Tuomas A. Lehtinen/Moment via Getty Images

By Sam Peters, CFA | Jean Yu, CFA, PhD

Investors Relying on Hope Have Much to Fear

Market Overview

In physics, there is no absolute measure of time and space. Rather, as we know thanks to Einstein, everything is relative, with events having impacts on one another. Similarly, financial markets also don’t have an absolute measure of time and most things are indeed compared relative to each other. As a result, every market cycle is unique and the variability of time between events is one of the big challenges in investing. However, what we do know is that markets regularly cycle between hope and fear and, within this arc of human emotions, key events tend to repeat themselves under similar conditions. With relativity in mind, we think it is worth looking back at the big events of 2022 and what they suggest for the big opportunities in 2023.

The first big change that we observed is that everything got cheaper as multiples were compressed. On an absolute basis, the multiple of the Russell 1000 Growth Index (RLG) compressed just over 30%, while the Russell 1000 Value Index (RLV) compressed almost 15% (Exhibit 1).

Exhibit 1: Multiples Under Pressure in 2022

As of Dec. 31, 2022 (Bloomberg Finance, L.P., ClearBridge Analysis)

As with physics, however, what matters is the relative measure. Despite growth valuations falling by twice as much as value, the relative value of value remained well above historic averages and remained in the cheapest decile (Exhibit 2). The key observation here is that relative performance moves between growth and value styles have never stalled out at these levels. Market cycle arcs persist until completed, and there is still a long way to go in favor of value in this current market cycle.

Exhibit 2: Value Remains Historically Undervalued

As of Dec. 31, 2022 (Bloomberg Finance, L.P., ClearBridge Analysis)

Given how painful 2022 felt, particularly for growth investors, it may seem hard to believe that growth didn’t make more progress. To be clear, progress was indeed made, but what was worked off was only investor excess. Unfortunately, there is still a long way to go before fear is priced in.

We view market price movements as the function of valuation and fundamentals and, within valuation, seek to identify any changes in the risk-free rate (the 10-year Treasury yield) and the equity risk premium. Throughout 2022, nearly 100% of the change in the market’s valuation multiple was driven solely by the movement in interest rates, leaving the equity risk premium essentially flat. Another surprising observation from the year is that fundamentals were not a big drag on performance; RLV earnings grew 5% while RLG earnings grew 1%. In other words, the pain felt by investors was almost entirely the increase in the cost of capital as the Fed raised interest rates.

Exhibit 3: Capital Costs Driven By the Risk-Free Rate

As of Dec. 31, 2022 (Bloomberg Finance, Damodaran Online)

This leads to the big question for 2023: how much will the market start to price in fear, especially if we experience a recession? In past cycles, a hostile Fed and dwindling liquidity have almost always led to some degree of market distress and fear being priced into the equity risk premium, particularly when there were signs of speculation and excess at the beginning.

The argument against fear getting priced in this year is what we call the 2023 hope trade. Specifically, the hope is that inflation will moderate and allow the Fed to reduce its aggressiveness before inducing a deep policy-engineered recession. If so, a little bit of economic pain will resolve the inflation problem and enable markets to return to a pre-COVID environment of favoring large-cap U.S. indices and growth stocks. The desire to return to past patterns, anchor on past experiences, and resist change is a feature deeply embedded in human behavior, and thus we are not surprised it is characteristic of every new market cycle. However, it never works out this way, and it is only when prior excesses inflict enough pain that investors embrace the new market cycle. We expect this cathartic transition to occur over the coming year and have a systematic process to determine if a transition event is happening and seize the opportunity when it does.

