97

Investment Thesis

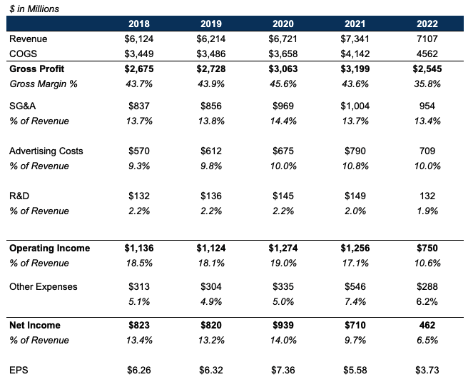

Over the past few years, Clorox (NYSE:CLX) has experienced a surge in its sales due to the pandemic, growing 8% from 2019 to 2020 and 9% from 2020 to 2021. This growth is in contrast to the 1.5% annual growth from 2018 to 2019, which is more in line to the mature growth that Clorox is accustomed to experiencing.

Dating back to last year, Clorox began to forecast declining sales as a result of the boom experienced during the pandemic. In this year’s FY 22’Q4 (ending in June 2022), Clorox reported net sales had declined by 3% YoY (not adjusted for inflation). In the same report, Clorox is forecasting sales for FY 2023 to be in the range of (4%) to 2% growth YoY (not adjusted for inflation). In short, Clorox is still working through the boom in sales during the pandemic and the growth from the pandemic won’t return anytime soon, but is there still value to be had in Clorox as a value stock?

Clorox SEC Filings

EPS Trend

Given the mature nature of Clorox’s business and that sales won’t be the primary driver of EPS in the future, the business is looking to control expenses, both within COGS and OpEx. On the COGS front, Clorox has successfully started to pass along the increase in commodity costs to the consumers, evident by gross margins being stable YoY in the most recent quarter, after declining 777 bps YoY. More evidence from the upcoming quarters will be needed to validate this trend, but management is providing guidance that margins will increase by 200 bps in FY 2023.

Clorox is also looking to streamline operating costs, by executing an initiative called “IGNITE strategy” in FY Q1’23 to increase efficiency and move the decision-making power closer to the customer. The initiative will generate $75-100m of annual savings once fully executed, but Clorox is expecting to take a $75-100m OpEx hit in FY 2023 due to the execution of the initiative.

Factoring in the operating cost improvements in addition to the flat to declining sales estimate, Clorox is forecasting fully diluted EPS to decline to $3.10-$3.47 for FY 2023. Adjusted EPS, when backing out long-term investments in digital capabilities, productivity enhancements, and factoring in the cost for the “IGNITE strategy”, is expected to be $3.85-4.22/share.

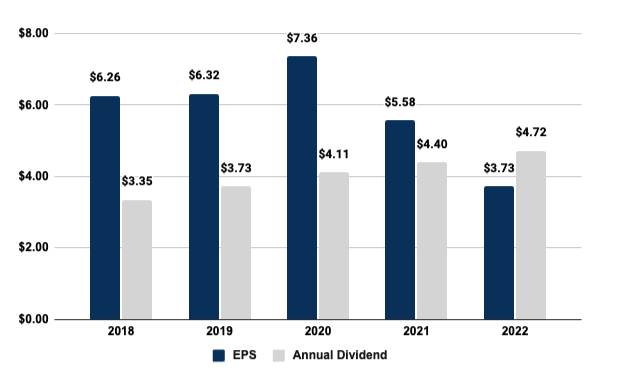

When looking at the company’s most recent EPS performance, 2022 to 2023 will be the lowest within the past five years, which the company attributes to a transition post-pandemic and gross margin pressure (due to supply chain issues, driven by the pandemic). It’s reasonable to assume 2023 will be the trough in terms of EPS and the company begins to stabilize and improve operating efficiencies in 2023+.

Clorox SEC Filings

With the softening of EPS in 2022 and 2023, before valuing Clorox on its dividend, is there any risk to the dividend, currently at $4.72/share?

