Khanchit Khirisutchalual

Market Overview and Outlook

A quickly changing interest rate environment, growing fears of a recession and geopolitical uncertainty made for a volatile second quarter of 2022. The Russell 1000 Value Index declined 12.21%, outperforming its growth counterpart by over 800 basis points.

Every sector of the value benchmark had negative returns: energy and more defensive health care, consumer staples and utilities sectors were down single digits, while economically sensitive sectors such as materials, financials and industrials were down double digits. While leading broader markets in recent years, information technology (IT) performed the worst within the value benchmark, down about 19%.

A resurgence in inflation forced the Fed’s hand in 2022, leading to progressively higher federal-funds rate hikes: 25 basis points in March, 50 basis points in May, and 75 basis points in June, the latter being the most aggressive hike since 1994. Starting in June, the Fed also began reducing the size of its $9 trillion balance sheet, i.e., conducting quantitative tightening (QT) by initially letting $47.5 billion in Treasurys and mortgage-backed securities mature per month, and increasing this monthly cap to $95 billion by September.

Aggressive rate hikes combined with QT are designed to slow the economy in order to combat unacceptably high inflation, with May CPI of 8.6% and 9.1% reported for June. Following the outlook for higher short-term rates, 10-year Treasury yields broke through 3% in June, the first time since 2018, and peaked near 3.5%, before falling back to 3% by the end of the month, as investors started pricing in the growing probability of a recession as the result of aggressive Fed actions.

The top contributor was our sole real estate holding American Tower (AMT), the leading independent wireless tower operator with roughly 221,000 properties globally, including about 43,000 in the U.S., 76,000 in India and 23,000 in Brazil. The company’s business model is to lease space on its towers to predominantly wireless carriers on a long-term basis, generally ranging 5–10 years in duration, with built-in price escalators. This approach results in a stable and predictable cash flow business with high incremental margins — attractive qualities especially in volatile markets like the second quarters.

We believe the global rollout of 5G cellular services will lead to increasing demand over the next several years. The company has also increased its exposure to higher-growth markets, such as the European tower market, through its acquisition of Telxius, and the U.S. data center market, through its acquisition of CoreSite. We view both assets as synergistic with the core business over time, particularly as the edge data center market evolves over time.

Also in the stable and predictable cash flow camp, though with a very different business model, global food and beverage company PepsiCo (PEP) reported very strong organic growth in the first quarter, driven by healthy price/mix, and raised revenue guidance, while holding EPS guidance. Notably, its beverage business showed expanding margins.

As the economic outlook began to sour, materials stocks tumbled, with commodity-focused companies bearing the brunt of the selloff after several months of strength. The Strategy’s materials holdings held up well, however, led by Air Products and Chemicals (APD), which reported decent results driven by better execution, pricing and margin improvements, particularly in Europe, as well as a shift in management comments from cautious to more positive on China.

APD continues to execute on its energy transition mega projects including blue and green hydrogen and sustainable aviation fuel (SAF), and also announced several traditional long-term projects during the quarter. Hydrogen, along with liquified natural gas, has been getting renewed focus in recent months as Europe attempts to reduce its reliance on Russian gas.

The health care sector dominated most of the other top contributors, led by UnitedHealth Group (UNH), whose high-quality characteristics were a safe haven while higher-multiple, more speculative stocks sold off in the quarter. Biotech company Amgen (AMGN) reported a good start to the year with a top- and bottom-line beat plus an effective guidance raise, and health benefits company Elevance (ELV), formerly known as Anthem, also executed well.

Becton Dickinson (BDX), a broadly diversified manufacturer of hospital supplies, laboratory research equipment and therapeutic medical devices, also performed well, showing signs it is able to take price to offset manufacturing cost pressure.

Main detractors came from the communication services and financials sectors. In communication services, telcos performed well in a shaky market, while cable and satellite services were weaker. Our main detractor here was Dish Network (DISH), a leading provider of pay-TV services, which is in the midst of its multiyear efforts to build a greenfield, cloud-native 5G wireless network. While it met its interim build-out requirements, Dish needs to raise capital in the short-to-medium term to continue.

