JHVEPhoto

CNA Financial (NYSE:CNA) recently released its second-quarter results.

Although the company was affected by the increase in the interest rates and the equity market drop, which affected both book value and fair value of non-redeemable preferred stocks, the insurance divisions recorded improved underwriting margins, resulting in a higher underwriting income.

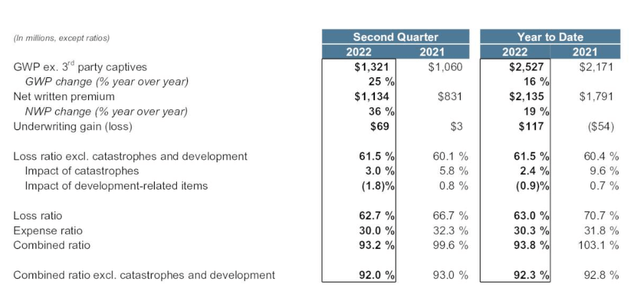

Source: CNA Financial Presentation

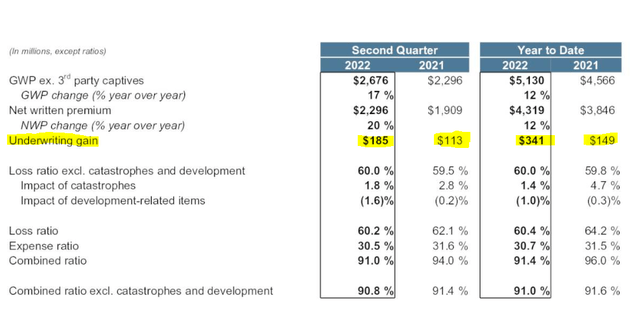

The insurer achieved the lowest quarterly combined ratio in five years, at 91%. Improved margins for commercial and international businesses drove the 4.6-point drop in the year-to-date combined ratio. As a result, the insurance company’s underwriting profit surged from $149 million to $341 million.

CNA Financial ended 2021 very well, has started 2022 on the right foot with improved underwriting margins, and continues to be on track to deliver steady FY2022 results, despite the turbulences from the equity and fixed-income markets.

With the interest rate increase, the book value has been affected as the fair value of preferred stocks, and fixed-income securities dropped. Nonetheless, the net investment income would grow from a medium/long-term perspective, as the average interest yield of the renewed fixed-income portfolio would be higher than now.

Improved margins and steady premium growth fueled the higher underwriting income.

The P&C segments posted a quarterly underwriting gain of $185 million, vs. $113 million one year ago in the same period. On a year-to-date basis, the underwriting gain surged from 149 million to 341 million, resulting from improved underwriting margins. The increase in the underwriting income resulted from two combined effects: (1) steady results from the specialty business and (2) higher margins from both commercial and international insurance divisions.

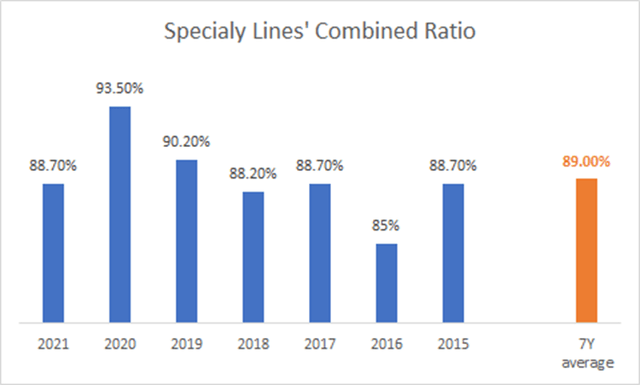

The specialty business remains the cash cow of the company. From 2015 to 2021, the combined ratio was almost always equal to or below 90%. The only exception was 2020, when the company suffered an increase in claims activity due to COVID-19. Although the claims activity was higher in 2020 than in prior years, the combined ratio remained excellent.

Source: Financial Reports (figures aggregated by the author)

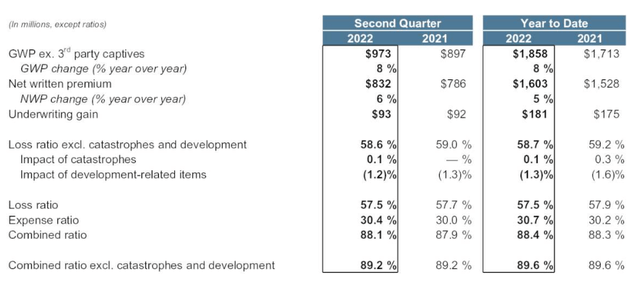

In Q2 2022, the segment delivered steady results, with an underwriting gain of $93 million, resulting from a combined ratio of 88.1%.

The year-to-date combined ratio was almost flat at 88.4%, resulting in an underwriting gain of $181 million vs. $175 million in 06M2021.

Nonetheless, it is not a surprise, as the segment delivers steady and recurring profits. However, the situation improved significantly for the two other business divisions: the commercial business and international activities.

The commercial business recorded a combined ratio of 93.2% vs. 99.6% in Q2 2022.

On a year-to-date basis, the combined ratio dropped by 9.3 points to 93.8%

The main driver of the underwriting margin improvement was the drop in catastrophe losses. Catastrophe losses were $45 million, or 2.4 points of the loss ratio, for the six months ended June 30, 2022, as compared with $166 million, or 9.6 points of the loss ratio, for the six months ended June 30, 2021.

Nonetheless, the underlying loss ratio (excluding catastrophe losses and run-off impact) increased by 1.1 points due to a shift in the business mix associated with the property quota share treaty the company purchased during the second quarter of 2021. The property coverages, which have a lower underlying loss ratio than most other commercial coverages, now represent a smaller proportion of net earned premiums.

In addition, the year-to-to-date expense ratio dropped by 1.5 points to 30.8%, driven by lower acquisition costs and higher net earned premiums partially offset by an increase in underwriting expenses.

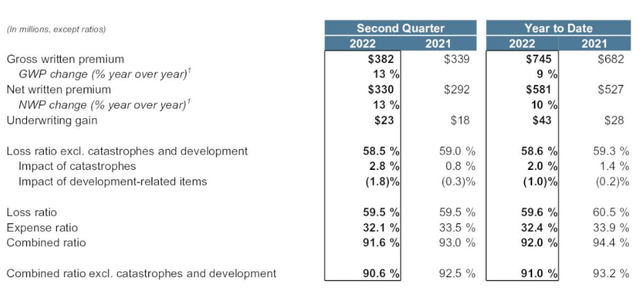

Last but not least, the international activities continued to generate reliable underwriting gains, led by an improvement in both the loss and expense ratio. The combined ratio of 92.0% improved 2.4 points for the six months ended June 30, 2022, as compared with the same period in 2021 due to a 1.5-point improvement in the expense ratio and a 0.9-point improvement in the loss ratio. The improvement in the loss ratio was driven by an improved underlying loss ratio, higher favorable run-off gains partially offset by higher catastrophe losses. Lower acquisition costs drove the improvement in the expense ratio.

With a drop in the year-to-date combined ratio and growth in premiums, the pre-tax underwriting profit almost doubled to $43 million.

Although the segment remains the smallest in turnover, the active de-risking policy will bear its fruits, with higher underwriting gains over the next quarters.

The company remains well-positioned in the specialty market, resulting in strong results from the specialty division. With more robust results recorded in Q1 and Q2 2022, CNA Financial seems well-positioned to deliver higher yearly underwriting results than in 2021.

Living In A Rising Rate Environment

As noted in my previous article, the rising US Treasury rates could significantly change how insurers operate. The search for yield will be less challenging than when the rates were near zero. Insurance carriers can consider rebalancing portfolios, perhaps moving back to traditional investments and relying less on alternative asset classes.

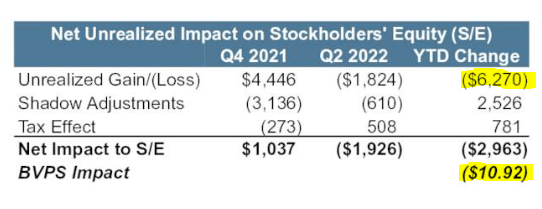

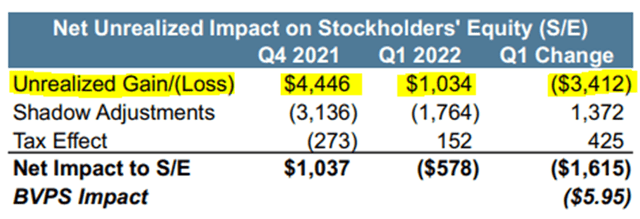

With the increase in the interest rates, the net unrealized investment gain position reduced to $1 billion in Q1 2022, affecting the book value accordingly.

Source: Q1 2022 CNA Financial Presentation

The downward trend continued in Q2 2022, as the company recorded an additional $1.8 billion of unrealized losses, resulting in a further adverse impact of almost $5 per share on the book value per share. For the first six months of the year, the unrealized losses amounted to $6.2 billion, affecting the book value per share (after adjustments and tax effects) by $10.92.

CNA Financial Presentation

Although CNA’s book value has been adversely affected by the changes in the fixed-income market, the insurer might benefit from a higher interest rate environment.

Generally speaking, insurance companies will benefit from rising rates and might be in a position to increase risk premiums for standard products and reinvest the money at a higher yield.

With steady results from the insurance portfolio and the higher financial income expected from the interest rate increase, I expect CNA Financial to continue reporting higher post-tax profits. For loyal shareholders, the higher generated earnings will result in (1) an increase in the quarterly dividend and (2) a special dividend which will be announced during the second half of the year, as the company used to do it every year since 2014.

Be the first to comment