RobsonPL/iStock Editorial via Getty Images

The SA readers that follow us will know that we have a good grip and understanding of banks. In our previous European Banks champion picks, we highlighted Crédit Agricole as one of our favorite banks in the continental area. Crédit Agricole S.A. (OTCPK:CRARF) engages in retail, corporate, insurance, and investment banking products and services worldwide with a particular focus in France and in Italy. The French bank operates its activities thanks to five divisions: Asset Gathering, French Retail Banking, International Retail Banking, Specialized Financial Services and Large Customers.

When we are looking at commercial banking, we used to evaluate them by looking at the following characteristics:

- We usually prefer retail-oriented businesses with a leading market position in their key markets.

- We looked at banks with solid fundamentals with attention to metrics such as the cost/income that measures a bank’s business efficiency. This is very crucial as street banking is a commoditized business.

- As dividend investors, we are looking for sustainable dividend yield and a strong focus on shareholder remuneration.

- We looked at the integrated bank-insurance-asset management businesses. This is mainly due to increased efficiency and has better cross-selling opportunities.

- We usually assess banks with superior CET1 above their peers to navigate uncertain times.

Latest Announcement

Thinking about points 1) and 2), we were not surprised to read in the news that Crédit Agricole S.A. has acquired on the market a 9.18% equity stake in Banco BPM S.p.A (OTC:BNCZF).

The Italian banking risk reopens with a surprise move. Almost two months after Unicredit’s aborted takeover bid, Banco BPM is again at the centre of big manoeuvres. The share in the Italian bank at current stock market values, is worth approximately €377 million. Looking at the details we see that:

- The French institute has not applied for the regulatory authority to surpass the 10% threshold in Banco BPM’s share capital;

- The transaction is not expected to have a significant impact on its CET1 ratio;

- Businesswise, the transaction will consolidate the group’s strategic and long-term relationship with the Italian bank. They are already involved in a consumer credit partnership through the Agos joint venture.

- Crédit Agricole will aim to expand the scope of strategic partnerships with Banco BPM in areas where it’s is already present (especially in Liguria where they have been growing organically and inorganically).

Conclusion

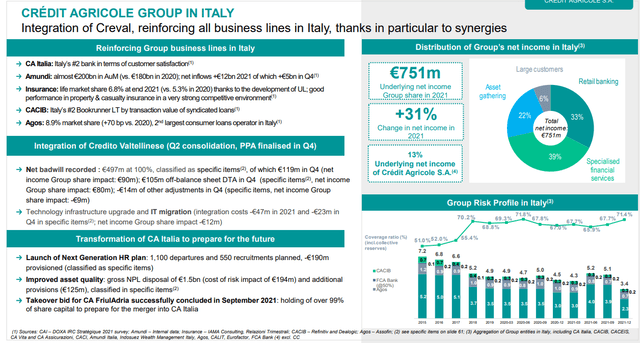

Crédit Agricole Group in Italy has 5.2 million active customers and over 17,500 employees. The bank has always been very attentive to M&A opportunities, just recently they rescued the three banks of Cesena, Rimini and San Miniato, moving successfully with CREVAL’s takeover and there are rumors of interest in the Ligurian regional bank called Carige. However, the move does not appear hostile at all. On the contrary, the tones used by Credit Agricole in the press release are quite friendly. Strategic M&A on a commoditized business will be a future key to success. We valued Crédit Agricole based on a return on tangible equity at 11% arriving at a €13 per share valuation versus the €10 per share at the time of writing.

Latest coverage for banks & diversified financials:

- Euronext: A Nice Play Link To The VIX

- London Stock Exchange Group: We See The Upside

- Erste Group Bank: Analysis On Eastern EU Exposure

- BNP Paribas: Everything Fully Priced In

- Credit Suisse: Valuation Is Less Important Than Earnings

- UniCredit: A Pass Again (For Now)

- Raiffeisen Bank International: Too Much Russian Exposure, Still Safe

Be the first to comment