simoncarter/E+ via Getty Images

Bear Markets Cement New Leadership

Market Overview

Unfortunately, when it comes to human behavior, nothing forces change like pain. Bear markets are certainly painful, but the silver lining is that the pain helps crystallize new market cycles as it corrects imbalances and forces investors to finally accept that the old bull market cycle is truly over. It also sets up new investment opportunities, as the repricing of risk inevitably pushes market prices below long-term value in a broader set of equities. However, investors must be patient for new opportunities to emerge, and the key in a bear market is to try to maximize adaptation by balancing short-term risks with long-term opportunity.

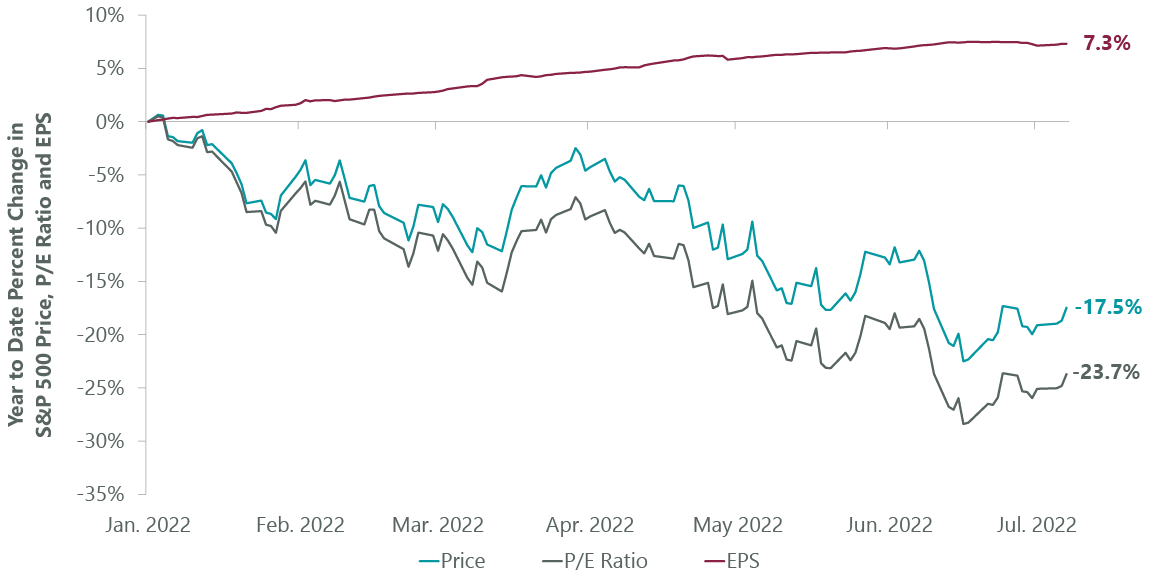

When both the year and the second quarter began, we still were not certain a bear market cleanse would be required. The market pain we did expect was that rising interest rates would pressure very high starting valuations for broad U.S. equity indexes. This has indeed happened (Exhibit 1), as the market has fallen over 20% despite earnings estimates rising over 8% year to date. As a complex adaptive system, the market is not a simple math problem to be solved. However, with the 10-year Treasury yield doubling from the start of the year, and equity risk premiums also rising, the simple math of valuation gravity was too much for markets to overcome. In addition, earnings estimates were only rising in two sectors: energy and materials, which by themselves were not enough to power the market materially higher.

Exhibit 1: While Prices Fall, Expected Earnings Rise

As of July 7, 2022. Source: Bloomberg Finance, L.P., ClearBridge Investments.

As investors, we typically avoid using the word hope, as it interferes with the ability to accept reality and impairs our capability to adapt to evolving challenges. However, we were indeed hoping that a recession could be avoided. The major pillars of the U.S. economy are broadly in good shape, including the consumer, the banking system and corporate balance sheets. More directly, with nominal economic growth at such robust levels, ironically there was room for the inflation part of growth to cool as interest rates rose, without resulting in a crash in real growth. However, with the war in Ukraine tragically grinding on, ongoing global energy shortages and wealth destruction from declining asset prices, the probability of a recession scenario has been rising to levels that require ongoing portfolio adaptation. What does this adaption entail?

- Starting Point Matters: With the portfolio valued at less than 10x earnings, a greater than 20% discount to its respective value index, we have less to fall from our starting point. We recognize that broad market earnings typically fall around 30% in a recession, but our explicit goal is to hold up better than this. The portfolio’s cyclical earnings risk is primarily in energy stocks and interest-rate-sensitive financials, where higher energy prices and higher rates are major fundamental tailwinds. In a recession, energy prices will fall and credit costs will rise. However, these stocks are already discounting a lot of this pain, and we do not expect either a collapse in energy prices or severe credit losses. After all, the major issue we face today is an energy supply shortage, and consumer and corporate balance sheets are in good shape. We are not going to see a repeat of the Global Financial Crisis (GFC) and the negative oil prices that defined the last two recessions. However, it is typical for fearful investors to round up the usual suspects from recent recessions, even though every downturn is different.

- Recession Scenario Test: Our valuation process continually estimates our investments’ absolute business value across various scenarios, including a recession. Despite not expecting the next recession to equal the GFC of 2008 in either character or magnitude, we have extensively stress tested our portfolio holdings’ business values under a GFC-like scenario. If you assume half the magnitude of the GFC, our business values would drop by roughly 15%. We think this is much more resilient than the overall market and reflects the valuation and fundamental advantages of our holdings, specifically our focus on companies with resilient free cash flow generation in both inflationary and deflationary environments. This focus has resulted in most of our holdings enjoying fortress-like balance sheets, and we expect all will make it through even a severe recession. The challenge and opportunity in a recession, however, is that prices are more volatile than business values, and forward returns would rise as market prices fall faster than business value. Right now, we are more focused on the challenge of falling prices, but the risk/reward of the portfolio is already extremely attractive, with roughly 30% downside to a full GFC scenario and well over 50% upside in a recovery.

- Recession Tactics: Given the starting valuations and fundamental strengths of our portfolio we did not have to make major changes as the bear market took hold. However, as the probability of a recession grew, we added additional defensive balance by adding positions in health care and regulated utilities. We also reduced some of our positions that had the highest price volatility in the portfolio. This included some of our energy names near their highs. Finally, we reduced some of the consumer credit names in the portfolio, while simultaneously adding deposit-funded financials that will materially benefit from higher interest rates and have demonstrated strong risk management on credit. With many defensive stocks already at valuation levels that fully reflect a recession, we refuse to invest in any name whose price is above our estimate of business value. The best defense is combining resilient fundamentals with reasonable valuations. We think we have struck a good balance on this front, and will continue to adapt, if needed, as the environment evolves.

Astute readers may have noticed we stuck to conveying our observations and adaptations to the current environment, rather than offering a concrete forecast. This reflects our investment process of being probability based, diversifying the portfolio to be robust in multiple scenarios and adapting only when an event materially shifts our pre-existing probabilities. Our guess is that this bear market is already two-thirds done on price declines, but we recognize that no one knows what the future holds. We take comfort in this ambiguity, especially since investors and pundits will almost certainly get more bearish and more negative as the bear market continues. This cascading cacophony of fear will create great opportunities for long-term, valuation-disciplined investors like us. The further prices fall below a reasonable range of business values, the greater the forward returns become and the fewer hard questions about the future we must answer.

“Bear markets are when new leadership gets cemented.”

The challenge is that investors are already so depressed we may not get an additional major reset in prices. Market cycles are also moving so fast that both good and bad news are discounted with a speed that can leave human prognosticators behind. At the time of our writing, it seems growth and inflation are moderating, which may allow the Federal Reserve to reduce the aggressiveness with which it has recently raised interest rates. If so, as earnings estimates drop from slower growth, valuation multiples may start to rebound from their recent plunge. Again, even two-variable equations like multiples and earnings are hard to handicap in a complex, adaptive world moving at digital speed.

There is one other key observation we can make: when people are under stress in a bear market, they become extremely shortsighted and lose perspective on long-term changes and opportunities. Yet, as we stated earlier, bear markets are when new leadership gets cemented. Value, as a style, was leading growth before this bear market, it is leading growth in this bear market, and we think it will lead coming out of this bear market. Why? The first supporting argument is simply that value leadership is what we are currently observing. Leadership, by definition, must lead. Secondly, even with recent value leadership, value relative to growth is just in the 95th percentile of history (Exhibit 2). This puts it roughly where value bottomed when the 2000 growth equity bubble popped, which we believe is highly supportive of our view that it is still very early for this ongoing value cycle. Thirdly, as we detailed in our last commentary, energy security and transition are the big problems the world needs to solve. This challenge is at the center of the current crisis, and we need to invest massively in global power for supply to catch up with demand. Energy demand declines during a recession as prices fall down the steep supply curve, but also rebounds just as strongly when growth bottoms. Despite this structural shortage and great fundamentals, energy stocks remain the cheapest value stocks in a value market.

Exhibit 2: Value Remains Historically Undervalued

As of June 30, 2022. Source: Bloomberg Finance, L.P., ClearBridge Analysis.

Portfolio Positioning

Given that we think the ongoing bear market will crystallize, rather than end, this still-nascent value cycle, we are excited by the growing opportunities to capitalize on the next stage of this value market. With the portfolio already in great shape from a fundamental and valuation perspective, the bar for new names is relatively high. However, we continue to find new names where the risk/reward is accretive to the portfolio, or where our portfolio construction benefits from its inclusion on the defense/offense spectrum. In some cases, we are getting both.

