drnadig/iStock via Getty Images

CNX Resources (NYSE:CNX) is one of the largest E&Ps in the Appalachian Basin. The stock has ridden recent strength in the price of natural gas to gain 50% YTD. That’s on the heels of a strong Q4 report that saw the company earn $2.90/share and generate $85 million in free-cash-flow. In total, CNX generated a whopping $356 million in FCF for full-year 2021. Even better, the company expects to generate ~$600 million in FCF this year (or ~$3/share). Considering the company has greater than 80% of 2022 production hedged, it has a pretty clear line-of-sight into that FCF estimate. That being the case, and given that many O&G companies are instituting base and variable dividend policies these days, CNX shareholders are likely thinking they will be on the receiving end of some fat dividend checks this year. Let’s take a closer look and see if that will be the case.

Investment Thesis

As most of you know, Putin’s decision to invade Ukraine has up-ended global energy and commodity markets. However, the truth is that natural gas prices were rallying even prior to the invasion due to a relative short-fall of supply – particularly in Europe. However, due to the fact that the US has an abundant supply of natural gas (my followers know I believe we live in an “era of energy abundance”), the domestic price of gas hasn’t moved nearly as much as it has in foreign markets:

That said, as you can see in the graphic above, NYMEX gas is up 50%+ since the beginning of the year. And since CNX’s roll-up of its MLP CNX Midstream Partners LP in 2020, the company has an integrated midstream network with strong logistics. Considering the difficulty of getting new pipelines permitted and constructed these days, CNX’s existing pipeline infrastructure has arguably become even more valuable.

The investment proposition here looks attractive considering CNX generated $356 million in FCF in FY2021, when the gas price was significantly lower than it is today. Indeed, the company is expecting to generate $600 million in FCF this year, or ~$3/share. That being the case, shareholders likely expect to be rewarded with some fat dividends this year.

Earnings & Balance Sheet

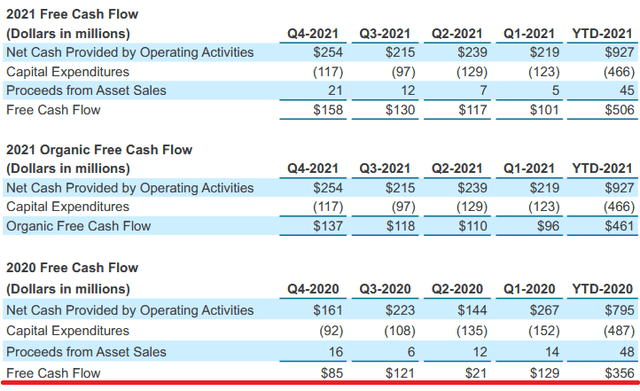

As I mentioned above, CNX generated strong free-cash-flow last year:

CNX FY21 Free-Cash-Flow (CNX Resources)

In fact, as explained during the Q4 conference call, the company’s strong FCF profile has enabled it to pay down about a half-a-billion dollars in debt over the past two years, as well as to refinance: CNX issued $400 million in 4.75% notes due in 2030 and used the proceeds to retire $400 million of 6.5% notes that were due in 2025. The result is that CNX has not only significantly reduced its overall debt-load, but has also significantly reduced – and extended the time duration – of the cost of a large chunk of its remaining debt (total long-term debt at the end of FY21 was $2.2 billion).

Overall, the company lost $2.31/share in FY21 – primarily due to combined aggregate derivative losses of $1.63 million in Q2 and Q3. Speaking of hedges, note that CNX has hedged greater than 80% of this year’s production. That obviously eliminates much of the potential upside in gas prices, but it also protects against the downside as well.

Going Forward

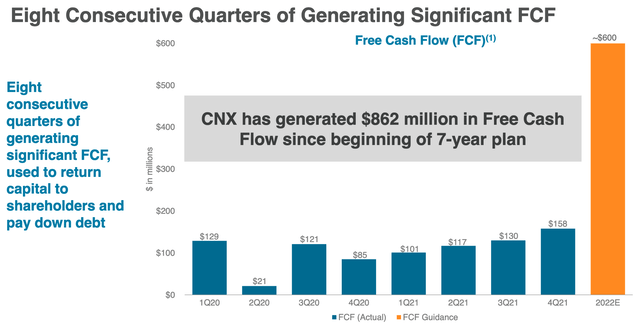

Given CNX’s significant hedge position, the company has strong visibility into its free-cash-flow potential for this year:

CNX Free-cash-flow Profile (CNX Resources)

As can be seen, the company is forecasting ~$600 million in FCF in FY22, or around $3/share. As a result, shareholders are likely expecting to be rewarded with some fat dividends checks this year.

