It’s better to spend money like there’s no tomorrow than to spend tonight like there’s no money.”― P.J. O’Rourke

Volatility has spiked in the markets over the past several weeks. Increasing worries about the coronavirus outbreak turning into a “pandemic” have knocked equities deep into “correction” territory. We re also are getting close to “bear market” levels after the huge sell-off in the markets on Thursday and Friday.

This fear has been fanned by most of the media which has varied from overly cautious to borderline irresponsible on the topic following the age-old newsroom adage “if it bleeds, it leads.” My opinion is that the overall death toll in the States will probably wind up somewhere between the Swine Flu outbreak of 2009/2010 (approximately 12,500 dead in the United States) and the horrid flu season of 2018 (approximately 80,000 dead), neither of which saw nearly the press coverage and none of the mass hysteria. The death toll stands at 17 in the U.S. as of this morning. We won’t even mention the media scare about the bird flu in 1997 that came to basically nothing.

This fear has been fanned by most of the media which has varied from overly cautious to borderline irresponsible on the topic following the age-old newsroom adage “if it bleeds, it leads.” My opinion is that the overall death toll in the States will probably wind up somewhere between the Swine Flu outbreak of 2009/2010 (approximately 12,500 dead in the United States) and the horrid flu season of 2018 (approximately 80,000 dead), neither of which saw nearly the press coverage and none of the mass hysteria. The death toll stands at 17 in the U.S. as of this morning. We won’t even mention the media scare about the bird flu in 1997 that came to basically nothing.

No one likes to have to worry about their family or being laid off and to watch their 401K tank on these sorts of fears. However, I think we need to take a step back and be grateful for five things around this outbreak while taking all necessary but sane precautions (thoroughly washing hands frequently but not hoarding water).

We Are Not Europe!

The first thing we should be grateful for is we are not Europe, where the outbreak is much, much worse. Italy alone has more than 10 times the confirmed cases than that of the U.S. and has had nearly 200 confirmed deaths from the virus as of this morning.

Part of the reason for this is our country closed all travel to and from China on January 31st for which the administration was called xenophobic, racist and overreacting by a good part of the press and DNC leadership. Hindsight being 20/20, this action probably at least delayed the outbreak here in the States if not mitigated it significantly.

The situation in Europe also could get much worse if Turkey follows through on its threats to no longer prevent the four million Syrian refugees living in their country from trying to get to the European Union. In addition, the Federal Reserve already cut rates by 50 basis points and still has some room to cut more, if necessary. Most of European sovereign debt already has negative rates, so their central bank has less “ammo” it can deploy.

A Small Subset Of Population At Risk

This is a point the media rarely brings up. So far all deaths in the United States have occurred in people that are over 70-years-old. Most had severe previously existing medical conditions as well. Of the 197 people that have died in Italy as of publication, the average age of the victim is 81-years-old. Italy has one of the oldest populations in the world, which is a key reason it has become a primary epicenter of this outbreak. This virus to this point has had little to no significant impact on the young.

This is inline with just about every other new virus outbreak in recent decades including SARS and the Swine Flu. Almost all the victims are old and/or infirmed and that’s the demographic the country should be focusing on. Most of the population has a much, much lower risk. That fact should eventually prick this mass hysteria bubble, one would think.

Help Could Be On The Way:

Myriad companies have announced programs working on new treatments for this novel coronavirus while others are working to get tests developed and produced. One of the more advanced vaccine programs is at Moderna (MRNA) which already has pushed its candidate into clinical testing.

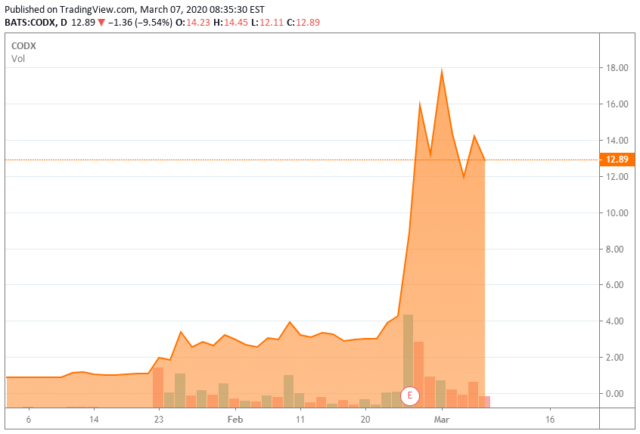

Co-Diagnostics (CODX) has seen a massive jump in its stock price as the company has announced its coronavirus virus test kits are now available for purchase by CLIA-certified laboratories who have yet to complete their Emergency Use Authorization submissions with the FDA. In late February, the company became the first U.S. company to receive a CE-marking for a coronavirus IVD. Co-Diagnostics is focusing on scaling up production to meet global demand and its stock has been one of the biggest winners in the market this year.

In addition, Congress just passed a $8.3 billion bill to provide funding for various coronavirus efforts. Like most rushed legislation, this bill will contain its fair share of “pork” that will be wasted, but a good portion of the funding should eventually find its way into vaccine development, prevention efforts and test procurement.

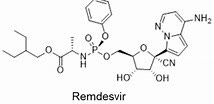

Finally, Gilead Sciences (GILD) has an existing drug Remdesivir that was originally developed to target Ebola but has considerable promise for this new coronavirus. The drug has showed strong in-vitro results against other coronaviruses like SARS and MERS. Remdesivir also was used on the first confirmed case in the U.S.. The patient responded well to treatment with all symptoms, except a cough, resolved within a week. Preliminary data from a trial in China could be out as soon as later this month. Positive results could set up one doozy of a rally in the overall market and could further the recent rise of Gilead as well.

Finally, Gilead Sciences (GILD) has an existing drug Remdesivir that was originally developed to target Ebola but has considerable promise for this new coronavirus. The drug has showed strong in-vitro results against other coronaviruses like SARS and MERS. Remdesivir also was used on the first confirmed case in the U.S.. The patient responded well to treatment with all symptoms, except a cough, resolved within a week. Preliminary data from a trial in China could be out as soon as later this month. Positive results could set up one doozy of a rally in the overall market and could further the recent rise of Gilead as well.

Flu Season Is Almost Over:

Flu season ends in a few weeks. It has been a bad flu season in some areas with some 127 people succumbing in North Carolina alone. The end of flu season should free up hospital beds as well as medical personnel to better focus on treating those with COVID-19. In addition, emergency rooms and urgent care facilities will be less packed as people will not go there thinking they might have the coronavirus when all they have are mild flu symptoms.

Flu season ends in a few weeks. It has been a bad flu season in some areas with some 127 people succumbing in North Carolina alone. The end of flu season should free up hospital beds as well as medical personnel to better focus on treating those with COVID-19. In addition, emergency rooms and urgent care facilities will be less packed as people will not go there thinking they might have the coronavirus when all they have are mild flu symptoms.

I also have read as humidity picks up in the months ahead the airborne virus will it have its fatty envelope melted off which makes it easier to be targeted by one’s white blood cells. One of the key reasons, prime flu season always is in the lower humidity times of the year, mostly during winter.

Consumers About To Get A Huge Stimulus:

Finally, one benefit no one seems to be talking about at the moment is the following. The collapse of interest rates have dropped mortgage rates down to all-time lows. The average 30-year mortgage rate has dropped to approximately 3.3%. A year ago, the average mortgage rate was at 4.4% in comparison.

This should support housing activity, a key economic engine. In addition, this drop in rates is triggering massive mortgage refinancing activity. Refinancing applications have surged some 160% over the past 10 weeks, the biggest rise since interest rates plunged in 2008/2009. This will trigger a huge amount of new discretionary income in millions of homeowners’ pockets. Once the current scare around the coronavirus fades, this should be a major support of consumer spending in the quarters ahead.

And those are what I see as some silver linings to this recent COVID-19 inspired panic. I expect the next few weeks to continue to volatile in the markets. I also plan to continue to put some of my “dry powder” into the market on any further dips in the market using buy-write option strategies.

And those are what I see as some silver linings to this recent COVID-19 inspired panic. I expect the next few weeks to continue to volatile in the markets. I also plan to continue to put some of my “dry powder” into the market on any further dips in the market using buy-write option strategies.

I wish all a safe and relaxing weekend and hope calm returns to the markets in the weeks ahead.

Microeconomics is about money you don’t have, and macroeconomics is about money the government is out of.”― P.J. O’Rourke

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Live Chat on The Biotech Forum has been dominated by discussion of buy-write opportunities and trading ideas around individual biotech stocks over the past several trading sessions during the market meltdown. To see what I and the other season biotech investors are targeting as trading ideas real-time, just initiate your two-week no obligation free trial into The Biotech Forum by clicking HERE.

Disclosure: I am/we are long GILD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment