Sundry Photography

Thesis

We urged investors to be wary about chasing the dip in Cloudflare, Inc. (NYSE:NET) in late September, as its valuation remained overly-aggressive, heading into a potential recession.

Accordingly, NET has fallen nearly 17% since our previous update, relative to the S&P 500’s (SPX) (SP500) 7% uptick. As such, NET has underperformed the broad market, as cloud-native software stocks come under further pressure as the enterprise spending environment weakened further.

Given Cloudflare’s weak profitability and an increasingly tenuous macro backdrop, we believe a near-term re-rating seems increasingly unlikely. The market has hammered NET in 2022, given its unsustainable valuation premium driven by the pandemic-induced craze.

Despite that, NET’s all-time total return CAGR of 33.5% since its IPO in 2019 suggests it remains a solid winner for early investors. Therefore, despite its YTD total return of -65.4%, it merely represented a significant pullback for these investors.

Notwithstanding, we discuss why we are constructive on the deep pullback from NET’s August highs (down nearly 45%). While the opportunity remains highly speculative, we view the reward/risk as more attractive at these levels.

However, investors are reminded to apply appropriate risk management plans if they decide to add exposure, as NET’s valuation remains aggressively configured.

Revising from Hold to Speculative Buy with a medium-term price target (PT) of $60 (implying a potential upside of 32%).

NET: The Market Only Wants To Hear Significant Outperformance

With Cloudflare stock down nearly 45% from its August highs, it’s clear that the market had anticipated a relatively tepid Q3 earnings release from Cloudflare.

Citi (C) analysts even shot down the release as “insufficient oomph for this multiple,” as the market certainly had the right to expect more. Therefore, we postulate that the market needed a confidence booster from CEO Matthew Prince and his team.

But, management reiterated macro risks several times in its earnings commentary, as an elongated sales cycle impacted its ability to win deals expeditiously. The company even added the risk factor into its quarterly filings, suggesting that the macro environment remains a significant impediment to its sales cadence.

While the company brought in a new Sales lead as it works toward its $5B revenue target, we believe the market needed more clarity and assurance on the company’s execution through the cycle.

Why? Because NET is not a cheap stock. There’s no margin for error, and the market will likely not entertain any perceived weakness.

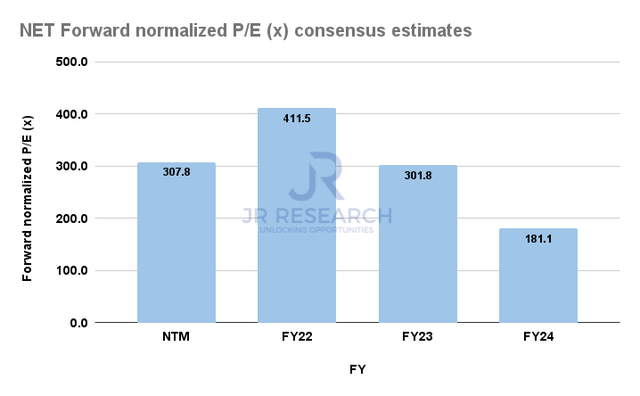

NET Forward normalized P/E consensus estimates (S&P Cap IQ)

We believe it’s clear that NET’s forward P/E remains highly aggressive, despite its steep pullback from its November 2021 highs. As seen above, NET last traded at an NTM normalized P/E of 308x. Even if we move forward, its FY24 normalized P/E of 181x remains highly expensive.

Relative to its SaaS peers’ forward P/E of 28x, it’s easy to understand why the market expects nothing but perfect execution quarter after quarter from Cloudflare.

