Steve Jennings

Cloudflare (NYSE:NET) is down a lot from all-time highs, but is still trading much more richly than tech peers. There’s a good reason for that: this is a company that executed strongly before, during, and after the pandemic – and continues to execute strongly now even as it laps tough comparables and faces macro headwinds. There is a saying that the business is more important than management – NET’s management team is nothing short of stellar but its underlying business is mission critical and offers an investment on the direct growth of the fast internet. NET remains highly buyable here for any high-quality tech allocation and I look forward to what I think will be phenomenal returns over the long term.

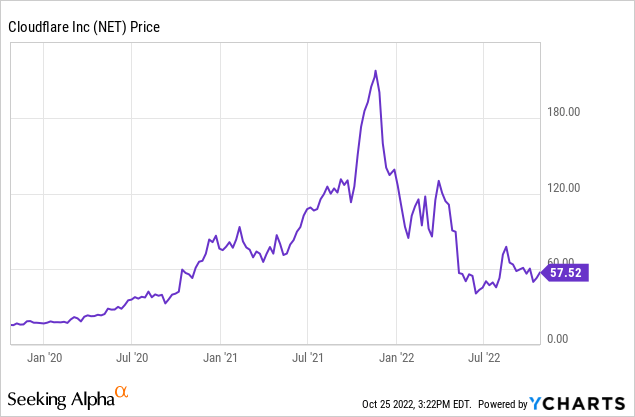

NET Stock Price

NET peaked at around $220 per share in late 2021 but has since fallen over 70%. The stock now trades lower than it did at the end of 2020.

I last covered NET in May where I discussed why the stock was a buy after delivering strong results amidst extremely bearish sentiment in the tech sector. The stock now trades around where it did prior to that earnings report, offering investors another opportunity to add this high-quality name to their portfolios.

NET Stock Key Metrics

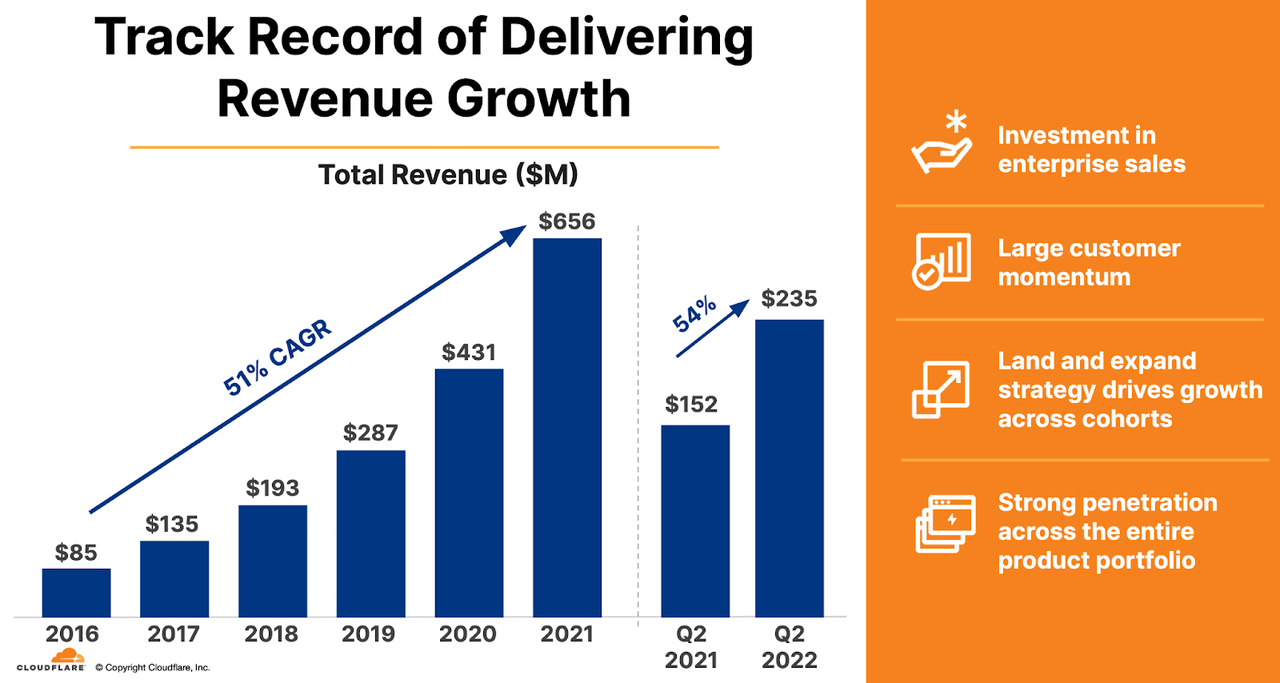

NET delivered 54% revenue growth in the latest quarter. That is especially impressive considering that it grew revenues by 52% in 2021 and 50.1% in 2020. While most companies are showing significant deceleration due to tough pandemic comparables, NET has somehow managed to sustain or even accelerate growth rates.

