andresr

Investment Summary

The quest to identify selective opportunities within healthcare and medical technology universe continues in H2 FY22. As we move to shift up the quality spectrum, bottom-line growth trends are now more important than ever to remain buoyant in the forward looking regime.

With that, we note Community Health Systems, Inc. (NYSE:CYH) exhibits a number of potential headwinds whilst continuing its erosion of operating value on a quarterly basis. With little flesh to put on the skeleton here, we rate CYH neutral at a $2.44 per share valuation until evidence presents to re-rate to the upside.

Exhibit 1. CYH 6-month price action = bearish

Data: Refinitiv Eikon

Q2 earnings show major slowdown

It was more than a challenging year for the company, and CEO Tim Hingtgen’s opening remarks from the earnings call spell out the tone for the rest of the presentation:

The second quarter was challenging in many regards, as we navigated through a particularly complex operating environment, but simply stated, we did not achieve the results we had expected.”

Consolidated revenue came in at ~$2.9 billion, representing a 260bps YoY decline a same store basis, below the national industry average in July of 4.1% YoY. The company also recognized a 210bps YoY decrease in net-revenue per admission, brought on by smaller non-patient revenue from the quarter. Contract labour came in at ~10% of the total labour cost to $150 million, up from $50 million in Q2 FY21, although, was down ~300bps on previous quarter. However, pre-pandemic contract labour was just 2%, so it has a way to go in bringing it back to range. Helping the cause, is that CYH’s nursing retention rate, it is still lower than pre-Covid. In other words, nursing staff turnover has increased above pre-pandemic, despite management slashing staff turnover by ~50% in the quarter.

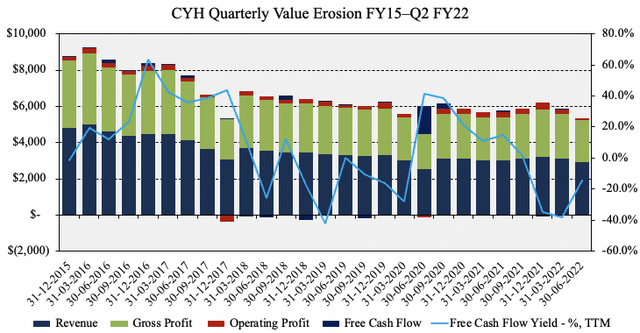

Non-GAAP EBITDA came in to $253 million, with ~$8 million of Covid-relief funds ($0.06/share). EBITDA margins tightened to 8.4%. Moving down the P&L, labour expenses – costs, and contract labour expense – continued to spike in Q2 FY22. Average hourly rate per-employee gained 8.5% YoY, although was down ~40bps sequentially. Management expects labour inflation to remain flat for the remainder of H2 FY22. As seen in Exhibit 2, investors have realized an ongoing pattern of quarterly value erosion from top-bottom. In particular, operating income and FCF have narrowed over the past few quarters, whilst investors currently realize a negative 14% yield on these cash flows.

Exhibit 2. Incremental erosion of operating value over the past 7-years to date on a quarterly basis

Data: HB Insights, CYH SEC Filings

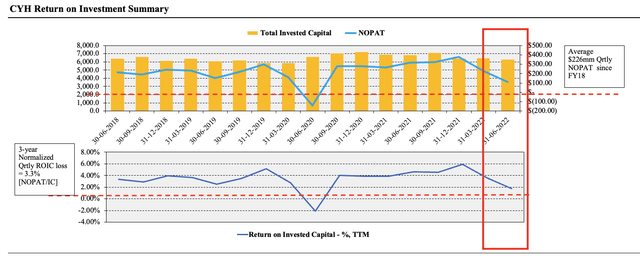

Capital expenditures (“CAPEX”) also decreased 9% YoY to $191 million, down from $212 million in Q2 FY21. The return on CYH’s invested capital has dwindled on a quarterly basis and came in at 1.76% last quarter. As seen in Exhibit 3, ROIC has pushed lower in the last 2 quarters as well, below 3-year quarterly averages of 3.3% on Q2 FY22 NOPAT of $111. Quarterly NOPAT conversion normalizes to $226 million over this time hence this was a below-average result as well. Moreover, CYH’s WACC is 7.4%, and the annualized ROIC of ~7.04% fails to meet this level. We need to see further uplift in ROIC to justify the investment case for CYH.

Exhibit 3. CYH’s return on investment has curled down since Q4 FY21

Data: HB Insights, CYH SEC Filings

Meanwhile, management was able to upgrade guidance for the full year. It now expects net operating revenues to be ~$12.2–$12.5 billion, down from previous estimates. It also projects ~$1.4 billion in EBITDA for the year and for this to carry to a net EPS loss of $2.55 at the upper end.

It also forecasts CFFO of ~$500–$600 million – an entire $100 million of variance – whereas CAPEX is tipped to reduce to $400–$450 million. Management notes the downspend in CAPEX stems from the inability to align its growth capital with the current labour market and the obvious economic conditions.

National healthcare and medical provider trends have been normalizing back to pre-pandemic levels, according to the latest Kaufman Hall National Hospital Flash Report from July 2022. Per the data, outpatient volumes spiked in June alongside operating room minutes with a 2.4% gain from June. Despite this, operating room minutes are down ~480bps YoY. Meanwhile operating EBITDA margins have narrowed by ~30% YoY, up to 46% when excluding CARES. Discharges also increased MoM and were flat YoY. With these in mind, pressures remain on margins further downstream, and will be integral to see a lift by FY22’s end.

Valuation

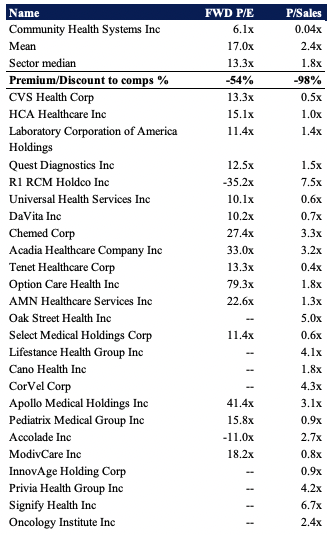

Shares are trading at a deep discount to peers across multiples used in this analysis. As seen below, CYH trades at a 54% discount to the GICS Industry median on 6.1x forward P/E. The discount suggests the market/analysts are expecting a below-industry performance from the company next year. Meanwhile, shares are priced at 0.4x sales, although, with the below-market net operating growth outlined above, there’s a chance this is more than justified.

Exhibit 4. Multiples and comps

Data: HB Insights,

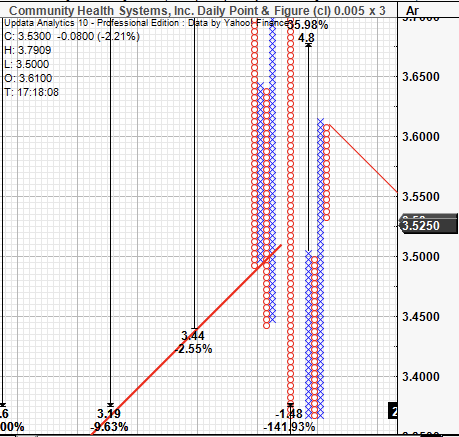

Using point and figure charts for an unambiguous measure of price action, we see there is upside support to $4.80 however there are downside targets clustered down towards $1.48 per share. At 6.1x FY23 EPS estimates of $0.71 this prices the stock at $1.05. The arithmetic mean of these figures is $2.44 and this is where we see CYH comfortably priced at this point.

Exhibit 5. Price action looks bearish with downside targets clustered to $1.48

Data: Updata

In short

After another lacklustre quarterly performance, CYH remains neutral on our ratings system. Headwinds appear to remain on the horizon and the macro landscape continues to squeeze labour costs and staff turnover. Not to mention, the ever-looming threat of a COVID-19 resurgence.

Despite its profitability, there are too many unanswered questions in this investment debate. This is, however, a contrarian’s dream as management remains committed to turning the picture around. Nevertheless, we price CYH at $2.44 and foresee many challenges ahead for the company. Rate neutral.

Be the first to comment