Hence, we believe the market didn’t buy into management’s argument that it proffered caution over macro headwinds since Q1’22, as CEO Matthew Price articulated:

I think we have been consistent in talking about the macro pressures now for the last three quarters. But generally, the overall macro environment hasn’t changed substantially throughout this entire year based on what we’re seeing. And so I want to make it clear that we’re not saying that we’re seeing a big change. We have seen that there was softness in the macro economy since Q1, and we’ve been talking about it since Q1. (Cloudflare FQ3’22 earnings call)

But A Speculative Opportunity Emerged

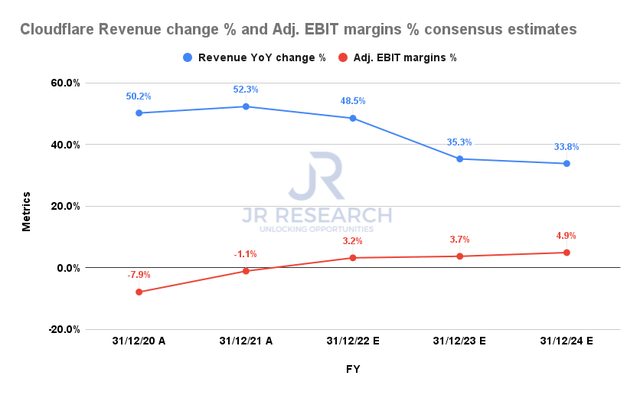

Cloudflare Revenue change % and Adjusted EBIT margins % consensus estimates (S&P Cap IQ)

Based on management’s Q4 outlook, Cloudflare is still expected to post revenue growth of 48.6% in FY22, well above the revised SaaS industry average of a 15.7% uptick. Also, it should mark another FY of improving operating leverage with an adjusted EBIT margin of 3.2%.

Notwithstanding, we believe the consensus estimates for FY23 have likely been marked down significantly, as Wall Street analysts expect just 35.3% revenue growth. Coupled with projected free cash flow (FCF) margins of about 2% in FY23, Cloudflare could fail to meet the rule of 40 metric in the next FY.

However, Prince also highlighted that he’s fond of the metric and uses that as a critical benchmark to assess the company’s performance. Prince accentuated:

I’ve always personally kind of found the sort of idea of the Rule of 40 to be pretty compelling. And so I think that we like that. If we’re growing north of 40%, then I think that’s showing that we can continue to execute and deliver on the enormous opportunity that we have ahead. (Cloudflare earnings)

Hence, we believe that the consensus estimates have likely baked in significant pessimism, lowering the bar for Cloudflare to outperform to the upside. As such, we believe it positions NET constructively for a re-rating if the company executes better than expected.

However, the critical question remains whether the market supports NET’s bottoming process at the current levels.

Is NET Stock A Buy, Sell, Or Hold?

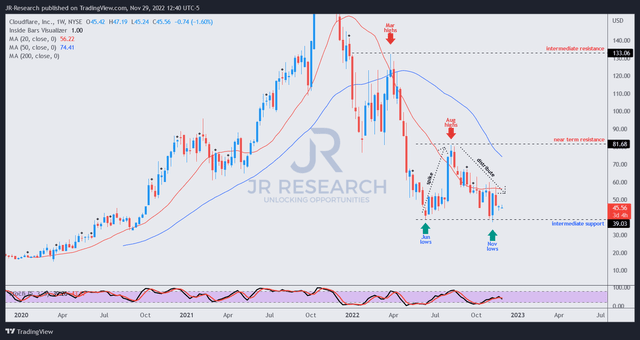

NET price chart (weekly) (TradingView)

As seen above, the bears have astutely distributed NET’s sharp spike toward its August highs over the past three months.

Hence, patient investors waiting for an opportunity to strike can assess whether they believe NET could potentially bottom close to its June lows.

We postulate that the bullish reversal that formed its November low seems robust. As such, NET appears likely to have formed its near-term bottom in November, bolstered by June lows, corroborating the strength of buyers close to these levels.

As such, we believe the opportunity to add exposure at the current levels is constructive.

Revising from Hold to Speculative Buy with a medium-term PT of $60.

Be the first to comment