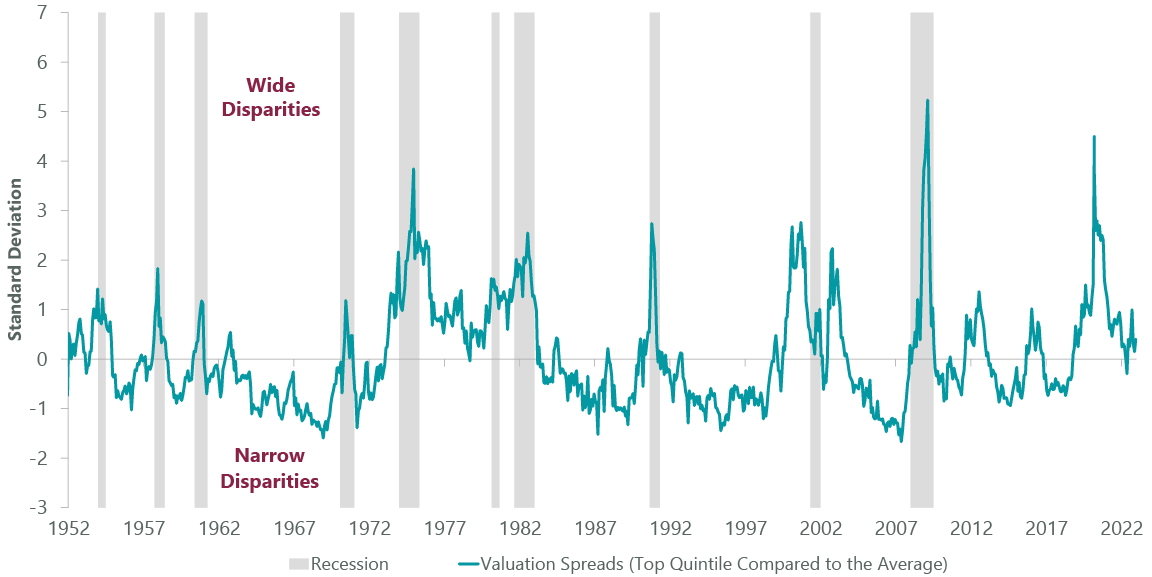

One of our key tactics as valuation-disciplined managers is monitoring valuation spreads and capitalizing on them when they get historically wide. Similar to high-yield spreads and volatility indices, valuation spreads typically explode higher during a recession. Current valuation spreads are not much above average historic levels (Exhibit 4), further proof that fear is not yet priced into the markets. While the value of value relative to growth still massively favors value as the big opportunity over the current market cycle, most U.S. stocks are not historically cheap and do not embed a recession on an absolute basis.

Exhibit 4: Valuation Spreads Near Historic Average

As of Dec. 31, 2022 (National Bureau of Economic Research, Empirical Research Partners Analysis)

Should the Fed indeed trigger a recession, valuation spreads will likely follow historic precedent and gap out. While the stocks unfortunate enough to drive spreads higher change with each occurrence, the list is typically comprised of the past cycle’s winners who have fallen from the glory due to forced selling from excessive leverage or worsening fundamentals. Yesterday’s heroes become today’s villains as excesses are cut away. We think this will again be the case, with distress most concentrated in stocks that were the biggest beneficiaries of the free capital era and excessive speculation by investors armed with leverage and derivatives. However, the tactical opportunity to be gleaned comes as equity correlations skyrocket during risk events, and good stocks are thrown out with the bad. However, just because a stock is down 50% does not make it attractively cheap. To avoid anchoring expectations, we rely on our rigorous valuation discipline to help us navigate the carnage and find attractive stocks when seemingly no one wants them.

Just because a stock is down 50% does not make it attractively cheap.”

Alternatively, the other potential outcome is no U.S. recession in 2023, not even a shallow one that anchors the hope trade. This is certainly not the consensus view, but consensus has been conditioned by the extremely low nominal growth environment that dominated the last market cycle. Just as we are prepared for a recession and wider valuation spreads, we also feel ready for a year marked by slowing nominal growth and inflation but no actual recession. As active managers, one of the core tenets of our portfolio construction process is not relying on any single outcome. Instead, we pride ourselves on having the agility to act decisively when opportunities reveal themselves, particularly when they come as a surprise. The key beneficiaries under this scenario would be extremely cheap stocks with cyclical earnings risk, and particularly credit-sensitive companies whose stock prices already incorporate the risk of a recession. We certainly have exposure to these stocks but feel confident in our ability to shift rapidly towards greater exposure if this branch of events plays out.

Although we continue to prepare for the opportunities that 2023 will bring, we have a high conviction in our current portfolio positioning for the current market cycle. Our valuation-driven metrics indicate the portfolio is even more attractively positioned than it was a year ago, with the portfolio’s price-to-business value gap expanding by nearly 10%. This was no easy feat in a year where the overall market’s cost of capital increased by approximately 40%. We attribute our strong positioning to our rigorous valuation-driven investment process which focuses on compounding business value across full market cycles, which includes difficult years like 2022. The result is a portfolio comprised of companies with resilient business models that generate the capital and free cash flow to meet their internal investment needs, while also maintaining strong balance sheets and returning capital to shareholders. When such businesses are priced well below their business value (typically signaled by high starting free cash flow yields), it becomes possible to derive strong returns from their price-to-value convergence.

This focus on resilience underlies our large allocation to energy stocks. The sector led the broader market for the second year in a row in 2022, up over 60% (driven entirely by fundamentals) while earnings and free cash flow climbed over 75%. However, due to fundamentals outpacing the move in stock prices, the sector actually became over 10% cheaper. Companies with swelling cash generation used it to pay down debt while supporting the highest returns of capital to shareholders in the overall market. However, just as important as what these companies did was what they didn’t do: raise capital spending. This continued discipline is what supports long upcycles, and current valuation levels are closer to trough than even during mid-cycle. Additionally, there are emerging signs that shale well productivity is beginning to roll over, bringing into question the ability of shale to meet ever-growing demand. The demand curve remains extremely steep and China’s pivot on COVID-19 lockdowns could result in further demand rebounding, pushing prices materially higher. With energy stocks continuing to trade at both record-low relative and absolute valuation levels, we think the path of least resistance remains higher in 2023.

Portfolio Positioning

While maintaining vigilance for emerging opportunities to strengthen the portfolio’s potential, one of the biggest questions in 2023 is the impact a potential recession would have on earnings. A key response to this unknown is to focus on stocks that should be well supported by earnings growth regardless of what happens. We have built an extensive watchlist of companies we feel have the resiliency and earnings growth to merit inclusion in the portfolio under the right conditions. As a result, we made a number of adjustments during the period.

Everest Re Group (RE), in the financials sector, is a reinsurance and property and casualty insurer that has been improving operations and reducing risk. The reinsurance market has transitioned to a very “hard” market in the wake of hurricane Ian and structurally rising reinsurance losses. The demand for reinsurance is estimated to be up over $30 billion, with capital supply down by over $50 billion, which indicates that reinsurance pricing is set to increase 30% to 70% globally in 2023, creating an extremely positive fundamental driver for Everest Re. As a result, Everest Re should enjoy earnings growth in 2023 that is largely insulated from macro risks, and we were able to capitalize on the stock trading close to book value before the reality of this supply/demand mismatch was reflected in the price.

We also initiated a new position in Las Vegas Sands (LVS), in the consumer discretionary sector, which owns and operates several high-profile resorts and casinos in Macau and Singapore. One of the highest probability macro events we anticipate in 2023 is a China reopening, with forecasts (and the Chinese government itself) targeting over 5% growth. A big driver of this growth will be the massive pent-up demand for travel and entertainment after almost three years of being locked down and accumulating a mountain of private savings. We felt that Las Vegas Sands was an attractively-valued opportunity to capture the Chinese reopening, and specifically an eventual rebound in Macau from historically depressed levels. Las Vegas Sands is yet another example of a name supported by strong earnings growth that should generate positive performance, regardless of recession potential, due to the downside protection afforded by its solid free cash flow generation from already reopened destinations in Singapore. When combined with the material upside as earnings and cash flow gap up on a Macau reopening, we believe the risk/reward tradeoff is heavily underappreciated from the market and were able to capitalize and enter the stock at an extremely compelling entry point.

As mentioned, we remain very positive on energy given the structural global shortage. However, with the cost structure of shale rising from higher services costs and well productivity falling, we made the decision to pivot from shorter-cycle shale production to longer-cycle conventional oil. We believe the current environment suggests that pricing power in energy services will continue to improve while the demand for offshore oil will increase. We invested in Noble Corp. (NE), in the energy sector, an offshore drilling contractor that targets ultra-deepwater and high-specification jackup markets, which we believe will be a major beneficiary of this shift. After emerging from bankruptcy caused by the recent severe downcycle, Noble has a recapitalized balance sheet moving into a positive pricing cycle that will drive dramatic growth in earnings and free cash flow. Like other parts of energy, the nightmare of the last cycle is reinforcing capital discipline and a focus on free cash flow rather than growth. We believe this subsequent longer duration cycle is not reflected in Noble’s current stock price, and long-term performance will be supported by growing shareholder returns from dividends and buybacks while maintaining a strong balance sheet.

Outlook

Although we cannot pretend to know the exact nature and timing of the events that will be the catalysts for market performance in 2023, we can make ourselves ready to act on them as they emerge. We prepared for it by constituting our portfolio with resilient companies trading well below our estimates of business value. This tactical and adaptive approach allows us to approach the coming year’s uncertainty without the need to rely on hope trades while remaining focused on the big opportunities that arise during each market cycle. We continue to be optimistic about this strategic opportunity for value and that its leadership will be further cemented in 2023.

Portfolio Highlights

The ClearBridge Value Equity Strategy outperformed its Russell 1000 Value Index during the fourth quarter. On an absolute basis, the Strategy had gains across 10 of the 11 sectors in which it was invested during the quarter. The leading contributors were the energy and healthcare sectors, while the communication services sector was the sole detractor.

On a relative basis, overall sector allocation contributed to relative performance but was modestly offset by negative security selection effects. Specifically, stock selection in the information technology (IT), utilities, health care, materials, and real estate sectors as well as an overweight allocation to the energy sector and underweight allocation to the real estate sector benefited performance. Conversely, stock selection in the financials, energy, and communication services sectors as well as an underweight allocation to the industrials sector weighed on returns.

On an individual stock basis, the biggest contributors to absolute returns in the quarter were Schlumberger (SLB), American International Group (AIG), Freeport-McMoRan (FCX), Oracle (ORCL), and AES (AES). The largest detractors from absolute returns were EQT (EQT), Meta Platforms (META), M&T Bank (MTB), Signature Bank (SBNY), and Uber Technologies (UBER).

In addition to the transactions listed above, we initiated new positions in APA (APA) in the energy sector, Expedia (EXPE) in the consumer discretionary sector, Corebridge Financial (CRBG) in the financials sector, Siemens (OTCPK:SIEGY) in the industrials sector, and Biogen (BIIB) in the health care sector. We also exited positions in Alphabet (GOOG) (GOOGL) and TripAdvisor (TRIP) in the communication services sector, DXC Technology (DXC) in the IT sector, and Sony (SONY) in the consumer discretionary sector.

Sam Peters, CFA, Managing Director, Portfolio Manager

Jean Yu, CFA, PhD, Managing Director, Portfolio Manager

Past performance is no guarantee of future results. Copyright © 2022 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results, or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information.

Performance source: Internal. Benchmark source: Russell Investments. Frank Russell Company (“Russell”) is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Russell® is a trademark of Frank Russell Company. Neither Russell nor its licensors accept any liability for any errors or omissions in the Russell Indexes and/or Russell ratings or underlying data and no party may rely on any Russell Indexes and/or Russell ratings and/or underlying data contained in this communication. No further distribution of Russell Data is permitted without Russell’s express written consent. Russell does not promote, sponsor or endorse the content of this communication.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment