Leon Neal

The fall from grace has been dramatic for shares of Coinbase (NASDAQ:COIN). Over the past year shares topped out around $368.90 and witnessed an -88.18% decline as shares fell -$328.02 to $40.88 in June. Over the past month, shares of COIN have rallied just 92.77% but are still down -63.58% YTD and are still off their highs by roughly 75%. Shares of COIN recently spiked as news broke about its partnership with BlackRock (BLK), allowing its institutional users to trade Bitcoin (BTC-USD). The BLK partnership announcement couldn’t have come at a better time as COIN has been associated with negative headlines such as layoffs and declining numbers. Its Q1 2022 earnings report was difficult as COIN missed on the top and bottom line, and the estimates for Q2 are not pretty. I am going to revisit a company I was bullish on to see if my perspective has changed going into Q2 earnings on 8/9/22.

There are aspects with the numbers that are certainly a cause for concern.

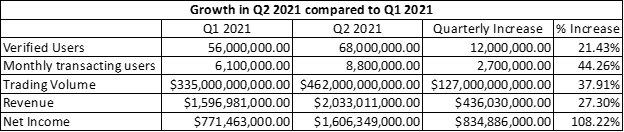

The story has certainly changed for COIN in 2022. At the close of Q2 2021, COIN was crushing the numbers. In Q2 2021, COIN produced EPS of $6.42, which was a beat of $3.84, and generated $2.23 billion in revenue, an increase of 1,098.0% YoY. Verified users grew 21.43% QoQ, revenue increased 27.30% QoQ, and net income grew 108.22% QoQ. COIN seemed like an unstoppable force as the numbers were outright impressive.

Steven Fiorillo, Seeking Alpha

Fast forward to the end of Q1 2022, and COIN has been a different story. Its userbase increased YoY by 75% (42 million), and its monthly users making transactions increased by 50.82% (3.1 million) YoY. COIN generates the majority of its revenue from trading activity, and that’s why the YoY numbers were perplexing. YoY the membership grew 75%, and monthly users making transactions increased 50.82% YoY, but the quarterly trading volume declined by -7.76% (-26 billion). This made COIN’s revenue decline by -$634.68 million (-35.24%) and its net income took a -$1.2 billion swing pushing its quarterly loss to -$430 million.

|

Q1 2021 |

Q1 2022 |

Difference |

||

|

Verified Users |

56,000,000.00 |

98,000,000.00 |

42,000,000.00 |

75.00% |

|

Monthly Transacting Users |

6,100,000.00 |

9,200,000.00 |

3,100,000.00 |

50.82% |

|

Trading Volume |

$335,000,000,000.00 |

$309,000,000,000.00 |

-$26,000,000,000.00 |

-7.76% |

|

Revenue |

$1,801,112,000.00 |

$1,166,436,000.00 |

-$634,676,000.00 |

-35.24% |

|

Net Income |

$771,463,000.00 |

-$430,000,000.00 |

-$1,201,463,000.00 |

-155.74% |

If revenue declined by -636.11 million YoY, how did net income decline by -$1.2 billion? From Q1 2021 thru Q1 2022, COIN’s quarterly total operating expenses increased by 111.57% ($907.5 million), and their revenue declined by -35.24% (-$634.68 million). Look at the two largest line items, technology and development and general and administrative. Given the nature of COIN’s business, it makes sense that continuous capital will be deployed to technology and development, so an increase of 209.76% to spur innovation isn’t something that would alarm me. After reading this article by the Wall Street Journal (WSJ) the general and administrative line caused concern from an operational perspective. General and administrative grew by 241.15% YoY. The WSJ cited that COIN’s headcount reached 6,000 this summer while FTX had 300 employees. In June of 2022, COIN laid off 1,100 employees, roughly 18% of its workforce.

If I speculate that general and administrative is 100% employee salaries, reducing its headcount by 18% would save $74.44 million per quarter in expenses bringing this line item to $339.13 million. If I reduce this line item to reflect my assumption, COIN’s total operating expenses would have been $1.65 billion in Q1 2021 if the workforce reduction occurred at the end of 2021. Their operating loss would have still been in the red by -$480.02 million. I don’t work at COIN, and I have no idea what the operational ramifications of an 18% workforce reduction will be to their output. Math is math, though, and based on the numbers, this workforce reduction would not have generated positive operating income in Q1.

|

Q1 2021 |

Q1 2022 |

Difference |

||

|

Transaction expense |

$234,066,000.00 |

$277,826,000.00 |

$43,760,000.00 |

18.70% |

|

Technology and development |

$184,225,000.00 |

$570,664,000.00 |

$386,439,000.00 |

209.76% |

|

Sales and marketing |

$117,990,000.00 |

$200,204,000.00 |

$82,214,000.00 |

69.68% |

|

General and administrative |

$121,231,000.00 |

$413,578,000.00 |

$292,347,000.00 |

241.15% |

|

Other operating expense, net |

$155,887,000.00 |

$258,627,000.00 |

$102,740,000.00 |

65.91% |

|

Total operating expenses |

$813,399,000.00 |

$1,720,899,000.00 |

$907,500,000.00 |

111.57% |

|

Revenue |

$1,801,112,000.00 |

$1,166,436,000.00 |

-$634,676,000.00 |

-35.24% |

|

Operating (loss) income |

$987,713,000.00 |

-$554,463,000.00 |

||

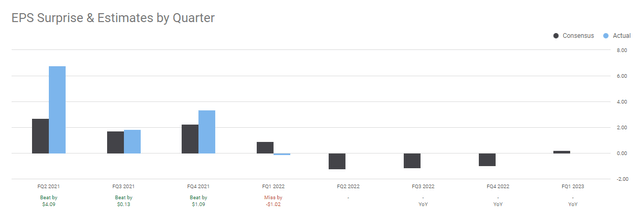

Outside of the operational expenses, I am concerned about the declining trajectory of its business. Members and member activity is up, but revenue and net income are declining. The consensus estimates now have 3 additional quarters of negative EPS baked into COIN’s outlook, and the current quarter has been revised 8 times. The street is calling for revenue to come in at $876.09 million in Q2 and -$2.77 of GAAP EPS. This is a bit hard to swallow because if I plug in $876.09 million of revenue with all Q1’s expenses and change the general and administrative number to reflect an -18% reduction, COIN would stand to have an operating loss of -$770.37 million in Q2.

