Melpomenem/iStock via Getty Images

I welcome questions. I hate assumptions.”― Red Haircrow

Today, we look at a small tech stock, whose shares have fallen on hard times recently as it picked a rough time to go public; hardly an unique theme here in 2022 to date. A beneficial owner has used the decline to add to their stake. A full analysis follows below.

CWAN – Stock Chart (Seeking Alpha)

Company Overview

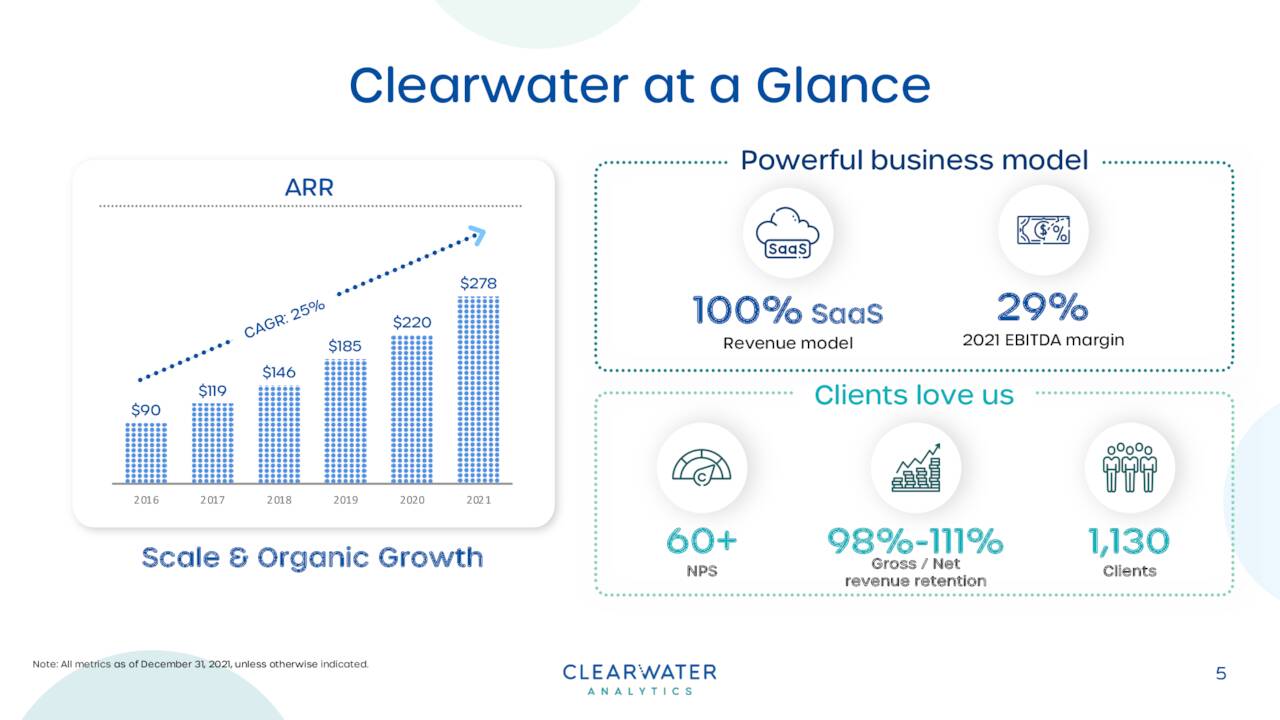

Clearwater Analytics Holdings, Inc. (CWAN) is a Boise, Idaho based software-as-a-service [SAAS] fintech focused on investment accounting and analytics for ~1,100 clients, including asset managers, insurance companies, pension plans, corporations, and governments. On a daily basis, it processes assets totaling $5.6 trillion, encompassing over 60 asset classes valued in more than 40 currencies that are regulated under nearly a dozen accounting regimes. Clearwater commenced operations in 2004 and went public on September 28, 2021, raising net proceeds of $582.2 million at $18 per share. The stock trades around $17.50 a share, translating to a market cap of $4.2 billion.

CWAN – At A Glance (March Company Presentation)

For tax mitigation and control purposes, the company is capitalized by four classes of stock. The 47.4 million Class A shares are publicly traded, confer economic interest, and bestow one vote per share. Owners of the 11.5 million shares of privately held Class B stock receive no economic interest but have one vote per share and can convert their stock into Class A shares. The 47.4 million shares of Class C stock are privately held, receive no economic interest, but confer to the owners ten votes per share. They are convertible into Class D shares, which bestow both economic interest and ten votes per share. The 130.1 million privately held Class D shares can convert to publicly traded Class A shares.

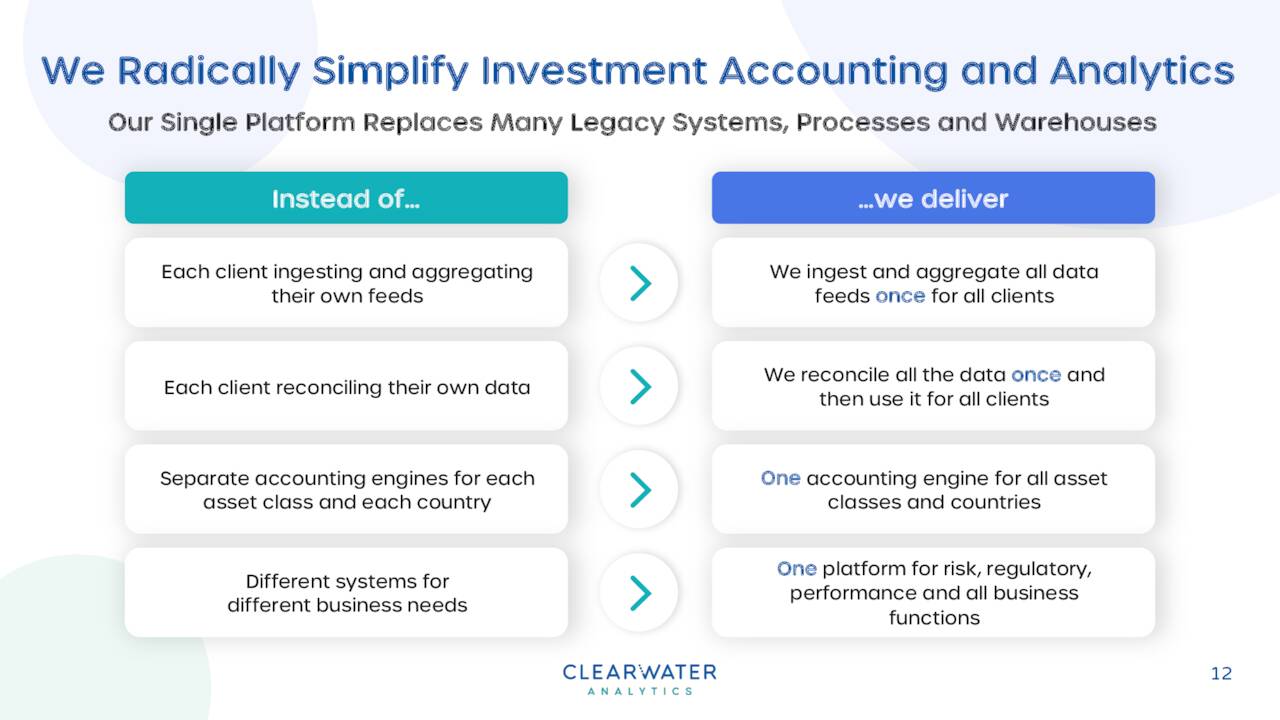

SaaS Platform

Imagine you are the chief portfolio manager for an asset management firm that invests in structured products, mortgage-backed securities, forex, stocks, and bonds, with operations in Tokyo, London, Dubai, and New York. You need to make sure that you are compliant with each country’s reporting regime while providing your clients with a daily view of their portfolios. You also want to know the impact that a 50-basis-point reversal in the five-year note will have on the performance of these portfolios. Clearwater provides these services. As per CEO Sandeep Sahai, “Instead of having a separate accounting engine for each asset class and each country, we built a platform that is multi-asset class, multi-currency, and multi-basis.” The portfolio manager can pull up highly configurable daily reports on demand.