Given current market conditions, capital needs combined with execution challenges were not well-received during the quarter. In financials, recession fears outweighed the benefits of rising interest rates; in the Strategy, Bank of America (BAC) and American Express (AXP) felt these concerns most acutely, although we remain comfortable with these businesses and their strong fundamental positions over the medium-to-long term.

In the industrials sector, farm equipment manufacturer Deere (DE) was down on cyclical concerns, with higher interest rates potentially impacting farmers’ purchase decisions. A selloff in agricultural commodities, albeit off their recent highs, along with ongoing supply chain disruption and overall inflationary pressures may present potential headwinds for agricultural equipment demand. We continue to like the business and Deere’s competitive position; its leadership position in precision agriculture brings benefits to both farmer profitability and the environment.

In anticipation of a more challenging economic environment, over the past year we have positioned the Strategy more defensively, lowering our consumer exposure, most recently through the sale of TJX (TJX), as well as reducing our financials weighting. At the same time, we have added to health care, and continue to look for attractive opportunities there, as well as the consumer staples sector, where we remain underweight.

Although we do not have a crystal ball, amid large economic and geopolitical uncertainties it is more important than ever to be investing in high-quality, defensible franchises that can weather periods of uncertainty and take advantage of weakness as they come out on the other side of a downturn.

Portfolio Highlights

The ClearBridge Large Cap Value ESG Strategy underperformed its Russell 1000 Value Index benchmark during the second quarter.

On an absolute basis, the Strategy had gains in two of 11 sectors in which it was invested for the quarter, with positive contributions coming from the real estate and consumer staples sectors. The financials, industrials, information technology (IT) and communication services sectors were the main detractors.

On a relative basis, overall stock selection and sector allocation detracted from performance. In particular, stock selection in the communication services, industrials, financials and utilities sectors detracted from relative returns. Underweights to the health care, energy and consumer staples sectors and an overweight to the IT sector also detracted. Conversely, stock selection in the materials, IT and real estate sectors proved beneficial.

On an individual stock basis, the largest contributors were American Tower, UnitedHealth Group, Progressive (PGR), Amgen and PepsiCo. Positions in Deere, Bank of America, American Express, Dish Network and JPMorgan Chase (JPM) were the main detractors.

ESG Highlights

Analyst-Led Engagements Uncover Value

Environmental, social and governance (ESG) investing has made much progress over the last two decades. Investors in public equities and corporations have taken more ownership of the impact they can have mitigating climate change and making progress on social goals such as diversity, equity and inclusion; ESG data and investment products have proliferated; and ESG assets under management have continued to grow, with most continuing to be actively managed.

Amid such growth has come scrutiny over potential differences between the claims and realities of ESG investing. This has come on the part of regulators, asset owners and increasingly in the public eye, among business and government leaders.

In this environment we think it worthwhile to highlight the value added by ClearBridge engagements and their role in our investment process and stewardship activities. We have made steady improvements and progress in our process, marked by several milestone years, from 2005, when we established a central research platform that began integrating ESG factors by sectors, to 2012, when we explicitly incorporated ESG analysis in analyst compensation and performance reviews, to 2014 when we formally introduced proprietary ESG ratings, which capture company-specific drivers of risk and return related to sustainability. Currently, 100% of our actively owned companies have an ESG rating assigned.

A key through-line in our history of ESG integration, and a key point of differentiation, is that it is carried out by our analysts: we think there is immense value in having the same person responsible for covering a company’s fundamentals and its ESG characteristics. Company engagements, therefore, are likewise led by ClearBridge sector and portfolio analysts, an approach that we believe gives them insights that might not be top of mind for other investors and a fundamental edge, gained through long-term discussions with CEOs and CFOs of portfolio holdings. ClearBridge’s analyst- and portfolio manager-led engagements offer value, driving positive change and contributing to a fundamental edge for our investment process.

