zoranm/E+ via Getty Images

Investment thesis

Clorox’s (NYSE:CLX) revenues, while steadily growing over the past 11 years, have stalled due to recent inflationary pressures and reduced demand for cleaning products. I personally believe Clorox will solve these problems, but I don’t feel confident enough right now to consider this company a buy.

The reliability of Clorox’s dividend is out of the question since the company has been issuing a growing dividend since 1978, however in the last year deteriorating earnings have brought the payout ratio momentarily above 100%.

Being a very solid business and in a saturated market, the risks of an investment in Clorox are relatively low, but consequently so are the profit opportunities.

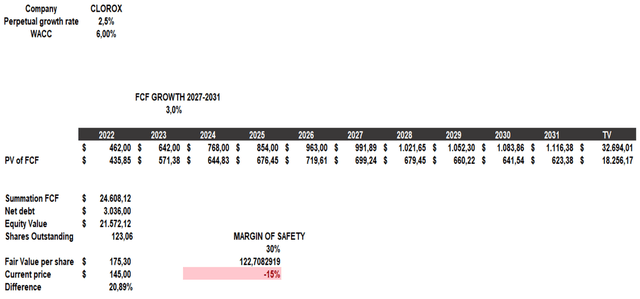

Using a discounted cash flow model with a 30% margin of safety, Clorox has a fair value of $122.70, so it is overvalued by 15%.

Personally I would only consider a purchase around $122, but if I already owned it I would not sell it as I believe in its long-term potential. This is a defensive company that with its growing dividend can provide a slow but stable return over time.

For all these reasons I believe Clorox is a hold, and if it reaches $122 a buy.

Business core and strategy

Clorox’s competitive advantage has depended on the popularity of its brands and the economies of scale that allow the company to market huge quantities of their products at an advantageous cost. In fact, to date, the company is able to operate in more than 25 countries and sell its products in more than 100 markets.

The most popular Clorox brands (The Clorox Company 2021 Integrated Annual Report)

Currently, Clorox’s core business is divided into 4 main segments:

- Health and Wellness: Consists of the offering of cleaning products, vitamins, minerals, and supplements marketed in the United States. Accounting for 38% of revenues, this segment is by far the largest, and includes brands such as Clorox, Pine-Sol, Formula 409 and RenewLife.

- Household: Consists of cat litter, enclosures, and grilling products. This segment accounts for 25% of revenues, and contains brands such as Fresh Step, Glad and Kingsford.

- Lifestyle: Consists of product offerings related to personal body care, water filtration and food seasonings. This segment currently has a 19% weight on revenues, and contains brands such as Hidden Valley, Burt’s Bees and Brita.

- International: This segment has a weight of 18% on total revenues and consists of product offerings outside of the United States. The brands that make up this segment are the same as those sold in the United States.

Overall, from what we can see, The Clorox Company presents a wide range of brands that make the company’s business quite diversified. This diversification, combined with the constant demand for its products because they are needed in everyday life, make Clorox’s core business very solid. Personally, thanks to its continuity of revenues and dividends, I consider this company among the most reliable in the consumer staples industry.

Speaking of corporate strategy, it is also worth mentioning the so-called Ignite Strategy. This is a strategy drawn up by Clorox in 2019 that presents various medium to long term economic, social, and environmental goals.

Regarding the economic goals, the company has set to improve net sales between 3% and 5% per year, as well as improve EBIT margin between 25 and 50 basis points. In addition, the last economic goal concerns the improvement of the free cash flow margin that must reach a value between 11% and 13%.

Regarding ESG goals, the most relevant are to maintain the recordable incident rate < 1, to sell 100% recyclable packaging by 2025, and to reduce the use of plastic by 50% by 2030.

After understanding what Clorox’s core business is about, it’s time to understand how profitable this company is.

Clorox from an income standpoint

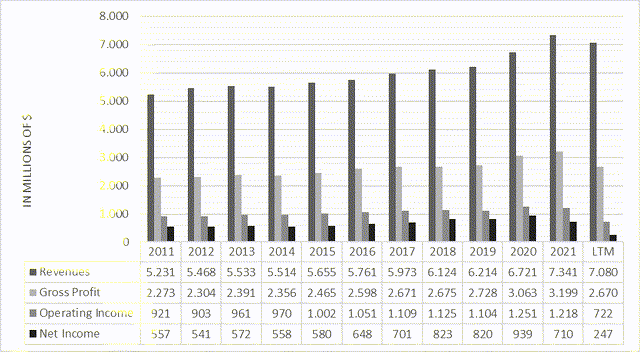

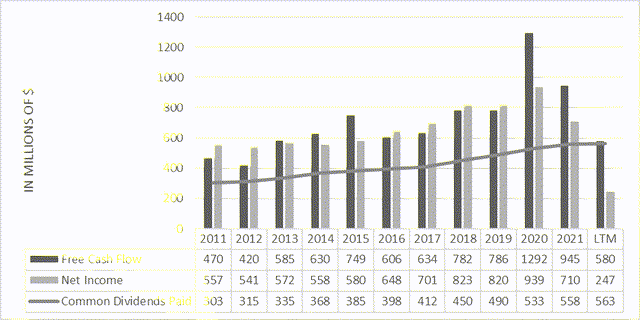

Income Statement 2011- LTM (TIKR Terminal )

The chart above shows what Clorox’s income values have been over the past eleven years. There are two aspects I would like to mention regarding this chart.

The first aspect concerns the continuity of revenues and profits: even if from one year to the next there have not been marked improvements, the long-term trend is always upward. Being a company that sells products necessary to everyday life, the solidity of revenues makes Clorox a company resilient to almost any economic context.

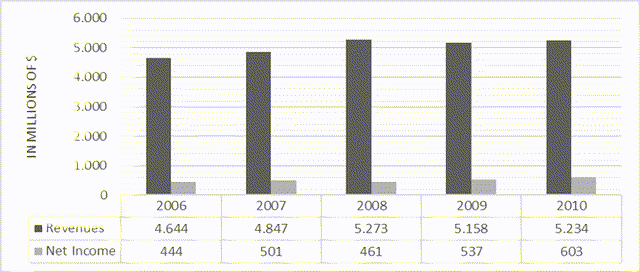

As we can see from the chart below, even during the financial crisis of 2008 Clorox’s profits continued to grow year after year, despite the world economy being in a recession.

Income Statement 2006-2010 (TIKR Terminal )

As a second main point, I would like to highlight what has been happening in the last 2 years to Clorox’s profitability: In 2020 and 2021 revenues have increased much faster than in previous years.

The reason why the company has had a significant increase in revenues in the last two years is related to the increase in demand for cleaning products.

The pandemic due to COVID-19 resulted in a significant increase in products to sanitize and sterilize our environment, and this resulted in a significant increase in demand for Clorox’s products. As a result of this increase in demand, Clorox’s price per share increased 54% between March 2020 and August 2020 to $239.87. However, from August 2020 to now, the price per share has plummeted over 40% to $145 per share. Why did this happen? The two tables below will answer this question.

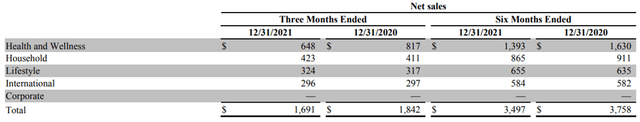

2020-2021 Net Sales (Last Quarterly Report )

In the final six and three months of 2021, net sales from the Health and Wellness segment decreased significantly compared to 2020. Although net sales from the other segments remained stable, this was not enough to avoid a $261 million reduction in net sales between the last six months of 2020 and the last six months of 2021.

The reason for the reduction in net sales is primarily due to two factors.

The first factor relates to reduced demand for products in the health and wellness sector. Thanks to vaccines today the pandemic is no longer a problem as it was in 2020, so the previous increase in demand for cleaning products has been decreasing month by month until it has reached a demand like the pre-pandemic one.

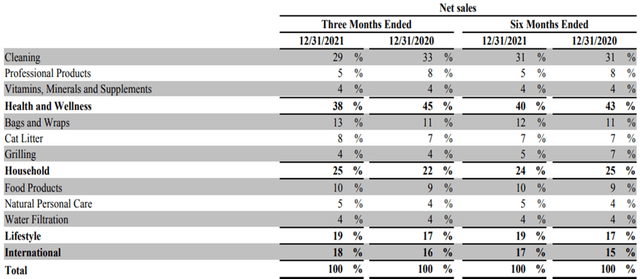

In the table below, in fact, the Health and Wellness sector has had a significant reduction in terms of importance in total net sales. At the end of 2020 it was responsible for almost half of all net sales; to date it has fallen by 7% and could continue to fall in the future.

