niphon

Investment Thesis

Comfort Systems USA, Inc (NYSE:FIX) reported good results in the third quarter of 2022. The end markets in which the company operates are still healthy and the company saw strong demand across both segments. This resulted in a healthy backlog of $3.25 billion at the end of the third quarter. Furthermore, the company’s M&A strategy under its strategic growth plan is also contributing to a higher backlog. These healthy market conditions and strong backlog should help the company deliver good revenue growth in the coming year. In addition, moderating inflation and easing supply chain issues should also help in gross margin recovery. However, the company’s valuation is expensive and growth prospects seem to be already reflected in its stock price at the current valuation. While I am optimistic about the future growth outlook of the company, its valuation keeps me on the sidelines. Hence, I have a neutral rating on the stock.

Last Quarter Earnings

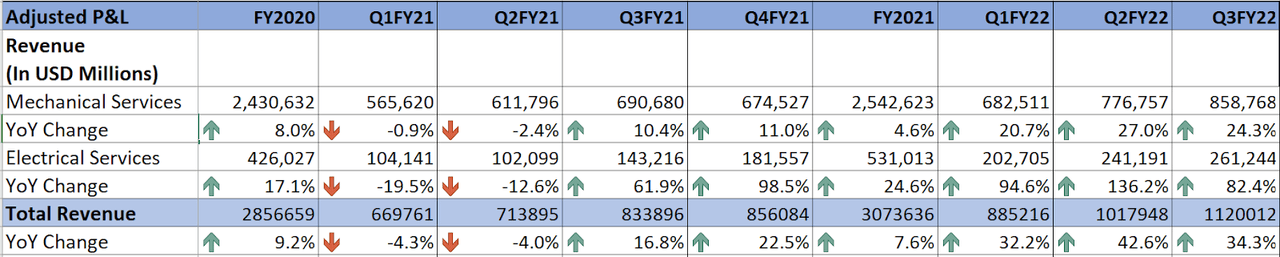

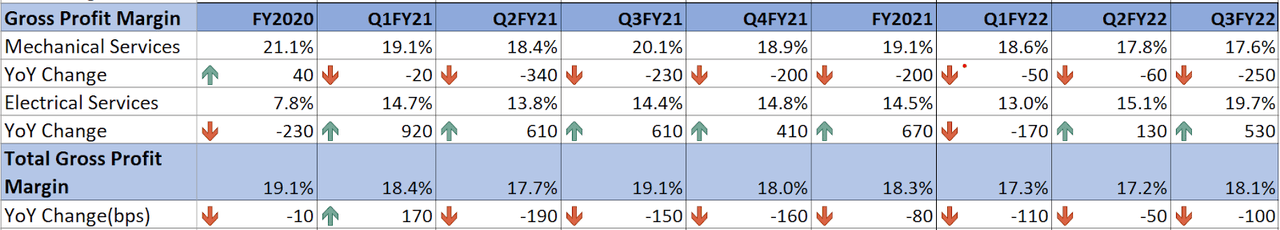

Comfort Systems reported better-than-expected results for the third quarter of 2022. Net revenue for the quarter was $1.12 billion, up 34.3% Y/Y and beating the consensus estimate of $1.05 billion. EPS was $1.71, up 34.6% from the year-ago quarter and above the consensus estimate of $1.37. The company’s gross margin decreased by 100 basis points (bps) to 18.1%. Adjusted EBITDA grew 22.8% Y/Y to $101 million, while the EBITDA margin at 9.0% represents a decrease of 90 basis points (bps) Y/Y. Revenue growth was driven by higher demand across all segments, strong backlog execution, and same-store revenue growth of 23%. Higher volume generation as a result of good same-store growth contributed to the increase in adjusted EBITDA and EPS. The decrease in margins was due to the pass-through of inflated material and equipment costs and the shift in the project mix.