During the quarter we added four names, including the following:

- Intercontinental Exchange (ICE) operates global financial exchanges and clearing houses, which we believe is a resilient business at a good valuation. One of our key tactics in a potential recessionary environment is to focus on stocks where earnings and cash flow will hold up better than the market. ICE fits the bill as it benefits directly from volatility in financial markets, including in commodities where we are seeing major price swings. During the first half, ICE earnings estimates came up modestly, but its valuation multiple fell over 30%. Some of this weakness is due to ICE’s planned acquisition of Black Knight (BKI), which we think makes strategic sense. However, it is being done as Black Knight’s business is projected to slow as housing activity cools on higher mortgage rates, and the deal may also face regulatory scrutiny. Regardless, the recent weakness in the stock gave us a price below our estimate of long-term business value for a solid and resilient business and we acted accordingly.

- M&T Bank (MTB) is a high-quality regional bank with a solid core deposit franchise and a history of being a very good lender across credit cycles. While a bank may find it easy to give away money in a loan, a strong bank franchise can gather low-cost long-term deposits. Deposit funding has not been worth much when rates were near zero, but with the Federal Reserve raising rates aggressively, good core deposit franchises will shine. M&T Bank is benefiting accordingly as net interest income is shooting higher as the company puts excess capital to work in higher-yielding loans and securities. So far in 2022, its earnings estimates have risen over 30%, while its earnings multiple has declined over 20%. We think earnings will remain resilient, especially relative to the overall market, and we see solid long-term value in M&T Bank as its price is well below our estimate of business value for this core-deposit-funded bank.

- Hess (HES) is one of the premier growth names in the energy sector. The company is exercising discipline in not hastening growth beyond its capabilities, as Hess’s massive Guyana oil production scales. Growth in energy has often been a double-edged sword, as exploration companies tended to grow production and burn cash. In the current environment, producers are increasingly focused on maximizing free cash flow and driving good returns on capital. As Guyana scales, Hess will have one of the fastest growth rates of free cash in the overall market, even if oil settles well below $100. This will allow the company to grow its business value at a double-digit rate over the next several years, a reality not captured in the current price. During 2022, Hess earnings estimates rose over 100%, but its valuation multiple fell over 30%. We think energy earnings and cash flow will be much more resilient than the overall market. We actively welcome the market’s skepticism, as valuations in the entire energy sector remain near historic lows despite great fundamentals. Finally, Hess’s Guyana oil will have some of the lowest greenhouse gas intensity of any oil currently produced, and these relatively clean and growing barrels will be needed by a world that is structurally short oil.

Outlook

Recently, ClearBridge’s Chief Investment Officer Emeritus and Portfolio Manager Hersh Cohen remarked that we are becoming some of the “old” portfolio managers of the firm. We found this banter to be incredibly complimentary, as Hersh points out that that grey hair and survival matter in this very challenging profession. Over our tenure, we have navigated three recessions, and are staring at our fifth bear market. Despite these sometimes-painful lessons, one point has remained remarkably clear: bear markets are ultimately where new opportunities arise. We are well-positioned to observe and will act accordingly.

Portfolio Highlights

The ClearBridge Value Equity Strategy underperformed its Russell 1000 Value Index during the second quarter. On an absolute basis, the Strategy had losses across all 11 sectors in which it was invested during the quarter. The leading detractors were the financials and industrials sectors, while the consumer staples sector was the top performer.

On a relative basis, overall stock selection detracted from relative performance but was mildly offset by a positive contribution from sector allocation effects. Specifically, stock selection in the industrials, materials, financials, consumer discretionary and communication services sectors as well as an underweight to the consumer staples sector weighed on returns. Conversely, stock selection in the information technology (IT) and an overweight allocation to the energy sector benefited performance.

On an individual stock basis, the biggest contributors to absolute returns in the quarter were Vertex Pharmaceuticals (VRTX), BioMarin Pharmaceutical (BMRN), Alibaba (BABA), Cigna (CI) and Pfizer (PFE). The largest detractors from absolute returns were Freeport-McMoRan (FCX), Signature Bank (SBNY), Uber Technologies (UBER), Bank of America (BAC) and Wells Fargo (WFC).

In addition to the transactions listed above, we initiated a position in SolarEdge Technologies (SEDG) in the IT sector. We also exited positions in General Electric (GE), XPO Logistics (XPO) in the industrials sector, Cisco Systems (CSCO) and Splunk (SPLK) in the IT sector, Devon Energy (DVN) in the energy sector, Bank of New York Mellon (BK) and Unum (UNUM) in the financials sector and Melco Resorts & Entertainment (MLCO) and Capri (CPRI) in the consumer discretionary sector.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment