Mario Tama/Getty Images News

Pay Attention to What People Do, Not What They Say

Retail sales might be doing just fine, at least according to the latest Bank of America (BAC) Global Research card spending data. Moreover, Costco (COST), one of the few firms that issues monthly same-store sales numbers, made news on April 6 with a robust monthly report. These optimistic figures fly in the face of dismal consumer sentiment readings recently.

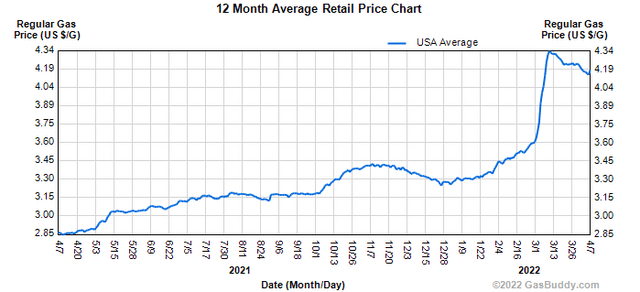

Higher Gas Prices Not a Big Burden

Let’s dig into the latest retail expenditure figures by Bank of America (BofA). The elephant in the room is, of course, gasoline prices. The average cost to fill up your tank continues to run high. One gallon of regular gas costs $4.20 even as WTI crude oil prices (USO) have dropped precipitously.

Figure 1 – U.S. retail gasoline prices:

Sifting Through Debit and Credit Card Data

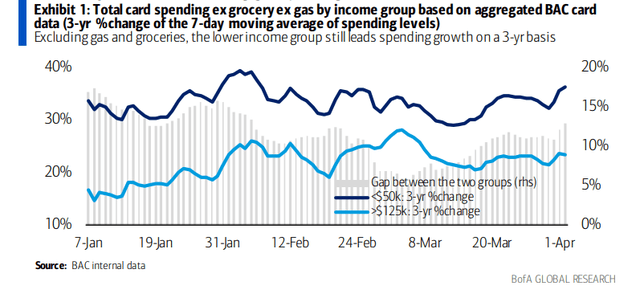

But backing out gas and grocery spending, retail sales look just fine. The lower-income group, in particular, has seen a rebound in card spending, per Bank of America internal card data.

Figure 2 – Card spending ticks up even as gasoline prices remain above $4 per gallon:

Tax Refunds Tick Up

What could be driving still-strong spending by Americans, particularly those on the low-end of the income scale? Tax refunds have been bigger than last year, according to BofA. The median tax refund size as of April 2 is more than 5% higher from a year ago, though it is about the same as was received in 2019.

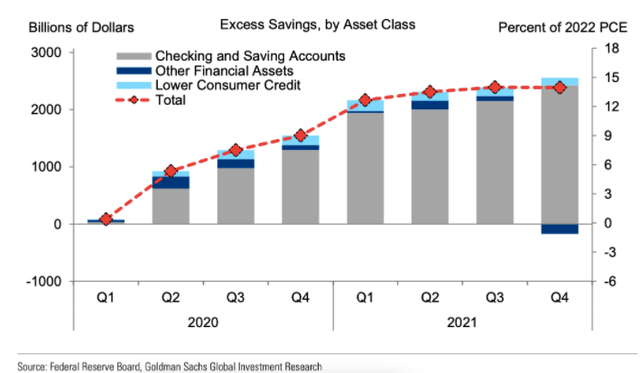

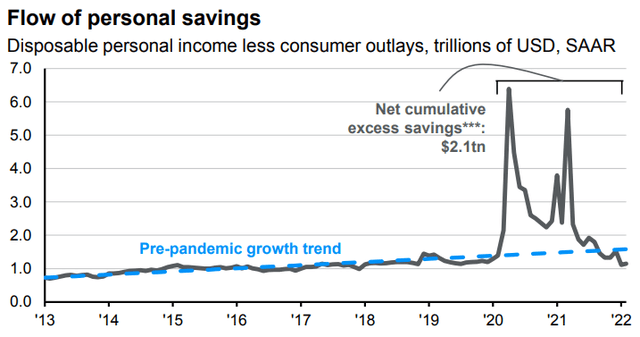

Consumers Remain Flush with Cash

Also, consider that there remain incredible excess savings in the coffers of consumers. Goldman Sachs reports that households have accumulated 14% of a year’s spending in excess savings (all withering away – due to inflation – in checking and savings accounts). While consumer checking accounts remain swollen, the U.S. personal savings rate has ticked lower – indicating that folks are finally beginning to spend down all of the stimulus cash received in 2021.

Figure 3 – Excess savings remains high:

Figure 4 – Flow of personal savings:

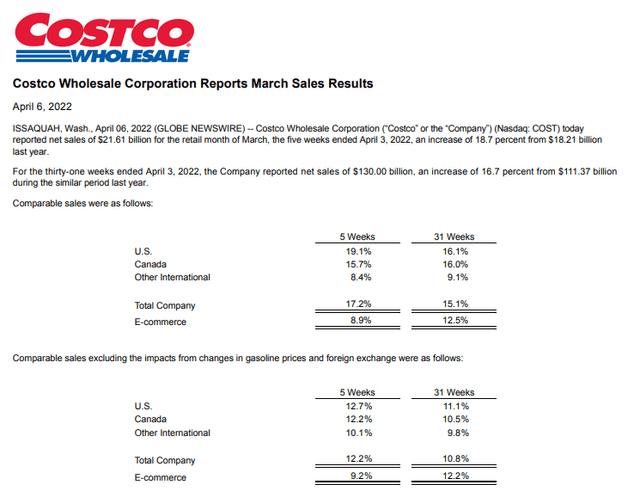

What Costco Has to Say

So where do we stand today? Costco, perhaps the best gauge of spending among middle and upper-end consumers, issued blowout March same-store sales numbers. It reported March comps of +12.7% for the U.S. (ex-gas).

Figure 5 – Costco’s strong March sales report:

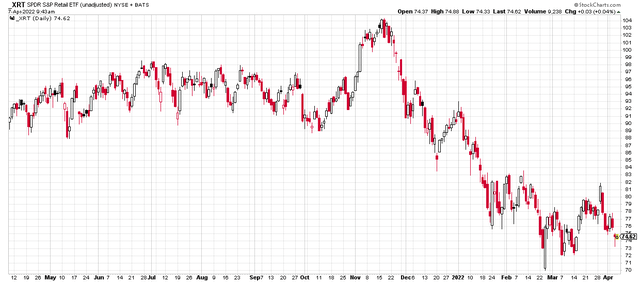

The Retail Play: XRT

How should you trade this optimistic spending scenario? Consider buying dips on the SPDR S&P Retail ETF (XRT). The equally weighted fund would benefit in the event that spending continues to run strong in the face of mounting macro risks and recessionary fears. It’s hard to discount the American consumer.

XRT’s Technical Take

Technically, a drop below $70 on XRT would suggest lower prices ahead, however. The fund is already down about 30% from its November peak. To avoid catching a falling knife, waiting for a sustained rebound above $84 could be a prudent move.

Figure 6 – XRT price history:

Conclusion

As earnings season gets underway, consumers appear to be resilient. Could sustained high gas prices and increasing interest rates hinder that trend? Maybe, but Americans are better positioned than ever to weather the storm.

Be the first to comment