2022 Q2 Presentation

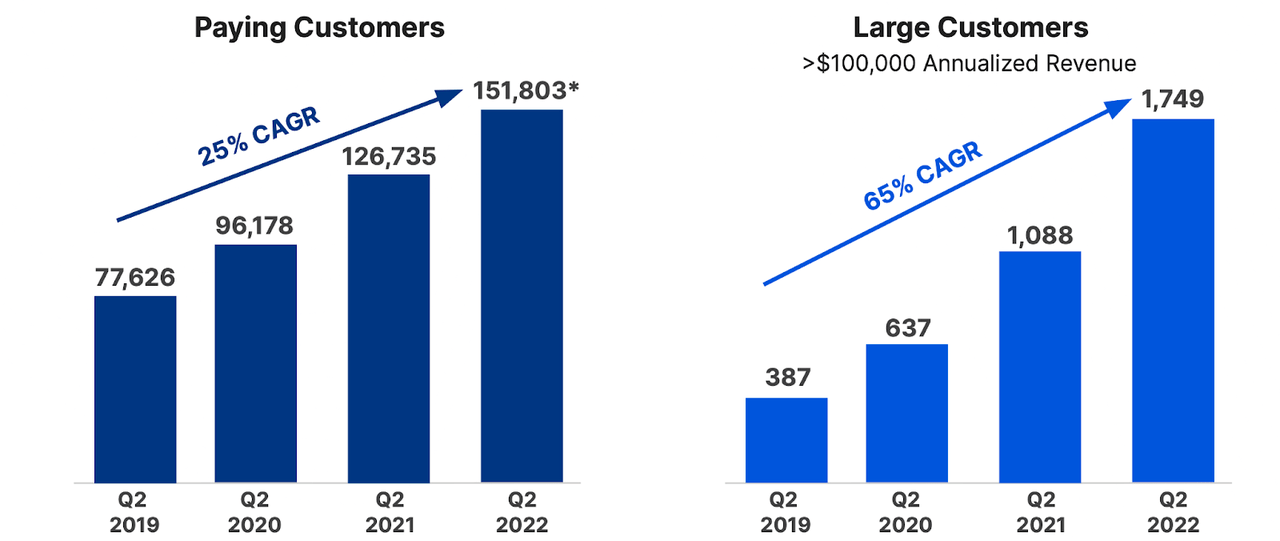

NET grew paying customers by 25% with strong 65% growth in its largest customers.

