vdvornyk/iStock via Getty Images

Codexis (NASDAQ:CDXS) is an American engineering company involved in the discovery, development, and sale of enzymes and other proteins. The company operates through two segments, the Performance Enzymes segment, and the Novel Biotherapeutics segment. These segments offer a plethora of products and technology that is commercialized on a global scale for pharmaceutical, food, and medical applications. Bioengineering is a growing industry that, while novel, is proving to have incredible results in the aforementioned applications and more.

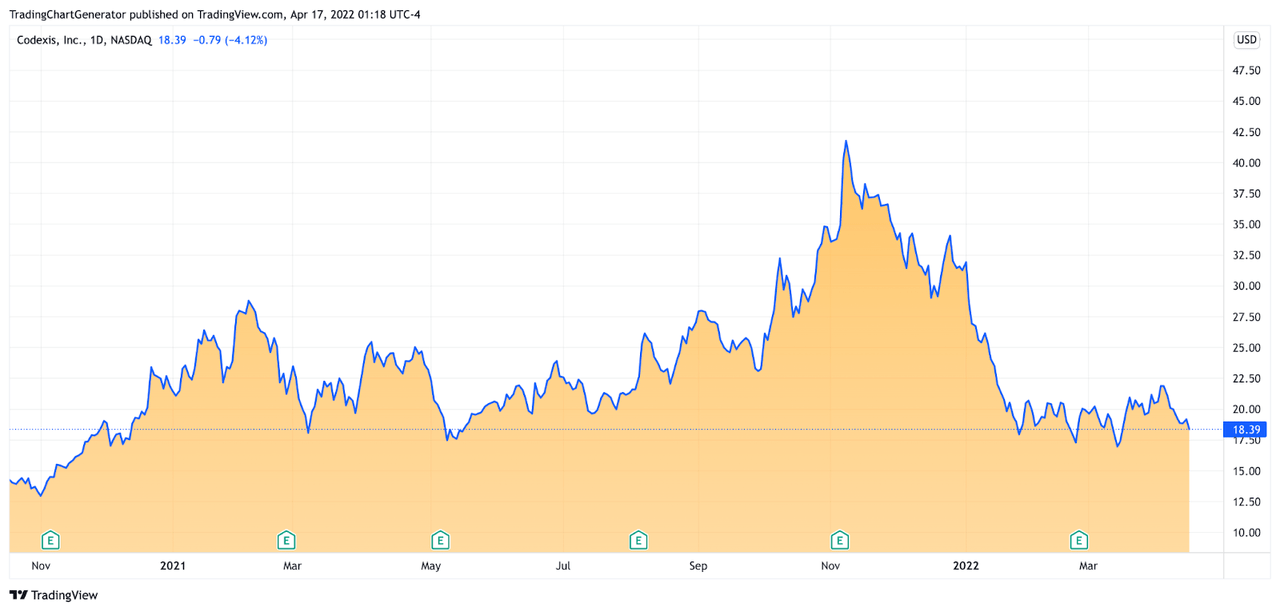

tradingview.com

The company has experienced losses in recent times, but given its track record in the development of products catching the eyes of bigger names in the sector, it is on track to finding a unique space. A cursory look at its business, the emerging industry, and the latest financial reports reveal that Codexis could soon experience rapid growth and make for a great investment.

Company And Industry Overview

Codexis has gained a reputation for delivering quality products, picking up a number of awards and recognitions over the years. The company’s work with nutrition has seen it partner with large brands such as Nestle to provide enzymes for metabolic disorders. Its work in biotherapeutics and the life sciences has also seen success and additional partnerships. The company has been able to build on its success through its technology platforms, such as the CodeEvolver, which uses machine learning and experimentation to perform protein engineering. Engineering is the keyword as it has become key in the prevention and cure of many illnesses thought to be incurable. As such, a flow of investment and funding has gone into the sector, with the bioengineering department seeing incredible growth over the years.

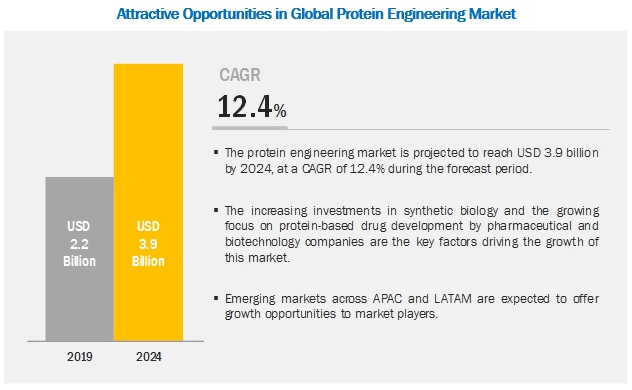

marketsandmarkets.com

Looking at the industry’s forecasted growth, the protein engineering market is expected to reach $3.9 billion by 2024, growing at a compound annual rate of 12.4% from $2.2 billion in 2019. This incredible growth rate shows the optimism and amount of investment that is going into the market as it continues to produce incredible results. More importantly, everything indicates that this is just the tip of the iceberg, and the future of therapeutics might be largely based on this sort of engineering. This makes it a great early investment for those who catch on, with the only remaining question being what company will be the right investment. While the promise of an early investment boom is great, the risk of investing in the wrong company is even greater, with most sectors seeing a large drop-out rate, so to say, of companies after the initial boom. Codexis faces strong competition in this regard, with much larger companies offering a wide range of products and solutions, but there are many factors that make the company unique enough to stake its claim in the long run.

