shutter_m/iStock via Getty Images

By Jim Wiederhold

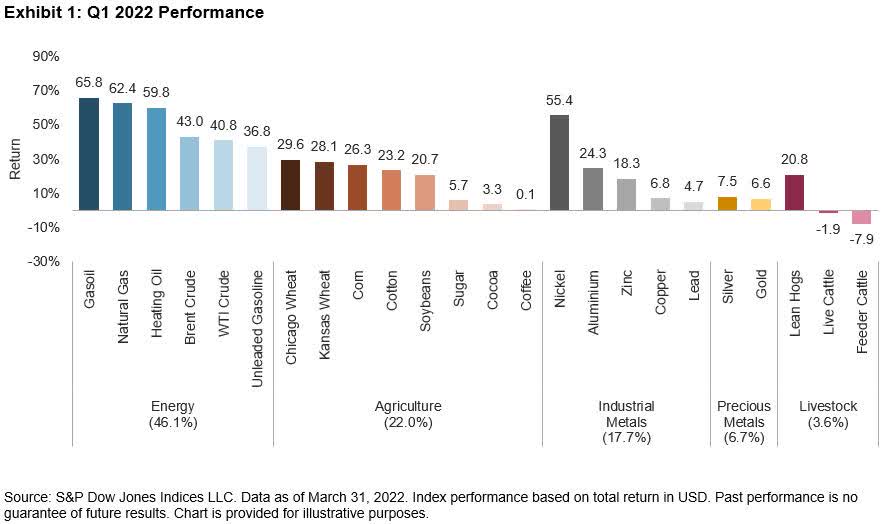

The S&P GSCI posted its best quarterly return in decades, as inflation continued to post the highest readings in decades. Commodities rose another 9.63% in March after an 8.8% rise in February. Geopolitical conflict and inflation were the two main reasons for the broad-based uptick in commodities prices (see Exhibit 1).

The S&P GSCI Energy continued to lead the way last month, up 12.47% in March. The uncertain supply situation from Russia, the world’s largest natural gas exporter and third largest oil exporter, led the U.S. to release a record amount of emergency oil from the Strategic Petroleum Reserve. Germany, highly dependent on Russian energy, initiated an emergency plan that could lead to energy rationing.

The S&P GSCI Agriculture rose 6.15%, as cotton and sugar rose by double digits, while coffee and soybeans dipped negative. The S&P GSCI Corn rose 8.44%, while the S&P GSCI Wheat rose 7.75% in March. Both grains were top exports from Russia and Ukraine but now shipments have been disrupted as the conflict continues and Black Sea ports have been sidelined. Egypt is highly dependent on wheat imports, with 80% coming from that region. Delayed shipments led the country to look to alternative countries such as the U.S. Wheat supplies in the U.S. are at their lowest levels in 14 years.

Within the S&P GSCI Industrial Metals, nickel recorded one of its biggest spikes in the history of the contract. After a wild ride with trading suspended after a massive short squeeze harangued the world’s largest nickel and stainless steel company, the S&P GSCI Nickel finished the month up 31.25%. The S&P GSCI Zinc rose 14.21%, as smelter production stalled and exchange stocks continued to move lower toward 15-year lows.

While all this volatility occurred in other sectors, the S&P GSCI Precious Metals quietly rose 2.70% due to its safe-haven status and a somewhat more cautious U.S. Fed tightening expectations caused tailwinds.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI please visit www.spdji.com. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment