Sitthiphong

Market Overview

Macro forces depressed U.S. equity markets in the second quarter, with the impacts being most felt by small and mid cap growth companies. Rising risk-free yields, overlaid on the dislocations from the pandemic (supply chain and labor shortage) and the horrific attack on Ukraine (energy and commodity prices) proved to be too much weight for equities. Stock multiples have sharply corrected from elevated levels during a period when many companies have been challenged by faltering demand and/or difficulties fulfilling customer requests.

Entering 2022, we believed the prospects of reduced fiscal stimulus and monetary tightening were likely to lead to choppy markets. Yet the pernicious and accelerating inflation trend has forced the hands of central banks globally, resulting in a rising probability of contraction.

The U.S. Federal Reserve turned more aggressive after the May Consumer Price Index release and short-term interest rates are headed higher. The yield of the 10-year U.S. Treasury note has more than doubled since the turn of the year, pressuring valuations across the spectrum of growth stocks as well as influencing fixed income instruments and credit spreads.

“Valuations are much more reasonable than at any time in the past 24 months with a mountain of capital to be deployed.”

Profit margins have been squeezed (from labor and commodity costs) and in some cases taken step functions lower. While companies have implemented multiple price increases, there are sticker shock effects yet to be counted. We’ve already seen, for instance, a softening of the red hot residential real estate market in response to higher mortgage costs for borrowers. Some retailers are struggling as consumer wallets are thinned by higher prices.

SMID cap growth stocks in the Russell 2500 Growth Index declined 19.55% in the second quarter as a result of the coalescence of these forces, firmly entering “bear market territory.” The Russell 2500 index declined 16.98%, slightly underperforming the larger capitalization market. Growth indices continued to underperform value indices given the multiple compression from higher interest rates and unfolding economic deceleration.

Innovation remained out of vogue again as investors had limited appetite for higher growth companies during this period of economic stress and portfolio derisking. The initial public offering market essentially remained shut after 2021’s excessive supply, with IPO proceeds down approximately 95%.

Against this tumultuous backdrop for SMID cap growth stocks, the defensive sectors of utilities (-5.52%) and consumer staples (-7.30%) held up best. The commodity sectors of energy (-11.89%) and materials (-14.92%) also outperformed as higher oil and natural gas prices and the announcement of long-term supply agreements to help Europe wean itself from Russian gas sources offered support, while financials (-16.58%), industrials (-18.17%) and health care (-19.11%) also beat the benchmark.

The real estate (-20.66%), consumer discretionary (-21.05%), information technology (IT, -23.50%) and communication services (-24.34%) underperformed.

During weak markets the ClearBridge SMID Cap Growth Strategy typically holds up better than the index, and thus we are dissatisfied that the Strategy modestly underperformed its Russell 2500 Growth benchmark. Despite this result, we maintain optimism in our portfolio’s construction. Price declines were most pronounced among some of our more innovative long-term holdings in health care, IT and consumer discretionary with bright growth prospects (such as Penumbra, Insulet, Etsy and HubSpot, all of which are retained in the Strategy).

Portfolio Positioning

After an active first quarter, we made relatively few changes this quarter. We favor the business prospects and competitive position of the Strategy’s holdings and believe managements are capably positioning their businesses for more austere times while continuing to invest for sustainable growth.

We initiated a position in EQT (EQT), the largest natural gas producer in the U.S. which possesses high-quality acreage in the Marcellus Shale. Tight natural gas supply and demand dynamics form a solid backdrop for EQT. The company should benefit significantly from a higher natural gas futures price curve, which should raise EQT’s already-strong free cash flow yield. Ongoing deleveraging should also support returns to shareholders.

We also added BWX Technologies (BWXT), which manufactures and sells nuclear components globally. BWX supplies nuclear reactors to the U.S. Navy and commercial power producers, primarily in Canada, as well as a nascent offering in nuclear medicine raw materials. With roughly 80% of the company tied to a highly visible and well-funded defense priority (nuclear submarines), the company should drive steady and defensive growth with multiple upside drivers from greater acceptance of nuclear energy’s role in the energy transition coupled with technology advances in micro-reactors and small modular reactors.

Following a multi-year investment cycle in both its core U.S. Navy business and nuclear medicine, free cash flow growth should inflect meaningfully, allowing for capital return and valuation rerating.

We exited online pet products retailer Chewy (CHWY) after becoming increasingly concerned about their user metrics as well as the tough comparisons it faces after a surge in demand from increases in pet ownership during the COVID-19 pandemic. We also sold out of Biohaven Pharmaceutical (BHVN), a developer of treatments for migraines and neurological rare diseases after it accepted a takeover offer from large cap pharmaceutical maker Pfizer (PFE).

Outlook

Calendar 2022 is half over and has had one of the poorest starts on record, with significant risk having been wrung out of financial markets evidenced by major value destruction in speculative assets such as crypto, meme stocks, de-SPACs, etc.

Markets are discounting mechanisms and the likelihood of a significant slowdown and/or recession is now well-known and appreciated. Realtime data such as purchase manager indices and consumer surveys already point to a sharp slowdown. Unanswerable is whether we are in another “Volcker” moment, where crushingly high nominal interest rates and a deep recession are needed to bend the curve of prices and inflation expectations. The severity and duration of the slowdown/recession and the prospect of peak inflation rates will, at least partly, dictate near-term equity market expectations.

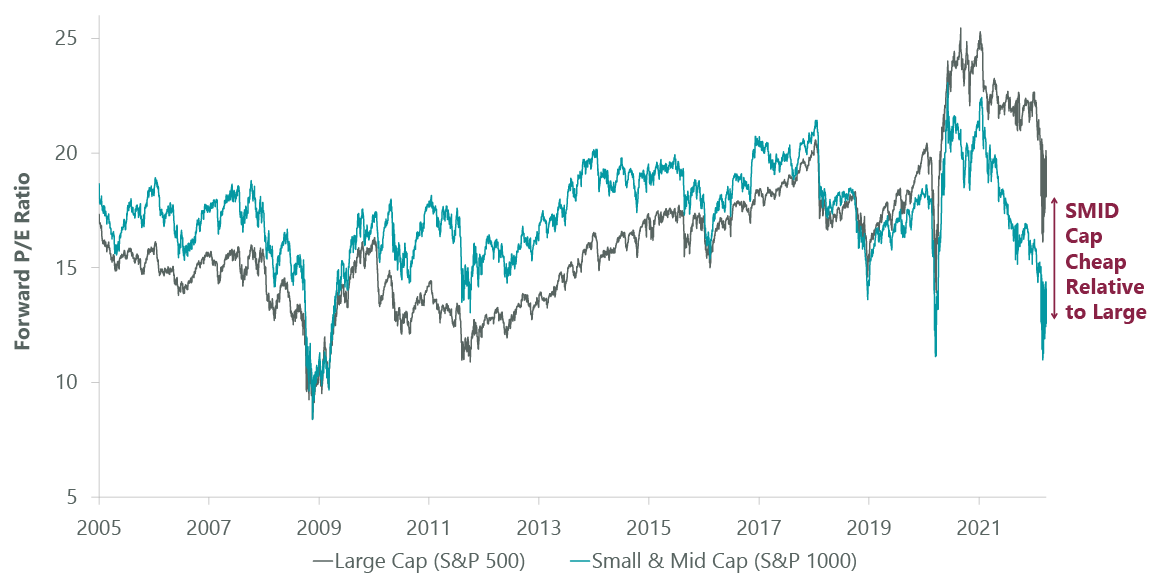

Exhibit 1: Valuations Support Small & Mid Cap Stocks

Data as of June 30, 2022. Source: FactSet, Standard & Poor’s.

The negatives are well-known. On the positive side, valuations are much more reasonable than at any time in the past 24 months (Exhibit 1), there is a mountain of capital to be deployed by private equity sponsors and SPACs, U.S. wholesale financial institutions have much more robust capital cushions than in 2008/2009 and investor sentiment seems massively bearish.

Macro headlines have dominated financial markets over the past six months. We have stuck to our long-standing playbook of focusing on a concentrated portfolio of growth businesses as well as assessing the competitive advantages and managerial competence of each holding during our derisking due diligence. As macro forces begin to recede as primary influence, we firmly believe our emphasis on quality and durable growth stocks will benefit clients.

Portfolio Highlights

During the second quarter, the ClearBridge SMID Growth Strategy underperformed its Russell 2500 Growth benchmark. On an absolute basis, the Strategy had losses across nine of the 10 sectors in which it was invested (out of 11 sectors total), with the real estate sector the lone contributor while the IT, health care, industrials and consumer discretionary sectors were the primary detractors.

In relative terms, overall stock selection detracted from performance. Specifically, stock selection in the consumer discretionary sector was the primary headwind to returns. Selection in the industrials, energy and communication services sectors was also detrimental. On the positive side, stock selection in the health care and real estate sectors and an overweight to consumer staples contributed to relative performance.

The leading contributors to absolute returns during the second quarter included Biohaven Pharmaceutical, Americold Realty Trust (COLD), Black Knight (BKI), Neurocrine Biosciences (NBIX) and BWX Technologies. Meanwhile, Penumbra (PEN), Momentive Global (MNTV), Insulet (PODD), Live Nation Entertainment (LYV) and Monolithic Power Systems (MPWR) were the greatest detractors from absolute returns.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment