RiverNorthPhotography

Earnings of Community Trust Bancorp, Inc. (NASDAQ:CTBI) will likely climb next year on the back of commercial loan growth. Further, slight margin expansion amid a rising rate environment will support earnings. Overall, I’m expecting Community Trust Bancorp to report earnings of $4.47 per share for 2022, down 9%, and $4.68 per share for 2023, up 5% year-over-year. Compared to my last report on the company, I’ve increased my earnings estimates mostly because I’ve raised my margin estimates. Next year’s target price is quite close to the current market price. Therefore, I’m downgrading Community Trust Bancorp to a hold rating.

Commercial Loan Growth Outlook Remains Positive

Community Trust Bancorp’s loan growth remained strong in the third quarter at around 2%, or 8% annualized. This growth is higher than what the company has been able to achieve in previous years. Going forward, loan growth will somewhat decelerate due to high-interest rates. Residential loans, which make up around a quarter of total loans, would be most affected by higher borrowing costs.

Community Trust Bancorp also has a large consumer loan portfolio, which makes up around 24% of total loans. The outlook for these loans is also bleak because of declining consumer confidence. The Conference Board’s Consumer Confidence Index dipped by around 2% in November compared to October 2022.

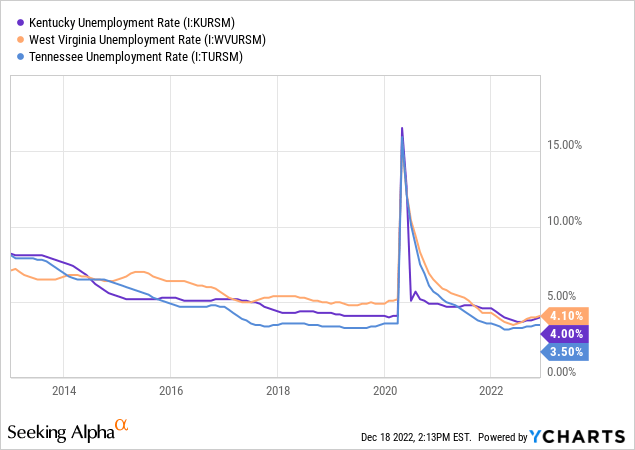

Fortunately, the outlook for commercial loans remains positive thanks to robust local job markets. Community Trust mostly operates in Kentucky with some presence in southern West Virginia and northeastern Tennessee. As seen below, the unemployment rates for all three states have remained quite low throughout this year compared to the last ten years.

Considering these factors, I’m expecting the loan portfolio to grow by 1% in the last quarter of 2022, taking full-year loan growth to 7.6%. For 2023, I’m expecting the portfolio to grow by 4.1%. Meanwhile, I’m expecting deposits to grow in line with loans. However, the growth of securities will likely trail loan growth as rising interest rates will decrease the market value of securities. Further, the reduction in the market value of securities will lead to unrealized mark-to-market losses, which will erode the equity book value. The following table shows my balance sheet estimates.

| Financial Position | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net Loans | 3,173 | 3,214 | 3,506 | 3,367 | 3,622 | 3,769 |

| Growth of Net Loans | 2.8% | 1.3% | 9.1% | (4.0)% | 7.6% | 4.1% |

| Other Earning Assets | 679 | 810 | 1,307 | 1,726 | 1,508 | 1,539 |

| Deposits | 3,306 | 3,406 | 4,016 | 4,344 | 4,580 | 4,766 |

| Borrowings and Sub-Debt | 294 | 308 | 429 | 331 | 303 | 309 |

| Common equity | 564 | 615 | 655 | 698 | 585 | 617 |

| Book Value Per Share ($) | 31.9 | 34.7 | 36.9 | 39.2 | 32.8 | 34.5 |

| Tangible BVPS ($) | 28.2 | 31.0 | 33.2 | 35.5 | 29.1 | 30.9 |

| Source: SEC Filings, Author’s Estimates (In USD million unless otherwise specified) | ||||||

Revising Upwards the Margin Estimate

Community Trust Bancorp’s net interest margin grew by 16 basis points in the third quarter, which beat my expectations. The company has slightly improved its deposit mix over the first nine months of the year. Non-interest-bearing deposits were up to 32.7% by the end of September from 30.6% at the end of December 2021. This improvement will make the average deposit cost stickier than before. The loan mix hasn’t improved in recent quarters, but it was already at a feasible position. Variable-rate loans make up a majority of total loans at around 67%, as mentioned in the earnings presentation.

The management’s simulation model shows that a 200-basis points upward shock to the yield curve can raise the net interest income by 3.83% over one year and 6.30% over two years, as mentioned in the 10-Q filing.

Considering these factors, I’m expecting the margin to increase by ten basis points in the last quarter of 2022 and a further ten basis points in 2023. Compared to my last report on Community Trust Bancorp, I’ve raised my margin estimate partly because of the third quarter’s performance. Further, the Federal Reserve has already increased the fed funds rate to a greater level than I previously anticipated.

Expecting Earnings to Grow by 5% Next Year

The anticipated loan growth will be the biggest driver for earnings next year. Further, the bottom line will receive support from slight margin expansion. On the other hand, inflation-driven growth in non-interest expenses will restrict earnings growth. I’m expecting the efficiency ratio (calculated as operating expenses divided by total revenues) to worsen to 54.5% in 2023 from an average of 53.9% in the first nine months of 2022.

Meanwhile, I’m expecting provisioning for loan losses to remain at normal levels. Nonperforming loans were 0.38% of total loans at the end of September 2022, while allowances were 1.22% of total loans. This coverage seems satisfactory to me considering the high-inflation environment and the threats of a recession. Overall, I’m expecting the net provision expense to make up 0.21% of total loans in 2023, which is close to the average from 2017 to 2019.

Considering these factors, I’m expecting the company to report earnings of $4.47 per share for 2022, down 9% year-over-year, and $4.68 per share for 2023, up 5% year-over-year. The following table shows my income statement estimates.

| Income Statement | FY18 | FY19 | FY20 | FY21 | FY22E | FY23E |

| Net interest income | 142 | 145 | 151 | 163 | 169 | 189 |

| Provision for loan losses | 6 | 5 | 16 | (6) | 5 | 8 |

| Non-interest income | 52 | 50 | 55 | 60 | 59 | 59 |

| Non-interest expense | 117 | 118 | 119 | 119 | 123 | 135 |

| Net income – Common Sh. | 59 | 65 | 60 | 88 | 80 | 84 |

| EPS – Diluted ($) | 3.35 | 3.64 | 3.35 | 4.94 | 4.47 | 4.68 |

| Source: SEC Filings, Earnings Releases, Author’s Estimates (In USD million unless otherwise specified) | ||||||

In my last report on Community Trust Bancorp, I estimated earnings of $4.41 per share for 2022 and $4.44 per share for 2023. I’ve increased my earnings estimate mostly because I’ve raised my margin estimates.

My estimates are based on certain macroeconomic assumptions that may not come to pass. Therefore, actual earnings can differ materially from my estimates.

Downgrading to a Hold Rating

Community Trust Bancorp has been increasing its dividend annually in the third quarter for more than a decade. Based on my earnings outlook, I’m expecting Community Trust to increase its dividend by $0.02 per share in the third quarter of 2023, leading to a full-year dividend of $1.80 per share. My earnings and dividend estimates suggest a payout ratio of 38.5% for 2023, which is close to the last five-year average of 40.8%. The dividend estimate suggests a forward dividend yield of 4.0%.

I’m using the historical price-to-tangible book (“P/TB”) and price-to-earnings (“P/E”) multiples to value Community Trust Bancorp. The stock has traded at an average P/TB ratio of 1.32 in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| T. Book Value per Share ($) | 28.2 | 31.0 | 33.2 | 35.5 | ||

| Average Market Price ($) | 47.3 | 42.1 | 34.4 | 42.3 | ||

| Historical P/TB | 1.68x | 1.36x | 1.04x | 1.19x | 1.32x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/TB multiple with the forecast tangible book value per share of $30.9 gives a target price of $40.6 for the end of 2023. This price target implies a 9.3% downside from the December 16 closing price. The following table shows the sensitivity of the target price to the P/TB ratio.

| P/TB Multiple | 1.12x | 1.22x | 1.32x | 1.42x | 1.52x |

| TBVPS – Dec 2023 ($) | 30.9 | 30.9 | 30.9 | 30.9 | 30.9 |

| Target Price ($) | 34.5 | 37.5 | 40.6 | 43.7 | 46.8 |

| Market Price ($) | 44.8 | 44.8 | 44.8 | 44.8 | 44.8 |

| Upside/(Downside) | (23.1)% | (16.2)% | (9.3)% | (2.4)% | 4.5% |

| Source: Author’s Estimates |

The stock has traded at an average P/E ratio of around 11.1x in the past, as shown below.

| FY18 | FY19 | FY20 | FY21 | Average | ||

| Earnings per Share ($) | 3.35 | 3.64 | 3.35 | 4.94 | ||

| Average Market Price ($) | 47.3 | 42.1 | 34.4 | 42.3 | ||

| Historical P/E | 14.1x | 11.6x | 10.3x | 8.6x | 11.1x | |

| Source: Company Financials, Yahoo Finance, Author’s Estimates | ||||||

Multiplying the average P/E multiple with the forecast earnings per share of $4.68 gives a target price of $52.1 for the end of 2023. This price target implies a 16.3% upside from the December 16 closing price. The following table shows the sensitivity of the target price to the P/E ratio.

| P/E Multiple | 9.1x | 10.1x | 11.1x | 12.1x | 13.1x |

| EPS 2023 ($) | 4.68 | 4.68 | 4.68 | 4.68 | 4.68 |

| Target Price ($) | 42.7 | 47.4 | 52.1 | 56.8 | 61.5 |

| Market Price ($) | 44.8 | 44.8 | 44.8 | 44.8 | 44.8 |

| Upside/(Downside) | (4.6)% | 5.9% | 16.3% | 26.8% | 37.2% |

| Source: Author’s Estimates |

Equally weighting the target prices from the two valuation methods gives a combined target price of $46.4, which implies a 3.5% upside from the current market price. Adding the forward dividend yield gives a total expected return of 7.5%.

In my last report on Community Trust Bancorp, I adopted a buy rating with a target price of $46.3 for December 2022. Since the issuance of that report, the stock price has rallied. As per my analysis, Community Trust Bancorp is now offering only a small total expected return. Therefore, I’m downgrading it to a hold rating.

Be the first to comment