Transforming Climate Risks to Opportunities

In many cases, ClearBridge engagements have specific objectives, such as encouraging the retirement of fossil fuels and increasing use of renewables. Such has been the case with electric power company AES (AES), with whose executives and board members we have been engaging for several years on the company’s path to reduce its carbon footprint. We believe our voice, as a top shareholder, has been a valuable addition to AES’s decision making along this path, and our engagements have helped us identify where climate-related risks in a company’s operations could be climate-related opportunities.

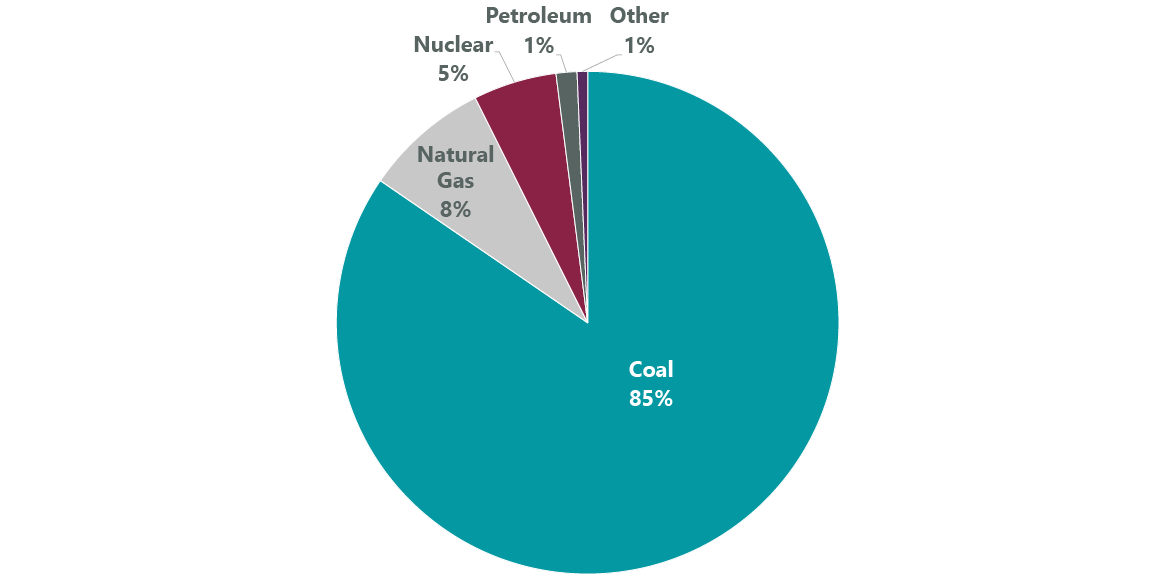

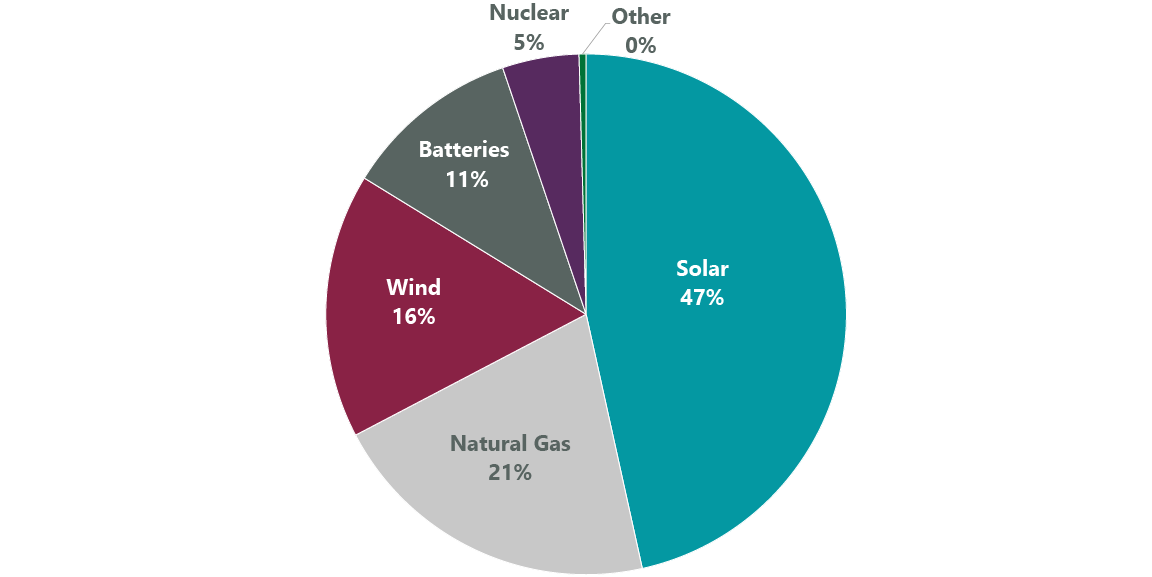

Several years ago, we began discussing with AES the lack of terminal value from coal (Exhibit 2), and we expressed how coal-related ESG concerns were weighing on AES’s valuation multiple, as the ESG risk premium was rising. We helped convince AES to stop investing in coal plants and start shutting down existing coal capacity. The next step was to add renewable energy exposure in the form of wind, solar and industrial scale battery storage (Exhibit 3), in line with U.N. Sustainable Development Goal (SDG) 7: Affordable and Clean Energy (we discuss how an investment framework may further the SDGs in our 2022 Stewardship Report). We shared our belief that any lost near-term operating earnings would be made up with a higher valuation multiple.

Exhibit 1: Planned U.S. Utility-Scale Electric Generating Capacity Retirements 2022 (14.9 GW Total)

As of Jan. 11, 2022. Source: U.S. Energy Information Administration.

Exhibit 2: Planned U.S. Utility-Scale Electric Generating Capacity Additions 2022 (46.1 GW Total)

As of Jan. 11, 2022. Source: U.S. Energy Information Administration.

As our discussions have progressed, AES has been increasingly aggressive in reducing its carbon intensity by lowering coal capacity and investing in renewable energy, as evidenced by its declining GHG emissions. As we had anticipated, AES’s valuation multiple recovered as its product mix shifted from coal to renewables.

