Photon-Photos

Copper Mountain Mining Corporation (OTCPK:CPPMF) expects a massive increase in production thanks to richer copper grade and a new mine in Australia. In my view, only considering future free cash flow from mining of gold and copper, the fair price is higher than the market price. I obviously see risks from failed assessment of reserves and new regulatory framework. However, the work of other analysts and my own financial models indicate that the company’s stock price is simply too low.

Copper Mountain

Copper Mountain is a mining company operating and developing assets in Canada and Australia.

The company’s flagship asset is the Copper Mountain mine, located in Canada, which produces copper, gold, and silver. Management is also developing the Eva Copper project in Queensland, Australia.

Investor Presentation

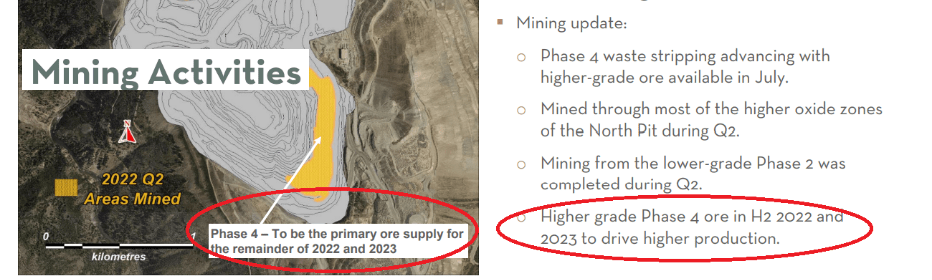

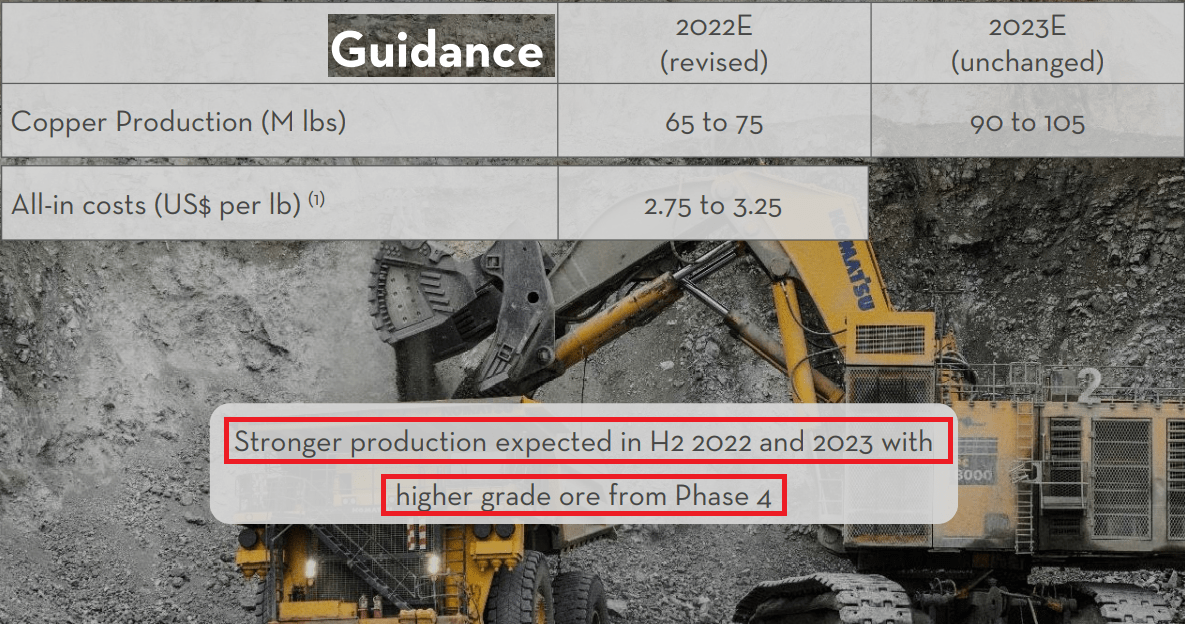

Let’s go straight to the point. I commenced research about Copper Mountain because in a recent presentation, management noted that production could increase significantly. Copper Mountain expects that several plant improvements, including expansion of the flotation circuit, could help recover more copper. Besides, the company believes that higher copper grade in Phase 4 Copper Mountain could lead to more production. Finally, the company may increase its total amount of copper production thanks to the Eva Copper project.