Revenue Analysis and Outlook

In the third quarter of 2022, Comfort System’s revenue totaled $1.12 billion reflecting an increase of 34.3% from the year-ago quarter. Revenue on a same-store basis grew by 23% Y/Y or $198 million. In addition to strong market conditions and strong backlog execution, the good revenue growth was due to an increase in the cost of materials and equipment due to inflation that was passed through to the customers. In the Mechanical Service segment, revenue increased by 24.3% Y/Y to $858.8 million. The increase was attributed to healthy demand in the industrial sector and increased activity in North Carolina and Florida operations. In the Electrical Segment, revenue totaled $261.2 million reflecting a Y/Y increase of 82.4%. The increase was due to an improved business mix in the segment and strong demand in the Texas region.

FIX’s Historic Revenue (Company Data, GS Analytics)

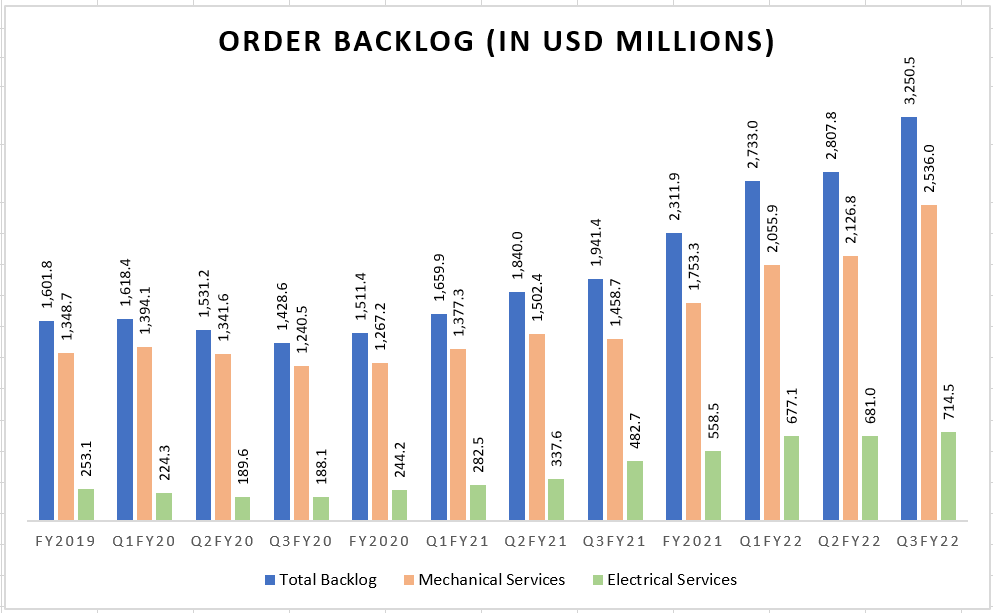

Backlog, an indicator of future revenue growth, also grew at healthy levels in the third quarter. The total backlog increased by 67.4% Y/Y to $3.25 billion. The increase in the backlog reflected a $1.10 billion or 57% Y/Y increase in the same-store backlog. In the Mechanical Service segment, the backlog increased by 73.8% Y/Y to $2.5 billion, while in the Electrical Service segment the backlog increased by 48% Y/Y to $714.5 million. The increase in the backlog was attributed to a healthy demand environment across all end markets. In addition to the healthy demand, the increase in the backlog was also a result of higher project commitments by the customers as they were signing in contracts earlier in order to allow for long lead times from manufacturers.

Moreover, the company’s recent acquisitions under its growth strategy also contributed to revenue and backlog growth. The growth strategy is focused on achieving higher margins and improved productivity through technological innovations and expanding market share by acquiring businesses having a strong workforce, leading design, and desirable market locations. The company’s acquisition of Ivey, MEP holding, and Atlantic gave a boost to the backlog by $207.7 million in total.

FIX’s Order Backlog (Company Data, GS Analytics)

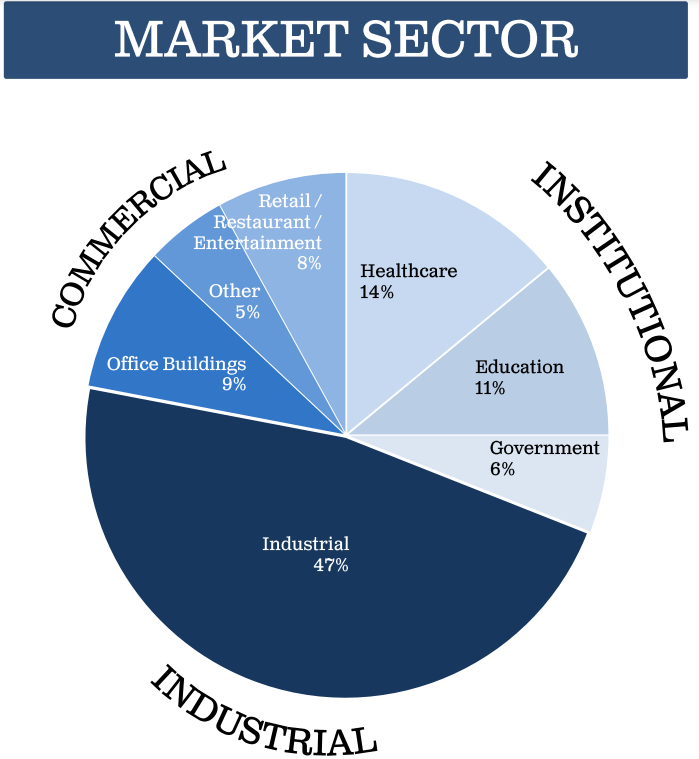

The market in which the company operates continues to remain healthy. The industrial end market which contributes to 47% of the company’s revenue is experiencing an increased level of activity and strong demand from Chip manufacturing and re-shoring activities, particularly in Texas, North Carolina, and Florida. In addition to the Industrial end-market, the Institutional and commercial end markets, which represent 32% and 21% of the company’s revenues, respectively, also remain strong with favorable market conditions as the economy reopens.

FIX End Market Exposure (Q3 2022 Investor Presentation )

Looking forward, I believe the company should be able to grow revenue in 2023. The healthy demand across all the sectors and a strong backlog along with the company’s M&A strategy should help in delivering revenue growth in the coming year. But, as the inflation of material and equipment moderates in the near to medium term, the company’s pass-through cost which accounts for ~50% of the revenue should stabilize. This should result in more normalized levels of revenue growth in 2023 versus the exceptionally strong revenue growth we are seeing in 2022. The current sell-side consensus is modeling 7.74% Y/Y revenue growth in FY23, which I believe is reasonable.

Margin Outlook

In the third quarter, Comfort Systems’ gross margin was 18.1%, reflecting a decline of 100 bps Y/Y. The decline in the gross margin was due to ongoing supply chain challenges and inflationary pressure on the cost of materials and equipment. In the Mechanical Services segment, the gross margin declined by 250 bps Y/Y to 17.1%. The decline was a result of changes in the project mix and higher equipment costs. While the equipment costs are essentially pass-through costs and do not impact the operating profit, an increase in these costs negatively impacts margins as the revenue number in the denominator gets bigger because of them. The gross margins in the Electrical Services segment increased by 530 basis points to 19.7%. This increase reflects higher leverage generated through volume growth. The increase in gross margin also reflects gains from prior job-related litigation which was connected to work completed by the company a few years ago.

FIX’s Historic Gross Margin (Company Data, GS Analytics)

Looking forward, I believe, inflation should moderate which should stabilize the cost of materials and equipment, and reduce the effect of pass-through of inflated costs on margins. In addition to moderating inflation, supply chain challenges should also ease in 2023. This coupled with higher volume generation makes me optimistic about the company’s margin growth prospects.

Valuation and Conclusion

The company is expected to post solid growth in FY23 helped by its good revenue growth and improving margins. According to consensus estimates, the company’s EPS is expected to grow 21.1% Y/Y in 2023. However, these growth prospects seem to be already priced in with the stock currently trading at a P/E of 24.22x 2022 consensus EPS estimates of $5.13 and 20.1x 2023 consensus estimate of $6.16 which are both above its 5-year average historic P/E of 18.1x. Hence, I have a neutral rating on the stock despite good growth prospects.

Be the first to comment