2022 Q2 Presentation

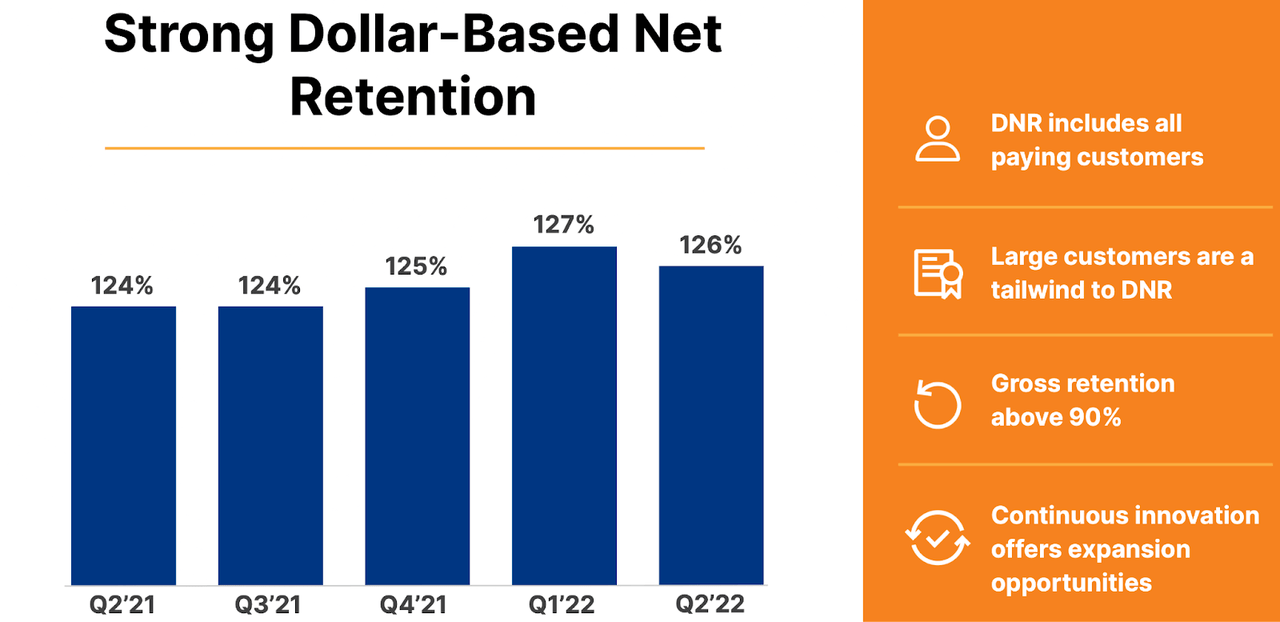

The company realized a 126% dollar-based net retention rate – a solid result which underscores the company’s ability to earn more from existing customers.

2022 Q2 Presentation

Seriously, that is a strong result. But on the conference call, CEO Matthew Prince surprisingly stated the following:

While there may be some noise in this number from quarter-to-quarter, we won’t be satisfied until it’s above 130% and best of breed among the companies we consider peers.

There is every reason to be counting on growth to implode here – tough comparables, inflation, and not to mention the rich valuation. But that just isn’t happening here – the strong customer growth coupled with high retention rates make me confident that this is a company that can sustain high growth rates even in a market that has lost trust in tech stocks overall.