CWAN – Model (March Company Presentation)

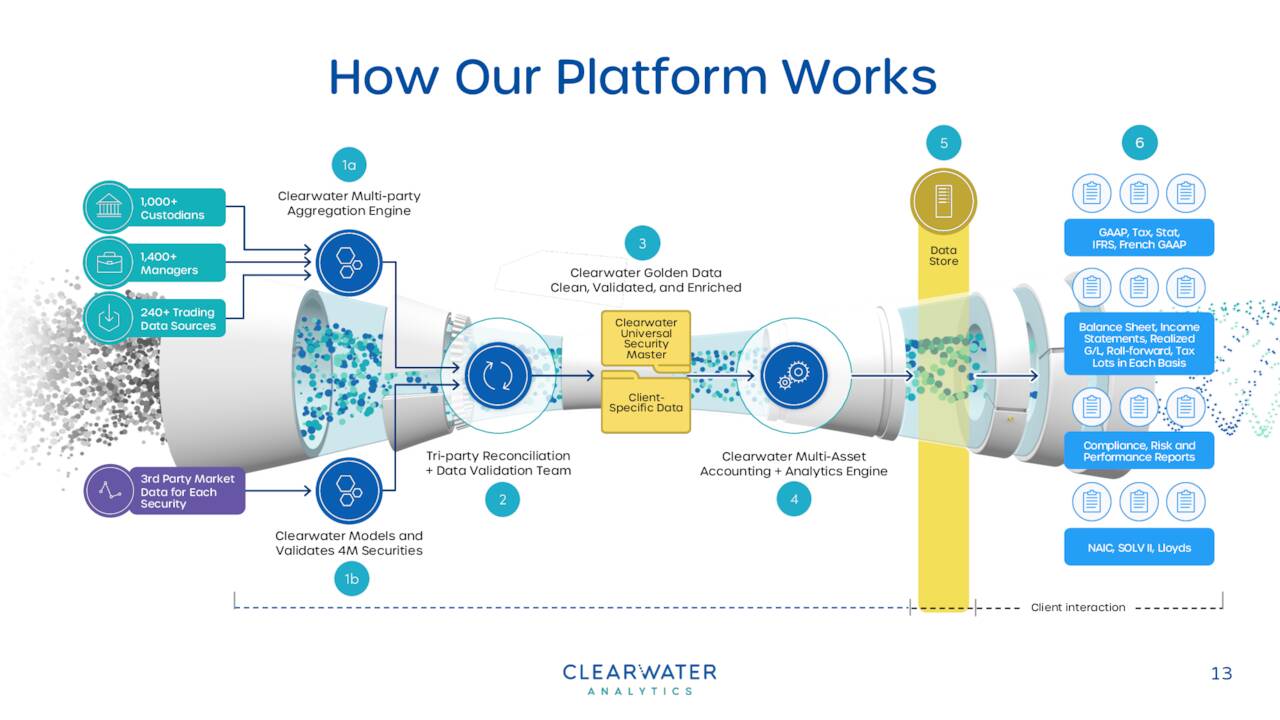

The platform establishes connections with ~1,000 custodians, ~1,400 managers, and more than 240 trading data sources to upload investment securities data into its aggregation engine, which is further verified by third-party data providers. Portfolios are then automatically validated by the platform. In those instances – about 9% of the time – where reconciliation requires further intervention (e.g., when the price on a structured product does not match market pricing), Clearwater’s reconciliation team steps in to resolve the issue. These steps speed the process of pricing and accounting, especially for less liquid assets. Once reconciled and validated, the data flows into the company’s accounting, risk, performance, and compliance engines and is processed into daily accounting and compliance monitoring reports, performance tracking and analytics.

CWAN – Platform (March Company Presentation)

Clients pay a recurring and tiered fee based on assets under management [AUM] for these services. At higher tiers of AUM, the lower the basis point rate charged. Other factors, including product mix, also affect pricing. Currently, 86% of Clearwater’s reportable AUM are fixed income or structured products. Clients can cancel their contracts with 30-days’ notice. Although it has ten offices in seven countries, ~90% of the company’s revenue is currently generated in the U.S. Approximately 25% of its top line is reinvested into R&D.

With that said, most asset managers and insurance companies have proprietary systems that feature bolted on infrastructure, which have numerous points of friction. Owing to the size and complexity of these legacy systems, a total replacement may be impractical. Enter Clearwater Prism solution, which provides a single security master and comprehensive portal for all investment data – in essence, replacing clients’ disparate data warehouses without replacing their existing systems. This master data source that management dubs the ‘Golden Copy’ is then fed into clients’ existing accounting, compliance, performance, and risk systems, eliminating manual reconciliation of said data.

Fintech Accounting and Analytics Marketplace

Relative to its competitors, Clearwater is unique in that its offering is 100% SaaS, whereas the former have on-premise legacy systems (with some SaaS) requiring large IT staffs. In addition to the in-house efforts of would-be clients, the company competes against fintech software offerings from SS&C (SSNC), State Street (STT), BNY Mellon (BK), SimCorp (OTC:SICRF), BlackRock (BLK), Northern Trust (NASDAQ:NTRS), and Fidelity National Information Services (FIS), amongst others. Collectively, these participants compete for a total addressable market of $10.1 billion, of which North American and European asset management represent the largest portion at $3.1 billion. Clearwater believes it can ultimately capture revenue of $1 billion from its core clients, consisting of asset managers, insurance companies ($1.3 billion opportunity) and corporations ($0.3 billion). It is also expanding into related prospects such as hedge funds, wealth management, pension funds – other buy-side institutional investors – which comprise an additional $2.7 billion opportunity. Clients that could benefit from Clearwater Prism constitute a largely untapped $1.4 billion market, as does similar verticals in the Asia Pacific region, which represent a $1.3 billion opportunity.

To date, the company’s belief that its platform is more comprehensive than its competition in terms of asset coverage and functionality is playing out, with it winning 80% of the proposals it writes while receiving net promoter scores over 60. Furthermore, Clearwater was able to grow its FY20 top line 21% to $203.2 million despite a challenging environment courtesy of the pandemic.

Fourth Quarter Results

On March 2nd, the company posted fourth quarter results. GAAP earnings came in at six cents a share as revenue grew just over 27% year-over-year to nearly $70 million. Both top and bottom line numbers slightly beat expectations.

|

Fourth Quarter 2021 |

Full Year 2021 |

|||

|

Revenue |

$69.8 million |

$252.0 million |

||

|

Year-over-Year Revenue Growth % |

27.4% |

24.0% |

||

|

Annualized Recurring Revenue (ARR)1 |

$277.8 million |

|||

|

Year-over-Year ARR Growth % |

26.3% |

|||

|

Net Income/(Loss)2 |

$0.1 million |

$(8.1) million |

||

|

Net Income/(Loss) Margin % |

0.2% |

(3.2%) |

||

|

Adjusted EBITDA |

$20.1 million |

$72.7 million |

||

|

Adjusted EBITDA Margin % |

28.8% |

28.8% |

The company ended the year with 1,130 clients, a nearly 23% increase on a year-over-year basis. 59 of these clients contributed at least $1 million in ARR. Clearwater’s platform ended the year providing processes and reports on $5.9 trillion assets daily. Leadership also provided the following guidance for FY2022.

First Quarter and Full-Year 2022 Guidance

|

First Quarter 2022 |

Full Year 2022 |

|||

|

Revenue |

~$70 million |

$302 million to $304 million |

||

|

Year-over-Year Growth % |

~23% |

~20% |

||

|

Adjusted EBITDA |

$17 million to $18 million |

$80 million to $82 million |

||

|

Equity-based compensation |

~$66 million |

|||

|

Depreciation and Amortization |

~$5 million |

|||

|

Interest expense |

~$2 million |

Balance Sheet & Analyst Commentary

The company ended FY2021 with just under $255 million in cash and marketable securities on its balance sheet against just over $50 million in debt.

The analyst community has been active around the stock since fourth quarter results posted. Since then, six analyst firms including JP Morgan and Wells Fargo have reissued Buy ratings. Albeit four of these contained downward price target revisions. Price targets proffered range from $23 to $27 a share. Both Morgan Stanley ($22 price target) and Loop Capital Markets ($20 price target) maintained Hold ratings on the stock post quarterly numbers.

Owing to the technicality that only 20% of the shares outstanding are currently available to the public, fund manager Durable Capital Partners is deemed a beneficial owner. The fund has been a buyer of Clearwater stock since late September in numerous transactions, the latest being in late February. During that time, it has added more than one million shares to its stake, upping its ownership interest to approximately 20%. One out of every eight shares in CWAN is currently sold short.

Verdict

The current analyst consensus has Clearwater earning between 20 to 25 cents a share as revenues grow some 20% to just over $300 million.

After the initial investor excitement surrounding its IPO – when shares of CWAN briefly traded above $27 – Clearwater has been hit hard, off nearly 40% from that all-time high. This downdraft is mostly a function of the entire SaaS sector entering a bear market, down over 20% during the same period. Being the only 100% SaaS solution for its vertical, Clearwater has a real opportunity to grab a meaningful share of its $10.1 billion addressable market. However, with a price-to-FY22E sales ratio of approximately 14, the company has to generate more than 20% growth at its top line – even with 75% Adj. gross margins and 28% Adj. EBITDA margins – to justify that valuation.

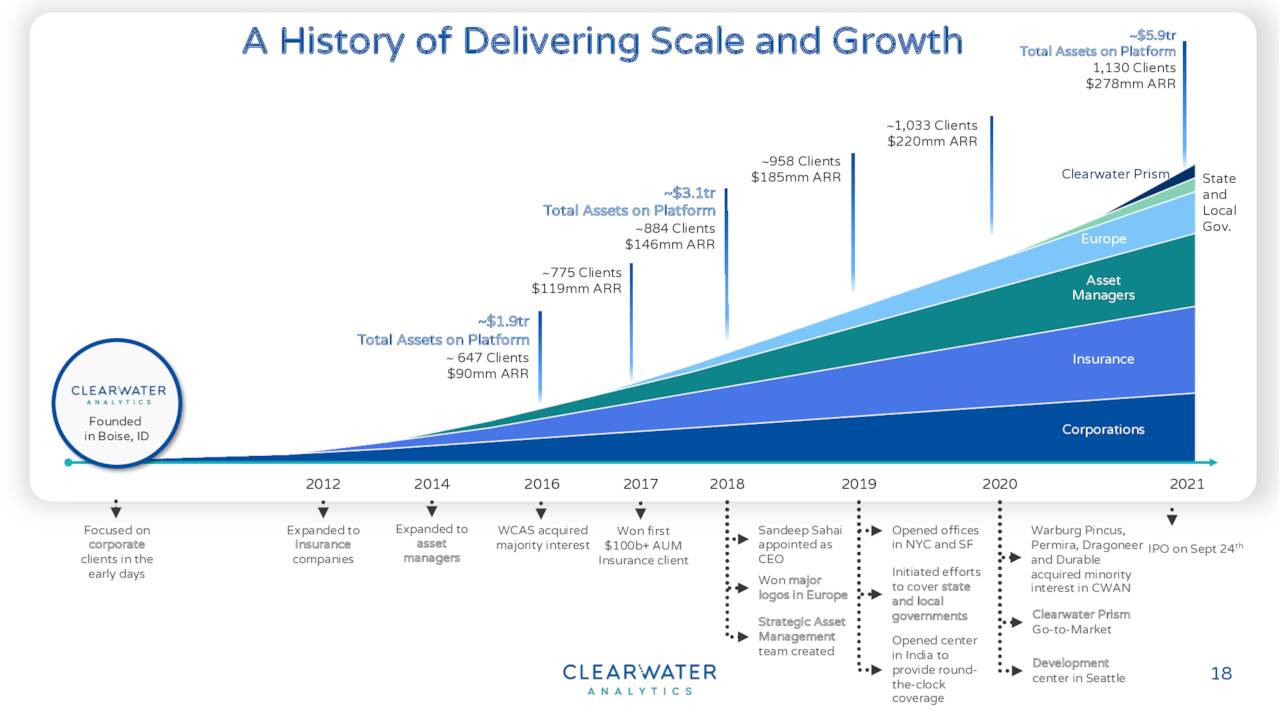

CWAN – Company Growth History (March Company Presentation)

And with the headwind of expected higher rates ahead, stocks with nosebleed valuations are typically the first victims of market revaluation as their way-in-the-future high earnings are discounted back at a higher interest rate. Not to mention the volatility in the markets triggered by the invasion of Ukraine.

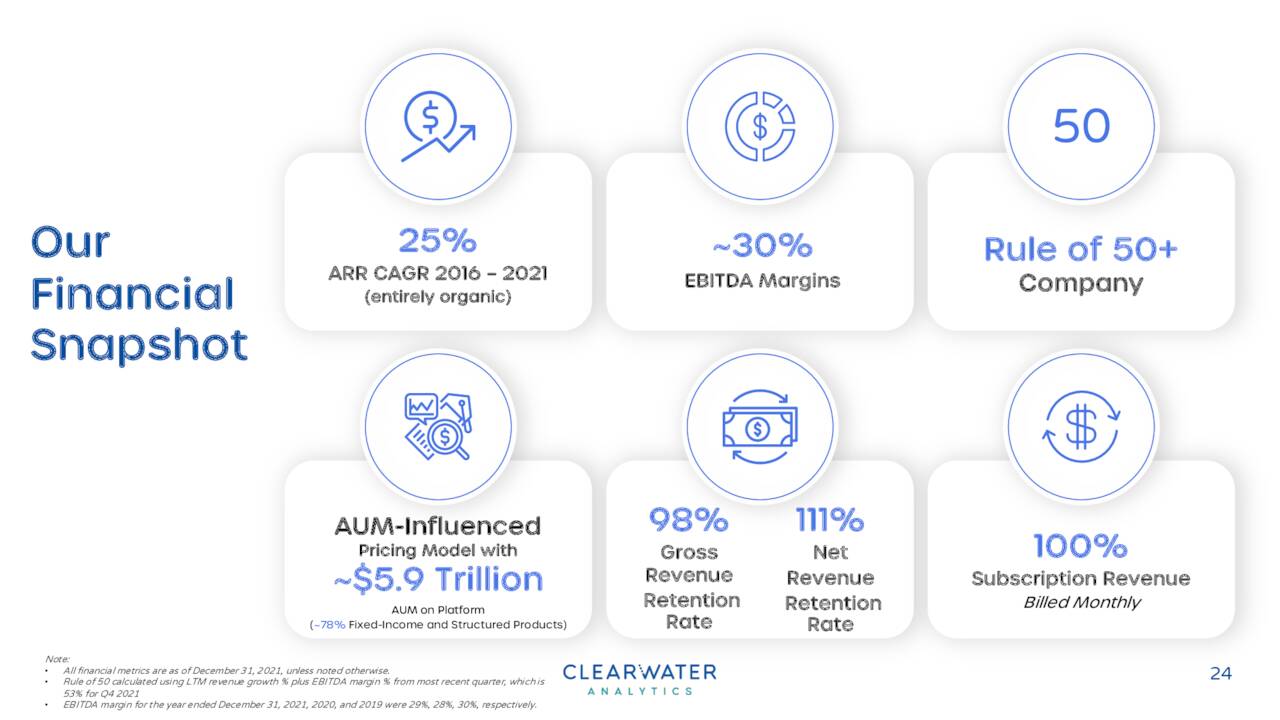

CWAN – Snapshot (March Company Presentation)

Additionally, with the vast majority of its clients’ AUM in fixed-income, higher rates could portend lower revenue from Clearwater’s pricing model. There is nothing wrong with the company’s disruptive offering, only its stock’s valuation. As such, the recommendation here is to wait for the fallout in the SaaS market to end before investment. A level below $13, or a price-to-FY22E sales ratio of ~10, is more palatable for the establishment of a small ‘watch item’ position as the company does seem to have some ‘best of breed‘ offerings, the shares are just too expensive at the moment.

We are here and it is now. Further than that, all human knowledge is moonshine.”― H.L. Mencken

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Be the first to comment