The new Euronext Amsterdam Stock Exchange Building in Amsterdam ivotheeditors/iStock Editorial via Getty Images

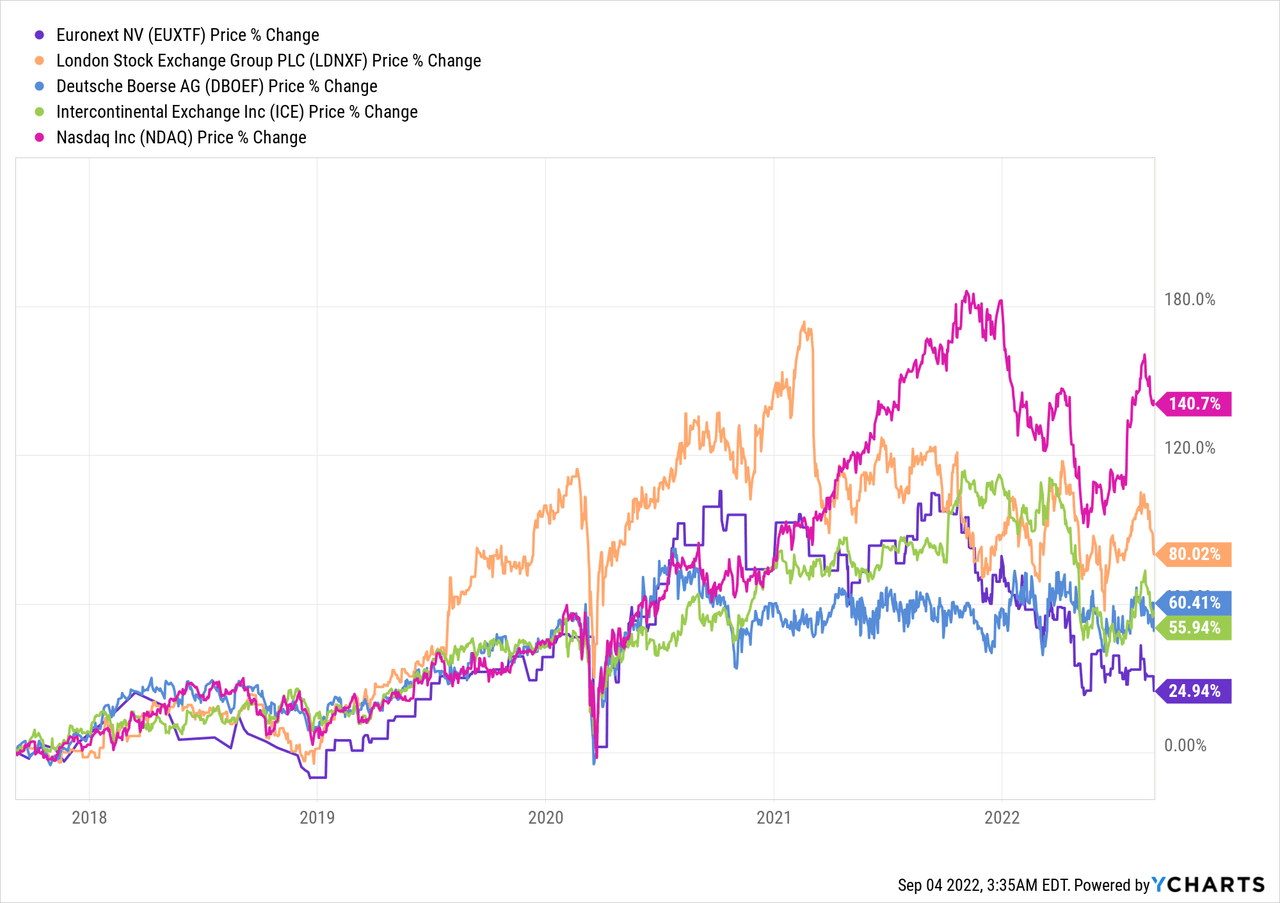

Since the end of 2022, Euronext (OTCPK:EUXTF) (OTCPK:ERNXY) has underperformed its peers. This currently makes Euronext the most undervalued Exchange compared to its peers based on a couple different valuation metrics.

The company has a strong moat combined with slow and steady growth for years to come.

Investors should expect market beating returns in the years to come until Euronext has returned to its fair value.

Based on my DCF calculation Euronext is currently undervalued while it offers a lower risk.

Combined with a 10%+ free cashflow yield, an expected 10%+ IRR and a beta of 0.58 makes me initiate my buy rating on Euronext.

Company overview

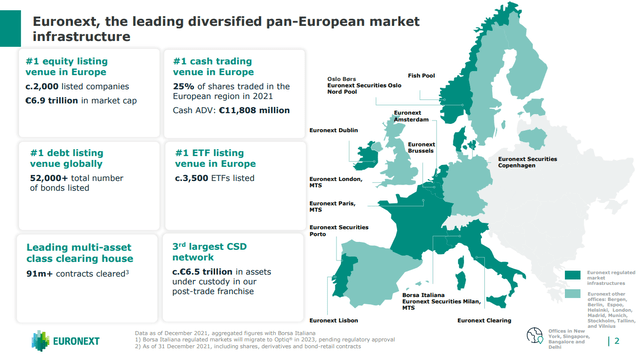

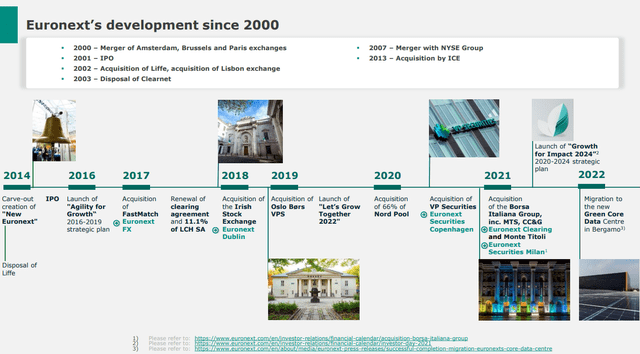

Euronext currently is the leading pan-European stock exchange. They have a great track record of organic growth in combination with growth from M&A. Example of this can be their most recent acquisition of Borsa Italiana.

Euronext currently operates 7 local exchanges, one bond trading platform, one central counterparty clearing house and 2 central security depositories.

Euronext Group Overview (Company Presentation) Euronext M&A (Company Presentation)

Impact 2024

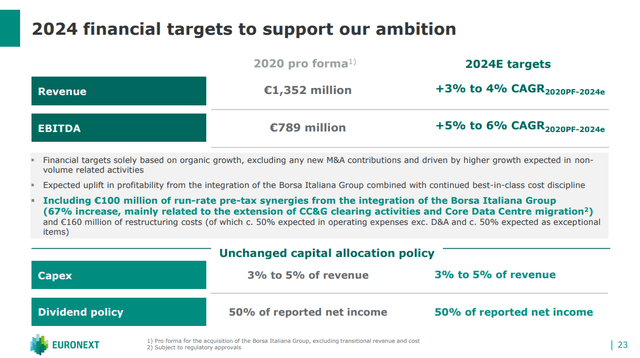

In their current 2024 financial strategic plan, Euronext is targeting a slow and steady 3% to 4% CAGR on the revenue side. Ebitda should grow 5% to 6% CAGR. Capex will remain the same. The current dividend policy still applies, this means a growing dividend over time. Please note here that it is based on 50% of net income so there can be years where the dividend will go down, but I expect over the longer term that the dividend will grow at a slow and steady pace.

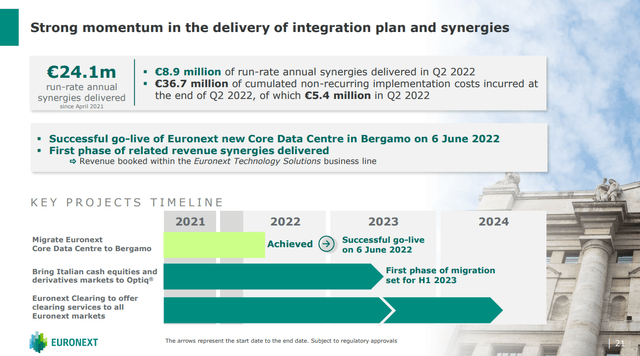

The integration of Borsa Italiana continues going into 2023 and 2024. These are expected to further deliver synergies. The current synergies are already up +67% from 60M EUR to 100M EUR versus the targets set in October 2020.

Currently two major projects remain. Bringing the Italian cash equities and derivatives markets to Euronext Optiq and Euronext Clearing to start offer clearing services to all Euronext markets.

Source: Growth For Impact 2024 IR Page

Source: Investor Day Presentation

2024 Financial Targets (Company Presentation) Key projects (Company Presentation)

Undervalued

Currently Euronext appears to be undervalued based on a couple different valuation methods.

The metrics I will use are:

- Earnings per share

- Ebitda

- Free Cash Flow

- Sales

Before looking at the individual metrics I want to share this table that gives a quick overview of Euronext’ valuations compared to its peers. You can see here that Euronext offers better valuations across the board.

| P/E Ratio | FCF Yield | EV/Ebitda | Dividend Yield | |

| Euronext | 17.9x | 10.69% | 11.4x | 2.61% |

| London Stock Exchange | 29.3x | 5.33% | 14.4x | 1.27% |

| Deutsche Boerse | 23.0x | 5.80% | 13.9x | 1.88% |

| Intercontinental Exchange | 24.0x | 6.52% | 15.6x | 1.40% |

| Nasdaq (NDAQ) | 25.5x | 5.18% | 17.7x | 1.24% |

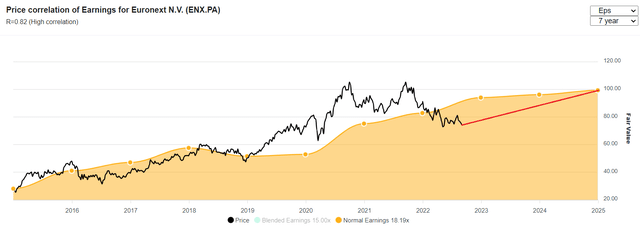

Price-Earnings Ratio

From the P/E ratio perspective, Euronext is trading at 17.9x well below the average of 25.45x their peers are trading at.

If the EPS keeps growing by ~6%, this would imply a fair value stock price of 100 EUR by the beginning of 2025. If Euronext reverts back to its fair value by 2025, this would imply a capital gain of 25.68 EUR/share or a CAGR 13.63% (excluding dividends).

Price to Earnings Ratio Chart (Author’s own software)

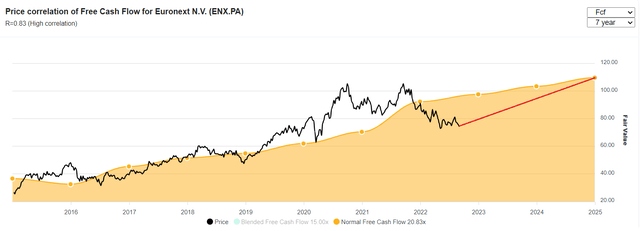

Free Cash Flow

Euronext currently is trading at a FCF Yield of 10%+. You don’t come across many companies that offer this kind of yield. It is also significantly higher compared to the average of 5%-6% FCF Yield from its closest peers.

If the FCF keeps growing by ~6%, this would imply a fair value stock price of 109 EUR by the beginning of 2025. If Euronext reverts back to its fair value by 2025, this would imply a capital gain of 34.68 EUR/share or a CAGR 17.92% (excluding dividends).

Price to Free Cash Flow Chart (Author’s own software)

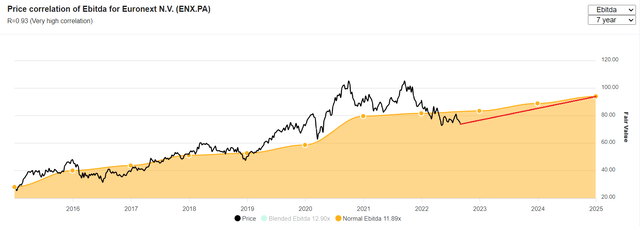

Ebitda

If the Ebitda keeps growing by ~6%, this would imply a fair value stock price of 95 EUR by the beginning of 2025. If Euronext reverts back to its fair value by 2025, this would imply a capital gain of 20.68 EUR/share or a CAGR 11.15% (excluding dividends).

Price to EBITDA chart (Author’s own software)

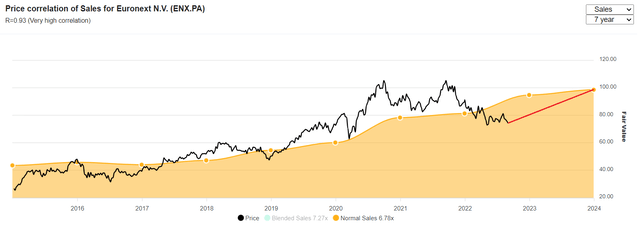

Price-Sales

If the EPS keeps growing by ~6%, this would imply a fair value stock price of 100 EUR by the beginning of 2024. If Euronext reverts back to its fair value by 2024, this would imply a capital gain of 20.68 EUR/share or a CAGR 20.43% (excluding dividends).

Price to sales chart (Author’s own software)

Discounted Cash Flow

From a DCF perspective Euronext currently is a buy. The suggested buy price from the DCF calculation is 98.88 EUR while the stock price currently is 74.32 EUR. This combined with a FCF yield of 10% suggest a big discount to fair value.

For the inputs I used the following:

- Growth rate: 6%

- Discount: 10%

- Margin of safety: 10%

Discounted Free Cashflow Calculation (Author’s own software)

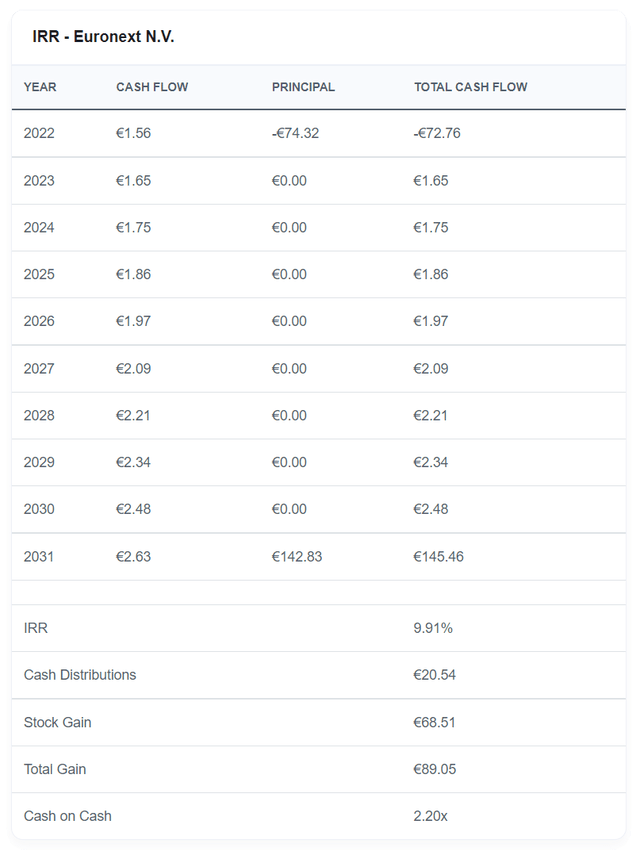

Internal Rate of Return

Using a modified IRR where I will model a 10-year investment period, I can find out how good or bad an investment in Euronext would be right now. Please note here that I’m using dividends as cashflows here.

Firstly I need to know what my terminal value would be in 10 years time.

To find this out I projected 4 different metrics into the future. The weighted result of this gives me my terminal value of 142.83 EUR.

| Metric | Growth | Terminal Multiple/Yield | Weighting | Terminal Value |

| Total | 100% | 142.83 EUR | ||

| FCF | 6% | 6% FCF Yield | 25% | 173.94 EUR |

| EBITDA | 6% |

13x EV/EBITDA2x DEBT/EBITDA |

25% | 104.90 EUR |

| EPS | 6% | 5% Earnings Yield | 25% | 141.31 EUR |

| Dividend | 6% | 2.40% Dividend Yield | 25% | 109.69 EUR |

The inputs I used for the IRR calculation are the following:

- Terminal Value of 142.83 EUR

- Buying Price of 74.32 EUR

- Dividend growth of 6%

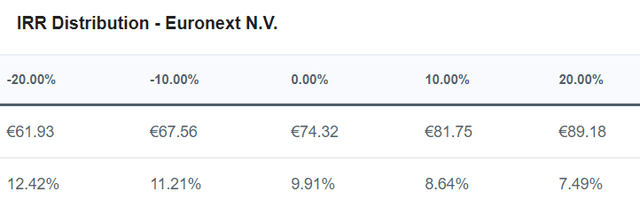

Using these inputs the expected IRR is 9.91%. This is in line with what I expect my investments to make.

I also included a IRR distribution for future readers.

Internal Rate of Return calculation (Author’s own software) Internal Rate of Return Distribution Model (Author’s own software)

Risks

I believe regulatory risks are the main concern at this point. Euronext is currently the biggest pan-European stock exchange by market cap. Employing their current M&A strategy will become increasingly more difficult going into the future.

The dividend policy is not the best and could be a bit volatile on the short term if net income would drop. If you really want a reliable growing dividend year after year, Euronext might not be for you until they improve the policy. However I still expect a growing dividend by 5%-6% CAGR over the longer term (10+ years).

Conclusion

Long-term investors should consider buying Euronext while its valuations are suppressed. Please keep in mind that Euronext is based in France, where the standard dividend withholding tax rate is 30%.

Euronext currently has an expected IRR of almost 10%+ at the time of writing this. All metrics that I discussed in this article are suggesting Euronext is trading below its implied fair value. The IRR is nothing too crazy but considering that the beta of this stock is only 0.586, I would argue it is pretty good from a risk/reward perspective.

Looking at the DCF calculation we have a suggested buy price of 98.88 EUR. Currently you can buy Euronext for 74.32 EUR.

The stock is trading at very high free cash flow yield of 10%+.

Given all of this, I am initiating a buy rating on Euronext and plan on adding to my position below 70 EUR.

Be the first to comment