Financial State

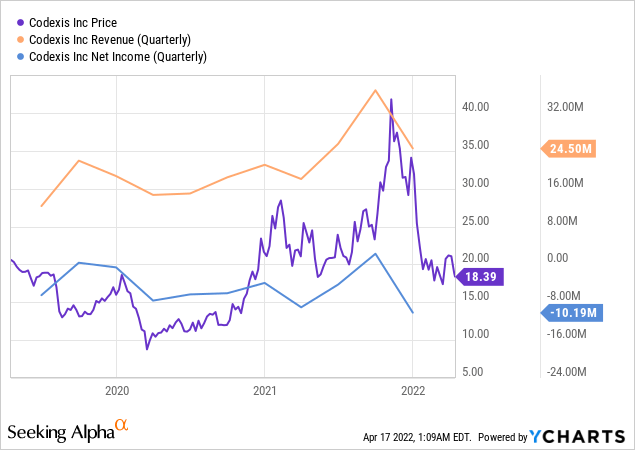

Codexis experienced a mixed bag of quarterly results, with revenues fluctuating between $18 million in the first quarter to $36.8 million in the third quarter before dropping to $24 million during the final stretch of 2021. Ultimately, Q3 proved to be the only profitable quarter, with the company ending Q4 with net income losses of -$10.2 million. However, the company did make substantial progress, not just on a year-on-year basis but also when compared to the last few years. The company was also able to double its product revenue throughout the year, going from $30.2 million in 2020 to $70.7 million by the end of the last fiscal year.

ycharts.com

Research and development revenues came second, at a reported $34.1 million, though this was down from the $38.8 million reported in the previous year. This dip in form was due to a decline in sales from Novartis, which completed a platform technology transfer with CodeEvolver in the third quarter, substantially affecting sales by the final quarter. Performance enzymes grew by $2 million, which was not enough to offset the losses from the aforementioned deal, but this also makes the overall growth of the company through product revenue even more impressive as it more than compensated for losses. Product gross margin accounted for nearly 60% in the fourth quarter of 2021, compared to 52% in the same quarter a year before, driven by increased sales of higher-margin products.

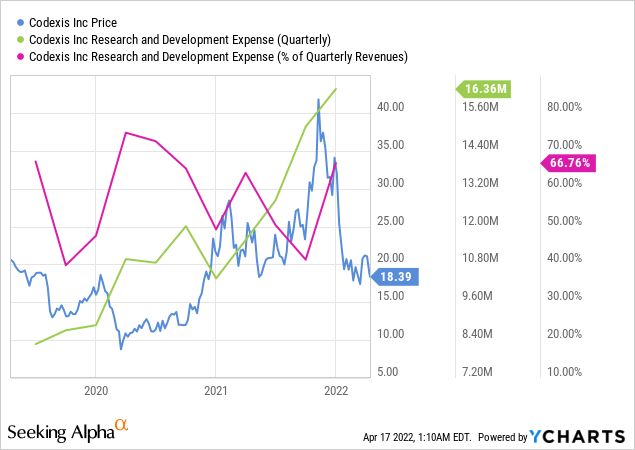

ycharts.com

Expenses also saw increases throughout the various departments of the company, with R&D expenses rising from $44.2 million in 2020 to $55.9 million in 2021, largely due to higher operational costs with an increase in employees and costly supplies. Sales, general, and administrative expenses also saw a substantial appreciation at a reported $49.3 million, compared to $35 million the year before, also attributed to higher employee count as well as stock compensations, legal fees, and consultants. In the end, the company reported losses per share in all but one of its four quarters and concluded the year with a final EPS of -$0.16. Earnings are expected to stay below the $0 mark all throughout 2022, but the company did beat all estimates the year before and is forecasted to see continued growth by the end of the year. Revenue is expected to increase at a rate equal to or greater than it was the year before, with projections ranging from $152 million in total revenues to $158 million by year-end. Product revenues are expected to continue leading the way by contributing to up to $118 million, according to the company’s guidance, most of which is to come from the sale of the company’s high-performance enzyme used in its collaboration with Pfizer.

Potential Risks

Codexis is faced with a number of minor risk factors that could offset its growth in the coming months as it attempts to make a profit. Growth in 2021 was aided by the purchase orders made from Pfizer, which may not repeat in the same fashion in 2022, potentially slowing down growth rates. The company is dependent on other much larger players in the sector, making its revenue stream equally dependent on purchase programs, and if those do not pan out for third parties, this could have adverse effects on the company. Any disagreements or termination of such collaborations would prove costly for the company and set them back to square one. Codexis is also going through a period of growth that is both encouraging and prone to a number of risks. These could include slower than expected launches of its products, or potential misfires in the future, largely affecting the company’s guidance for the year.

Other potential risk factors include changes in the market, higher prices that could drive operational costs even higher, and the prolonging of the global pandemic that is affecting all industries. If Codexis sticks to its current strategy, however, it has the potential to continue to find growth in specializing in its own areas and collaborating well with companies that have a bigger influence on the market.

Conclusion

Codexis is an interesting option for those looking for companies with great potential for growth over the next few years. The company may be overshadowed by more looming figures, but it also means that its full potential has not yet been realized, and it has a greater capacity for growth than more established companies. Investors will need to assess some noteworthy risks involved, which naturally do not guarantee success but do indicate that growth will not be so sudden. Nevertheless, even the recent company losses should not be seen as a discouraging factor but instead an opportunity to buy in early before the company experiences a surge in growth that parallels the market.

Be the first to comment