Leon Neal/Getty Images News

Coinbase (NASDAQ:COIN) enjoyed strong results in 2021, the same year of its IPO, but the stock has turned into a nightmare for investors in the current year.

As the tide went out of the cryptocurrency market, Coinbase’s profitability went with it, leaving the stock without fundamental support. Balance sheet assets would only support the valuation at a share price of around $22.

The crash in crypto is one of the biggest stories of the year. The price of Bitcoin (BTC-USD) is down 55% year-to-date, and other popular coins are doing even worse: Ethereum (ETH-USD) is down 68%, Cardano (ADA-USD) is down 63%, and Solana (SOL-USD) down 76%.

These happen to be the four coins listed most prominently on the Coinbase homepage to prospective customers, with the tempting invitation to “Buy”.

But with the uptrends in these coins having been broken, that is inevitably going to dent the enthusiasm of potential customers.

Crypto has been above all a momentum trade: if you don’t buy them now, they will just keep going up, and you’ll miss your chance.

But when momentum is working in the opposite direction, why get involved? Unlike productive assets with cash flow – stocks, real estate, or bonds – there can be no “margin of safety” when buying a crypto coin that’s suffering in a bear market. And unless a greater fool will eventually come along to buy them off you at a higher price, then the greater fool is you.

The anguish in the crypto markets has been hitting Coinbase shareholders too, with the COIN share price itself down by 76% year-to-date, or about the same percentage decline as a weak crypto token.

Unfortunately for Coinbase shareholders, the market cap even after this decline is still an enormous $13.1 billion.

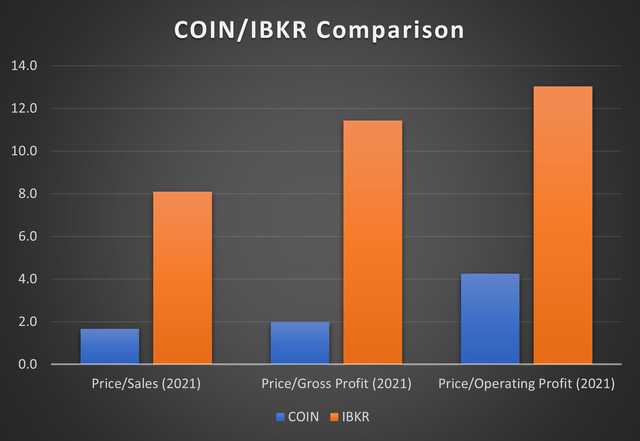

Let’s do a top-level comparison between Coinbase and Interactive Brokers (IBKR). We can think of Interactive Brokers as a blue-chip, diversified, long-standing broker with high-quality clients. Compared to Coinbase shares, shares in Interactive Brokers should be lower risk.

Using last year’s figures, Coinbase looks very cheap! In the rear-view mirror, it looks like Coinbase has sold off too much, and is now offering some real value to investors.

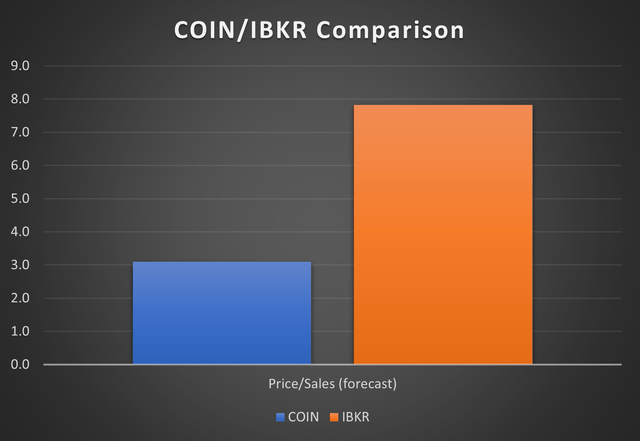

But it’s very different when we look at the same metrics using 2022 forecasts:

Coinbase is still much cheaper when it comes the Price/Sales multiple, though the gap has narrowed considerably.

Interactive Brokers is forecast to achieve a low single-digit revenue increase this year, in its slow and steady fashion.

But Coinbase is heading for an enormous 46% revenue decline, according to forecasts.

Why does the market award a much higher multiple to the revenues at Interactive Brokers, compared to the multiple it awards the revenues at Coinbase? It’s not hard to see why.

Coinbase made a $550 million operating loss in Q1 2022, and is now heading for a loss in the current year (so the company does not have a forward P/E multiple).

And judging by the words from management at Coinbase, it is not planning to achieve consistent profitability any time soon.

At the company’s most recent earnings call, CEO Brian Armstrong said (and I have added the bold):

You can expect volatility in our financials, given the price cycles of the cryptocurrency industry. This doesn’t phase us because we’re always taking a long-term perspective on crypto adoption. We may earn a profit when revenues are high, we may lose money when revenues are low. But our goal is to roughly operate the company as breakeven, smoothed out over time for the time being. We are looking for long-term investors who believe in our mission and will hold through price cycles.”

I interpret this to mean that in good years for crypto, Coinbase will make a profit. In bad years, the company will make a loss. Coinbase is betting that the overall crypto space will grow and grow, and this is what will enable long-term profitability.

If this expectation turns out to be false, however, then Coinbase shareholders will find that they own a company that is structurally unable to make a profit, because it has been designed for a market opportunity which simply does not exist.

As the bear market in crypto lengthens, this is already having on-the-ground repercussions for the company.

On May 17th, the company’s Chief Operating Officer wrote to employees that hiring would have to slow down:

Heading into this year, we planned to triple the size of the company. Given current market conditions, we feel it’s prudent to slow hiring and reassess our headcount needs against our highest-priority business goals.

But she expressed absolutely no loss of confidence in the long-term outlook.

However on June 14th, further action was needed, and a restructuring plan was announced by the company, “to manage its operating expenses in response to current market conditions and ongoing business prioritization efforts“.

I have added the bold:

The Plan involves a reduction of the Company’s workforce by approximately 1,100 employees, representing approximately 18% of the Company’s global workforce as of June 10, 2022, following which the Company expects to have approximately 5,000 total employees as of the end of its current fiscal quarter on June 30, 2022. The Company expects execution of the Plan to be substantially complete in the second quarter of 2022.

This is almost certainly the right course of action. But how much more restructuring might be needed?

The Coinbase balance sheet showed cash of $6.1 billion as of March 2022.

The company also owned $180 million of the USDC stablecoin, and $765 million of crypto assets.

(Coinbase does not just own crypto assets for operating purposes. It also invests its own funds into the asset class – as if its risk exposure to crypto wasn’t big enough already!)

On the liability side, the company had long-term debt of $3.4 billion. It has bonds due in 2028 and 2031.

If Coinbase were to lose another $500 million over the course of the rest of the current year, and then lose then same amount over the entirety of 2023, the excess of its cash balance over its long-term debt figure could soon fall below $2.0 billion.

There are many large moving parts in the company’s cash flow statement, so there’s a wide range of possibilities over the next two years. But whichever way you look at it, the balance sheet can’t survive sustained losses at the rate seen in Q1, and it certainly can’t survive an increase in that rate of loss for very much time at all.

Crypto investors are known to have a high tolerance for risk, but I think that even their courage might be tested if they saw the Coinbase cash balance dwindle further, while its debt pile remains significant. As has already been pointed out here, Coinbase customers face the prospect of potentially becoming general unsecured creditors of the company, in a worst-case scenario.

As an equity investor in financial companies, my own preference would be to invest in a normal, diversified, long-established broker, which is able to make profits regardless of the direction of the markets. Coinbase does not fit this profile, and its many risks do not yet appear to be fully priced into the stock.

The company’s March 2022 balance sheet declared a book value of $6.5 billion (or around $29/share).

Given the prospect of ongoing losses, impairments and restructuring costs, and the speculative business model, I believe the market cap for the stock should be at a material discount to book.

For example, at a 25% discount to book value, to allow for current losses and impairments, the shares could potentially find support at $22.

To avoid continued downside, Coinbase needs a positive reversal in the crypto markets – this has happened before, of course, so it could happen again. If crypto prices return to their all-time highs, before the Coinbase balance sheet suffers much more financial damage, then the company has a chance of recovery.

Alternatively, the company could take matters into its own hands and adopt a hard-nosed cost-cutting strategy with the objective of consistent profits even at depressed crypto prices.

In this context, the recently-announced restructuring plan could be seen as a step in the right direction. Deeper cost cuts, with the aim of consistent profitability, could help to put a floor under the share price.

Be the first to comment