JHVEPhoto

Shares of ConocoPhillips (NYSE:COP) have been an extraordinary performer over the past year, rallying about 60%. Even after this rally, the stock is still inexpensive, trading at about 10x free cash flow. Like many of its peers, COP has adopted a variable and generous shareholder return program, though its management team remains a bit more growth-oriented than others.

In the company’s second quarter, it earned $5.1 billion or $3.91 per share. That profit was triple last year and up $800 million sequentially. Production was 1,692mboe/d, and when the company reports Q3 results, we should see a modest sequential increase as the company guides to full year production of 1,700-1,760mboe/d. Impressively, Conoco reduced SG&A costs by 19% to $96 million from last year. As a consequence, corporate costs will be just $900 million this year, from the $1 billion previously expected. Over the past six years, Conoco has slimmed down and streamlined operations, so that 70% of profits come from the Lower 48, 13% from Alaska, and 9% in Europe, the Middle East, and Africa.

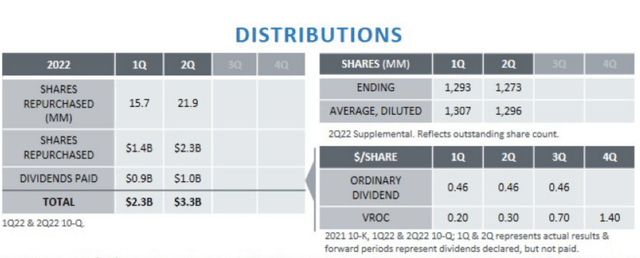

With this earnings power, Conoco has been a free cash flow gusher. Q2 free cash flow was $5.9 billion. Before M&A, H1 free cash was $11.1 ($9.7 billion including M&A). Given this cash flow, COP has paid down $2.9 billion in debt and brought its cash position up to $8.5 billion. This is while budgeting $7.8 billion on cap-ex. Accordingly, management upped its 2022 capital return budget from $10 billion to $15 billion.

COP is returning cash flow in three ways. First, it is paying a $0.46 regular dividend, which costs just over $2 billion per year. Then, it pays a supplementary dividend. With the $1.40 it is paying in Q4, it is paying another $2.60 in special dividends in 2022. That is another $2.9 billion. With the remaining $10 billion, COP is buying back stock. Given it bought $3.7 billion in stock in H1, the pace is picking up dramatically in the second half. With a $148 billion market capitalization today, the combined returns equate to just over a 10% yield

Now when the company reports third quarter earnings, we are likely to see a sequential decline from these extraordinary Q2 results. Each $1 move in crude oil has a $110 million annualized impact on COP’s results, and WTI averaged about $89 in Q3 from $108 in Q2, so this will be about a $500 million headwind. In addition, there is likely to be an increase in operating costs, given the 7-8% inflation the organization is seeing, which is why I am looking for EPS to be the $3.35-$3.65 range, still about $14 per share on an annualized basis. There also may be some catch-up cap-ex payments in either Q3 or Q4, but it points to be about $5 billion in free cash flow (or $20 billion annualized). Even with oil in the $80s, COP is well positioned to sustain a ~$15 billion shareholder return program.

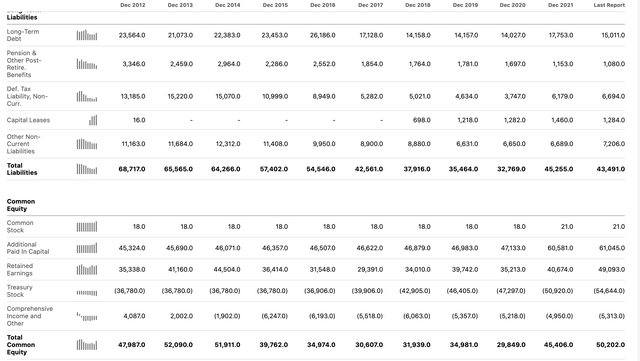

In the first half of this year, COP paid down debt, but with gross debt down to $17 billion and net debt of just $8.5 billion, the balance sheet is in excellent shape. In 2012, the company had $20 billion more in liabilities than equity. This debt-heaviness continued through 2016 when the fracking boom turned to bust, forcing painful years of balance sheet repair and a dividend cut. Today, it has $7 billion more in equity than liabilities. Having cleaned up its balance sheet, COP can safely pivot to focus on rewarding shareholders. Combined with its unmatched size in the E&P space, its strong balance sheet makes Conoco arguably the most defensive pure-play oil & gas producer.

Now in addition to rewarding shareholders, COP is being a bit more aggressive on the growth front. To be clear, this does not mean the company is returning to its over-zealous expansion in the 2012-2016 period than ended up in a dividend cut. In fact CEO Ryan Lance has made clear the company will only invest in production with a cost of supply below $40. This ensures the company can stay profitable even if the current strong commodity price environment ends. However, unlike peers that promise to pay out most or all of its free cash flow, COP has committed to return at least 30% of operating cash flow, leaving up to 70% for M&A or cap-ex because Lance wants “to grow and develop the company over the long haul.” In practice, this 30% is a floor more than a target as it is slated to be above 40% this year.

With this flexibility though, Conoco is making exciting moves on the LNG (liquified natural gas) front. It is taking a 3.12% stake in Qatar’s $30 billion LNG expansion or a $900 million investment. This will start producing in 2026. Conoco is also taking a 30% stake in Sempra’s (SRE) Port Arthur LNG facility, providing up to 5 million tons of natural gas per year. These two moves make Conoco an even bigger player in the LNG market, which is a shrewd strategic move.

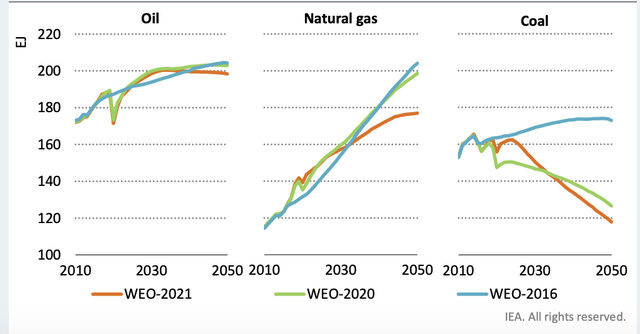

First, the demand outlook for natural gas is particularly strong. As you can see below, the International Energy Agency expects natural gas demand to rise through 2050 as it gains shares from coal. I would also note for those who fear oil assets could be stranded due to climate policies that while oil demand peaks around 2030, it will stay at that level nearly until 2050. The world will need a lot of hydrocarbons for a very long time.

International Energy Agency

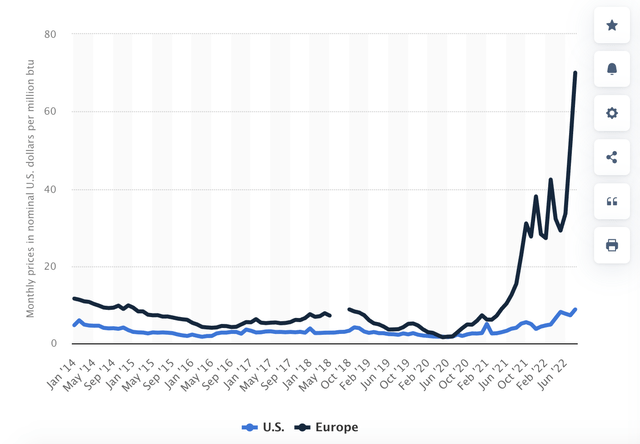

The current geopolitical environment is also very favorable for LNG. With Russia stopping its exports of natural gas to Europe, the price of European gas has skyrocketed relative to the US as the continent bids up every cargo of LNG it can find. With Nord Stream 1 blown up and the war proving to be a very protracted conflict, the energy rupture between Russia and Europe appears fairly permanent. While Europe is scrambling to buy LNG this winter, remember that Russia was supplying Europe with gas all through the first of 2022, something it will not do in 2023. As a consequence, Europe may need to buy even more gas next year.

Given the time it takes to build out LNG export facilities, tankers, and import facilities, I expect Europe will pay substantially more for natural gas than the US for several years. With these investments in Qatar and the Gulf Coast, COP is positioned to benefit from this secular trend and even receive higher prices for its natural gas production, which otherwise would be sold in the domestic market.

Statista

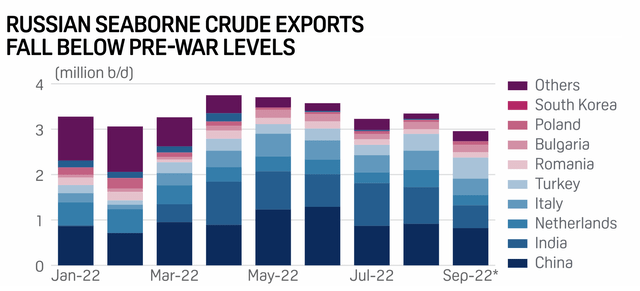

While natural gas and LNG get the attention, I would also note that Russian oil exports are falling, and Russia could eventually hold back oil as it has gas. While oil has been hit the past three months by the strong dollar and recession worries, Russian supply worries combined with the OPEC+ production cut leave me of the view that the market is discounting the risk of oil markets remaining tighter than expected for longer, keeping prices fairly elevated even if economies slow.

S&P Global

At $90 oil, Conoco is trading at just less than 10x forward free cash flow. Its large buybacks will also help to reduce the share count and drive up earnings power over time. That is an attractive valuation to buy into a defensive oil company, which has a great balance sheet and is making shrewd, manageable investment to benefit from structural changes in global energy flows. For comparison, EOG Resources (EOG), which I view as similarly defensive but is a bit smaller is trading 9x free cash flow while Ovintiv (OVV), which is more speculative, is trading about 6x.

A modest premium to E&P peers is justifiable given its size, and ultimately, I think investors should be willing to own companies like Conoco down to an 8% distribution yield or about 12x, given my view energy prices can stay higher for longer, meaning this period of $15 billion shareholder capital returns can continue well beyond 2022. This would imply a share price of about $140 for COP, or 20% upside. I would be a buyer of Conoco and use any weakness to add more.

Be the first to comment