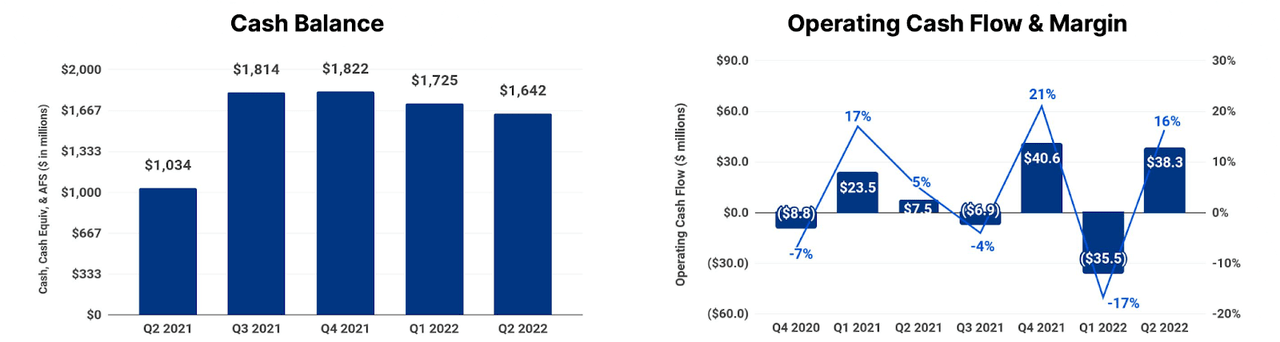

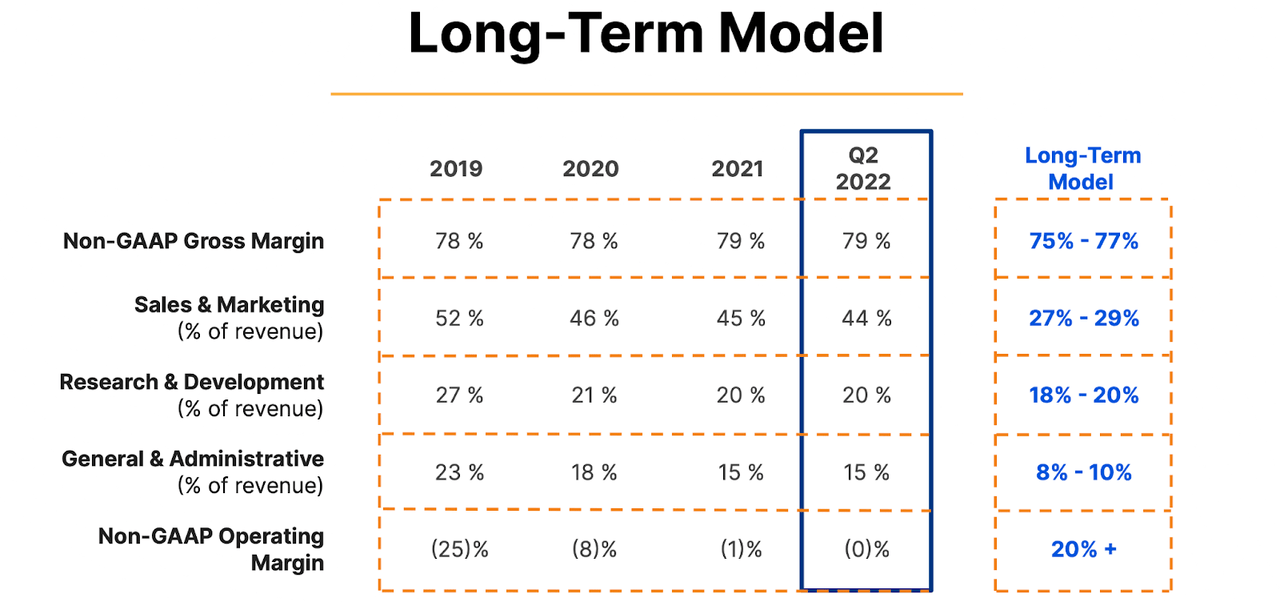

NET ended the quarter with $1.6 billion of cash versus $1.4 billion of convertible notes. $1.3 billion of those notes carry a 0% interest rate, matures in 2026, and converts at $250.94 per share (net of capped call transactions). That strong balance sheet is paired with a solid margin profile. NET achieved a negative 2% free cash flow margin in the quarter.

2022 Q2 Presentation

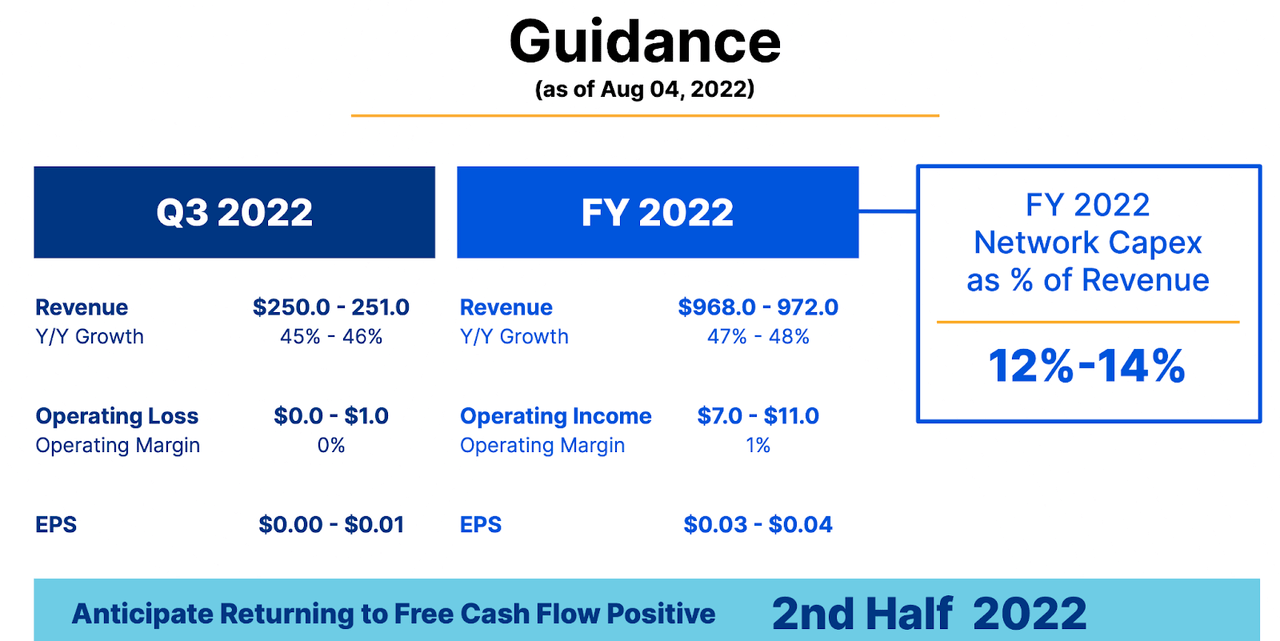

NET expects free cash flow to be positive in the second half of 2022 – appeasing investors who have suddenly focused squarely on profitability. For the remaining investors who still care about growth, NET has guided for up to 46% revenue growth in the next quarter and 41.7% revenue growth in the fourth quarter. I note that full-year guidance of up to $972 million in revenue is an increase from prior guidance of up to $959 million in revenue (and that was an increase from initial guidance of up to $931 million in revenue).

