andreswd/E+ via Getty Images

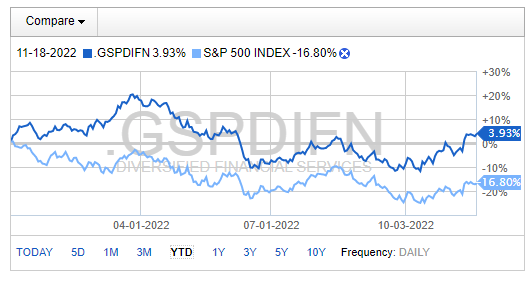

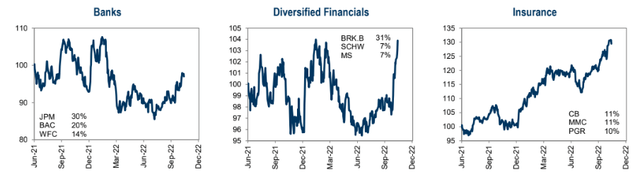

Diversified financials have done relatively well this year. The industry has a positive total return, while the broad market is down nearly 17%. Driving the alpha is the area’s 31% weight in Berkshire Hathaway, but other names have fared fine in 2022. One small-cap investment-related firm is down by more than one-third on the year. I see a value case, however.

Diversified Financials Industry With YTD Alpha

Fidelity Investments

Diversified Financials Industry Surging Relative to the Broad Market

Goldman Sachs Investment Research

According to Fidelity and Bank of America Global Research, Compass Diversified (NYSE:CODI) is a private equity firm specializing in add-on acquisitions, buyouts, industry consolidation, recapitalization, late-stage, and middle-market investments. Compass’ business model is to acquire companies at attractive price multiples, steer them through a transition period of performance improvement, then opportunistically monetize the investments and recycle the capital into new opportunities. Compass currently owns six branded consumer businesses (Marucci, Ergobaby, Lugano, Velocity Outdoor, BOA, and 5.11) and four niche industrial businesses (Advanced Circuits, Arnold Magnetic, Sterno, and Foam Fabricators).

The Connecticut-based $1.4 billion market cap Diversified Financial Services industry company within the Financials sector has slightly negative trailing 12-month GAAP earnings and pays a high 5.1% dividend yield, according to The Wall Street Journal.

CODI is more of a capital markets stock as it gives investors exposure to middle market investments, mainly in the Industrials sector. With ample liquidity, there is the potential for its management team to take advantage of attractive opportunities over the coming quarters if we see continued weakness in capital markets.

In its most recent quarter, the company missed on earnings but topped analysts’ revenue expectations. Overall, it was a solid quarter and CODI guided higher on 2022 per-share profit forecasts. Consumer adjusted EBITDA growth was 18% year-on-year, while Industrial growth was also impressive at +16.4% from the same quarter a year ago. Its leverage now stands at 3.9x, higher following the purchase of PrimaLoft, but still below its 5.0x covenant. Liquidity is robust at $485 million as of the end of Q3.

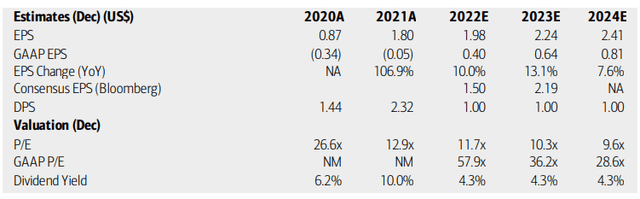

On valuation, analysts at BofA see earnings rising at a solid clip this year and next, with moderate growth then seen in 2024. GAAP earnings are below operating profits. The Bloomberg consensus forecast is less upbeat compared with BofA’s outlook. Interestingly, dividends are expected to hover at $1 per share for the next two years, but decent free cash flow could warrant periodic payout increases. Overall, I like the valuation given the growth prospects.

Compass Diversified: Earnings, Valuation, Dividend Forecasts

BofA Global Research

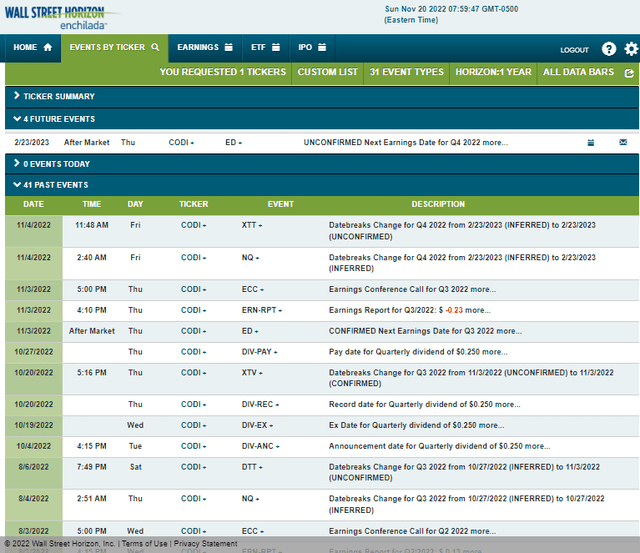

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q4 2022 earnings date of Thursday, February 23, 2023, AMC. The calendar is light aside from the earnings event.

Corporate Event Calendar

Wall Street Horizon

The Technical Take

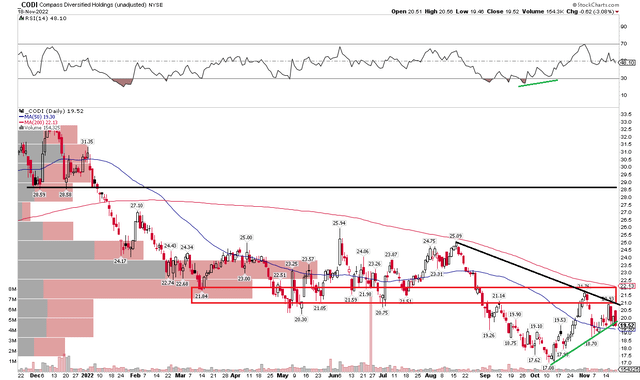

CODI has been a sharp underperformer so far in 2022 while the broader industry is in the black. I see the stock consolidating right now. Notice in the chart below that there is a symmetrical triangle with shares coiling. Unfortunately, a steep selloff last Friday resulted in a bearish marubozu candlestick. CODI closed near the week’s low, implying the potential for near-term downside this week.

Taking a bit of a longer-term view, though, I see resistance in the $21 to $22 zone – notice there is a high supply of shares traded in that range as measured by the volume-by-price indicator on the left. That will be a tough area for the bulls to crack, and it’s made all the more challenging since the falling 200-day moving average comes into play at $22. The stock has failed in two past attempts to rally above that long-term trend indicator. Moreover, there’s further resistance near $28.

A break below $19 would support the case for a retest of the October $17 low, but that is where I see long-term support. So it’s a buy-the-dip play.

CODI: Shares Consolidating Below Resistance, Bearish Near-Term Risks

Stockcharts.com

The Bottom Line

I like Compass’ growth outlook coupled with a valuation that looks to turn attractive very soon. The chart has work to do, though. I think it is a buy for long-term, yield-focused investors. Short-term traders should wait and see how the current consolidation pattern resolves.

Be the first to comment