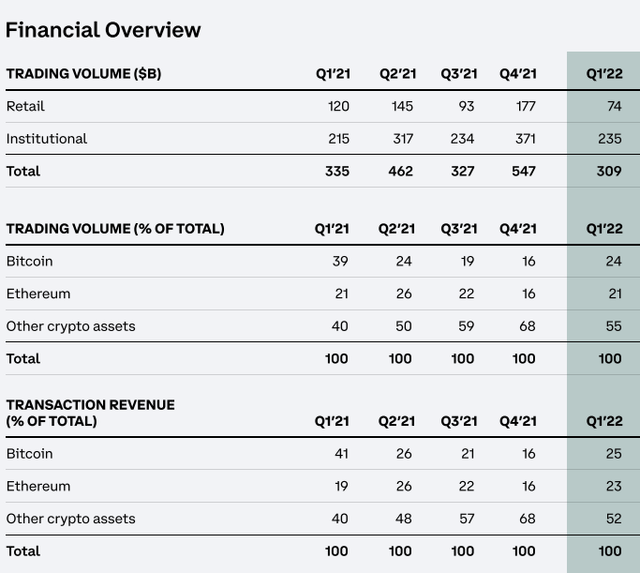

Everything lives and dies with trading volume for COIN. In Q1, retail accounted for 23.95% of COINs trading volume while institutional accounted for 76.05%. BTC-USD and Ethereum (ETH-USD) accounted for 45% of COIN’s trading volume on a cryptocurrency level. Going back to an article I wrote on 8/13/21, which has not aged well as COIN just fell apart, I had put the trading volumes of the top 60 coins by market cap. BTC’s trading volume over the current 24-hour period was $33.3 billion, and ETH’s was $27.2 billion. BTC was at $45,760, and ETH traded at $3,170. Right now, BTC has a $29 billion 24-hour trading volume, and ETH is at $18.9 billion. BTC is trading at a -$4 billion daily volume (-12.12%), and ETH is trading at a -$8.3 billion (-30.51%) daily trading volume from roughly the same time last year. This doesn’t get me excited that COIN will surprise on the consensus estimates since their numbers live and die with trading volume.

While the numbers are trending in the wrong direction, the latest news could be very promising

COIN was selected by BlackRock to provide Aladdin clients access to crypto trading and custody via Coinbase Prime. Coinbase Prime was built for institutions as it integrates advanced agency trading, custody, prime financing, staking, and staking infrastructure, data, and reporting that supports the entire transaction lifecycle. Coinbase Prime has over 13,000 institutional clients and provides the ability for trade execution of 200 assets and custody for more than 300 assets. Aladdin was built to manage BLK’s business and is used by over 200 institutions, including insurers, pensions, corporations, asset managers, banks, and official institutions. BLK began selling the Aladdin software in 1999 and has amassed a tremendous foothold in the industry.

Institutional accounts for 76.05% of COIN’s trading volume. BLK is one of the world’s largest investment management firms providing its services to institutional, intermediary, and individual investors, including corporate, public, union, and industry pension plans, insurance companies, third-party mutual funds, endowments, public institutions, governments, foundations, charities, sovereign wealth funds, corporations, official institutions, and banks. This is a huge win for COIN as this partnership could significantly increase its trading volume, leading to additional transactional fees, which would drive revenue growth. The combination of this partnership and the possibility of the crypto markets rebounding and gaining a resurgence of interest could get COIN back on track.

The risk factors outside of normal business operations

Every business has risk factors, but COIN could be in the sights of the SEC, and that’s a different set of issues. Last month federal prosecutors filed an insider trading case against a former Coinbase manager, and at the same time, the SEC asserted that seven crypto assets traded on the Coinbase platform qualify as securities. The WSJ reported that:

“If a court agrees with the SEC that some of the digital tokens are securities, Coinbase would likely have to stop trading them on its exchange. Coinbase itself could potentially face liability, such as fines if the SEC eventually sues Coinbase over its decision to list the assets.”

I am not a lawyer and have no idea what the future will hold. The math behind a possible outcome is simple, though. Hypothetically if the SEC classifies several “cryptocurrencies” as “securities” and COIN is forced to delist them, then that’s less tradable assets on the platform. Less tradable assets could lead to fewer transactions, leading to less revenue.

These are risk factors that should be researched and considered

Conclusion

I was bullish on COIN when the revenue and net income trend were growing at a rapid pace. I think COIN has changed to a wait-and-see story if you have a large appetite for risk. There are many variables that will need to play out. COIN could still end up being a great long-term investment, but they need to get their operating expenses under control, get back to revenue growth, develop more revenue-generating products, and hope that the SEC doesn’t change the operating landscape of cryptocurrencies. I think the BlackRock deal has given COIN a huge shot of adrenaline, and it will be interesting to see how much COIN’s institutional trading volume increases by. I wouldn’t be surprised if COIN becomes a 2-3x from these levels, and I wouldn’t be surprised if it trades lower. I think COIN is a hold at the moment due to the BlackRock deal, even though Q2 2022 looks like it will be ugly.

Be the first to comment