Investor Presentation Investor Presentation

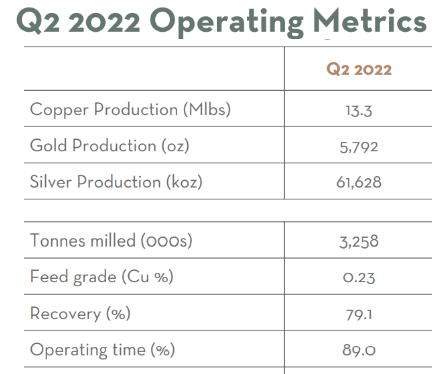

In the most recent quarterly report, CMMC reported a significant and promising production guidance increase. In Q2 2022, copper production included 13.3 million pounds and 5.7 koz. However, management expects a total of 65 to 75 million pounds of copper in 2022 and a total of 90 to 105 million pounds in 2023. In my view, production growth will likely lead to larger revenue growth, more free cash flow, and stock price increases.

Quarterly Report Quarterly Report

Balance Sheet

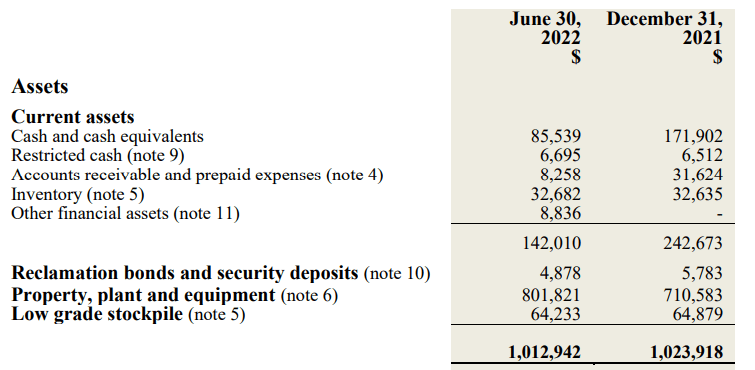

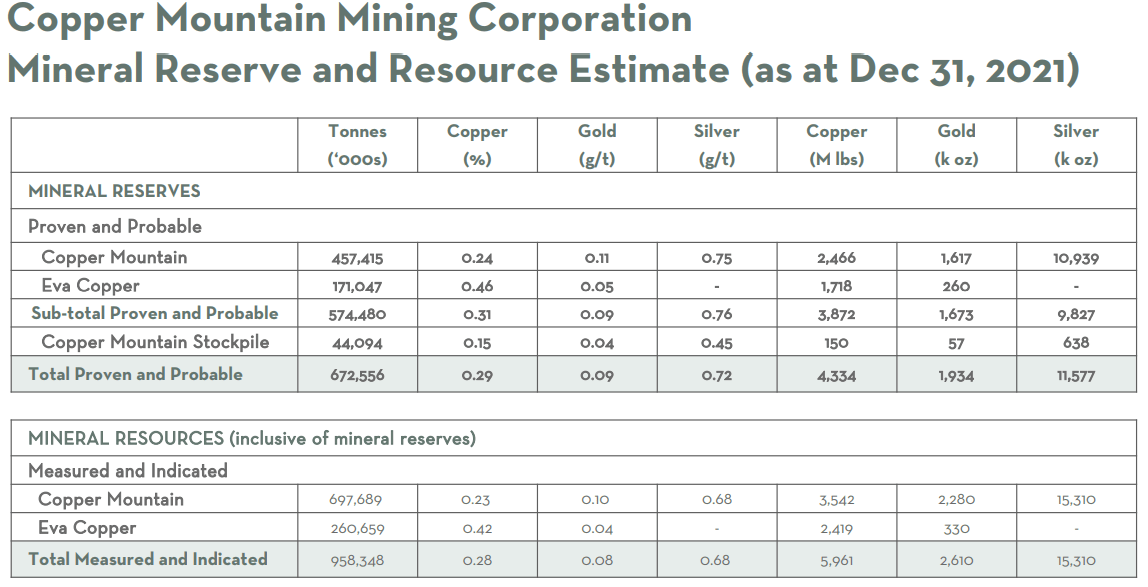

As of June 30, 2022, the company reported CAD85 million in cash, total assets worth CAD1 billion, and total liabilities worth CAD541 million. The financial situation appears stable, but Copper Mountain will require more cash for the capital expenditures required for the Eva Copper project.

Quarterly Report

The company has long-term debt of $284 million, which is not a small amount. However, considering future production of copper, the debt seems small. In 2030, I believe that the company could be delivering free cash flow of more than $201 million.

Quarterly Report

Under A Beneficial-Case Scenario, Production Of Both Probable And Proven Reserves Would Lead To A Valuation Of CAD2.9 Per Share

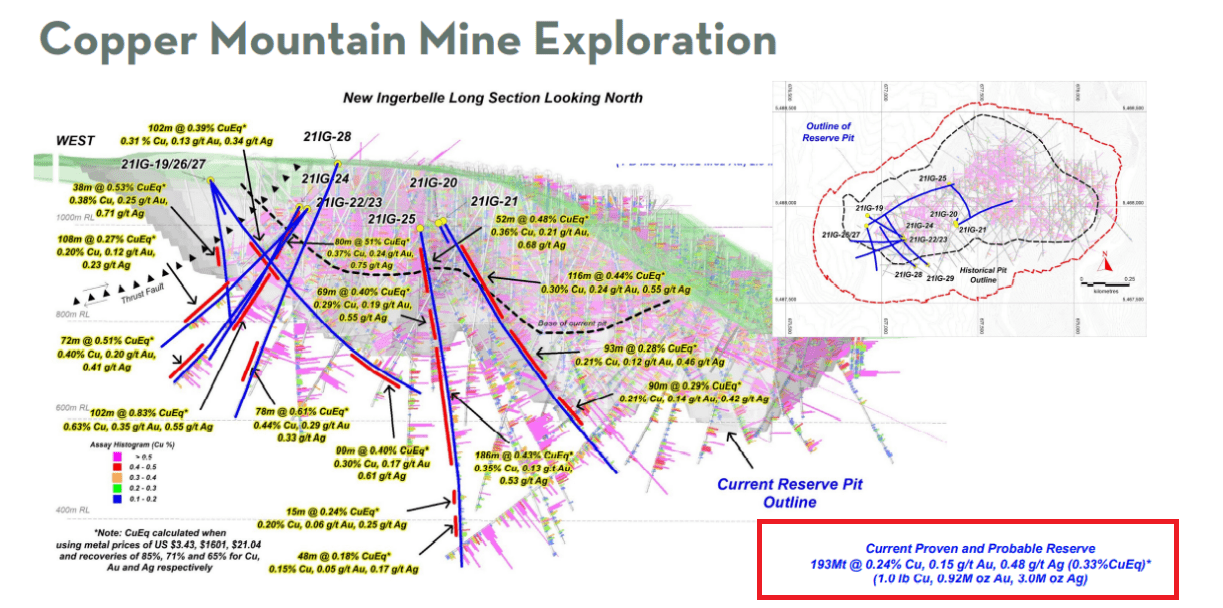

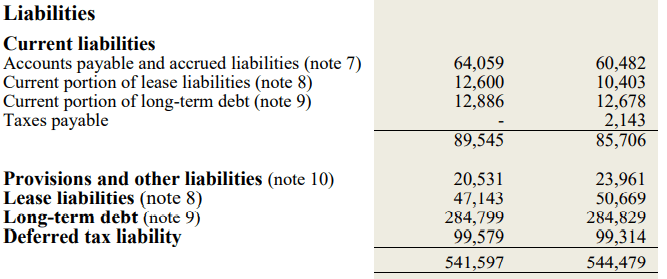

Under my best-case scenario, I assumed that Copper Mountain will successfully measure all its proven and probable reserves. It is an optimistic but realistic assumption. Keep in mind that the amount of reserves increased from 1,066 million pounds to more than 2,331 million pounds in the past. With more investments in exploratory work, mining engineers will likely measure more reserves.

Investor Presentation

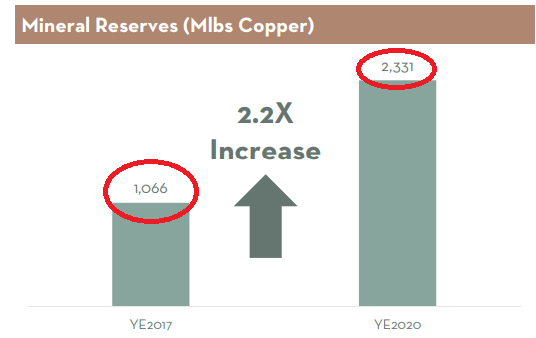

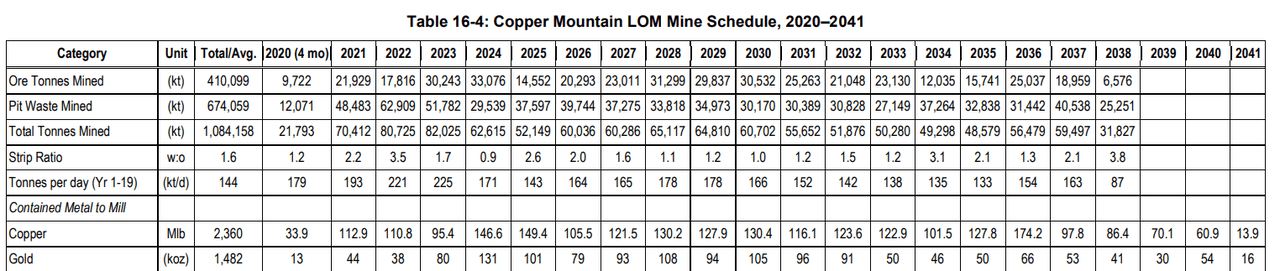

For the valuation of the Copper Mountain asset, I assumed the production of copper and gold. As of December 31, 2021, proven and probable reserves included 1.617 koz of gold and 2,466 million pounds of copper.

Investor Presentation

In the technical report delivered for the Copper Mountain asset, engineers believe that copper production would range from 110 million pounds in 2022 to 130 million pounds in 2032. The production of gold per year would range from 38 koz in 2022 to 131 koz in 2024. My numbers are not at all far from the production expectations given by management.

EXPANSION STUDY AND LIFE-OF-MINE PLAN NI 43-101 TECHNICAL REPORT

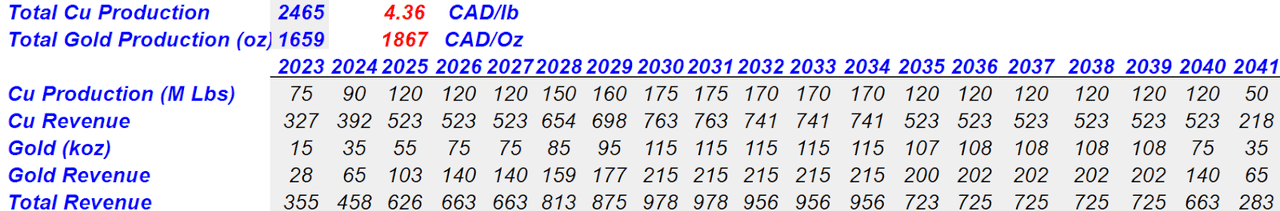

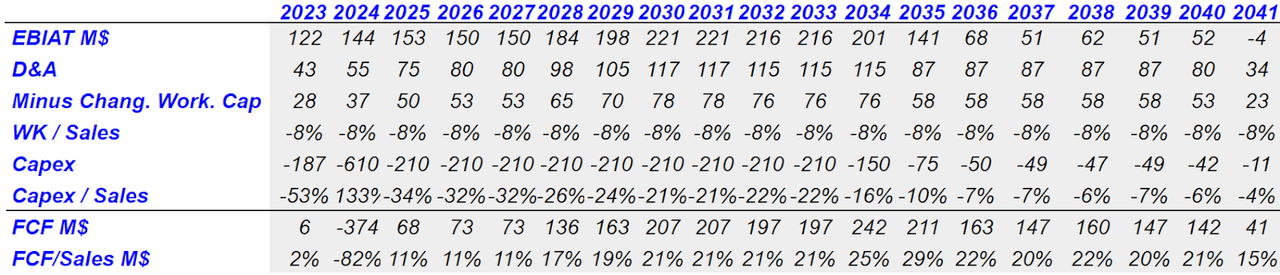

Under this case scenario, I assumed production of 2465 million pounds of copper and gold production of 1659 oz. Assuming CAD4.36 per pound of copper and CAD1867 per ounce of gold, I obtained total revenue ranging from CAD283 million to CAD978 million.

Author’s Work

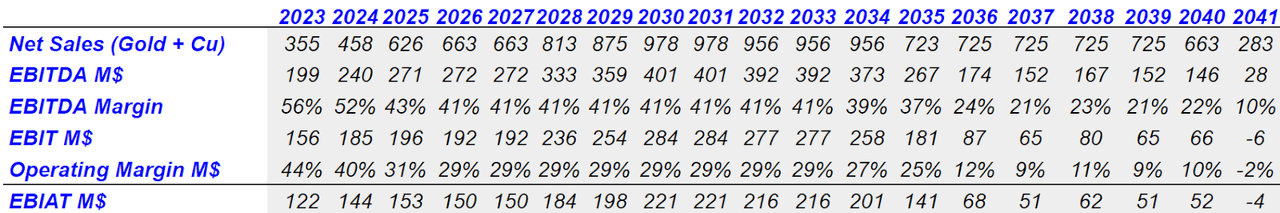

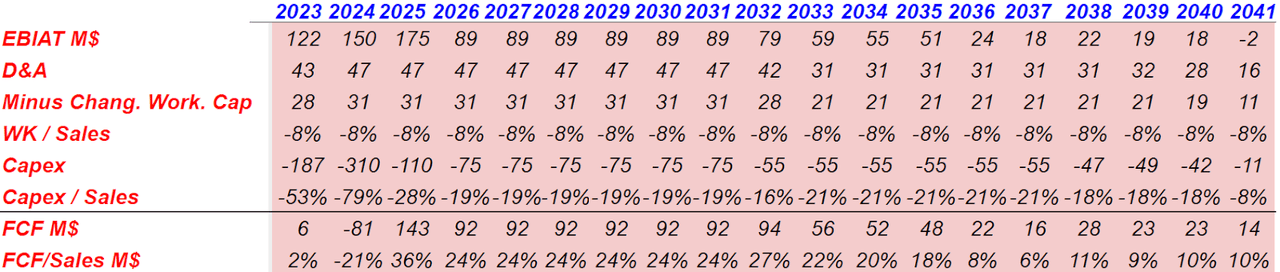

I also assumed a declining EBITDA margin from around 56% in 2023 to 10% in 2041 along with an operating margin of 29% from 2026 to 2033. I used an effective tax of 22%, which resulted in an EBIAT between CAD52 million and CAD221 million.

Author’s Work

To obtain future free cash flow, I added D&A, and used changes in working capital/sales of 8% and capital expenditures around CAD610 million and CAD41 million. My results included a maximum free cash flow of CAD207 million in 2031 and FCF/Sales between 11% and 21%. I believe that my numbers are both realistic and conservative.

Author’s Work

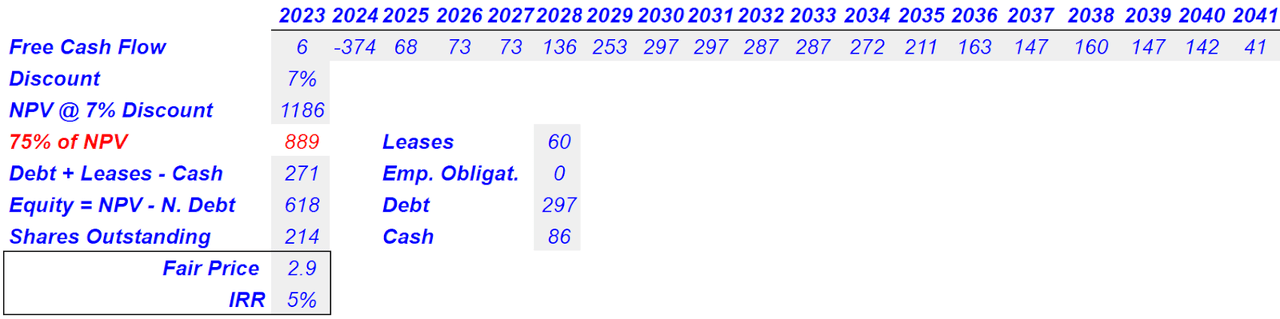

Now, by summing future free cash flow and using a discount of 7%, I obtained a valuation of CAD1.1 billion. Copper Mountain obtained a net present value of close to CAD1 billion for its project. I do believe that this figure is close to the reality of the project. With that, let’s note that the company owns 75% of the project. Hence, shareholders will enjoy around CAD890 million from the future free cash flows.

With 75% of the net present value, I added CAD86 million in cash, and subtracted debt of CAD297 million and leases worth CAD60 million. Finally, dividing by 214 million shares outstanding, the result includes a valuation of $2.9 per share.

Author’s Work

Risks: Lack Of Financing, Declines In Copper Grade, Failed Reserves Assessment, And New Environmental Regulations

The company mainly depends on the development of the Copper Mountain mine. In my view, the most worrying would be lack of financing. If management does not have cash in hand to make more capital expenditures, production may be lower than expected. If a sufficient number of equity researchers and analysts discuss the decline in production, the stock price will likely trend down.

I would also be very worried about an unanticipated decline in grade or tonnage of ore mined. Less grade would also lead to a decline in the proven mineral reserves, which would lead to a decline in the total amount of assets. Besides, investment analysts may lower their production expectations, which would make certain shareholders sell their shares.

Incorrect information about the proven and probable reserves could occur. If mining engineers failed to research the amount of copper or gold under the earth, future revenue would be lower than expected. Increase in the estimation of capital expenditures, opex, or transportation costs could also drive future free cash flow down.

Finally, new regulatory framework in Canada, new laws, and environmental regulations could increase the operating costs of the Copper Mountain mine. Besides, in Australia, authorities may decide to stop the development of the Eva Copper project, which may have an impact on the company’s total valuation.

Risks: Detrimental Conditions And Only Considering Proven Reserves, The Company Could Be Valued At $1.05

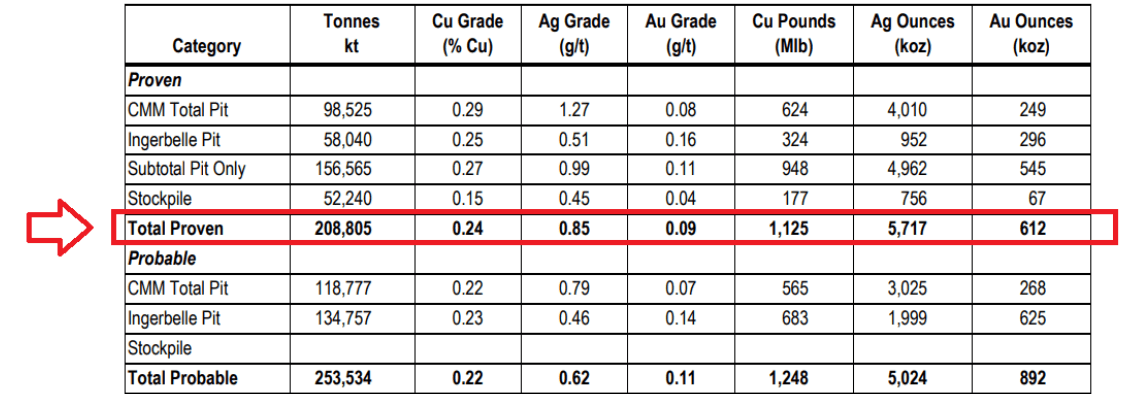

Under this scenario, I tried to be as conservative and pessimistic as possible. I included only the production of the proven reserves, which usually have 90% of likelihood of being economically viable. In the last technical report, management included proven reserves of 612 koz and 1.125 million pounds of copper.

