djedzura/iStock via Getty Images

We were right and wrong in Clearwater Paper’s (NYSE:CLW) previous analysis.

Last time, we said that looking to the past, “the company has found it difficult to fully pass cost inflationary pressures onto the consumer, particularly in the more competitive consumer product division”. We were also forecasting a “sales rebound starting from Q2 (mainly driven by higher selling prices)“. Well, at the time, we were right, but the company surprised us by delivering a performance that we never expected to see. During the earning season, we already provided a comps analysis between Essity (OTCPK:ESSYY) and Kimberly-Clark (KMB), favouring the European company. Looking at the just-released Clearwater’s results, we were wrong in our future expectations.

As also Clearwater Paper explained: “since 2015, significant capacity additions have been added by producers targeting the private branded market”. Having listened to the P&G call, we understood that private label is now re-emerging (especially in Europe). Since our initiation of coverage, the World has changed. We are now living in a rising inflation environment with detrimental consumer sentiment. Customers are starting to reduce expenses and are back to cheaper alternatives, i.e., private label offerings.

Private label market share (Clearwater Paper Q2 results)

Q2 results

Here are the main numbers achieved during the Q2 performances:

- The company was able to pass through inflationary pressure over the quarter. This happened both in the consumer products division and in the pulp & paperboard segment;

- Top-line sales increased by 30% compared to the previous year’s end quarter. In numbers, sales stood at $526 million, driven by the consumer products division and the pulp & paperboard division, which grew by 29% and 30%, respectively. As already mentioned, most of the growth came from price increases but also volume recorded a plus 8% in Q2. This confirmed the private label positive trends;

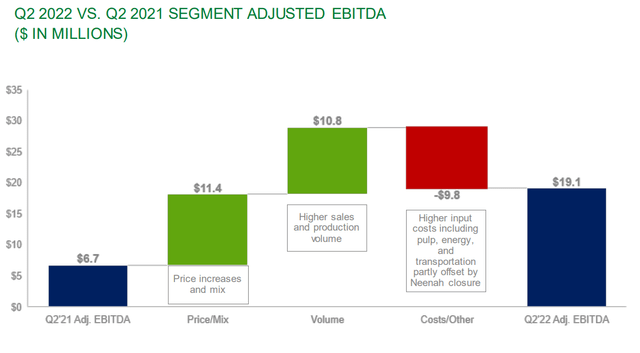

- Adj. EBITDA recorded a $63 million result compared to $14.8 million achieved in the same period last year. The margin improved from 3.6% to almost 12%. Despite these, the company is still affected by higher raw material costs, energy pressure, an increase in chemicals and additional logistic costs;

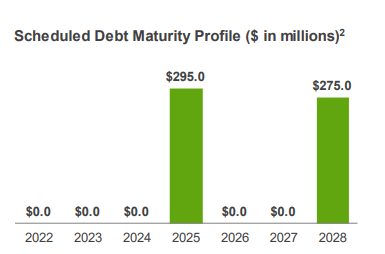

- Debt was further cut, and there are no significant maturities until 2025;

- The group’s net income stood at $15 million;

- The company started to implement its buyback plan.

EBITDA pulp & paperboard segment (Clearwater Paper Q2 results)

Conclusion and Valuation

Compared to our universe coverage within the sector, Clearwater Paper is a small company. Last time, we derive a target price of $32 per share based on an EV/EBITDA of 5.5x. After having analyzed the Q2 performance, we are not surprised to see this positive stock price reaction.

Clearwater Paper stock price evolution (Yahoo Finance)

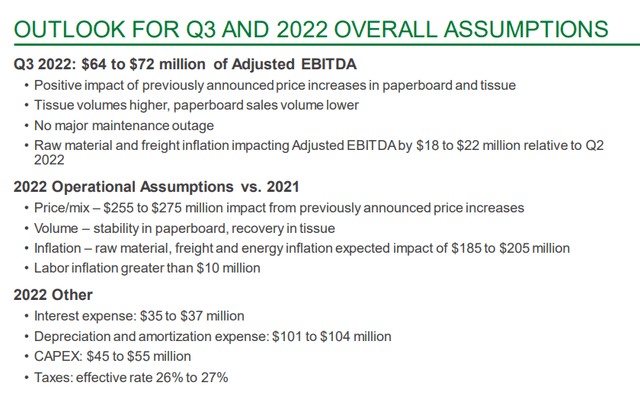

What is important to say is that the company is now targeting new price increases and confirmed the outlook for the following quarters. If we adjust the numbers (taking into consideration the net debt calculation), we derive a target price of $43 per share. This is based on a 5.5x EV/EBITDA. Unfortunately, we are followers of Clearwater Paper, and it was a shame.

Be the first to comment