Grafissimo

Company/Opportunity Overview

I have been focusing on ADRs in Brazil in key sectors such as telecom, banking, and consumer goods. Companhia Energética de Minas Gerais (NYSE:CIG), commonly referred to as Cemig, is an interesting Brazilian ADR to consider. Cemig is involved in the generation, distribution, transmission, and sale of electricity in Brazil.

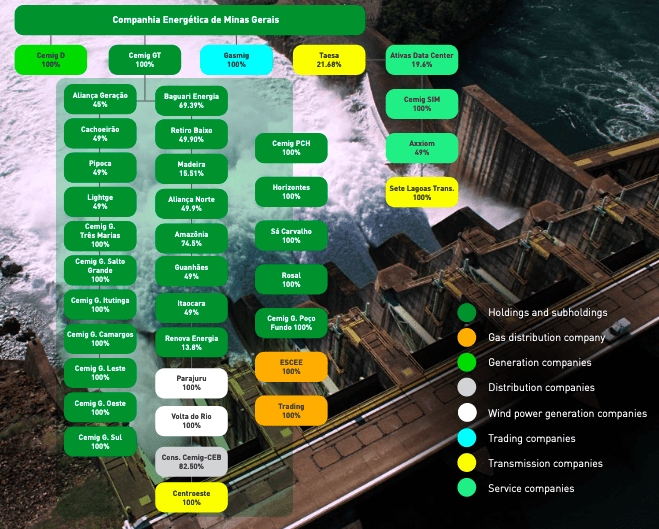

Cemig provides energy to multiple municipalities in Brazil and has been operating since 1952. Cemig operates in multiple areas and is present in 26 states in Brazil. The company currently has an 18% market share in Brazil. The company operates through a variety of holding and sub-holding companies, and primarily focuses on renewable energy.

Cimeg Annual Report

Cemig operates in the following segments:

-

Generation: Cemig has stakes in 83 generation projects in 10 states in Brazil. Most of these are hydroelectric projects

-

Transmission: Cemig operates a transmission grid of around 10,000kms

-

Distribution: The company is the largest electricity distribution company in Brazil, and serves 96% of the state of Minas Gerais, and 42.9% of all residential consumers

-

Commercialization: Largest energy trader in Brazil

-

Natural gas distributor

Research Gate

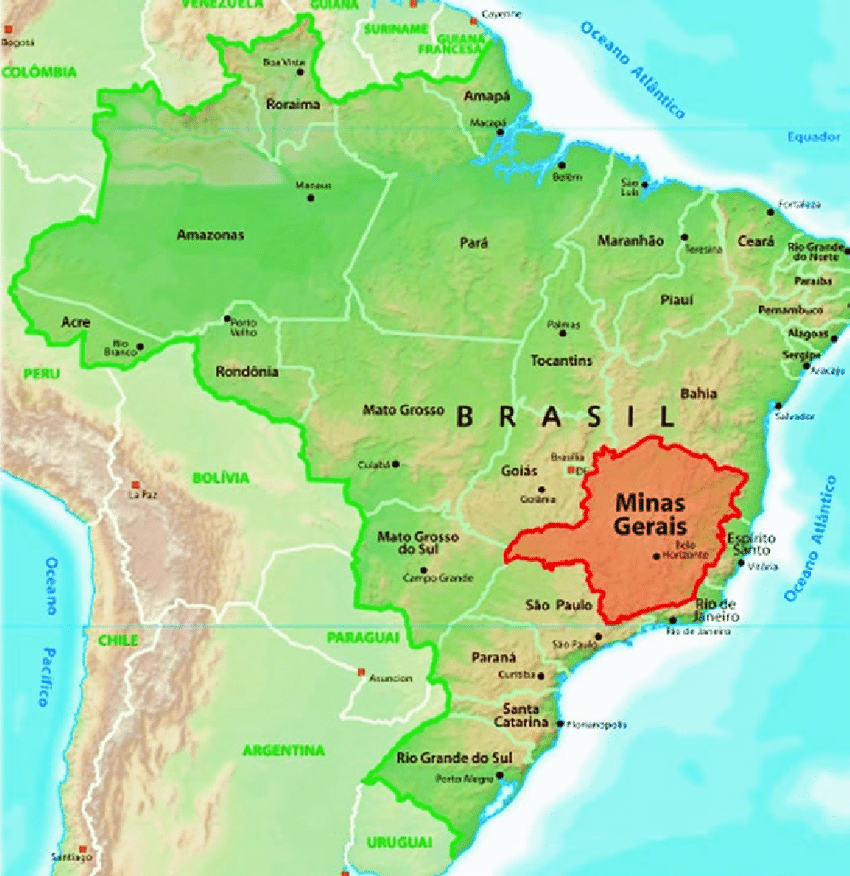

The company is highly active in Brazil and serves almost all consumers in the state of Minas Gerais. 10.1% of Brazil’s population lives in Minas Gerais, and the state is responsible for 8.7% of Brazil’s GDP.