2022 Q2 Presentation

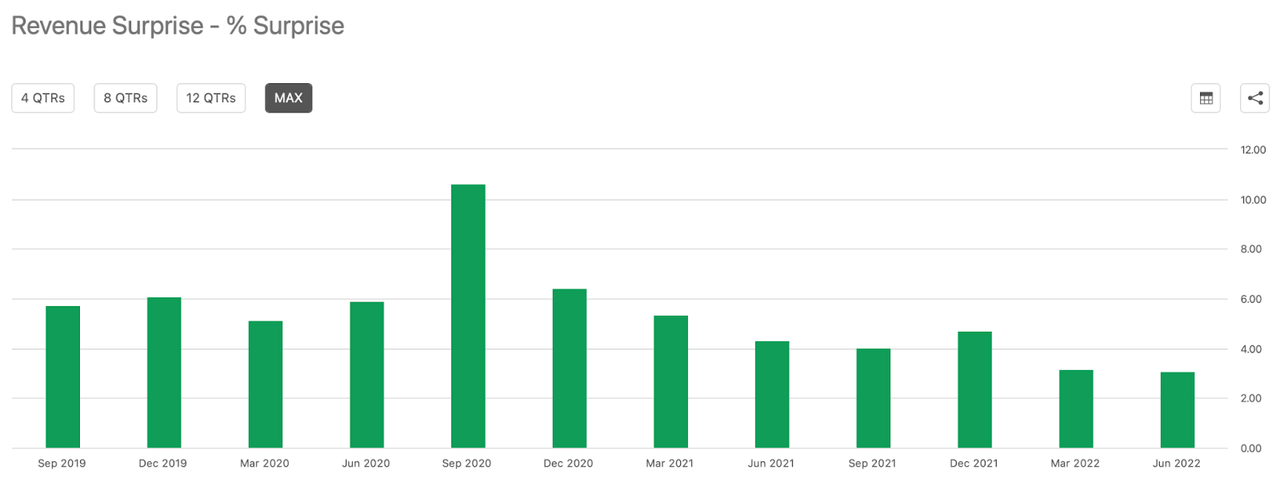

Based on the company’s history of beating on revenue estimates, I expect that guidance to prove conservative.

Seeking Alpha

Is NET Stock A Buy, Sell, or Hold?

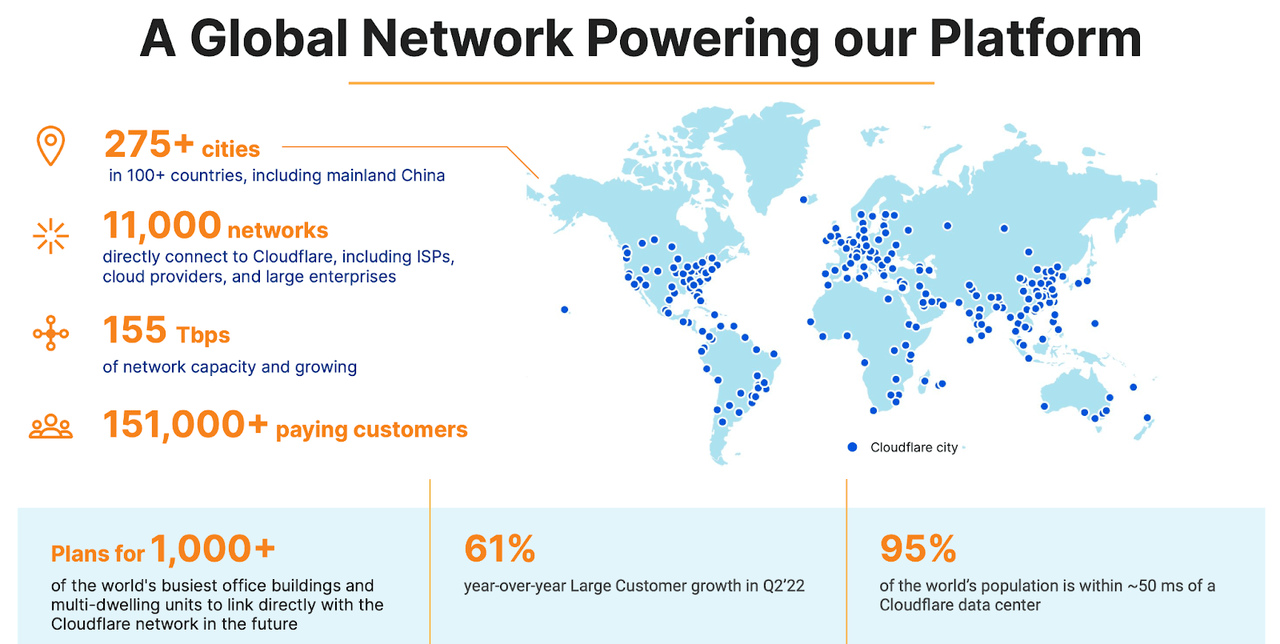

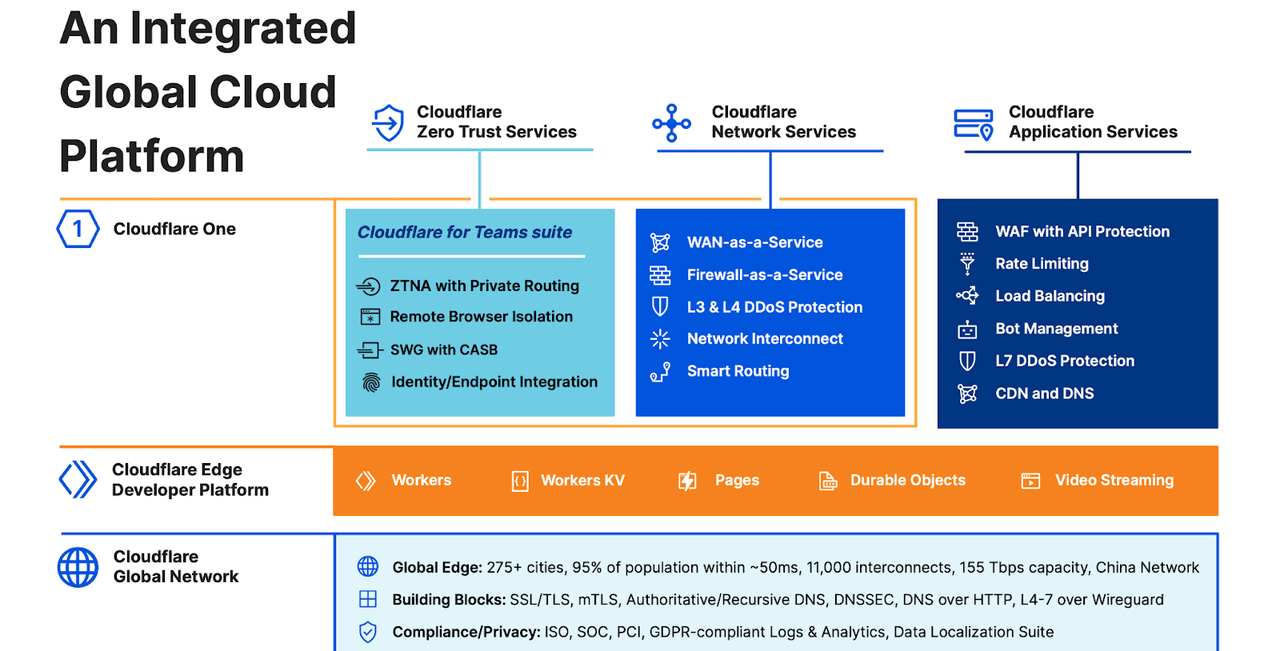

NET remains a compelling investment on the growth of the internet or more specifically, a faster and more secure internet. NET is a content delivery network (‘CDN’). Have you ever found that internet content (like images, text) on some websites load faster than others, even on the same internet network? The reason for the discrepancy is that the faster website is likely a customer of NET. NET operates a network of proxy servers and data centers in over 275 cities in over 100 countries – the general idea is that it brings the content closer to the end-user. Because NET has such a wide network, more of the globe has access to the faster internet.

2022 Q2 Presentation

NET is the biggest CDN by customer count – more customers gives NET the resources to build a wider network. A wider network in turn leads to more consistently fast internet and more customers. This is a positive feedback loop which makes me believe that this will eventually be a “winner takes most” kind of market.

The core investment thesis here is that after NET brings in customers for the faster internet, it can cross-sell cybersecurity products to protect the data.

2022 Q2 Presentation

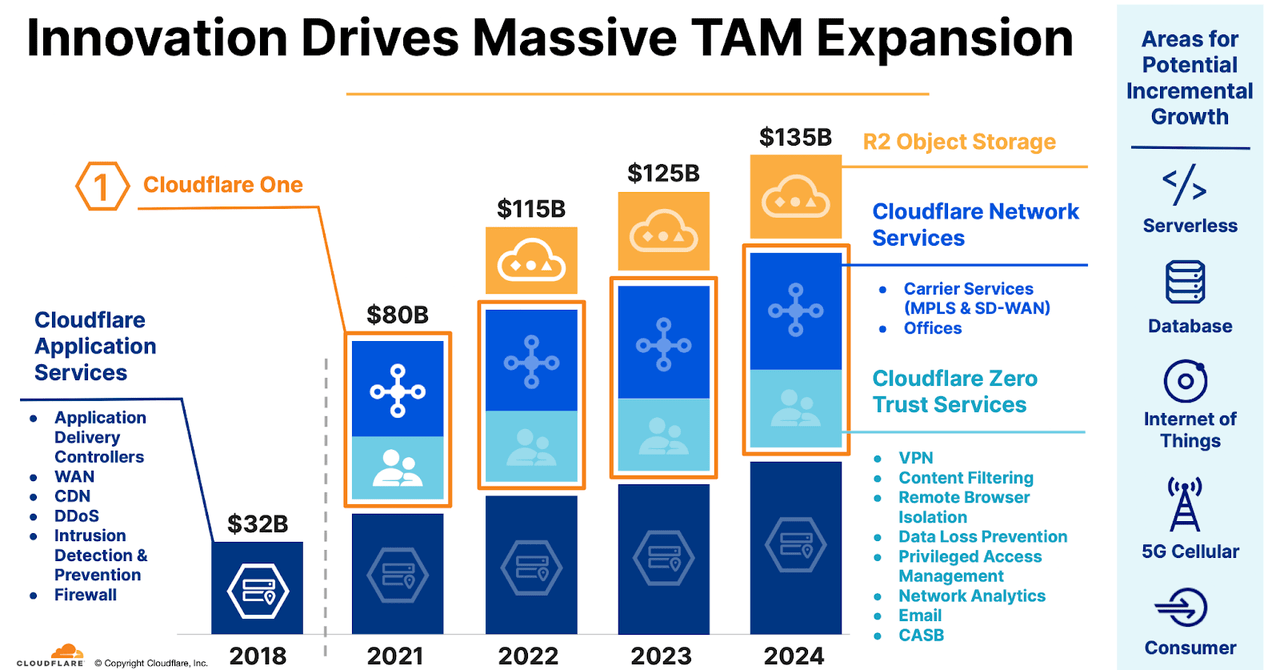

Investors have soured on total addressable market (‘TAM’) discussions as of late, but we can see below for an idea of how much the additional products help to increase its growth trajectory.

2022 Q2 Presentation

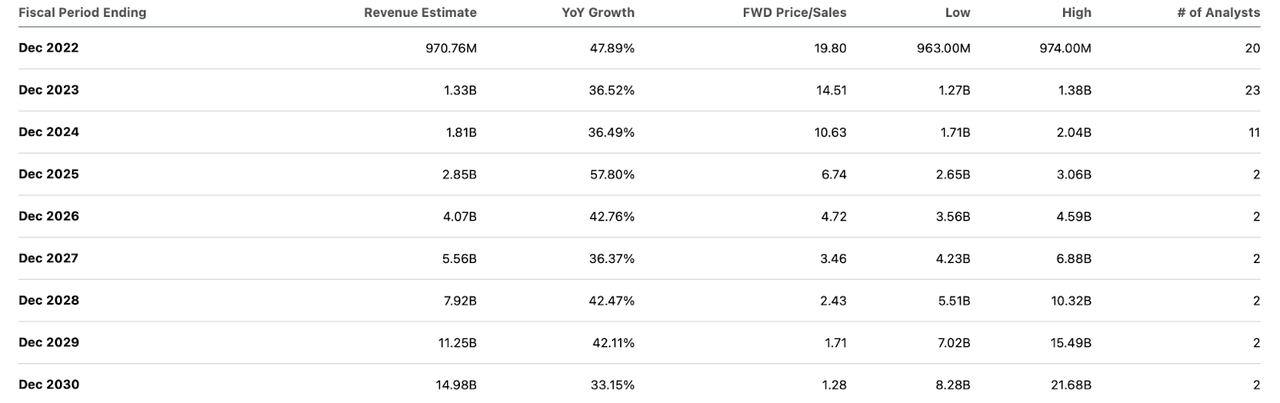

Unfortunately, NET is not one of the many tech stocks to see their valuations pulverized amidst the tech crash. Sure, the stock has fallen dramatically, but it was previously trading at bubbly valuations. NET is trading at around 20x this year’s revenue estimates.

Seeking Alpha

That is the kind of valuation that I might have balked at even prior to this crash. But NET has won me over through its strong execution and I am now of the view that this is a company that can sustain elevated growth for years to come. Consensus estimates might prove optimistic but I can see this company sustaining at least 35% growth over the next 5 years. The company has guided for 20% non-GAAP operating margins over the long term.

2022 Q2 Presentation

I expect that to prove woefully conservative due to the long growth runway of this company. Nonetheless, assuming 20% long term net margins, 30% growth, and a 1.5x price to earnings growth ratio (‘PEG ratio’), I can see NET trading at 9x sales in 2027 (again assuming just 35% annual growth through 2027). That represents a stock price of $120 per share, or 14% compounded annual upside over the next 5 years. I expect returns to be far stronger as this is a name that deserves a 2x to 2.5x PEG ratio and growth rates may be much stronger than projected.

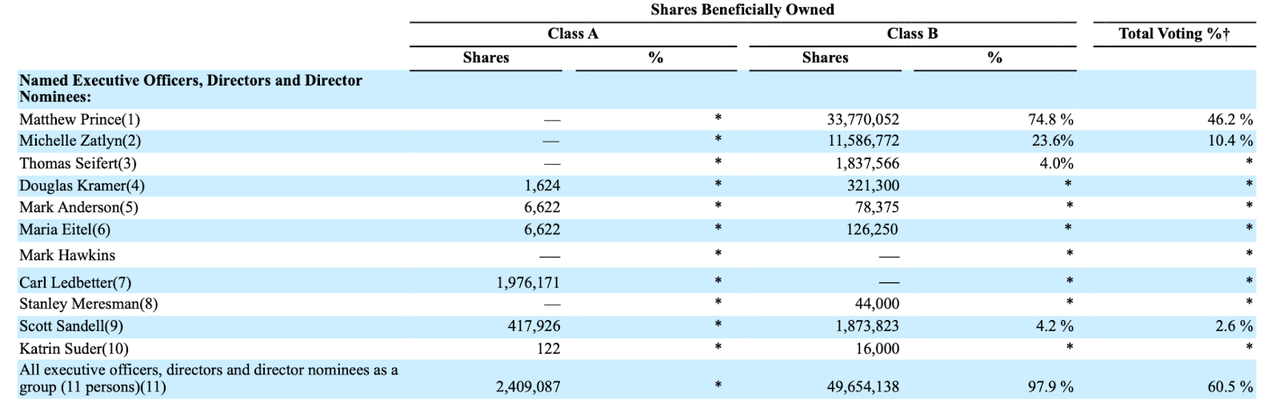

Another thing to consider is that insiders have great “skin in the game.” CEO Matthew Prince owns over 30 million shares (worth around $2 billion as of current prices), COO Michelle Zatlyn owns 11 million shares (worth around $700 million) and insiders collectively own around 15% of outstanding shares.

2022 DEF14A

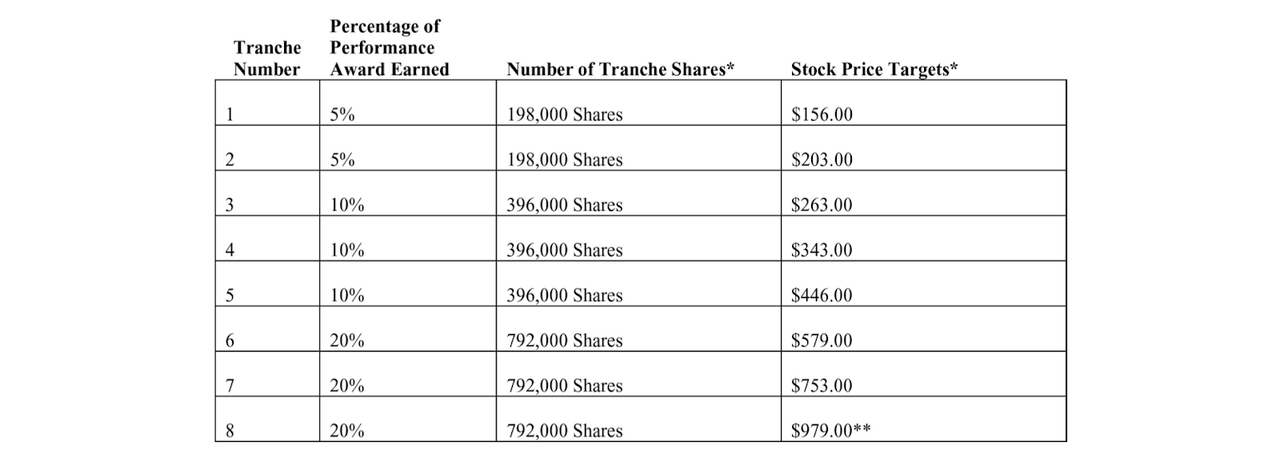

That’s not all. Both CEO Matthew Prince and COO Michelle Zatlyn were awarded performance incentive compensation at the end of 2021 which contains stock that vests in several tranches (and expires in a decade) – you can see the stock price targets below.

2022 DEF14A

The weighted average target price is $585 per share, representing over 800% upside over the next decade. How realistic is that? Consider that if NET averages 28% compounded growth over the next 10 years and sees its multiple contract to 13x sales, then the stock would have returned 800%.

What are the key risks here? Probably valuation. It is possible that this is a “too good to be true” story and growth is set to crumble at any moment. Management’s confidence might prove to be either foolishness or deceptiveness – time will tell. There is also the risk of a cybersecurity attack which negatively impairs its reputation and long-term growth trajectory. Those risks considered, I view the company as having less business risk in spite of the lack of GAAP profits because secular trends point to a faster internet, not a slower one. As I discussed with subscribers of Best of Breed Growth Stocks, a diversified basket of beaten down tech stocks may be the perfect strategy in the current environment. NET fits the bill as part of the higher quality allocation in that basket. I rate NET a buy as a high-quality pick in the tech sector.

Be the first to comment