2020-2021 Net Sales % (Last Quarterly Report )

The second major factor, according to the company, is the considerable increase in costs for manufacturing and marketing products. The recent inflationary spiral has led to a significant increase in raw materials and logistics costs, all of which have increased Clorox’s total costs. Taken together, these two factors have had a double negative effect on Clorox: a reduction in revenues and an increase in costs. Despite the recent difficulties, however, I believe Clorox’s profitability has not been compromised and will return to growth. As a company with a competitive advantage and selling essential goods, if profit margins were to shrink further due to the inflationary spiral, it is likely that there will be an increase in the prices of goods sold in the future. Also, the recent reduction in demand for cleaning products I believe should be understood more as “a return to the ordinary” rather than a negative event for the company, since the previous increase was achieved by an extraordinary occurrence. Finally, I think the drop of over 40% from all-time highs is justified, since the company was overvalued quite a bit in August 2020. The pandemic had a temporary positive effect on Clorox’s revenues, but that did not justify a 54% increase in the stock price.

Dividend sustainability

Clorox’s dividend is definitely one of its strengths.

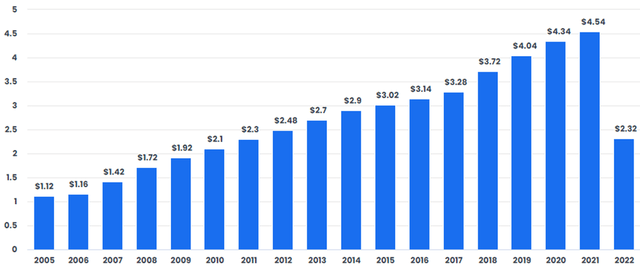

Having consistent and growing revenues over the long term, Clorox has been able to issue a dividend that has been increasing year after year since 1978. The chart below shows the amount distributed to shareholders for each share purchased since 2005. Not even the financial crisis of 2008 has stopped Clorox from increasing its dividend.

(Obviously, the 2022 value is low because not all dividends have already been issued this year).

Dividend growth since 2005 (The Clorox Company)

By analyzing the dividend in detail, we can also observe the sustainability of this dividend.

Dividend sustainability (TIKR Terminal )

From 2011 to 2021, the dividend issued was always lower than both net income and free cash flow. The only exception is the last 12 months where the dividend issued exceeded net income, but not free cash flow.

I do not personally believe that the result of the last 12 months will jeopardize the increase in dividends in the coming years since this is a temporary difficulty. Reaching a net income of $820 million as in 2019 the company still has room for dividend growth.

Risks and opportunities for Clorox

Although I consider the risks related to an investment in Clorox rather low compared to the market average, it is worth pointing them out in any case.

The first risk concerns the recent economic difficulties related to the increase in prices of raw materials and logistics. The inflationary spiral we are observing is no longer considered temporary, and we cannot know how long it will last and especially if it will get worse. If Clorox were to raise the selling price of its products but fail to gain customer acceptance, we can expect difficult years ahead for this company.

The reduction in revenues due to reduced demand for cleaning goods may not have been fully discounted yet, and this could lead to a further decline in revenues in upcoming quarters.

A final risk, perhaps the most important, is related to the failure to meet the ESG goals set out in the Ignite Strategy.

The company has noted that the increase in demand for products with lower environmental impact is increasing more than the company has planned through its past investments. While this may be an opportunity to increase sales of those products, there is a risk that there is not enough supply, so significant investment will be needed over the next 5-10 years to expand production.

Finally, the last point I want to address is an opportunity rather than a risk.

Climate change triggered by emitted pollution is leading to an acceleration in the spread of infectious diseases, animal-borne diseases, and the spread of dormant viruses through thawing permafrost. Of course, no one wishes for these viruses and diseases to be spread worldwide, however these are the facts, and the advent of new pandemics is not unlikely.

Clorox is a company that has already proven to perform well in such contexts since its cleaning and disinfection products were in high demand when the panic over Covid-19 had reached its peak. This doesn’t mean that to invest in Clorox you have to hope for a new pandemic (that would be absurd), but it does mean that if a new scenario arises where cleaning and disinfection products are highly demanded, we know that Clorox will perform well.

How much is Clorox worth?

Every investment is the present value of the future cash flow; therefore, the valuation of Clorox will be conducted through a discounted cash flow model. This model will be constructed as follows:

- Perpetual growth rate of 2.5% based on the average of the world’s annual GDP growth and the average level of inflation over the long term.

- WACC represents Clorox’s weighted average cost of capital.

- Free cash flow values included from 2022 to 2026 represent TIKR Terminal analysts’ estimates.

- The free cash flow growth estimate from 2027 to 2031 is 3%. I used the minimum growth rate expected by the company relative to net sales.

- The values of the outstanding shares and net debt belong to TIKR Terminal platform.

Discounted Cash Flow (Sources already cited )

According to this model Clorox is currently undervalued as its fair value is $175.30 while the current price is $145. However, I personally prefer to always consider a margin of safety of at least 30% to reduce the likelihood of overvaluing a company. Using this margin, Clorox is still overvalued since its fair value is $122.70.

Be the first to comment