Proven reserves are classified as having a 90% or greater likelihood of being present and economically viable for extraction in current conditions.

Probable reserves are reserves calculated to be at least 50 percent likely to be recovered through drilling. Probable Reserves Definition

EXPANSION STUDY AND LIFE-OF-MINE PLAN NI 43-101 TECHNICAL REPORT

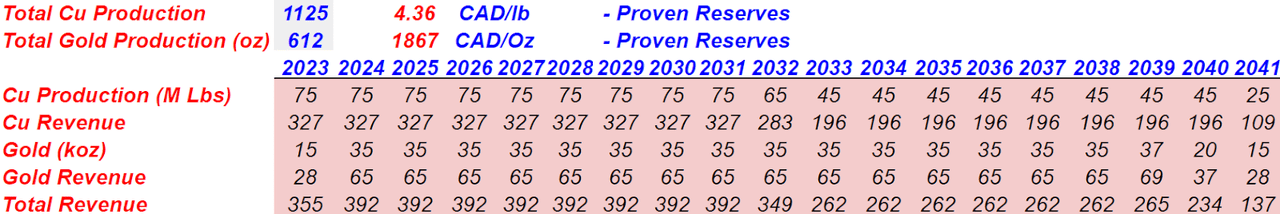

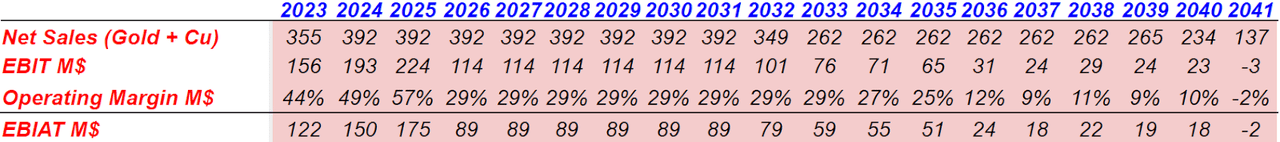

With the production of only proven reserves, I obtained total revenue close to CAD355 million and CAD137 million. Note that I assumed a price of CAD4.36 per pound of copper and CAD1867 per ounce of gold.

Author’s Work

With an operating margin close to 44% in 2023, 29% in 2031, and 11% in 2038, and an effective tax of 22%, I calculated future EBIAT. It is considerably lower than that in previous cases.

Author’s Work

Lower production of metal will most likely require less capital expenditures. With this in mind, my capex/sales ratio is a bit lower than that in previous cases. The free cash flow results in less than $92 million per year.

Author’s Work

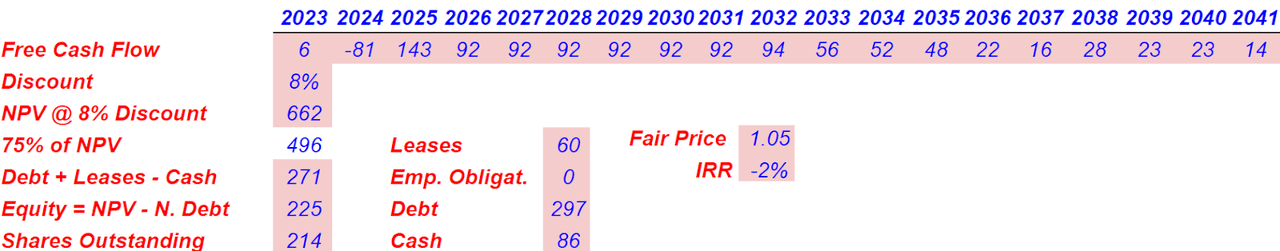

With a discount of 8%, 75% of the net present value of the asset results in $496 million. If we sum the cash and subtract the debt, the result is an equity valuation of $225 million and a fair price of $1.05 per share.

Author’s Work

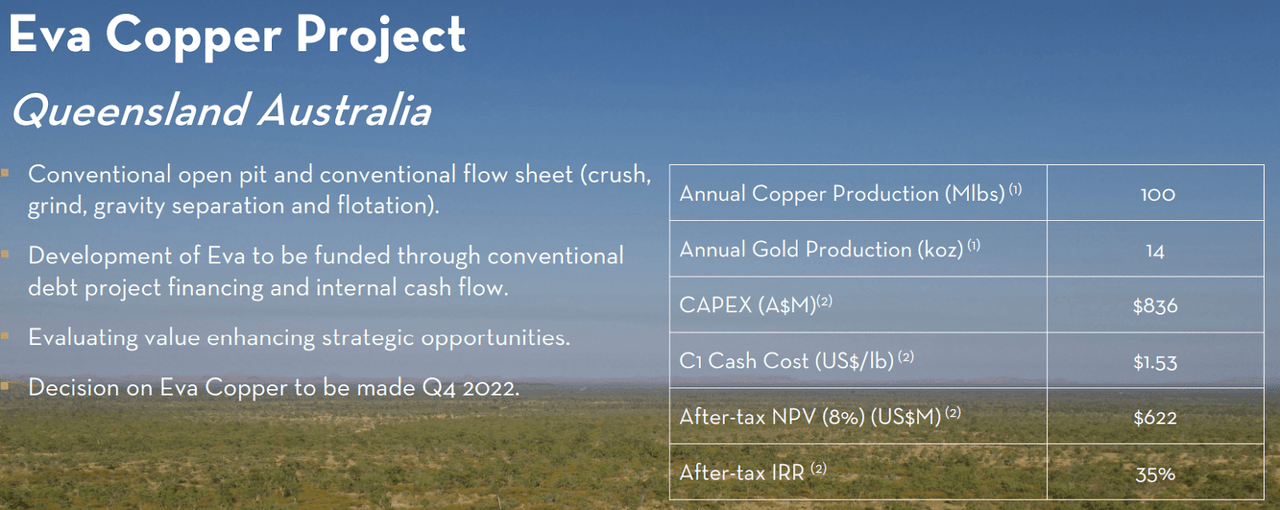

In my view, it will be difficult for CMMC’s stock to go that low. Keep in mind that I am not taking into account the production from the Eva Copper project in Queensland, Australia, and the probable mineral resources. The Eva Copper Project was said to have an after tax net present value close to $622 million.

Investor Presentation

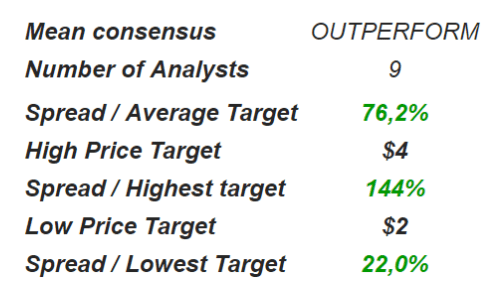

Most Analysts Believe That The Fair Price Should Be Close To CAD2-CAD4 Per Share

Investment analysts out there appear to be even more optimistic than me. A total of 9 analysts gave a valuation target between CAD2 and CAD4 per share. The difference between the current price and their price target is significant.

Investment Analysts

In my view, most of them are mainly using both probable and proven reserves, and incorporating the valuation of the Eva Copper project. Considering the expectations of analysts and the results of my financial models, the company looks like a buy at the current market price.

Takeaway

Copper Mountain recently announced a significant increase in the amount of production in the Copper Mountain mine, and the Eva Copper project could also contribute. Only considering the valuation of the Copper Mountain mine and the probable and proven reserves, I believe that the stock price could reach CAD2.9 per share. Other analysts are even discussing CAD4 per share. Yes, I do see risks from environmental regulations, failed mineral assessment, or miscalculation of future capex or opex. However, in my view, there is a lot more upside potential than downside risk.

Be the first to comment