JHVEPhoto

Enbridge (NYSE:ENB) is a Canadian midstream company with international operations and some of the largest operations in the world. The company currently has a dividend yield of more than 6% and an impressive portfolio of assets and growth potential that we expect will support substantial shareholder returns.

Enbridge Performance Update

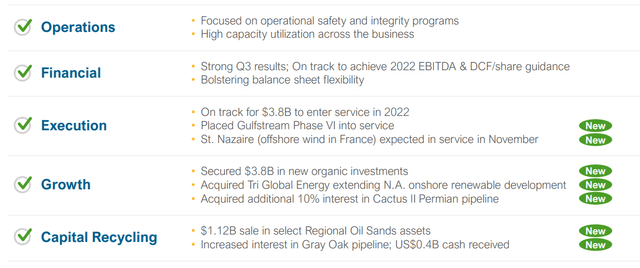

Enbridge has continued to perform well throughout its business, helping to highlight its financial strength.

Enbridge Investor Presentation

Enbridge Performance – Enbridge Investor Presentation

The company has continued to perform well across its asset portfolio, focusing on expanding its portfolio and driving returns. The company continues to have one of the largest gas transmission, distribution, and storage portfolios with 20% of U.S. natural gas transmitted and 2 Tcf of natural gas delivered to serve 75% of Ontarians.

The company is on track to put $3.8 billion worth of assets into service in 2022 with several major midstream and renewable assets. The company also has managed to secure a matching number of growth investments and opportunities, along with capital recycling, which can be used to generate substantial returns.

The company’s renewable portfolio is now 2.2 GW of energy serving almost 1 million homes with almost $3 billion in growth capital in executions. The company continues to also have very substantial liquid volume, with the mainline pipeline remaining arguably the most important pipeline in North America.

Enbridge Market Potential

Enbridge continues to operate in markets that have substantial potential. This is especially true as the global community views current major oil suppliers, such as Russia, as less reliable actors.

Enbridge Investor Presentation

Enbridge Market Potential – Enbridge Investor Presentation

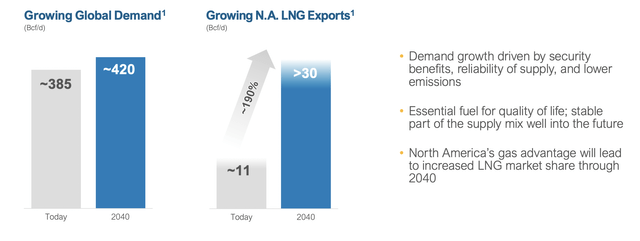

Global natural gas demand is expected to grow only slightly from today to 2040, with demanding growing by <10% to 420 Bcf / day. However, North American LNG exports, supported by the stability of the environment and supply, is expected to go much faster. LNG exports are expected to reach 30 Bcf / day from a 3% market share to 7% market share.

That market potential means substantial demand for Enbridge to use its assets to transport natural gas.

Enbridge Continued Capital Investments

Enbridge has numerous routes where it can continue to expand its capital spending to generate strong returns.

Enbridge Investor Presentation

Enbridge Investor Presentation

Enbridge Asset Opportunity – Enbridge Investor Presentation

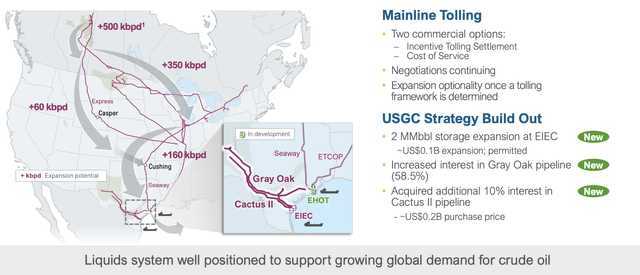

The company is expanding its oil portfolio with bolt-on developments as continued pressure has hurt the company’s ability to maintain and expand its pipelines. However, it’s still been able to increase volume substantially with almost half a million barrels per day of liquids moving throughout the company’s entire system.

The company also has done bolt-on acquisitions and construction for its pipeline system, where relevant, in order to increase its cash flow. This includes storage expansion and the company’s interest increase in the Gray Oaks pipeline as a result of capital recycling.

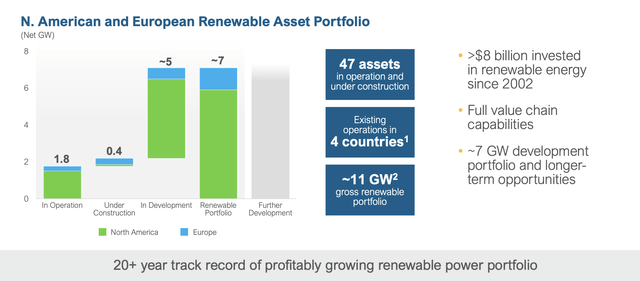

From a renewable asset standpoint, the company is working too rapidly expand its retirement portfolio. The company has 1.8 gigawatts in operation and 0.4 gigawatts under construction. However, under development it has a massive 5 gigawatts with a substantial amount in Europe. The company has $8 billion invested already and we expect that to ramp up substantially.

Enbridge Investor Presentation

Enbridge Capital Spending – Enbridge Investor Presentation

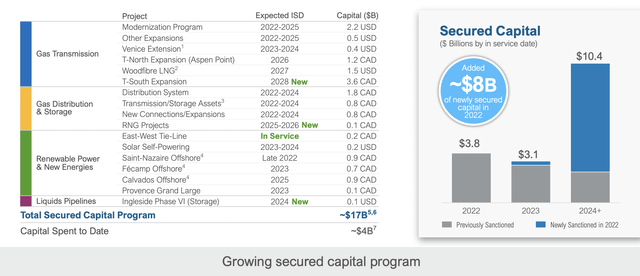

Overall, the company’s total secured capital program is a massive $17 billion CAD (~$13 billion USD). The largest source of this is the new T-South pipeline expansion, expected to cost $2.7 billion USD along with its general gas modernization program. In renewable power and energies, the company is expecting to spend $2.2 billion with a completion date by 2025.

The company has spent $3 billion of that $13 billion USD capital program so far and we expect it to continue its growth enabling strong shareholder returns. We expect the company’s capital program to continue to be in the range of $2-3 billion USD per year, a number the company will continue to pay from its cash flow.

Enbridge Financial Strength

Financially, the company has the strength that we expect will provide continued shareholder returns.

Enbridge Investor Presentation

Enbridge Financial Strength – Enbridge Investor Presentation

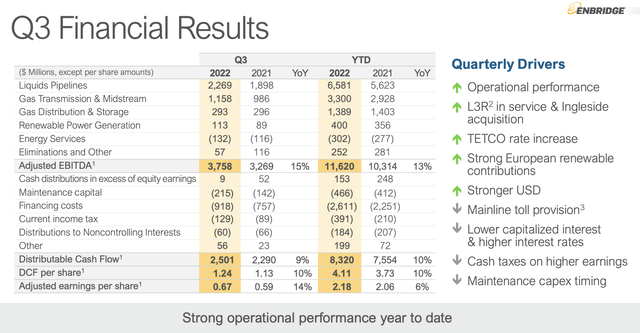

The company earned $2.5 billion in DCF in 3Q 2022, and $8.3 billion annualized, highlighting its financial strength. The company’s YoY DCF growth is almost 10%. The company’s annualized DCF can be expected to be almost $11 billion, an incredibly strong FCF yield for a company with a $80 billion market capitalization (implying an almost 15% FCF yield).

That highlights how the company can continue to comfortably pay its dividends while still having substantial cash flow left over for shareholder returns. We expect the company to continue cautiously paying its dividend while using additional cash to expand share repurchases.

One other item worth focusing on from above is the company’s debt load. The company continues to have a substantial debt load although it’s lucky that in a high interest rate environment, 90% of its debt load has a fixed interest rate. However, the company still spends almost $4 billion a year in interest, a substantial interest load.

We feel the company’s debt load is hitting the point where its ability to continue driving shareholder returns is getting restricted, especially as debt rolls off. At minimum we’d like to see the company use its cash flow to pay off its debt as it comes due.

Thesis Risk

The largest risk to the company’s thesis is its debt load in a volatile environment and its continued capital spending. The company’s investments could continue to pay out, with higher returns than its cost of capital, but there’s no guarantee of that. However, the debt and the required obligations will stay with the company and potentially hurt its ability to generate returns.

Conclusion

Enbridge has a strong and unique portfolio of assets that we expect the company will be able to use to generate substantial shareholder returns. The company has a dividend yield of more than 6% and a double-digit DCF yield that enables the company to continue to invest on both growth and share repurchases.

That combination helps to highlight how the company is a valuable investment. The major risk we see for the company is the risk of continued pressure against expanding its assets and various governments that are against the expansion of fossil fuels. Additionally the company has a massive debt load that continues to cost it. Both of those risks are amplified by continued capital spending, which we recommend investors pay close attention to.

Be the first to comment