tdub303/E+ via Getty Images

It’s been about three and a half months since I wrote my “continue to avoid” piece on C.H. Robinson Worldwide, Inc. (NASDAQ:CHRW), and in that time, the shares are up about 15.25% against a loss of 4.4% for the S&P 500. So, I missed out on some gains while the rest of the market has broken down. I want to revisit the choice again, to see if it makes sense to buy at current prices or not at these higher prices. I’ll make that determination by looking at the most recent financial performance and by looking at the stock as a thing distinct from the underlying business.

Welcome to the “thesis statement” of my article, dear readers. It’s here where I regale all of you with the “gist” of my argument, so you don’t have to wade through 1,800 of my words. You’re welcome. I think the recent financial history here is “good” or “bad” depending on how you look at it. If you’re the sort to focus on the income statement, all looks great, with both revenue and net income up nicely over the past year. If you’re the sort to look at the capital structure, you can’t help but notice the deterioration on that front. I’m also of the view that the dividend is not as well covered as it could be, and that the company will need to return to the credit or capital markets over the next 18 months. The stock is cheap, but it’s not cheap enough in my view, given that there’s a good chance that demand will soften this year and next. That means that what appears to be cheap now will look far less cheap as the “E” in “PE” drops. For that reason, I’m going to resist the temptation to chase this stock, and will wait to buy when conditions are more favourable.

Financial Snapshot

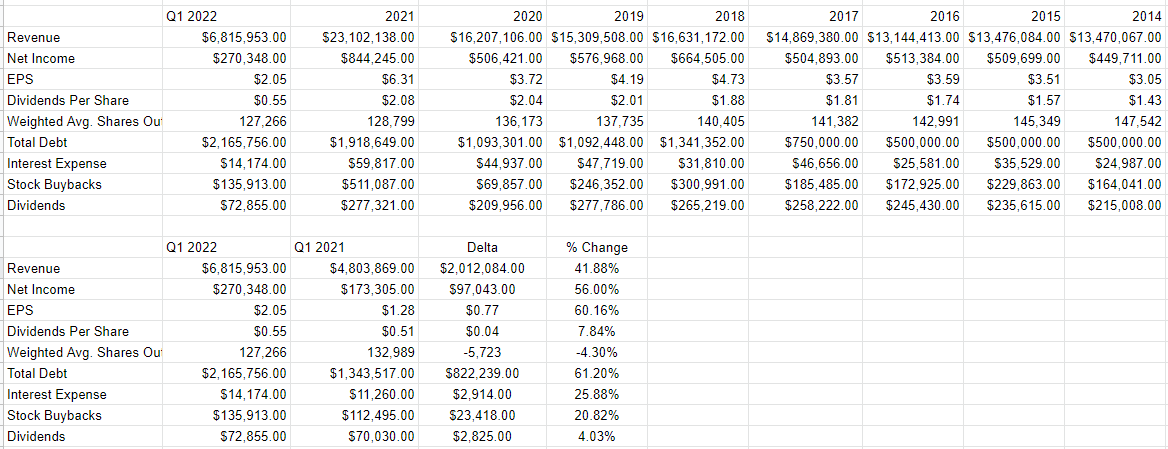

I’d say that the most recent financial performance has been good in some ways, and not others in my estimation. When we focus on the income statement, things look quite good. Specifically, revenue and net income are higher by 42%, and 56%, respectively. Management has rewarded shareholders with this performance by increasing the dividend by just under 8%. Dividend payments have risen by only 4.03% from the same time last year, because the company has retired about 5.7 million shares.

Things look less good when we look at the capital structure. Specifically, total debt has increased massively over the year, and this is troublesome. It’s particularly problematic in my view because it will have an impact on the dividend (see below). Also, as a result of the added debt, interest expenses have increased by about 26% from the same period last year.

Thus, I’d rate the financial performance here as “mixed.”

Dividend Sustainability

I think investors are interested in dividend sustainability for two reasons. First, having a sense of future cash flows received from dividends helps with planning for obvious reasons. Second, the dividend buoys the stock price. If there’s risk that it won’t be sustained, there’s risk that the stock will drop. As my regulars know, I’m as much of a fan of accrual accounting as any semi-sane person can be, but when it comes to dividend sustainability, I look at cash flows.

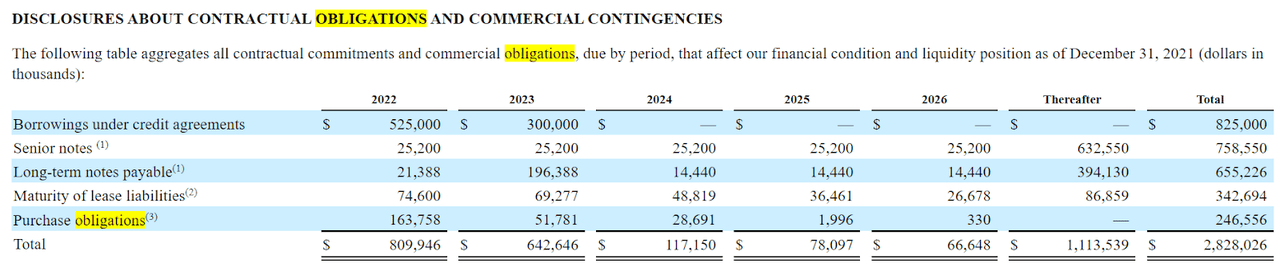

We see from the following, plucked from page 36 of the company’s latest 10-K, that the company is on the hook for $809 million this year, and $642 million next year, and $117 million in 2024. Against these obligations, the company has about $242.8 million cash on the books. In addition, over the past three years, they’ve made an average of $476.5 million in cash from operations while spending an average of $82.4 million on cash for investing activities. This leads me to suspect that the $277 million or so the company spends on dividends a year isn’t well covered. Thus, there’s a fairly good chance that the balance sheet will continue to deteriorate as the company borrows to fund dividend payments.

C.H. Robinson Contractual Obligations (C.H. Robinson 2021 10-K)

Acquisitions

As my regulars know, I don’t write much about acquisitions except to remind hopeful investors of the fact that they fail to meet expectations fairly regularly. I don’t think much about them because they usually come with debt. This means that the business may grow, but so does the risk, so investors are no better off in my view. For those who consider this opinion to be controversial, let me ask if you think it’s prudent for management to take your money, and with it engage in an activity that has a 70-90% failure rate?

Anyway, I write all of this as a preamble to write about one of the recent acquisitions. C.H. Robinson acquired Prime Distribution Services for $222.7 million in cash. The idea is that this was a great acquisition because it added scale and value-added warehouse services. Because I’m the sort to try to spoil as many positive feelings as possible, I’d point out that fully $176.7 million (i.e., 79%) of this acquisition cost was goodwill. In my experience, when acquisitions go sideways, goodwill falls dramatically, which hits earnings fairly hard. So, while some investors are happy about such things, I take the opposite view.

Given all of the above, I’d be happy to buy this stock if it’s trading at a reasonable price.

C.H. Robinson Financials (C.H. Robinson investor relations)

The Stock

My regulars might have flinched a little bit when they read that “reasonable price” comment. That’s because they know that my obsession with not overpaying has cost me gains, as is the case here. My contention, though, is that we’re looking for “risk adjusted returns” and not just “returns.” My regular readers also know that I consider the stock and the business to be very different things. If you’re new here, and you haven’t heard me drone on about this to the point of tedium, let me tell you now: I consider the stock and the business to be very different things. Specifically, every business buys a number of inputs, including labour, transportation services and the like, performs value-adding activities to those, and sells the results at a profit. In the final analysis, that’s what every business is. The stock, on the other hand, is a scrip of paper that represents an ownership stake in the business and that gets traded in a market that aggregates the crowd’s rapidly changing views about the future health of the business. It’s also possible that the stock’s movements relate to the crowd’s view about “the market” in general, and have very little to do with what’s going on at the company. This is troublesome, but I think we can take advantage of the situation by buying when the crowd grows despondent and eschewing shares when the crowd gets a bit too manic. I think the crowd’s quite capricious, with the result that the shares move up and down much more dramatically than would be warranted if the analysis was based only on what’s happening at the company. In other words, the stock is often a very poor proxy for the health of the underlying business. It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name.

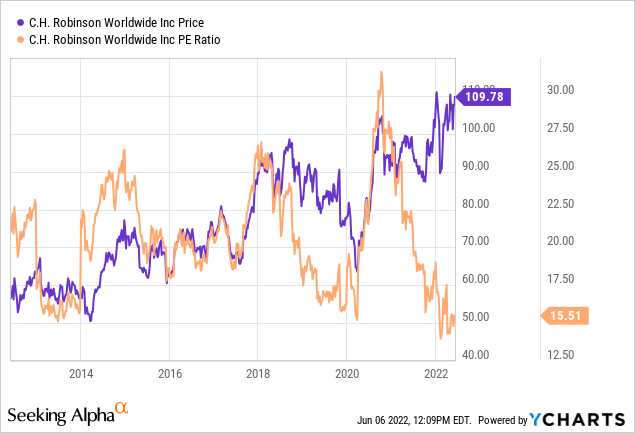

I measure the relative cheapness of a stock in a few ways, ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. I like to see a company trading at a discount to both the overall market, and to its own history. In my previous article, I acknowledged that the shares were trading near the low end of their valuation on a PE basis, but I was concerned that revenue would eventually hit a wall, which would drive earnings lower, which would drive valuations higher. Things haven’t changed much on that score, per the following:

My nervousness about future sluggishness in demand lingers. While it’s unclear, the company itself is suggesting there’s a chance that the market has switched into “oversupply“, which would obviously impact margins. There’s a very good chance that freight rates will fall in 2022, relative to the same period a year ago. Given this, I’m still of the view that what appears as “cheap” today will be expensive when future results soften. For that reason, I’m inclined to continue to avoid the shares. I’d rather preserve capital and miss out on upside at a time when the market itself has bearish tendencies, than take a bet based on the hope that 2021’s excellent results can be repeated.

Conclusion

It’s true that I missed out on some gains over the past few months here. This creates a strange temptation to try to “catch up” with the stock by piling into it now. That would be a mistake in my view, and I have to remind myself that what the market giveth, the market can taketh awayeth. Although the shares appear cheap now, they may very well appear expensive when the “E” in PE drops as a result of softer demand. Add to this the fact that I think the company will need to return to the well in order to finance the dividend, and I’m not sanguine about this investment. I may miss out on some future price gains, but these will turn out to be ephemeral in my view.

Be the first to comment