monsitj

Investment Thesis

CNH Industrial’s (NYSE:CNHI) Q2 results should benefit from a healthy order book, pricing actions, improved productivity at facilities, and strong end markets. However, the second half of this year doesn’t look that good with headwinds in the form of uncertainty in the economy, declining commodity prices, and rising interest rates. The stock has seen a good correction since early June due to these concerns and is currently trading at just 8.59x current year consensus EPS estimates. The long-term outlook for the company looks good as it is constantly investing in organic and inorganic growth opportunities. The company’s acquisition of Raven Industries should drive the agriculture segment’s growth through development in the precision agriculture space, whereas the acquisition of Sampierana should drive the construction segment’s growth by expanding CNHI’s product portfolio and geography. The company is also focusing on improving its margins through operational efficiencies and digitalization. I believe the short-term concerns are already getting priced in the stock at current levels and the risk-reward for long-term investors is favourable. Hence, I have a buy rating on the stock.

Mixed Short-Term Outlook

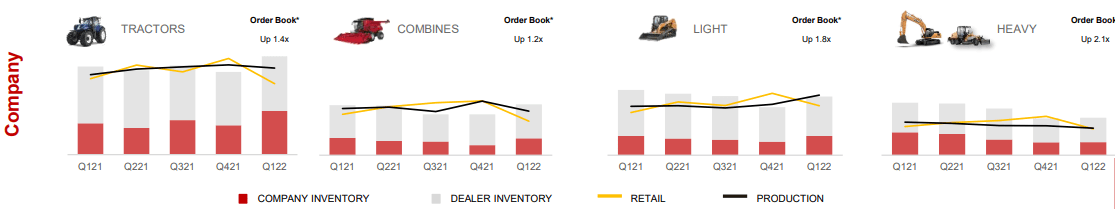

The demand across both the agriculture and construction segments remained strong in the first half of this year, leading to a healthy order book in Q1 22 and this trend is expected to continue in Q2 22 as well. In Q1, the order for tractors and combines was up 1.4x and 1.2x, respectively, in the Ag segment, and the order for light and heavy equipment was up 1.8x and 2.1x, respectively, in the Construction segment. The strong demand in the Ag segment was driven by increased soft commodity prices, which led to higher farm income, whereas the Construction segment benefited from the strong housing industry. After the demerger of CNHI’s On Highway business in December 2021, the Agriculture segment now contributes the most (~70%) of CNHI’s industrial revenue.

CNHI’s product category performance (Company Presentation)

CNHI has been implementing price hikes across its business portfolio to offset the inflationary cost environment. In Q1 22, the pricing in the Ag segment was up 12% and up high single digits in the Construction segment. The increased pricing is helping the company to more than offset the inflationary costs and improve profitability. Additionally, the company has been adjusting its production schedules to accommodate parts shortages due to supply chain challenges. The inventory levels had increased in the first quarter compared to that in FY21 as a result of supply chain challenges. However, at the time of the last earnings call, management mentioned that production in April improved to a certain extent. This should support the volume growth of the company in the second quarter of FY22. I believe the sales growth of the company in Q2 FY22 should benefit from a healthy order book, pricing actions, strong end markets, and improved production levels.

While I am expecting good results when the company reports its Q2 results, its outlook beyond Q2 FY22 looks challenging due to the uncertainty in both agriculture and housing end markets. Soft commodity prices have been declining since June 2022, which should start affecting the farmer’s income as the input costs still remain at elevated levels. This should result in farmer postponing their plans to upgrade their equipment from the existing ones. Additionally, the farmer’s sentiment index has been declining over the past few months due to rising inflation and uncertainty in the economy and has dropped to the lowest level in June 2022 since October 2016. This should impact agriculture end market. Apart from this, rising interest rates should affect the buying power of people, leading to lower housing starts which will in turn impact CNHI’s construction business. I believe the weaker end-markets should impact the volume growth of the company in 2H FY22.

Solid Long-term Prospects

At its capital markets event held in February 2022, CNHI laid out its five strategic priorities to improve the company’s revenue and profitability. These five priorities include customer-inspired innovations; brand and dealer management; operational excellence; technology leadership; and sustainability. These initiatives should help the company to improve its customer success (measured by Net Promoter Score), gain market share by almost 200 bps over the 3-year plan period, and drive margin expansion.

The first priority is to develop products by coordinating with its customers and introducing over 200 new products over the next three years, with 150 products in agriculture and 50 products in the construction segment. Strengthening its brand and dealer is the next priority, followed by giving its dealer better tools to work with. Operational excellence should be achieved by evolving the company’s previous system of WCM (World Class Manufacturing) to the CNHI business system. The CNHI business system is about driving customer-focused ties, significant benefits for customers, and margin expansion at the same time. This should be done by expanding on lean manufacturing, improving quality, improving productivity, culture, and strategic sourcing. Finally, the company is also working on sustainability and introducing biofuel and electric-driven vehicles.

CNHI has been expanding its product range in the agriculture segment both organically by innovating new products and inorganically through partnerships such as Monarch and Bennamann, and acquisitions such as Raven Industries. The company plans to bring its first small battery electric tractors through its partnership with Monarch, whereas with Bennamann Solutions it is creating a circular economy model to reduce carbon emissions from the environment. The acquisition of Raven Industries in November 2021 is expected to play an important role in the technology side of the business. Raven’s expertise in the precision agriculture space should bridge CNHI’s automation gap and help the company expand its product portfolio. The precision ag space is expected to contribute to growth with higher content, especially on the combines in the high horsepower machines, driving market share and margins, which are expected to grow further after 2024 as the integration of Raven is completed.

The profitability of the agriculture segment has improved over the years, and the company is building on robust foundations that management expects will eventually lead to mid-teen EBIT margins for 2024, even if the markets were to soften. The company is targeting generating revenue in the range of $16.5 bn to $17.5 bn from the agriculture segment in 2024 and an adjusted EBIT margin in the range of 14.5% to 15.5%.

The construction segment is also benefitting from a number of global tailwinds and the company’s transformation efforts. Significant infrastructure investments are underway, driven by the infrastructure bill in the U.S. (which is expected to drive growth starting FY23), the EU’s long-term budget coupled with the next-generation EU program, and other programs across the world. The company is also working on new technologies to improve the efficiency and productivity of machines. Last year, the company acquired Sampierana, which helped CNHI expand its portfolio of mini and medium excavators. CNHI is focusing on digitalization and automation to deliver increased productivity and improve its profitability. The company is expecting sales in the range of $3.7 bn to $4.5 bn by FY24 and an adjusted EBIT margin in the range of 5.5% to 6.5%. The management is targeting a total revenue including financial services in the range of $22 bn to $24 bn in 2024 adjusted EPS at around $1.70.

Valuation & Conclusion

If we look at CNHI’s valuations, it is trading at 8.59x FY22 consensus EPS estimates and 7.92x FY23 consensus EPS estimates. The stock price has corrected significantly since early June thanks to the correction in grain prices. While it will likely impact orders and volumes in the near term, I believe these short-term headwinds are already getting priced in at these levels. On the other hand, I believe investors are overlooking the company’s longer term growth prospects at these valuations. Hence, I believe risk-reward is attractive and have a buy rating on the stock.

Be the first to comment