Maksim Safaniuk

With talks of a recession looming in 2023, capital preservation is a key concern among many in the investment community, and historically speaking, one of the best places to park cash amidst market volatility is in the consumer staples sector.

While stocks like General Mills (GIS) and Campbell Soup (CPB) may first come to mind, so-called sin stocks shouldn’t be ignored. This brings me to Constellation Brands (NYSE:STZ), which is home to a number of leading alcoholic beverage brands. This article highlights whether if STZ is currently a buy at the current price, so let’s get started.

Why STZ?

Constellation Brands is a large, multinational alcoholic beverage company based in Victor, New York. It is one of the world’s largest producers and marketers of beer, wine, and spirits.

With an impressive portfolio of well-known brands such as Corona Extra, Robert Mondavi Wines, SVEDKA Vodka, Black Box Wines, and Kim Crawford Wines, Constellation Brands has built an impressive collection of assets with pricing power. This is reflected by STZ’s respectable B+ Profitability grade, with sector leading gross profit and EBITDA margins of 52% and 37%, respectively.

Having STZ stock could be a smart move for long-term investors wanting exposure to premium brands. The stock has done very well for investors over the past decade. As shown below, STZ’s total return of 626% over the past 10 years has thumped the 227% total return of the S&P 500 (SPY) over the same timeframe.

STZ Total Return (Seeking Alpha)

Meanwhile, STZ is performing well with strong consumer demand driving sales and volume up by 15% and 12% YoY during its latest reported quarter. This is reflected by the beer business growing volume by nearly 9% YoY in its latest second fiscal quarter, representing more than 9 million additional cases sold to retailers.

Also encouraging, STZ’s beer business is outperforming the category overall by growing its market share, and now accounts for 28% of the high-end segment. Moreover, STZ’s wine and craft spirits also posted solid volume growth, with the latter category seeing double digit volume growth.

Looking forward, Constellation Brands is focused on innovation and development of new products which could drive growth and profitability in established markets while also reaching out to new markets across different countries globally. This includes recent momentum around its Chelada brands, the recent launch of Fresca Mixed, and the expansion of Modelo Oro, all of which is expected to resonate well with the Hispanic population in the U.S.

It also invests heavily into marketing campaigns to promote its brands, which should give its direct-to-consumer business a boost. The DTC model is highly attractive as it’s able to capture the retail markups and save on distribution costs. Management updated on promising DTC growth trends as highlighted during the recent conference call:

Beyond product innovation, we continue to extend our growth in direct-to-consumer and three-tier e-commerce channels, as well as International markets. Wine & Spirits DTC net sales grew 15% in the second quarter, as our investments in these channels continue to yield strong performance.

We also continue to outperform in three-tier e-commerce delivering dollar sales growth 16 points ahead of the competition in the second quarter. Importantly, we are also outperforming in three tier e-commerce with our beer business, which achieved a seven-point lead in dollar sales growth versus competition in the second quarter.

STZ maintains a healthy BBB rated balance sheet and while the divided of 1.4% isn’t particularly high, it does come with a low 28% payout ratio, a 5-year CAGR of 10%, and 7 consecutive years of growth. Moreover, STZ should be regarded as more of a total capital return story, as management is targeting $5 billion in total capital returns this year, inclusive of share repurchases and dividends, not bad for a company with just a $42.7 billion market cap.

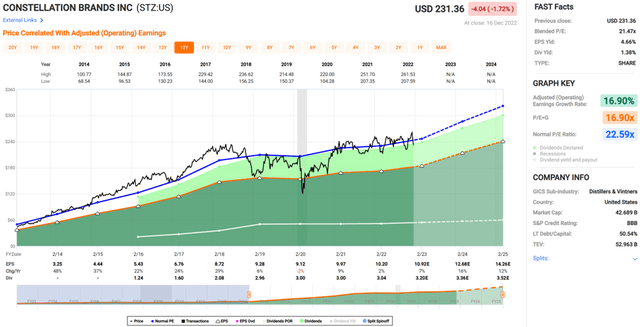

Turning to valuation, I believe STZ looks appealing after the recent drop to $231, with a forward PE of 20.9, sitting meaningfully below its normal PE of 22.6. While value investors may want to wait for a bigger discount, long-term investors may want to layer in at current prices, as near to medium term fluctuations may not matter all the much over the long run.

STZ Valuation (FAST Graphs)

Analysts estimate 13% to 14% annual EPS growth over the next two years, and have a consensus Buy rating with an average price target of $278, implying the potential for very strong returns.

Investor Takeaway

Constellation Brands has done exceptionally well in terms of total returns, and currently has a healthy balance sheet and the valuation has gotten appealing. Its focus on product innovation, marketing campaigns, and direct to consumer sales should help the company sustain its growth trajectory going forward. Given STZ’s strong outlook, capital returns plans, and recent dip in price, long-term growth investors may want to consider adding the stock to their portfolio at current prices.

Be the first to comment