This is an interesting value stock to monitor, but there are still multiple risks approaching this year, most of which will be very hard to predict. Some of these include the following:

-

Brazil’s energy mix is not very diversified and it is pushing heavily for renewables. Nuclear energy and natural gas still make up a small % of the mix.

-

This company is a state-owned, but news has been circulating about potential privatization. However, nothing has materialized, so investors have to count on the risks associated with investing in a state-owned company.

-

Emerging market equities in general are risky because of sovereign debt issues, rising inflation, slower growth, and increased yields as developed countries raise rates.

-

Elections in Brazil will be held on the 2nd of October.

-

Financial results were acceptable, but there are other higher-growth stocks out there. Furthermore, companies like this are much harder to analyze because of the large number of subsidiaries, and this could deter some investors.

Some of these four events could result in lower valuation. Furthermore, if Brazil or global markets experience further risks this stock could witness a significant pullback.

Brazil and Energy: Need for Diversification

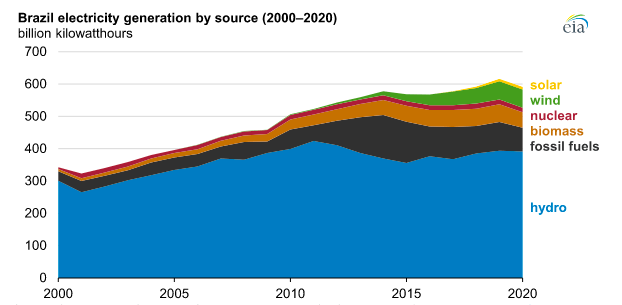

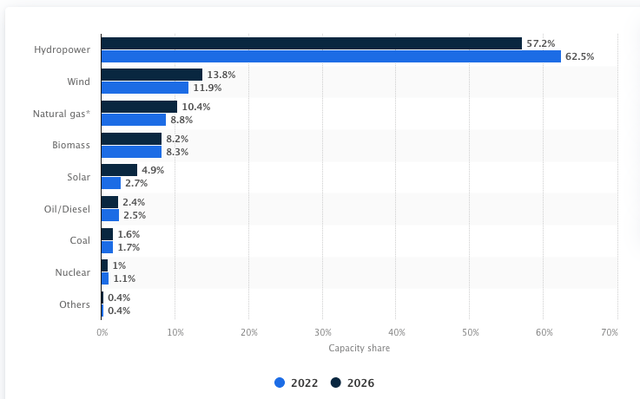

Hydropower has been the country’s main energy source for decades. Hydropower accounted for around 66% of Brazil’s total electricity generation in 2020, and Cemig focuses almost exclusively on renewable energy. Hydropower used to generate around 80% of electricity, but Brazil made a move to diversify after droughts in the country caused issues.

EIA

Meanwhile, other sources such as wind and solar (14.6%), biomass (8.3%), natural gas (8.8%), nuclear power (1.1%), oil (2.5%), and coal (1.7%) make up a smaller percentage of the total energy mix. Nuclear energy is a part of Brazil’s energy diversification plan, as it only has one plant but is moving to add more in the future. As of 2022, Brazil still relied heavily on hydropower for electricity generation and does not plan to significantly diversify away from this.

Brazil’s overreliance on hydropower makes it vulnerable to risks that occur due to droughts. Furthermore, the distance between most of Brazil’s hydropower capacity is located far away from demand centers. In the past, Brazil has had to rely on other countries, such as Argentina, during dry seasons.

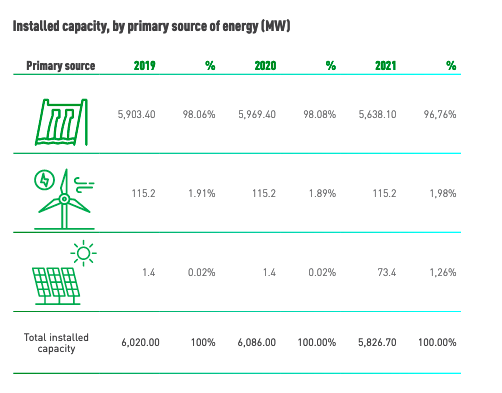

Cemig focuses primarily on hydropower but does operate in other renewable segments.

Cimeg

If you look at the 5-10 year performance, it is clear that Cemig’s share price was not extremely impacted by the performance of hydropower in Brazil, and that the decline in the stock price was also driven by macroeconomic factors and the decline in emerging market sentiment in general. Furthermore, the company’s operations and very diversified and safe. The company’s share price is actually up 26% in the past year, compared to the 10% decline of the iShares MSCI Brazil Capped ETF (EWZ). Accordingly, I have grouped this stock with other safe stocks such as Vivo Group (VIV), as these stocks may experience smaller drawdowns and larger gains relative to other sectors such as banking.

Potential for privatization

Companies that provide activities classified as public services in Brazil tend to be state-owned. However, potential privatization could be a major catalyst for the stock price, and a pretext for a higher valuation. The company brought in a new CEO in early 2020, and this CEO said that he would be interested in potentially privatizing Cemig. It could be very easy for a strategic investor to take advantage of this situation, especially since ESG/renewable energy is becoming very popular.

The government currently owns 51% of the company’s shares. The governor of Brazil’s Minas Gerais State also said it was his goal to privatize this company by the end of 2022. This is a very significant event to monitor, but should not be a significant part of the investment thesis, as delays are common.

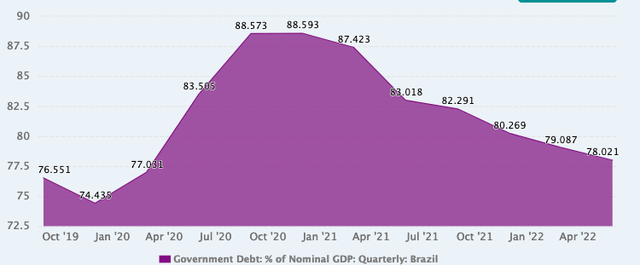

The debt level of Brazil can also be used as a factor to consider when assessing the likelihood of privatization in general. Brazil’s Public Debt recently reached 79.1% during Q1 2022, recovering slightly from the peak of late 2021. Higher debt levels often serve as a pretext for more rapid privatization.

This event will be difficult to predict, as privatization in emerging market economies is often delayed, even when the privatization could help reduce the country’s public debt. However, the rise in public debt in multiple emerging economies since 2020 has been a common trend, and many of these countries are struggling due to the large % of government revenue spent on interest payments. If possible, many countries prefer to wait for more bullish sentiment in the equity markets before kicking off privatization, so it is difficult to say what will happen. Although SOEs are often notorious in many emerging markets, Cemig is well run, profitable, and has a strong industry standing. However, privatization could help to improve operations if it brings in the right strategic investor, rather than a financial investor.

Recent Performance

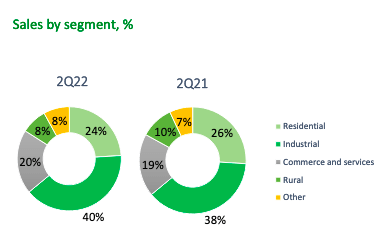

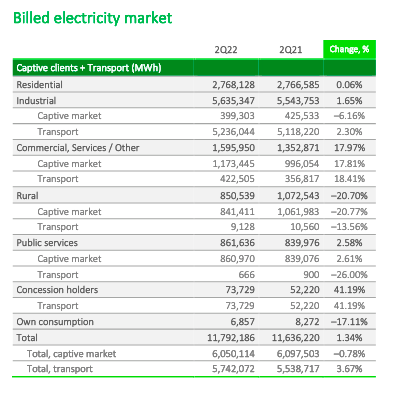

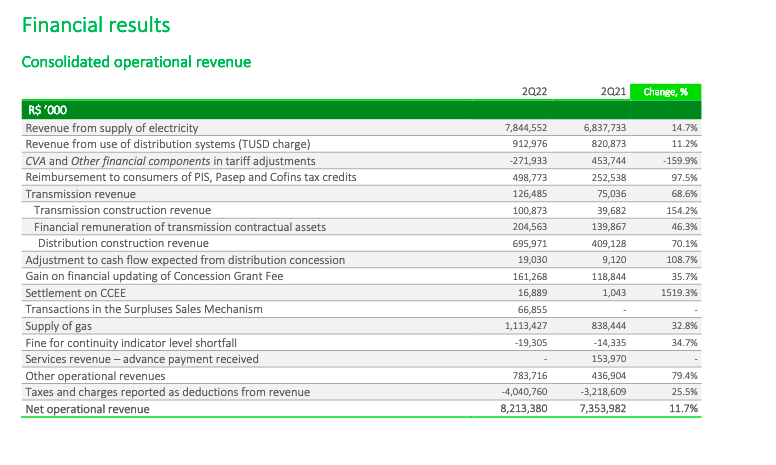

Recent financial results were acceptable, and there is room for growth in multiple segments. During Q2 2022, the company grew its customer base by 1.9%. Rural markets could be drivers of growth in the future, as they currently make up a smaller % of revenue. A study showed that a 1% growth in GDP would generate a 0.475% growth in electricity demand in Brazil.

Cimeg Q2 Presentation

Residential and industrial customers collectively accounted for 64% of its total customer base, while rural consumers only represented 8% of its sales. Cemig’s main strategy in the future could be to focus on rural consumers and to expand geographically.

Cimeg Q2 Report

Its natural gas segment is also becoming a key driver of growth, accounting for 13.5% of revenue during Q2 2022. The company’s subsidiary received the rights to supply natural gas to distribute natural gas in the state of Minas Gerais through 2053.

CIG Annual Report

Geographical Diversification

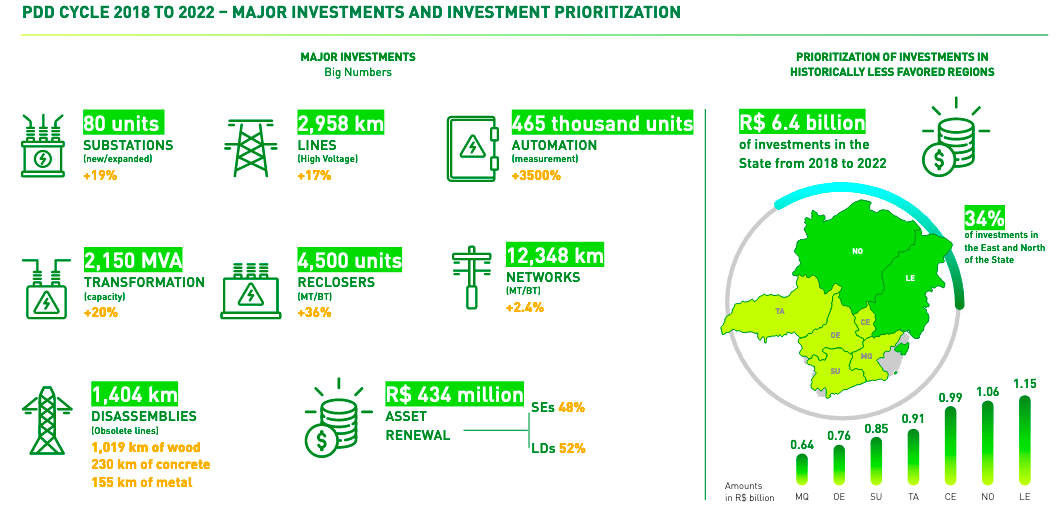

Cemig has also been investing heavily since 2018, and has been focusing on underserved geographical areas. It has chosen to focus 34% of its investments in the Eastern and Northern parts of the state.

Cimeg

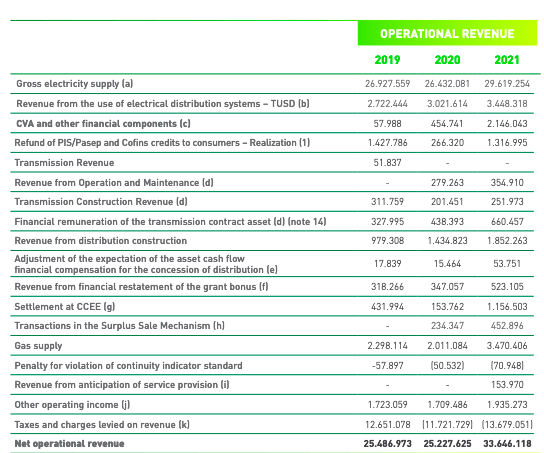

2021 was a very favorable year for the company, and it has been able to deliver consistent growth since 2019. The company’s revenue grew by 32% between 2019 and 2021.

Cimeg Annual Report

Wait and See

I think that the potential privatization could be a major catalyst, although 2022-2023 is one of the worst times to do so in my opinion, as emerging market equities are at a low. Countries that can weather the storm would be better served to wait to do so in an emerging market bull market, if possible. Other frontier and emerging markets have much riskier sovereign debt profiles. If not, I am still not deterred from investing in this company because it is an SOE.

Although I am not a fan of Brazil’s energy mix, this company is a safe bet as it has a strong market share in Brazil. The company’s operations and energy mix may change in the future, and this will be very difficult to monitor/predict. If you look at the 5-year chart, it is also clear to see this stock is not impacted by any of these natural events, and that it experienced relatively weaker drawdowns during emerging market turmoil. Pullbacks for this stock should be weaker relative to other growth stocks, so November-December may not be a bad time to begin initiating a position. However, stocks like Vivo and other Brazilian consumer ADRs are still much safer bets.

Be the first to comment