Justin Sullivan

I rated Colgate-Palmolive (NYSE:CL) a buy in my article on October 2021. The stock was trading at $75.90. At that time, the stock looked cheap on a relative basis when it was trading at an EV to EBITDA multiple of 15.8x, while Procter & Gamble (PG) was trading at 17.5x. The stock quickly rose after the article’s publication to a price of $85.34 [near a 52-week high] in December 2021, for a 12.4% gain in three months. I took some profits as consumer staples climbed to their highs at the end of 2021. But today, the company may be overvalued, and it may be best to wait before buying Colgate-Palmolive (CL).

Colgate-Palmolive Benefits From Multiple Expansion

Colgate-Palmolive has benefited from an expansion of its valuation multiple, with investors rushing to the safety of the consumer staples sector. Fast forward to today, the stock is trading at a forward EV to EBITDA multiple of 16.7x, and Procter & Gamble is trading at 16.59x. Last year both companies had similar profit profiles with EBITDA margins of about 23%.

Today, Procter & Gamble has pulled ahead of Colgate-Palmolive with an EBITDA margin of 26.4%. Colgate-Palmolive’s EBITDA margin has deteriorated to 20.2%, a difference of 620 basis points compared to Procter and Gamble (Seeking Alpha/YCharts). Today, Colgate-Palmolive is trading a forward PE of 27x, while even technology giant Alphabet (GOOGL) (GOOG), with immense cash flows and margins, trades at a forward PE of 20x. When I see Colgate-Palmolive at this expensive valuation, I am reminded of a famous quote by Warren Buffett:

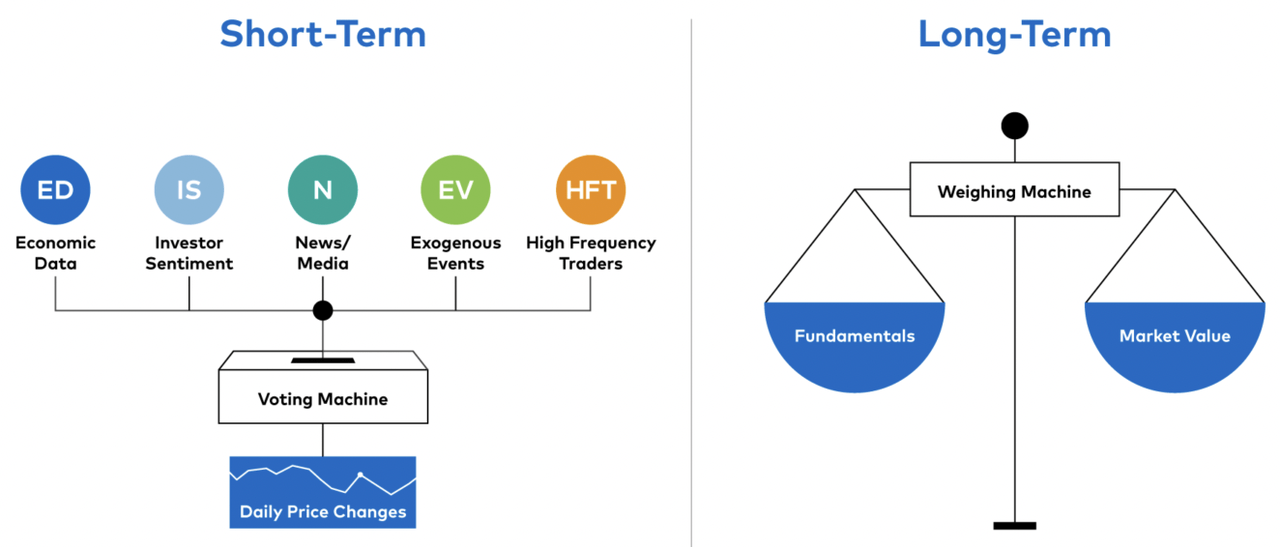

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

In the long-term, a company’s fundamentals decide its market value (Exhibit 1). Colgate-Palmolive is currently richly valued given its low-mid-single digit growth prospects and lack of pricing power.

Exhibit 1: Stock Market is a Weighing Machine in the Long-run

Stock Market is a Weighing Machine in the Long Run (Polen Capital)

Investors taking shelter in the consumer staples sector will look for higher return opportunities in technology and other sectors when the current market volatility and market downturn find a bottom. At that time, companies like Colgate-Palmolive’s valuation will return to earth and would provide a great buying opportunity for long-term investors.

