Bet_Noire/iStock via Getty Images

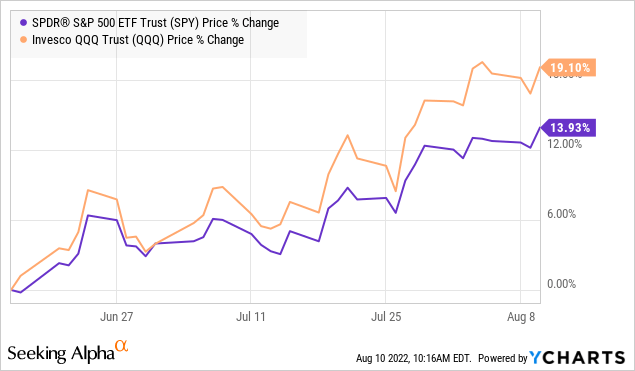

It was a goldilocks July CPI print with the headline rate at 8.5% y/y, down from 9.1% in June, and even below expectations of 8.7%. Every data point in this report came in “cold”, surprising expectations to the downside, including a flat core month-over-month figure which excludes energy and food prices. Stocks are surging with the NASDAQ-100 (QQQ) trading up by more than 1% while the S&P 500 (SPY) is breaking out into a 3-month high, up over 15% from its June low with the bulls back in control.

Investors can slice it any way they want but the setup is very positive for equities and risk assets by putting a lid on one of the biggest headwinds in the market this year being the persistently climbing consumer prices and its implications for monetary policy. Our takeaway here is that we’re past “peak inflation” and the economy has room to improve going forward.

While the recent correction in commodity prices including gasoline over the last several weeks played into the report, the Fed will end up getting some credit as a confirmation its strategy is working. With another rate hike at the September FOMC nearly locked in, what’s more important is that the macro conditions are proving to be resilient. The July payrolls report last week highlighted the underlying momentum in the economy.

Interest rates still have room to climb higher, buts it’s not a problem as the economy benefits from inflation trending lower. In other words, calls for a doom-and-gloom economic collapse or 70s-style stagflation nightmare and stock market crash are simply not playing out.

What Comes Next?

We’ve been bullish on stocks and expect another leg higher. Our biggest insight is that this latest inflation update will likely dominate headlines for the next few weeks with the result being a gradual but sure enough shift in sentiment. There are too many people stuck in extreme pessimism that will have to contend with the reality of the latest data.

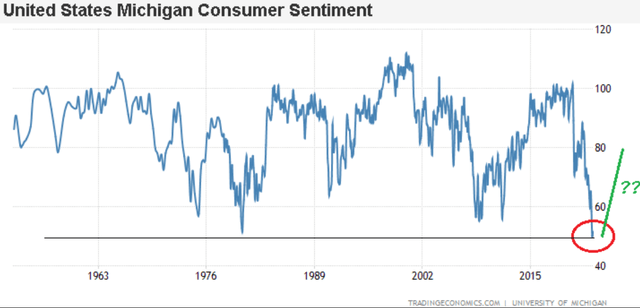

Connecting the dots, we don’t need a crystal ball to expect many of the “leading indicators” to start moving higher. Case in point, the U.S. Michigan Consumer Sentiment Index hit a record low in June amid the ugly inflation data that month. This latest CPI report can mark the start of a new trend higher as the new narrative spreads. Similarly, global PMI indicators should also get a boost with producers seeing some relief in cost pressures. The point here is to say macro conditions have room to improve giving buyers more confidence as a catalyst for the market to continue climbing higher

As it relates to stocks, an environment of inflation cooling off is also a strong signal for corporate earnings. A lot of companies have been tightening their belts to deal with the rising cost, possibly preparing for even higher prices. Through Q3 and into Q4, better-than-expected operating conditions open the door for earnings to surprise to the upside against what have been some low expectations.

We can also look forward to hearing some updated Fed messaging. While the latest inflation data likely isn’t enough to mark a complete pivot away from quantitative tightening to a dovish position, it’s clear the Fed is closer to being at neutral today than where the expectations were just a few weeks ago. Inflation surprising to the downside can roll back the rate hike trajectory into 2023 as another positive for the market and broader financial conditions.

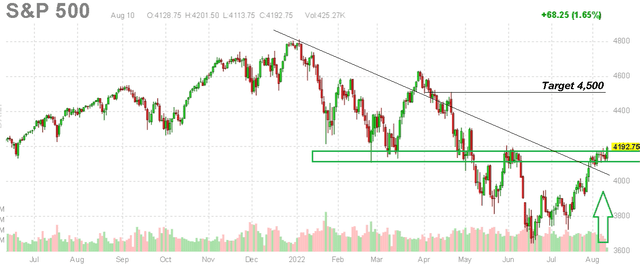

A Breakout In the S&P 500

We’re watching for a technical breakout in the S&P 500 closing in on the all-important 4,200 level. The way we see it, the risks are tilted to the upside and it won’t be a surprise to see some follow-through here based on short covering and the more positive momentum.

While it likely won’t be a straight line higher, our message here is to add exposure to equities with the S&P 500 targeting a move towards 4,500 as our year-end price target. We like growth and tech stocks with the biggest opportunities being in the beaten-down names. An ongoing rotation away from “value” and defensive consumer staples is a positive signal to run with.

Anyone waiting for a re-test of the June lows, nearly 15% away, will need another proverbial shoe to drop marking a major deterioration of the current macro baseline, which we don’t see happening. The bulls have things in their corner, with the VIX currently crashing to a 4-month low, which is evidence of declining volatility which we expect to continue to close out the summer.

Be the first to comment