anyaberkut

Once again, a great deal has transpired since my previous Clovis Oncology (NASDAQ:CLVS) article including key updates from Rubraca and FAP-2286. These updates have failed to move the share price against the market-wide selloff, despite their long-term implications for the company. I believe these updates have validated the company’s efforts to expand Rubraca’s label and dive into the targeted radionuclide therapy “TRT” program. Clovis is leaving 2022 with some potent data that could fuel a turnaround in the coming years. Moreover, I believe these updates support the numerous buyout rumors over the years, which have kept the ticker in play and provided great trading opportunities. Now, I am finally adding the “acquisition target” to my CLVS bull thesis.

I intend to review the recent updates and how they bolster the “acquisition target” story. In addition, I will review some of the ticker’s downside risks that investors should be aware of. Finally, I present my game plan for my CLVS position as we close out 2022, which includes applying a lesson learned from the AVEO and GBT buyouts.

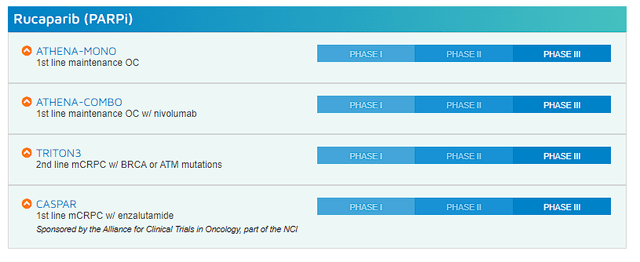

Rubraca in Ovarian Cancer

Rubraca has had a noteworthy year in terms of clinical data. Back in June, Clovis presented Phase III ATHENA-MONO data that emphasized Rubraca’s benefits as a first-line maintenance treatment in “advanced ovarian cancer who previously responded to platinum-based chemotherapy” regardless of BRCA mutation or homologous recombination deficiency “HRD” status. The ATHENA-MONO data confirmed that Rubraca hit its primary endpoint with PFS and ORR being resoundingly superior to the placebo group. Moreover, Rubraca’s safety profile was matched to previous trials.

Not only did Rubraca hit its primary endpoint, but Rubraca was able to show its ability to be operative regardless of BRCA mutations or HRD status. This is critical considering LYNPARZA and ZEJULA have had decent marks in frontline maintenance, but, both have shown fitful results depending on their BRCA mutations or HRD status. So, Rubraca might have the data needed to show it is superior to its competitors.

Recently, Clovis announced that they submitted Rubraca’s sNDA to the FDA and a Type II variation to the EMA for approval in the “first-line maintenance treatment for women with advanced ovarian cancer regardless of biomarker status who have responded to first-line platinum-based chemotherapy.”

Clovis believes that the Rubraca’s PFS results from the Phase III ATHENA-MONO trial support approval. PFS was the primary endpoint for the trial, however, it is important to note that the FDA recommended that Clovis “wait for more mature overall survival data from ATHENA-MONO to submit the sNDA or, if it chooses to submit the sNDA prior to receiving more mature overall survival data, then the sNDA may need to be discussed at an Oncologic Drugs Advisory Committee “ODAC” meeting.” The company also pointed out that the FDA will “consider overall survival data from other rucaparib (Rubraca) clinical trials when it reviews the ATHENA-MONO dataset.”

Rubraca in Prostate Cancer

Clovis also publicized encouraging top-line data from the Phase III TRITON3 trial in mCRPC. The data revealed that Rubraca as a monotherapy was able to hit the primary endpoint of significantly improved radiographic progression-free survival “rPFS”. What is more, Rubraca’s safety profile in the TRITON3 study “was consistent with Rubraca labeling.” Clovis plans to submit the sNDA to the FDA in the first quarter of next year and will target the BRCA subgroup of patients. In addition, Clovis plans to deliberate with the FDA over “submitting for the broader ITT population.”

If approved, Rubraca has the chance to be “the first and only PARP inhibitor that has demonstrated superior radiographic PFS compared to chemotherapy”, which is significant considering that chemotherapy with docetaxel is the longstanding standard of care in this arena. This means that Rubraca might be able to supplant chemotherapy in this setting.

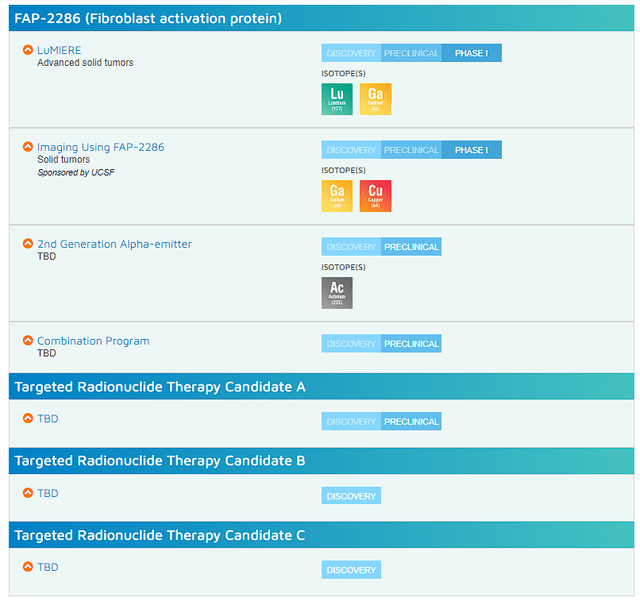

FAP-2286 Showing Promise

Earlier this year, Clovis reported initial data from FAP-2286, their leading targeted radionuclide therapy “TRT” program. The company stated that there was a partial response in a “heavily pre-treated” pseudomyxoma peritonei of an appendiceal patient who completed six rounds of 177Lu-FAP-2286. Furthermore, Clovis publicized that there was a reduction in serum tumor marker carcinoembryonic antigen “CEA”.

Clovis recently announced updated Phase I data from 177Lu-FAP-2286’s Phase I/II LuMIERE clinical study examining the safety, pharmacokinetics, dosimetry, and preliminary anti-tumor activity of the targeted radiotherapy candidate. The updated data revealed that there was “an additional patient with RECIST stable disease through cycle four of treatment.”

So, the updated data supports that 177Lu-FAP-2286 has respectable tumor uptake in a variety of tumor types with sustained tumor retention. Clovis anticipates “additional clinical data from the LuMIERE study to be presented at a medical conference in the first quarter of 2023.” In addition, Clovis is planning Phase II expansion cohorts for 68Ga-FAP-2286 in multiple tumor types to initiate in Q1 of next year.

What is more, Clovis and Isotopia Molecular Imaging declared a two-year clinical supply agreement that provides Clovis with Isotopia’s lutetium-177 “177Lu” for use with FAP-2286. According to the press release,

“177Lu is a beta-emitting radiopharmaceutical precursor with a half-life of 6.7 days. It is used in precision oncology for targeted radionuclide therapy. It has the ability to deliver therapeutically-beneficial radiation precisely to a tumor when bound to disease-specific targeting therapeutics. “

If Clovis is going to maximize FAP-2286 and become the clear leader in targeted radionuclide therapy, they are going to need a long-term supply of high-quality radioisotopes. The agreement with Isotopia bolsters the company’s capability of hitting that objective.

Buying the Buyout Scenario

In my previous CLVS article, I discussed how the recent Rubraca and FAP-2286 data spark buyout rumors including Sanofi (SNY) being a potential suitor. I believed that rumor was credible considering Sanofi was once interested in Tesaro before they were acquired by GSK (GSK). However, I have always seen CLVS buyout rumors to be more of a trading opportunity, rather than something investors should see as a primary component of the bull thesis. This standpoint encouraged me to book profits on spikes in the share price, rather than hoping the buyout rumors were true and the company was going to be acquired at a premium valuation.

Now, I am considering adding the acquisition target component to my bull thesis. The Rubraca and FAP-2286 developments might have potential suitors kicking the tires. In addition, the recent spike in M&A agreements tells us that both buyers and sellers are looking to make deals.

Why Would Clovis Be An Acquisition Target?

First and foremost, Rubraca is already approved and has the potential to significantly improve its label.

Clovis Oncology Rubraca (Rucaparib) (Clovis Oncology)

Admittedly, PARP inhibitors are not living up to the hype they had several years ago, but they still have room to grow and should be useful tools for the foreseeable future. Rubraca’s commercial ceiling might be lower than projected, but that doesn’t mean it doesn’t have value to a potential suitor. Rubraca could be easily imported into almost any oncology portfolio and would provide an instant increase in revenue without the need for an expanded commercial organization. So, any oncology company looking to boost earnings to keep their growth trend on track could see Rubraca as a great fit.

FAP-2286 appears to be operative and could be a trailblazing product in peptide-TRT. What is more, the company appears to be building a vast TRT pipeline that could establish them as a clear leader in this arena.

Clovis Oncology TRT Pipeline (Clovis Oncology)

One might not think that a type of radiation therapy is cutting-edge and will not attract interest from a suitor, but the fact remains that radiation therapy is still a backbone roughly half of all patients receive as one of their treatment options. It is possible that TRT is able to replace traditional radiation therapy treatments, which could be a massive commercial opportunity. Again, Clovis is essentially one of the frontrunners in this arena, so it would make sense for them to be an acquisition target.

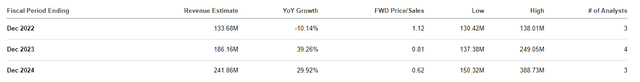

Another factor to consider is the company’s valuations and share price performance. The company is projected to pull in $133.68M this year, which is roughly a 1x price-to-sales. The industry’s average price-to-sales is historically about 5x, so we can say CLVS is trading at a discount for its revenue.

Clovis Revenue Estimates (Seeking Alpha)

A potential suitor could offer a relatively low buyout price of $5 per share and it could still be a discount just for Rubraca’s revenues.

Perhaps most importantly, Clovis is in such a weakened financial position that they should be looking to sell. The company had $94.6M in cash and cash equivalents at the end of Q2, which was down from $143.4M in Q1. That level of cash burn is alarming, so we can’t expect that cash position to last into 2023. What is more, the company has $668.38M in total debt that is looking to be overwhelming when the company is only estimated to pull in approximately $138M this year. Yes, Clovis is expected to report respectable growth in the coming years, but the cost of Rubraca’s efforts and the acceleration of the TRT programs is going to chew through that cash. A potential buyer is probably doing the math and realizes they can get CLVS at a discount.

Certainly, we don’t know if CLVS will receive a buyout offer and if the company will accept the terms. However, the company’s assets have value, the market environment is producing M&A deals, and the company is limping along financially… the conditions are favorable for Clovis to accept a deal. Therefore, I am finally considering a CLVS buyout to be part of my long-term bull thesis, rather than just a trading opportunity.

Downside Risks to the Buyout Thesis

Adding a buyout scenario to your bull thesis does come with some downside risks that can quickly wreck the chances of the company being acquired. First of all, the company’s finances are a major concern, which will most likely continue to wreak havoc on the share price until it is addressed. A potential suitor might see this as leverage in negotiations for a better price as the company continues to run on fumes.

Another risk to the buyout thesis is the economic environment. Indeed, M&A activity appears to be elevated at this time, but that might change if the global economy makes a turn for the worse and potential suitors need to conserve their cash reserves.

Last but not least, there is always the risk management does not want to sell, or they are holding out for a better valuation. It has been rumored that Clovis has been a potential acquisition target multiple times over the past several years at much higher valuations. I believe the company is in a better position now than they were a few years ago, so it is possible management is not going to sell because they believe the company is close to making a turnaround.

All these risks make a buyout-centric thesis very fragile, so investors need to be prepared for disappointment. It is conceivable that Clovis does not take a deal and the share price continues to disintegrate along with shareholder value.

For me, I am simply adding the potential of a buyout to my original thesis which is centered on the ticker being undervalued with a potential for a turnaround in the coming years. However, I cannot let the addition of the buyout scenario cloud my judgment and coerce me into amassing an oversized position or preventing me from booking profits in hopes the buyout is just around the corner.

How Does This Change My Strategy?

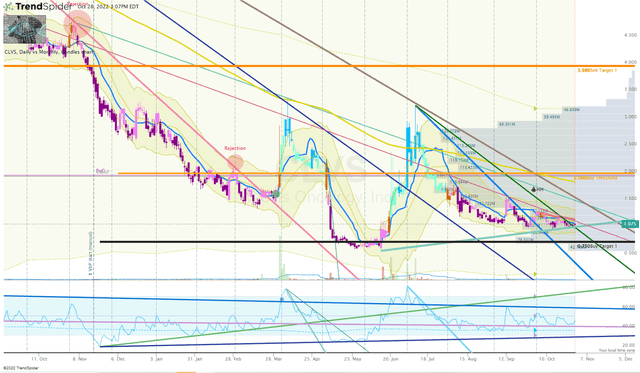

As I mentioned in my previous CLVS article, I took advantage of the excessive selloff and was able to get my cost average under $1 per share and was looking to book profits to get my position back in the “house money” state. However, the CLVS Daily Chart was presenting several bullish signals that indicated we could have seen a long-term bottom, and decided to hold onto my position until CLVS hit my Sell Targets.

CLVS Daily Chart (Trendspider)

CLVS Daily Chart Enhanced View (Trendspider)

My strategy was to obtain a house money position by the time the share price hits my second Sell Target, thus, de-risking the position and permitting me to hold a generous position for the long term.

Now, I am still looking to get the position to “house money”, however, I am not looking to book additional profits. Instead, I will be holding onto those remaining shares for a long-term position just in case the company decides to take a deal.

Another adjustment of note is that I am not going to set any sell limit orders and will set alerts for those target prices in order to execute human-instructed trades. This way, I will be able to avoid selling at a lower price if there is a spike in the share price due to a buyout or some speculation. This was a lesson learned from AVEO and GBT buyout announcements.

Regardless of a buyout, I am still planning on maintaining a CLVS position for at least five more years in anticipation that the company will finally start to maximize Rubraca’s potential and will be considered a trailblazer in TRT.

Be the first to comment