Robust Revenue Growth, But Margins Are Under Pressure

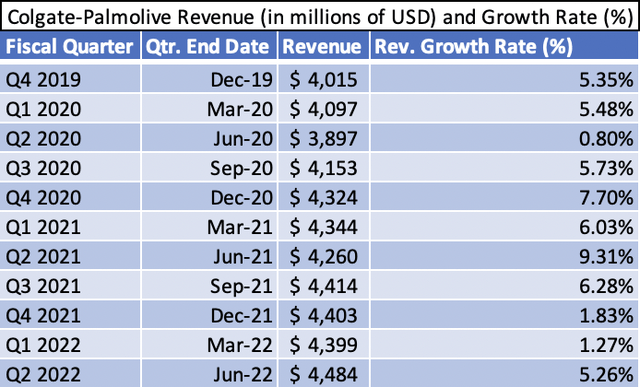

The company has seen high single-digit revenue growth in the past few quarters. Since Q4 2019, the company has increased sales by an average of 5%, with a standard deviation of 2.5% (Exhibit 2).

Exhibit 2: Colgate-Palmolive Revenue & Growth Rate

Colgate-Palmolive Revenue and Growth Rate (Seeking Alpha, Author Compilation)

In Q3 2021, the company saw overall sales grow by 6.5%, but organic sales grew at 4.5%, with a 2% benefit from foreign exchange. The company saw inflation reduce gross margins by 510 and 670 basis points in Q3 and Q4 2021, respectively.

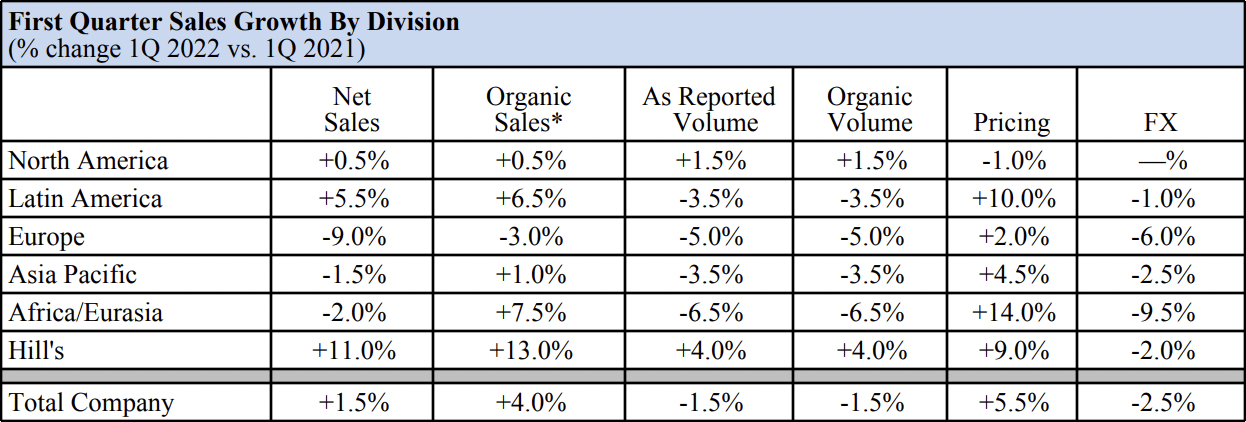

In Q1 2022, the company saw organic sales growth in all its divisions (Exhibit 3) but reported a decline in volume in all but its North America and Hill’s Pet Food divisions.

Exhibit 3: Colgate-Palmolive Q1 2022 Division Sales and Growth Rate

Colgate-Palmolive Q1 2022 Division Sales and Growth Rate (Colgate-Palmolive Q1 2022 Press Release)

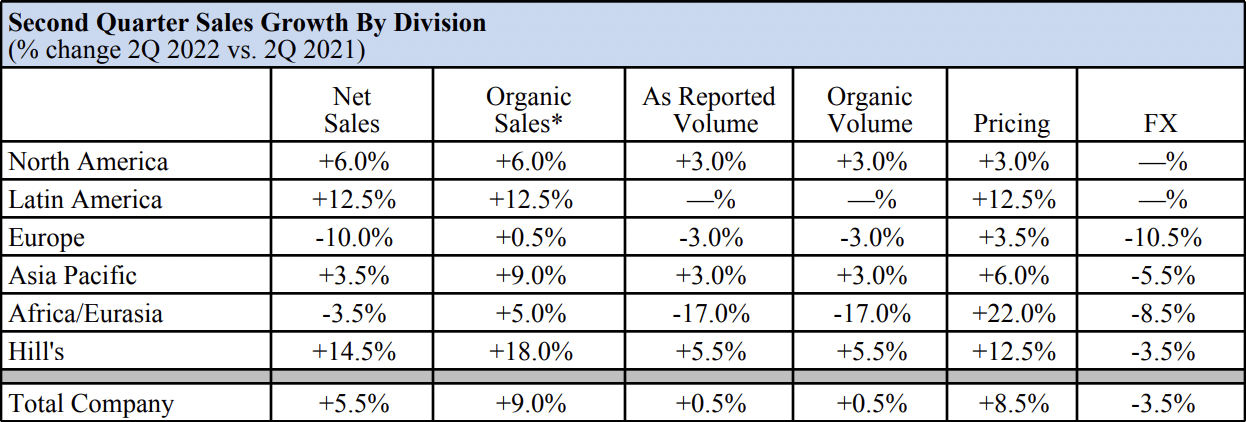

The company’s Q2 2022 produced a mixed bag in organic sales, volume, and pricing growth (Exhibit 4). Europe saw a 10% decline in net sales, with volume down 3% while pricing was up 3.5%. The strength of the U.S. Dollar hurt European sales since foreign exchange had a negative 10.5% impact on sales.

Exhibit 4: Colgate-Palmolive Q2 2022 Division Sales and Growth Rate

Colgate-Palmolive Q2 2022 Division Sales and Growth Rate (Colgate-Palmolive Q2 2022 Press Release)

The company’s margins are now lower than their past average, suggesting that they have not successfully passed the costs of inflation to the customer. Gross margin fell below 60% in Q3 2021 due to inflation. As of Q2 2022, the gross margin stands at 56.9%. That is a substantial pullback in gross margins. But, the company could not increase prices to keep up with inflation.

Exhibit 5: Colgate-Palmolive Gross Margin (%) [Q4 2019 – Q2 2022]

Colgate-Palmolive Gross Margin (%) [Q4 2019 – Q2 2022] (Seeking Alpha, Author Compilation)![Colgate-Palmolive Gross Margin (%) [Q4 2019 - Q2 2022]](https://static.seekingalpha.com/uploads/2022/9/5/28462683-16624260972099216.png)

Asia-Pacific Can Drive Long-term Growth For Colgate-Palmolive

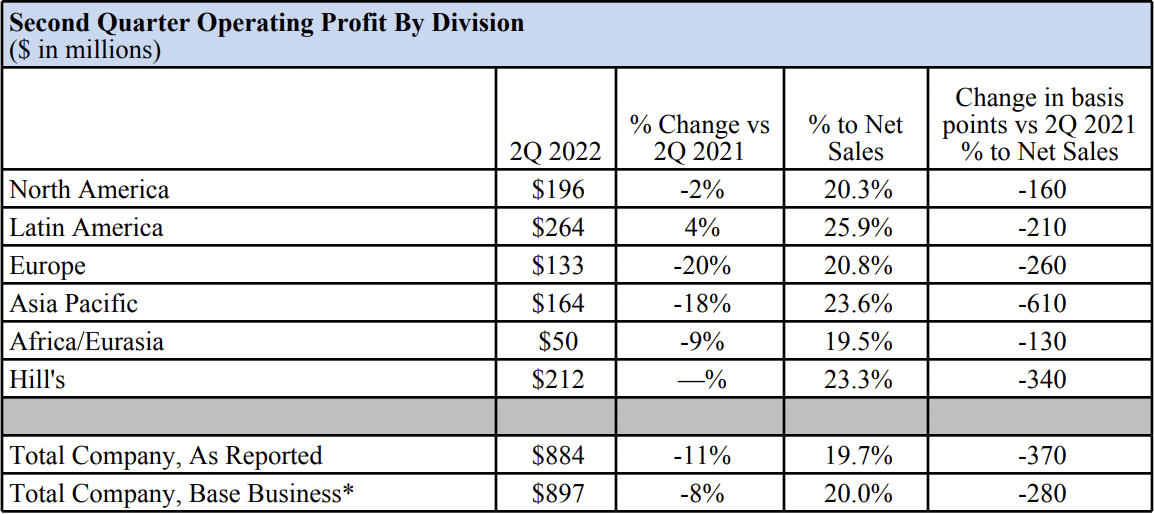

In Q2 2022, the Asia Pacific division would have shown a robust 9% organic sales growth if not for the negative 5.5% impact of the strong dollar. The company has higher profit margins in Latin America and Asia than in North America (Exhibit 6) due to better brand recognition and pricing power in Asia and Latin America than in North America. Influential retailers in North America, such as Costco (COST), Walmart (WMT), and Target (TGT), can prevent price increases. But, in the splintered retail markets of Asia, brands like Colgate-Palmolive likely hold much sway over distribution and pricing.

Exhibit 6: Colgate-Palmolive Operating Profit by Division

Colgate-Palmolive Operating Profit by Division (Colgate-Palmolive Q2 2022 Earnings Press Release)

The company has a long runway of growth in Asia, which currently accounts for 16% of total sales, while North America accounts for 22%. The company has excellent, strong brands that can grow for years in Asia’s fast-growing markets. The long-term future is bright for Colgate-Palmolive. Inflation should ease in the coming quarters, and the dollar’s strength should diminish as other economies catch up to the U.S on interest rates. These two factors could boost profits if economies around the globe stay strong in the coming quarters.

Dividends, Share Buybacks, And Cash Flow

The company’s profitability and operating cash flow margins have deteriorated significantly. Its operating cash flow margins stood at 8.7% and 11.7% in Q1 and Q2 2022. Even after these two quarters, its average operating cash flow margin has stood at 19.2% since Q4 2019. Once the pressure of inflation and the strong dollar eases, the company should be able to increase its operating cash flow margins to about 20%.

The company paid a quarterly dividend of $0.47 for Q2 FY 2022 for a total dividend payout of $436 million. Given its operating cash flow for Q2 2022 of $528 million, the company paid 82% of its operating cash in dividends. The current dividend yield is 2.41% compared to the 1.5% yield offered by the S&P 500 Index. Investors should remember that the risk-free 10-Year US Treasury note yields 3.2%, higher than the yield provided by both Colgate-Palmolive and the S&P 500 Index.

The company has spent another $381 million in share buybacks in Q2 2022 and $3.66 billion in buybacks since Q4 2019. The company has reduced its diluted outstanding shares by just 2%, or 18.6 million, since Q4 2019. The company’s buybacks barely keep up with the dilution caused by executive compensation plans. For instance, at the end of 2021, 28 million options, warrants, and rights were outstanding as part of the executive compensation plan. Investors should expect buybacks to prevent further diluting outstanding shares and nothing more.

Monthly Price Return Correlation With The S&P 500

A medium positive correlation of [0.42] between the monthly returns of Colgate-Palmolive and the Vanguard S&P 500 Index ETF is likely one of the reasons why investors prefer this stock and, in general, the consumer staples sector during times of market downturns. Consumer staples stocks like Colgate-Palmolive are less volatile than the market indexes. According to Yahoo Finance, Colgate-Palmolive has a beta of 0.47 based on five-year monthly returns. A linear regression of the monthly returns from June 2019 to August 2022 of Colgate-Palmolive as the dependent variable and the Vanguard S&P 500 Index ETF as the independent variable yielded a lower beta of 0.34. This low beta suggests that Colgate-Palmolive’s stock will move less than the market. In a market downturn, such as the one we are in now, Colgate-Palmolive can support a portfolio against losses. Colgate-Palmolive has lost just 0.45% in the past year compared to the 13.5% loss in the Vanguard S&P 500 Index ETF.

Conclusion

Investors have sought protection in the consumer staples sector and have pushed up the valuation of Colgate-Palmolive. High inflation and the dollar’s strength are adding to its troubles. Inflation should start easing in the coming quarters, and the dollar may have already peaked. Colgate-Palmolive can continue growing between 3% to 5% annually in the long term and can protect a portfolio against market volatility. The company may be a tad overvalued at this time. I plan on waiting before adding more Colgate-Palmolive to my portfolio.

Be the first to comment