AntonioSolano/iStock via Getty Images

Introduction

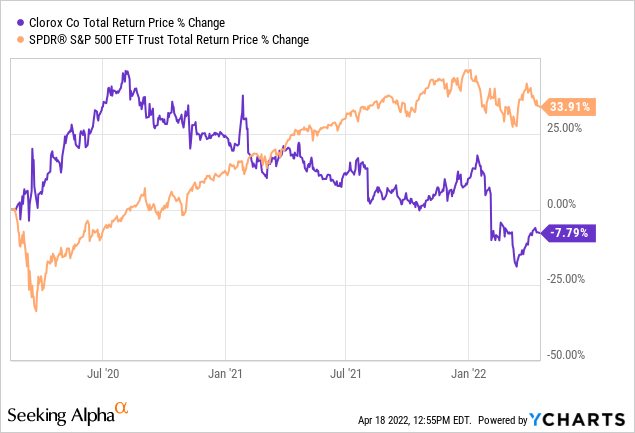

I always like to begin my articles by reviewing any past coverage I’ve written about a stock so we can see how my previous expectations have turned out. I’ve only written one previous article on Clorox (NYSE:CLX), which came out right at the very beginning of the COVID pandemic on February 14th, 2020. It was titled “Clorox: A 10-Year Full-Cycle Analysis“. I suggested in that article investors sell Clorox because its high valuation would likely produce poor medium and long-term returns. Since then, here is how the stock has performed compared to the S&P 500 ETF (SPY):

What is interesting here is that Clorox initially had a huge bump from the pandemic. With what was otherwise a pretty boring stock, the price jumped about +45% from the publication of my article until the end of July 2020. During this period when everyone was focused on keeping surfaces clean and disinfected, Clorox became what I call a “story stock”. For most investors during this time, the Clorox thesis amounted to “People will be cleaning more, and therefore they will be buying more cleaning products. That makes Clorox a buy.” In credit to some of the contributors here at Seeking Alpha, there were several articles during this time that shared my view that Clorox was a “sell” during this COVID-story bubble period. Anyone who was investing in this stock for the medium-term for longer and not simply making short-term trades, hopefully, learned a valuable lesson about narratives and investing. And that lesson is that once we move beyond the short-term, narratives don’t mean nearly as much as numbers. Narratives are unpredictable, and most of the time, they follow the stock price rather than lead it. Longer-term numbers from earnings and cash flows, over time, will predict with some accuracy where stock prices typically go, especially at the extremes when a stock is dramatically overvalued or undervalued.

For this reason, I try to avoid narratives in my articles as much as I can, and always make the foundation of my articles rooted in numbers rather than narratives.

The most dangerous narratives are the true ones

It’s important to point out that the story surrounding Clorox’s increased sales due to COVID were basically true.

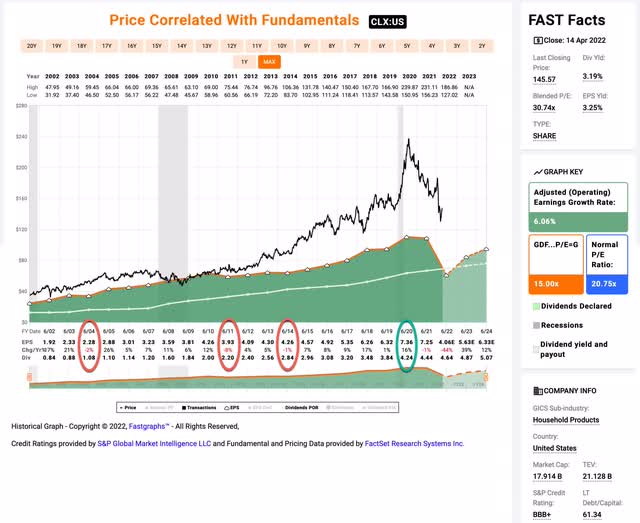

FAST Graphs

CLX’s EPS grew 16% in 2020 during the pandemic. Other than 2018, which was a year with big corporate tax cuts which boosted earnings growth that year, 2020 was the fastest CLX’s earnings had grown since 2005. That 16% growth rate was about 4x what I estimated CLX’s growth rate at leading into the pandemic. So, this was a major boost to earnings growth just like the story said it was.

The problem was that when CLX was trading at a P/E over 30, that assumes 16% earnings growth will basically last a decade or more. Not only was that unlikely to be how this played out, but the reverse was more likely to be true because a lot of CLX’s sales were likely pulled forward from the future into 2020 and 2021. This creates a situation where not only was CLX’s earnings unlikely to continue growing at 16% for a decade (which is what it would take to justify a 30 P/E ratio), but they were likely to shrink because overall demand, post pandemic, would shrink.

This is a dynamic I call “boom/bust”, and I have written several articles about it this year, including on companies as big as Apple (AAPL) and Alphabet (GOOGL) (GOOG). The key difference with Clorox is that, while most of these other businesses likely won’t see the bust until 2023, CLX is already experiencing it. (Additionally, while CLX’s boom/bust was caused directly by the pandemic, the others are mostly driven by stimulus given out during the pandemic rather than the pandemic itself. So, while the pandemic is mostly over in the US, the stimulus only recently stopped and is still circulating in the economy.) For this reason, I think CLX is a good stock to study when it comes to the basic dynamics surrounding “boom/bust” patterns.

Booms and busts can be distinguished from what I consider to be “normal” cyclicals because booms and busts are typically caused by one-time (or very rare) factors that happen to come together at a particular time and place. Because these occurrences are rare and somewhat unpredictable ahead of time, they don’t really form what I would consider a predictable “cycle”. What this means is that past history doesn’t serve as a particularly good guide for booms and busts, and we have to rely on logic and reasoning instead.

Fortunately, when it came to Clorox, it was already overvalued before the pandemic, so it was an incredibly easy stock to avoid buying for medium and long-term investors. But there are other stocks that are trading at more attractive valuations which are much more tempting to value investors today. My hope is that Clorox can serve as an example of what might lie in the future for some of the “stimulus boom/bust” stocks that haven’t fully busted yet.

But before I get into that commentary, I’m going to go ahead and run my basic full-cycle analysis on CLX in order to see where its valuation stands given the price has dropped off its highs quite a bit. CLX has historically been a very stable earnings growing stock, so I will share the valuation technique I use for less-cyclical stocks.

Market Sentiment Return Expectations

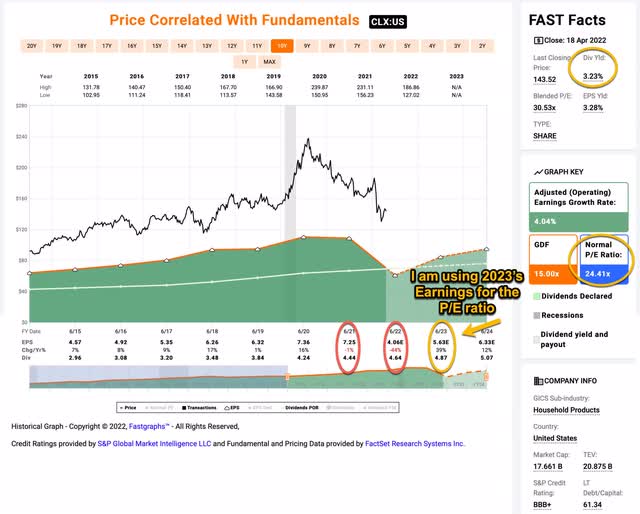

In order to estimate what sort of returns we might expect over the next 10 years, let’s begin by examining what return we could expect 10 years from now if the P/E multiple were to revert to its mean from the previous economic cycle. Since we have had a recent recession (albeit an unusual one) I’m starting this cycle in fiscal year 2015 and running it through 2023’s estimates.

FAST Graphs

I have chosen to use the earnings estimates from 2023 because they are more generous than 2022’s earnings. In fact, I wouldn’t be surprised if their earnings normalize a little quicker than analysts expect. A lot depends on whether we have a recession next year or not.

Clorox’s average P/E from 2015 to the present has been 24.41 (the blue bar circled in gold on the FAST Graph). Using 2023’s forward earnings estimates of $5.63 (also circled in gold), Clorox has a current P/E of 25.78. If that 25.78 P/E were to revert to the average P/E of 24.41 over the course of the next 10 years and everything else was held the same, Clorox’s price would fall and it would produce a 10-Year CAGR of about -0.55%. That’s the annual return we can expect from sentiment mean reversion if it takes ten years to revert. If it takes less time to revert, the losses could be quicker and steeper.

Business Earnings Expectations

We previously examined what would happen if market sentiment reverted to the mean. This is entirely determined by the mood of the market and is quite often disconnected, or only loosely connected, to the performance of the actual business. In this section, I will examine the actual earnings of the business. The goal here is simple: We want to know how much money we would earn (expressed in the form of a CAGR %) over the course of 10 years if we bought the business at today’s prices and kept all of the earnings for ourselves.

There are two main components of this: The first is the earnings yield and the second is the rate at which the earnings can be expected to grow. Let’s start with the earnings yield (which is an inverted P/E ratio, so, the Earnings/Price ratio). The current earnings yield is about +3.88%. The way I like to think about this is, if I bought the company’s whole business right now for $100, I would earn $3.88 per year on my investment if earnings remained the same for the next 10 years.

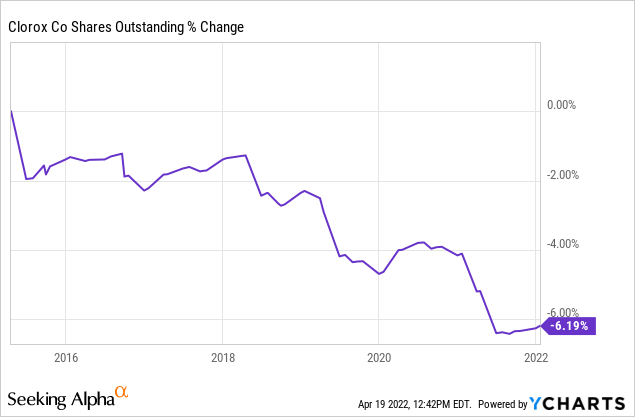

The next step is to estimate the company’s earnings growth during this time period. I do that by figuring out at what rate earnings grew during the last cycle and applying that rate to the next 10 years. This involves calculating the EPS growth rate since 2015, taking into account each year’s EPS growth or decline, and then backing out any share buybacks that occurred over that time period (because reducing shares will increase the EPS due to fewer shares).

Clorox has bought back about 6% of the shares outstanding over this period so I will back those out for my earnings growth estimates. Additionally, I will account for their recent -45% earnings decline the past couple of years, but I will also assume +39% earnings growth for 2023. Taking this all into account, my earnings growth expectation for Clorox is about +2.51%. (Prepandemic it was a little over +4%, so this is pretty much in line with what it has been since 2007 or so.)

Next, I’ll apply that growth rate to current earnings, looking forward 10 years in order to get a final 10-year CAGR estimate. (In Clorox’s case, all these will be post-2023 because I pulled those expectations forward.) The way I think about this is, if I bought Clorox’s whole business for $100, it would pay me back $3.88 plus +2.51% growth the first year, and that amount would grow at +2.51% per year for 10 years after that. I want to know how much money I would have in total at the end of 10 years on my $100 investment, which I calculate to be about $144.63 (including the original $100). When I plug that growth into a CAGR calculator, that translates to a +3.76% 10-year CAGR estimate for the expected business earnings returns.

10-Year, Full-Cycle CAGR Estimate

Potential future returns can come from two main places: Market sentiment returns or business earnings returns. If we assume that market sentiment reverts to the mean from the last cycle over the next 10 years for Clorox, it will produce a -0.55% CAGR. If the earnings yield and growth are similar to the last cycle, the company should produce somewhere around a +3.76% 10-year CAGR. If we put the two together, we get an expected 10-year, full-cycle CAGR of +3.21% at today’s price.

My Buy/Sell/Hold range for this category of stocks is: Above a 12% CAGR is a Buy, below a 4% expected CAGR is a Sell, and in between 4% and 12% is a Hold. This makes Clorox a “Sell” at today’s prices. It should be noted that by using 2023’s expected earnings, I was actually being pretty generous with my assumptions for Clorox (but I do think it was reasonable to do so in this situation). Even if I had assumed a 4% long-term earnings growth rate, Clorox still would have been right at the sell threshold.

Conclusion

My view of Clorox stock is pretty simple at this point. I view it as a simple bond proxy that over the longer term will likely be able to pass most inflation onto their customers (even though they might be having some difficulty doing that at this very moment in time). For that reason, investors should probably think of this stock as an inflation-protected bond and simply look at the dividend yield and ask themselves whether that is an adequate yield or not. The dividend growth rate has been about 6% in recent years, and they have some room to continue raising it for a while assuming earnings recover over the next couple of years.

Personally, for stocks that have very low earnings growth rates like Clorox, I would want to see a dividend yield in the 7-8% range before I would get interested in buying the stock. In order for that to happen, the price would need to drop about -50% from here. While I suppose it could happen during a recession, especially since CLX’s earnings have dropped a lot this year, there are so many yield-hungry investors in the market right now that I probably won’t get the chance to buy this stock at the price I would like. Nevertheless, I don’t think the forward long-term returns, even after the stock’s recent sell-off, are attractive enough to hold onto this stock. There are simply better opportunities in the market, and if bond yields continue to rise, Clorox stock will become less and less attractive over the near term unless investors view it as a temporary safe haven during a recession.

Be the first to comment