mppriv/iStock via Getty Images

Coda Octopus Group (NASDAQ:CODA) is certainly not a familiar name to most, yet in the marine technology world, they definitely have a swagger. The company claims to design and sell the world’s only 3D, 4D, 5D & 6D imaging sonar solutions, giving users the ability to see, in real-time, multiple underwater targets from a single sensor.

In November 2021, I opened my coverage of the company with an article labelling it “dramatically undervalued” and spoke to the potential of its products in the defense markets. Since that time, the company has been punished even further, declining roughly 37%, largely due to subdued results stemming from inflation in the company’s supply chain, currency fluctuations and delays in defense quoting, demonstrations and contracts with the US government due to the pandemic.

In this article, I would like to explore statements and progress made by the company in the recently reported Q3 earnings release and why I believe that the company may be getting back on track regarding key growth programs while remaining severely undervalued in my opinion.

Overview

The company operates in two groups, the products group, which will be my main focus of discussion today and the engineering business, which produces specific parts for defense contractors around the world, such as the phalanx close in weapons system present on US Navy warships, thermite, a hardened computer system for the battlefield among many other items.

The primary purpose of the engineering business in my opinion is to secure and build relationships with defense contractors and while it is an important source of revenue for the company, the main growth component undoubtedly is the products group.

The products group focuses on sonar. And this is not fish finder level sonar, this is serious military-grade hardware and software that the company currently sells into various industries, governments and defense markets around the globe including oil & gas companies, mining companies, construction companies, renewable energy companies and many more.

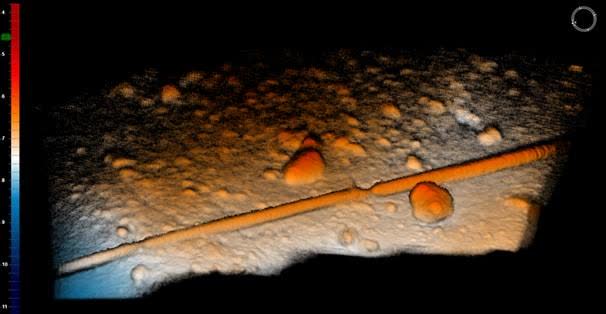

The below images were taken by the Coda Octopus produced Echoscope 3D product.

Coda Octopus Yahoo

These are not photos, they are sonar-generated images captured in real time by the Echoscope product. Coda Octopus claims that it is the only system in operation in the world able to capture images like these in 3D.

Seeing these images, it is no wonder why the US government has asked Coda Octopus to develop the DAVD system (Diver Augmented Vision Display) for use by naval warfare operators. The DAVD system has integrated into a diver’s helmet, the ability to see, communicate and operate freely, underwater, in zero visibility and in zero light conditions.

In addition, the company has long sought a seat at the table for Echoscope sonar in the next generation of autonomous underwater vehicles that are in development in the United States and allied navies.

It would appear that the company’s efforts in developing the defense applications of its technology are finally on the brink of paying off after a long pause due to the COVID-19 pandemic.

In the Q3 release on September 14th, CEO Annmarie Gayle stated the following:

In the TQ2022, a significant portion of our sales were generated from our real time imaging sonar, Echoscope PIPE®, to US Prime Defense Contractors for integration into their new generation of underwater vehicle programs that are currently being designed. This is supportive of our business development strategy to increase sales of our real time imaging sonar, the Echoscope®, into defense programs around the world. We expect this success to pave the way for multiple sales into these programs with long term recurring revenues. In addition, the new generation of underwater vehicles that are currently being developed increases the market opportunity to have our technology embedded into these new programs, realize multiple sales of the technology and increase our market share.

We have also made solid progress on our new diving management system, DAVD. Specifically, we have started to supply GEN 3 DAVD systems to the Navy and are currently delivering DAVD GEN 3 upgrades for GEN 2. We also have a US-based marine engineering provider already using the DAVD system and the Echoscope® in a commercial diving project. Looking ahead, we will be demonstrating the DAVD to the UK Ministry of Defence in October 2022 and expect adoption of the DAVD system from multiple customers later this calendar year including foreign navies as well as several construction and offshore service providers that operate in the commercial diving sector. Lastly, we are currently customizing the DAVD technology for the single largest potential adopter of the DAVD and anticipate having prototypes for this particular US defense customer by the end our fiscal year, October 31, 2022.

What is key here in my view is the statement that the Echoscope product has now been integrated into prime defense contractors programs for next-generation underwater vehicles. This, to my knowledge, is a first for the company and would be a long sought-after market to establish.

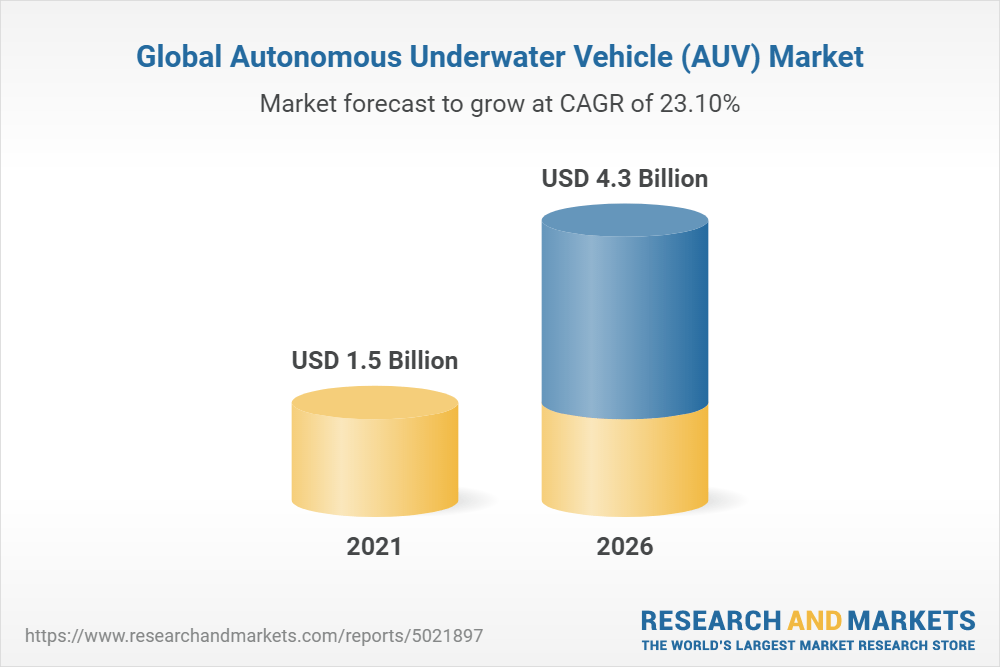

It is well known that the US government and allied navies around the globe are developing autonomous underwater vehicles “AUVs” with the purpose of monitoring and tracking hostile nations’ subsea activities and that this market is set to explode over the next decade.

Research and Markets

Integrating Echoscope into this growing market would be a huge coup for Coda and a true game changer for the stock. These programs take time to develop, and I do not expect the company to book meaningful revenue from this market for a few years, however, this development appears to have been completely missed given the market’s rather muted reaction to the earnings announcement.

In addition, DAVD appears to be gaining momentum as well after suffering serious delays due to the COVID-19 pandemic and the travel restrictions in place. The DAVD system is one that absolutely must be demonstrated in person given its hands-on, first-person nature and with nearly all restrictions now null and void, it appears that the company is getting back on track regarding its development and demonstrations.

In total, it appears that the company is on the verge of getting its mojo back in full force and has a multitude of opportunities that have the potential to light a fire under the stock. What is even better is that the company remains to date, absolutely dirt cheap in my opinion.

