense related customers. This is accretive to margins since the NOI margin for the defense sites is 60% on average compared to only 46% for standard regional offices; a 1400bps higher margin profile.

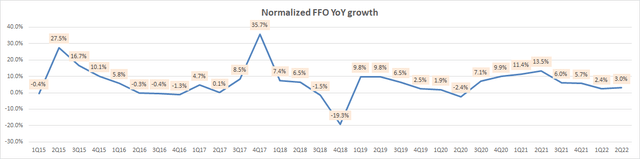

FFO growth outlook

Management expects the combination of the defense budget tailwind and the development project expansions to yield funds from operations (FFO) CAGR of at least 4% from 2023 to 2026. This seems quite reasonable, considering that the last 4 years’ normalized FFO CAGR is 5.8%. Here is how the metric has tracked historically:

Normalized FFO YoY Growth (Company Filings, Own Analysis)

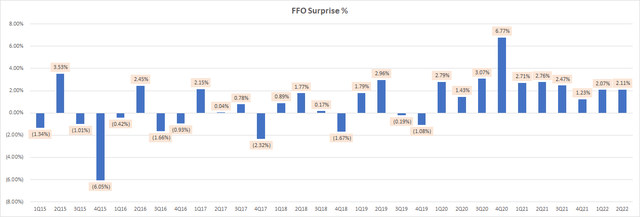

In my read of it, management commentary suggests they are confident in doing better, suggesting that their 4% FFO CAGR guidance is conservative. They seem to have a track record of underpromising and overdelivering relative to consensus expectations since the company has delivered positive FFO surprises for the past 10 consecutive quarters as well:

FFO Surprise % (Capital IQ, Seeking Alpha, Own Analysis)

Hence, I expect the growth and expansion tailwinds to net a much higher than 4% CAGR in normalized FFO over the next 4-5 years.

Valuation

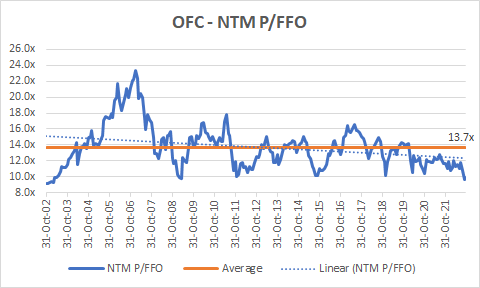

OFC is currently trading at 10.0x 1-yr forward P/FFO, which is at decades lows:

OFC’s NTM P/FFO (Capital IQ, Own Analysis)

The long-term average 1-yr forward P/FFO has been 13.7x. The linear trendline of the valuation multiple sits close to 12.0x.

$2.44 is the consensus estimate of FFO/share for FY23. Given the attractiveness of REITs and the healthy growth prospects for OFC, I believe a re-rating back towards the trendline 1-yr forward P/FFO of 12.0x is reasonable. This would yield a fair value estimate of $29.28, resulting in a 21.5% upside from the current stock price of $24.10.

Technical Analysis

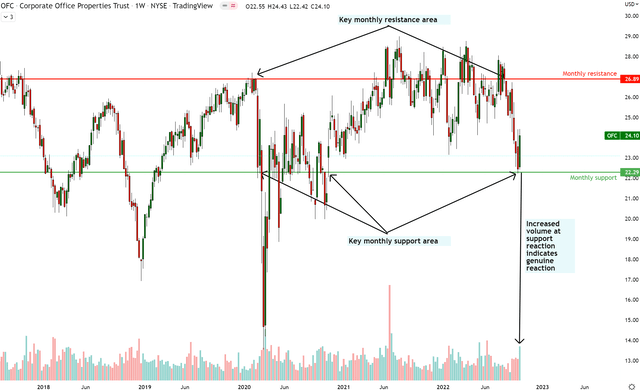

OFC Technical Analysis (TradingView, Own Analysis)

OFC is currently showing a strong reaction at the monthly support level at $22.29, supported by a volume spike. This increases chances of a genuine reaction at the level. The stock seems headed toward the monthly resistance at $26.89, corresponding to a 11.6% upside. This is less than what the fundamental valuation suggests so we have to be on high alert and be ready to cut early if the technicals show trouble in blasting past the monthly resistance toward the $29 region.

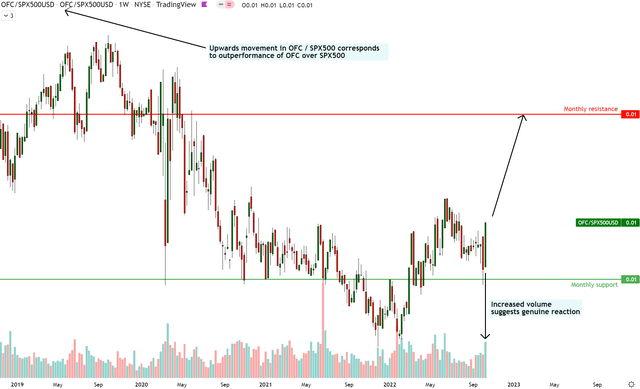

OFC vs S&P 500 Technical Analysis (TradingView, Own Analysis)

I feel more confident in the bullish structure shown in OFC vs S&P500 (SPX). Here, there is a very enthusiastic buyers’ reaction of the monthly support level, with high volumes. And there seems to be more space to go till the next key area of monthly resistance is hit.

Considering the absolute and relative technical analysis of OFC together, my conclusions are that OFC will outperform the S&P 500, but may not have as smooth a ride upwards in terms of absolute returns.

Key Things To Monitor

In their latest presentation, OFC noted that they would have 1.2 million square feet of development leasing pipeline remaining after 2022. In the glossary section, they clarified the definition of this pipeline:

DevelopmentLeasing Pipeline: Formerly called the Shadow Development Pipeline, this internally maintained schedule tracks potential future development leasing transactions for which the Company is competing and believes it has a 50 or greater chance of winning within the next 24 months.

Hence, I believe monitoring the quantum of the development leasing pipeline and looking out for any erosions or reduced estimates is the most important thing to track.

From a macro perspective, the health of future US defense budget spend is also monitorable, although I think there is a low-risk chance that this parameter would decrease given the current geopolitical environment.

Concluding Thoughts

Like reinsurance and insurance stocks, I believe REITs are a great vehicle to generate alpha in the current market. OFC seems like a great buy to benefit from wars and inflation within the REITs space. As the stock is reacting sharply with volume from key support levels, I believe it is best to position oneself quickly as this stock could run up fast.

Be the first to comment