However, according to management, that does not appear to be the case. I say that because the management team was asked “why not introduce a dividend” during the Q4 conference call (note the company currently pays no dividend whatsoever) There was a long-winded answer by CNX CEO Nick Deiuliis, but the bottom line is that he ended with the following:

So until that math changes, I think it’s going to be debt reduction and share count reduction.

In other words, share buybacks. Long-term energy investors have seen this movie before: companies suspending buybacks during down-cycles (when the stocks are a bargain), and ramping buybacks up dramatically during up-cycles (when the stock is either fairly or fully valued). These buyback programs typically benefit the executive management team much more than they do the ordinary shareholder.

That being the case, and with CNX stock’s already large gain YTD, and with so many other stellar dividend income stocks in the energy patch, I don’t see a compelling reason to invest in CNX Resources. When you have companies like Pioneer Natural Resources (PXD) and EOG Resources (EOG) delivering huge dividends to investors (see PXD Could Pay $20/share In Dividends This Year), why invest in a company that flat-out says it will not be doing so and, perhaps even worse, will now be pouring money into stock buybacks after the stock has already had a big run-up? I can understand some portion of FCF to pay down debt and to be allocated to stock buybacks, but none allocated toward dividends to the ordinary shareholder?

Risks

CNX’s debt profile looks reasonable and manageable given its hedge book, low cost production, and the macro environment.

The company recently announced proved reserves of 9.63 Tcfe. That equates to an estimated 16.3 years of production based on FY21’s total net production of 590 Bcfe. That being the case, there is no shortage of resources.

As with all commodity producers, CNX is a price taker and we still live in an era of energy abundance. Note despite all the hand-wringing by energy company CEOs that they cannot raise production due to lack of rigs and/or crews to run them, note the Baker-Hughes US rig count increased by +16 last week.

As I have written on Seeking Alpha many times before, energy companies focusing on oil production in the Permian also produce a lot of associated natural gas. That production enters the market and reflects all the way up to the Marcellus region and puts pressure on natural gas prices. Indeed, that is the major reason that natural gas producers in the Marcellus have had a relatively tough decade despite some of the lowest cost producing assets on the planet (i.e. we really do live in an era of energy abundance).

Summary & Conclusion

CNX appears to have a very strong FCF profile for FY22. The company has a relatively long-life resource base and significant strength in midstream infrastructure and logistics. However, the executive management team does not seem to be even moderately friendly when it comes to shareholder returns in the form of dividend directly to its investors. That being the case, I can’t advise investing in CNX shares when energy investors have excellent alternatives in very shareholder friendly management teams at companies like PXD and EOG. I rate CNX a relatively weak HOLD.

An alternative assessment comes from analysts at Wells Fargo, who recently upgraded the price-target to $26, or ~24% upside compared to Friday’s close.

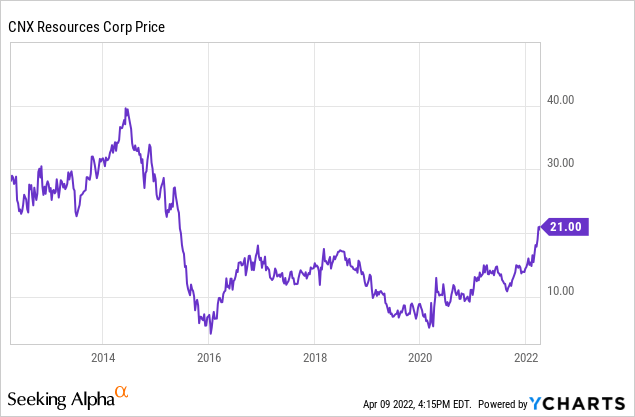

I’ll end with a 10-year price chart of CNX stock, and note that there have been huge opportunity costs associated with owning the shares during the biggest bull-market of our lives:

Be the first to comment