Valuation

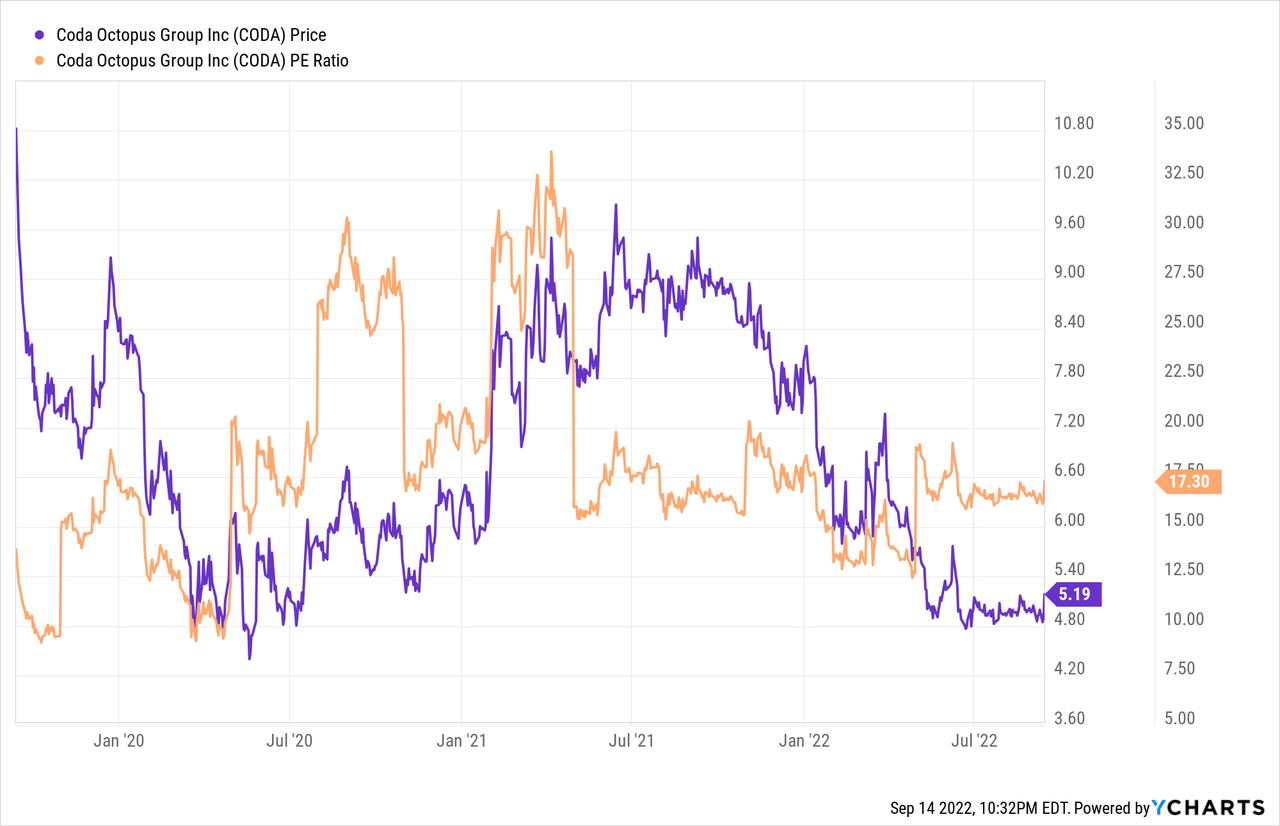

Coda Octopus stock has never traded like a meme stock or had a premium valuation attached to it in my opinion, however even considering recent history, the company appears to be dramatically undervalued.

YCharts

YTD, shares are down a whopping 37%, hovering just above $5 a share. With the Q3 earnings numbers now in, the company trades at a TTM P/E ratio of only 15.69, well below the longer-term average. In addition, earnings estimates for 2023 currently stand at $0.53 giving the company a forward P/E of only 9.77.

The company’s balance sheet is also a source of serious strength for Coda, as they have over $21 million in cash with zero debt. The company’s entire market capitalization is only $56.2 million as of 09/14/22, meaning that nearly 38% of the value the market places on them is held in cash.

For a company poised for growth and one that has remained highly profitable throughout the pandemic, this valuation to me makes no sense at all.

Risks

Coda Octopus is a micro-cap stock and as such is both extremely volatile, rather illiquid and carries a high degree of risk. Since my last article on this company in November 2021 highlighting the defense potential of the stock, shares have dropped 37% as the company has faced numerous delays and restrictions caused by the COVID-19 pandemic, leading to lower than expected revenues along with significant inflation and supply chain concerns regarding components used in the company’s prototypes in development.

The pandemic, over the last few years, has significantly delayed many of the growth plans the company has eyed in the defense field and given the fluid nature of both the markets in which it operates and the global pandemic, supply chain issues and the ability to demonstrate its products in person may arise again in the future leading to a further drop in share prices.

The company does appear to have a solid base of business in the commercial sector, however, the main focus of the company on the sonar market does make it vulnerable to technology changes that could occur at any moment. In addition, the company has significantly suffered recently from currency fluctuations as the majority of the company’s revenue is booked in Europe and Asia, yet reported in US dollars as mentioned in the 10-Q recently filed. If the trend of the US dollar strengthening continues, the company could continue to face headwinds in reported revenues.

There appears to be a lot to like about the company, however, this is a very risky investment and anyone looking to invest in a company such as this should thoroughly and independently research the risks faced, along with hold the appropriate risk tolerance needed for such an investment.

Bottom Line

It is entirely possible that I am missing something here given the profound lack of public information available about this company, however all signs that I can find a point to a company that is dramatically undervalued and is poised for growth, specifically in the defense market over the next few years. The rise of AUVs in the defense market is not at all a secret and could be a game changer for Coda Octopus going forward.

I see the potential for this company to trade at multiples of the current price if they are successful at winning a share in the AUV market, as well as continued success with the DAVD product.

In my opinion, the downside may be somewhat limited at these levels given the sustained and continued profitability in the commercial sector along with the company’s rock-solid balance sheet, though it could always go lower. In short, I am personally actively buying and building my small current position in Coda further at current levels.

I would like to again remind all readers that this is a very risky, small company and the shares are not overly liquid given the puny 3-month average daily volume of only 10,800 shares. In prior trades, I have personally moved the stock a few percentage points, so caution is warranted. Always consult a licensed financial advisor to consult based on your own financial and risk tolerance situation before investing in this or any security product.

Let me know your thoughts in the comment section below, and if you are a user of the Echoscope product, I would love to hear your opinion. Thank you for reading and good luck to all!

Be the first to comment