hoozone/iStock via Getty Images

Investment Summary

Since our last review on CONMED Corporation (NYSE:NYSE:CNMD), market fundamentals in the underlying medical devices market have been stretching upward. This has led to us to re-rating a number of previous stocks both to the upside and downside. We decided to seek out CNMD one more time to gauge its latest results and see where it is positioned moving ahead. To put it simply, we can’t keep revisiting a stock if it doesn’t deliver, when there are tremendously strong individual opportunities available to allocate to. Nonetheless, based on our latest findings, we believe there is reason to keep an eye on CNMD looking ahead. Net-net, we continue to rate it a hold, but are far more constructive on the stock.

Q3 numbers show reasonable strength down the P&L

Turning to the latest results, CONMED Corporation sales growth for Q3 saw an increase of 10.6%, resulting in $275.1mm at the top. Global organic growth for Q3 at 7.9%, constant currency that’s 12.1%. Revenue from the recent acquisitions was $10.3mm in the quarter. This strong performance was driven by solid growth in both orthopedics and general surgery businesses, with orthopedics growing 14.0% and general surgery growing 10.7% worldwide.

Switching to the international markets, it, too, delivered good upside with 9.6% YoY growth, while the domestic business grew ~14% reported. It pulled this down to GAAP net income for the third quarter totaling $46.1mm, compared to net income of $14.9mm in the third quarter of 2021, a 200% YoY gain. This is what initially drew our attention to revising the position on CNMD in the first place. If it can continue this kind of earnings leverage, there is a chance it could extend further. But that is a highly contingent investment offer nonetheless.

Moreover, while the company has posted strong results, we’d also advise that the industry continues to face challenges, particularly with healthcare staffing levels and global supply chain inconsistencies. This is being observed across our entire coverage. While these issues did not worsen in the third quarter, they only saw a small delta compared to the second quarter.

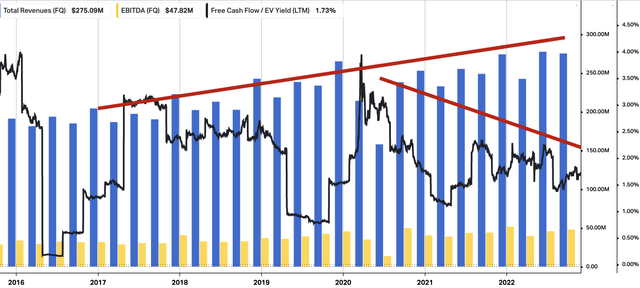

If we complete further analysis, we see there’s been a divergence in the company’s top-to-bottom line fundamentals over the past 2-years. Whilst the long-term revenue trend has remained in situ, trailing free cash flow (“FCF”) yield hasn’t kept the same gradient.

Exhibit 1. CNMD long-term operating performance. Note the divergence between top and bottom line. Question is, what is the return on capital from these outflows?

Data: HBI, Refinitiv Eikon, Koyfin

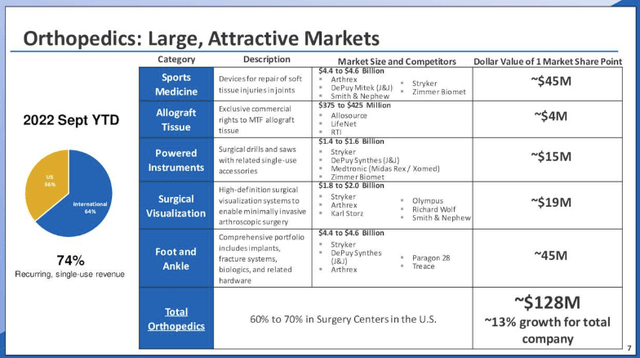

One notable takeaway from the earnings call is that management are focused on broadening horizons further in its core portfolio. You can see below, in the takeout from the investor presentation, that CNMD is intently focused on growing its footprint in the orthopedic surgery market.

You should know that this is the industry that produces and sells medical devices, products, and services related to orthopedic surgery. Think surgical instruments, implants, braces, and other medical devices, as well as services such as surgical procedures and rehabilitation services. Hence, it’s a never-ending revolving circulation of raw materials, manufacturing, and supply chain, etc.

The orthopedic surgery market is a rapidly growing segment of the healthcare industry, with global market size estimated to reach ~$27Bn by 2027 at CAGR of 7.6%. Advances in technology, such as 3D printing and robotics, have allowed for more precise and efficient surgical procedures, leading to shorter recovery times and improved patient outcomes, along with an aging population. Sports medicine has also been a large growth market and driven advancements in research for the broader space. For CNMD, one of its larger growth markets is in sports medicine, and also the partnership with Musculoskeletal Transplant Foundation (“MTF”).

Exhibit 2. CNMD growth engine: Orthopedics [Q3 investor presentation]

Image: CNMD Q3 FY22 Investor Presentation

Allograft tissue, also known as musculoskeletal tissue, is tissue that has been donated [usually] by a deceased person and processed for transplantation into a recipient. The tissue is typically used in orthopedic surgeries to repair or replace damaged or missing tissue in the musculoskeletal system.

The use of soft tissue allografts has seen a marked increase in order to accommodate the broad spectrum of ligament reconstruction procedures and fixation techniques required on the market today. It has a large placing in sports medicine for ligament or tendon ruptures, or cartilage defects. MTF allograft tissue is a valuable resource in the orthopedic surgery market, as it can help restore function return to play even faster than harvesting a patient’s own tendons and ligaments. Hence, we look forward to see where CNMD grows this market.

Recent study results suggest that competitive and recreational athletes can expect a 68% chance to return to some level of sport which is statistically high at an elite level. The results are compounded with patient-specific rehabilitation protocols.

Given the growth percentages above, we believe this is a key market segment where CNMD will continue to do well, and can be used as a benchmark for operating performance going ahead. You can see above that the dollar value for 1 point of market share is ~$128mm, enormous growth percentages as mentioned.

CNMD: Technical drivers

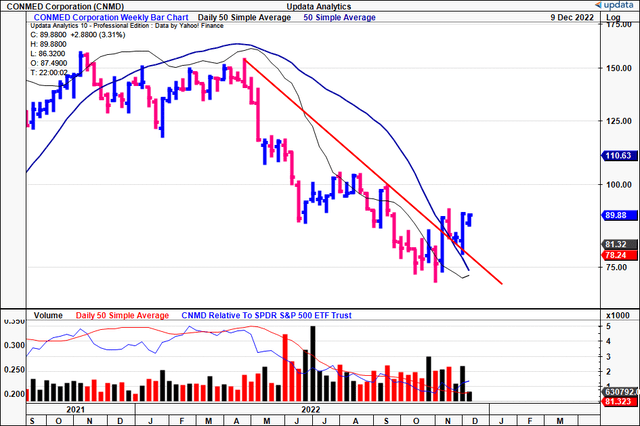

We also see CONMED Corporation stock has broken out above a fairly long downtrend in recent weeks, just like many of its peers within the space. The question we have is how do we gauge price visibility for the coming weeks and months.

Firstly, there’s been fairly strong ascending volume of late for the stock, and this shouldn’t be discounted.

Second, it has crossed above both 50DMA and 250DMA’s for the last 4 weeks. We have been seeing this occurrence in a lot of the stocks that have bounced from their multi-year lows. It’s a question of whether it’s sustainable or not.

Nevertheless, we look forward to seeing what the recognition of this pattern means further down the line [the stock crossing up above both MA’s so rapidly].

Exhibit 3. Breakout above recent downtrend. Can it continue?

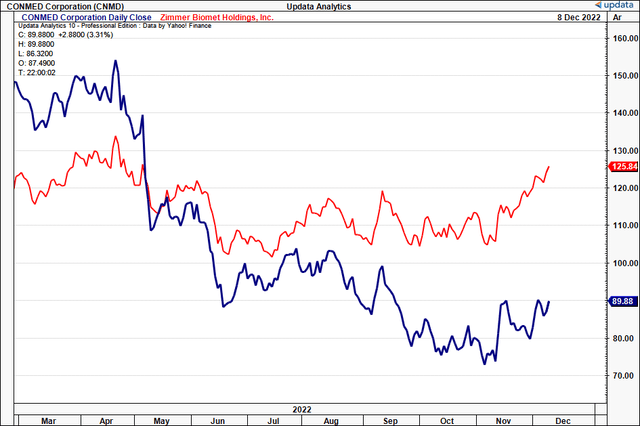

We then checked the recent performance of CNMD against another key player in our medical devices coverage, Zimmer Biomet Holdings, Inc. (ZBH). We recently revisited our ZBH position with a buy, and it has begun to curl up. Investors can read it here. You can see below that ZBH has pulled away from CNMD in terms of performance these past few months. What this tells us is that CNMD’s revenue miss versus consensus in Q3 can’t have gone un-noticed, and that perhaps much of the other good news from the quarter has been priced in.

The other way to look at it is that if ZBH is catching a bid, what’s that say about the broad sector, and can CNMD secure the same buying support.

Exhibit 4. CNMD vs recent long ZBH

In short

We reiterate our hold call on CONMED Corporation with the same $92 valuation. Factors are improving, but we’d like more to assess any changes before pulling the trigger on CONMED Corporation.

Be the first to comment