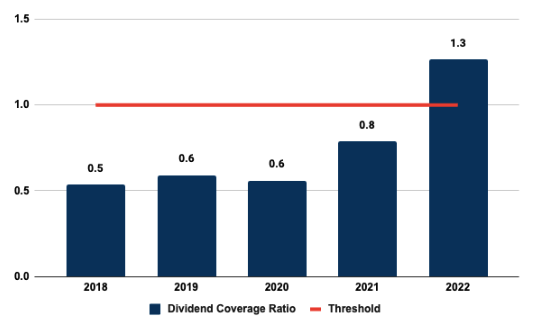

Dividend Safety

Looking at the past five years, Clorox’s dividend coverage ratio has started to tick above 1.0, which is a sign that dividends might start becoming unstainable given the net income of the business isn’t able to fully cover the dividend.

Clorox SEC Filings

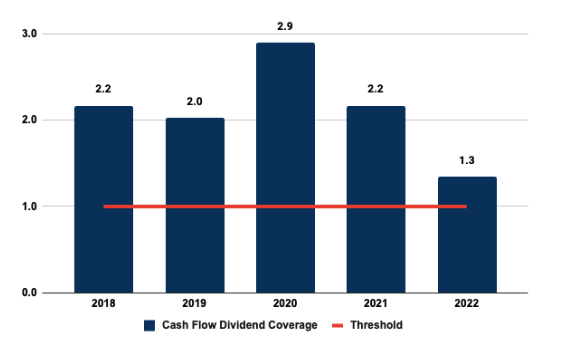

Given the ratio isn’t safely below 1.0, it’s time to look into the cash flows of the business deeper to understand the true cash flow impact within the operations of the business. When looking at cash flow from operations and the dividend paid out annually, Clorox is above 1.0, which is good within this ratio as it represents Clorox is generating more than 1x of cash flow to cover its dividend, signaling strength within its dividend coverage.

Clorox SEC Filings

The main divergence between these two ratios is due to the non-cash charges that Clorox recognizes within its income statement but is able to back out of its cash flow. After this analysis, the cash generation of the business is still strong at Clorox and the dividend is safe.

Company Valuation – Dividend Valuation

Using the Gordon Growth Model, we determine the share price of Clorox. The assumptions used within the Gordon Growth Model are below:

-

Current Dividend: $4.72/share is the dividend over the last 12 months

-

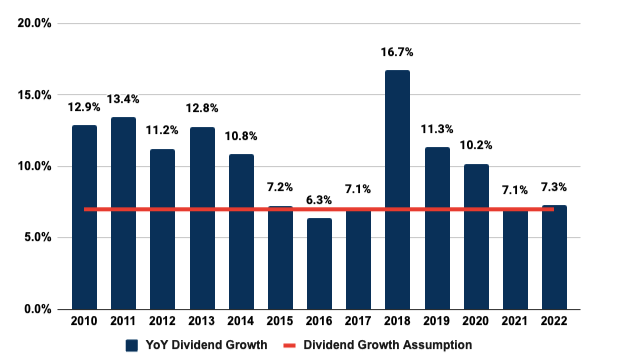

Dividend Growth Rate: 7% – this has been the average increase that Clorox has issued over the past two years being 10%+ during the pandemic

-

Cost of Equity / Required Rate of Return: 9.9%

-

CAPM

-

Risk-Free Rate: 4.24% – 2-year treasury bill

-

Beta: 0.98 – beta between CLX and S&P 500 over the past year

-

Expected Return: 10.0% – the average return of the stock market over the past century

-

-

The output of this calculation is a share price of $162, which is based on today’s value. When adjusting the two most sensitive assumptions in CAPM, the risk-free rate (Federal Reserve rate increases) and beta (Clorox is a consumer staple and it is less sensitive to economic changes), the value of the shares only increases. This is largely driven by the dividend growth rate of the business, and when looking into the dividend growth rate since 2010, only one year resulted in a dividend increase of less than 7% (2016).

Clorox SEC Filings

Takeaway

Based on the Gordon Growth Model and the near-term events, Federal Reserve rate increases, and impending recession, the shares of Clorox are currently undervalued by 15-20%. Shareholders are also being compensated with a 3.3% annual dividend yield while the shares appreciate closer to the fair market value.

Be the first to comment