ClearBridge encourages companies to align their net-zero goals with the Science Based Targets Initiative’s (SBTi) standards, which clearly define pathways for companies to reduce carbon emissions in line with the Paris Agreement goals. In April 2022 we met with AES Investor Relations and its General Counsel to discuss setting science-based targets as the latest step in this path, and in line with SDG 13: Climate Action.

At the meeting, AES confirmed it is exiting coal in 2025. The company continues to develop as a leader in renewable energy, in June 2022 announcing the formation with other leading U.S. solar companies of the U.S. Solar Buyer Consortium, which will invest more than $6 billion in solar panels to scale up domestic solar manufacturing.

Grasping Realities Behind Net-Zero Targets

Environmental impact is a major issue for the transportation industry, including logistics and freight companies such as portfolio holding United Parcel Service (UPS). Recent engagements with the company have given us a better understanding of the challenges in lowering emissions in transport as well as where innovations may be coming from in the years ahead. In ESG-focused engagements in March and May 2022, we discussed UPS’s path to net-zero using science-based targets.

Though it has a 2050 net-zero goal in line with SBTi, UPS has issues complying with SBTi standards because aviation constitutes 60% of UPS’s Scope 1 and 2 emissions. This is an area over which UPS has little control, however, and the maximum exclusion for a source of emissions for SBTi approval is 5%. UPS has committed to a 2050 carbon neutral goal, which is the same as the SBTi’s goal, although UPS takes a different view of the first 15 years of the path, finding existing technology unable to warrant as aggressive a path as SBTi’s.

Over the course of our engagements, we discussed the technical challenges facing the logistics and freight industry and the state of several key technological developments that will be crucial to helping the industry continue to lower emissions. For example, UPS is looking to sustainable aviation fuels, which are biofuels used to power aircraft with a smaller carbon footprint than jet fuel; however, planting to create the enormous amount of feedstock required to replace crude oil is not sustainable.

Electric aircrafts are another potential solution, and UPS will have the first of 10 electric aircraft by Beta Technologies delivered by 2024, with an option for 1,400 more. While these planes help time-sensitive health care deliveries and benefit small and medium-size businesses, they have a range limited to 250 nautical miles. A more sustainable path, particularly for long-range transportation, could be the use of hydrogen, but the technology and infrastructure is in nascent stages of development and largely out of UPS’s control. We have encouraged the company, however, to increase pressure on its suppliers to accelerate the development of these technologies. ClearBridge also has ongoing active discussions with aerospace manufacturers on these issues.

Connecting Governance and Long-term Shareholder Value

In addition to finding value in engaging on climate risks, net-zero targets and new technologies, we also add value to our investment process with engagements on a variety of governance topics. For example, we have long supported toy and game maker Hasbro’s management and board on strategic, operational and ESG-related topics; the company ranks highly on almost all areas of ESG evaluation, including diversity at board and all-employee levels.

We maintain long-term relationships with Hasbro management, and in April 2022, after an activist shareholder started pushing for strategic change at the company, we stepped up our dialogue with senior management and the board.

While we appreciate some of the concerns raised by the activist, we were against most of its suggestions, which we believed would be destructive to long-term shareholder value. We did not believe it was in our best interest to replace three board members with activist-nominated board members — the existing board is replete with talent from the media, technology, content, gaming, entertainment and social media industries.

Over multiple meetings with Hasbro’s CEO and CFO and as many as three board members, our strong relationships helped us better understand what changes would be made where appropriate, and what strategies would remain intact. We had frequent opportunity to share our thoughts on board composition, long-term strategic priorities, compensation, capital allocation and disclosures. All of these became import topics for review during this time. In June 2022 the activist’s proposals were rejected by shareholders. We remain in support of management as it continues on its path of brand-building and growing digital content for its customers.

Advancing a Smart Farm Future

In our engagements with farm equipment maker Deere, we have followed new technology as it has developed from early promise of environmental and social benefits to market reality. In March 2022, Deere’s Chairman & CEO and CFO met with ClearBridge’s investment team in our New York offices. While prior to the pandemic we had regularly hosted the company, this meeting was among the most interesting as the relatively new CEO outlined a bold plan that placed improved environmental stewardship squarely at the center of the company’s future.

Industrial farming, at its core, is not an especially environmentally friendly enterprise. Agronomic practices have improved over time, but fertilizer, herbicide and pesticide applications and water usage remain problematic. Deere believes its precision farming technology can drive down chemical and fertilizer volumes materially —possibly by as much as 70% — as sensors and cameras attached to tractors, sprayers and combines help determine the exact level of chemicals that might be required.

This more precise methodology is expected to: 1) improve crop yields; 2) reduce farmer input costs; and 3) improve overall land management capabilities. Farmers will make more money and grow more food to support global populations while at the same time better caring for the soil. There are also substantial environmentally positive knock-on effects because fertilizers largely are either carbon-based or mined.

There are also social benefits to Deere’s precision farming, such as increasing access to cost savings for smaller, non-commercial or family farms, and the contribution of improved crop yields toward SDG 2: Zero Hunger. This is in addition to its benefits for SDG 15: Life on Land through promoting sustainable use of terrestrial ecosystems. Deere’s technological strength also includes bringing connectivity to farmers in emerging markets, for example improving Wi-Fi access for farmers in Brazil.

New equipment pricing has moved much higher recently as Deere upgrades its offerings to support this effort. That said, the company has introduced substantial aftermarket packages so farmers using older equipment, who may not be able to afford completely new items, benefit from this technology.

Lastly, we discussed a timeline for transitioning large farm equipment away from diesel to an alternative fuel. At present, however, there is no viable alternative that has the power requirements necessary to drive a tractor for an hour, much less a full day, making any such transition a more distant opportunity.

Overall, we had been waiting to have this discussion for several years, and we were pleased the company’s technologies finally appear to have caught up to precision farming’s initial promise.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment